What is Quantitative Easing?

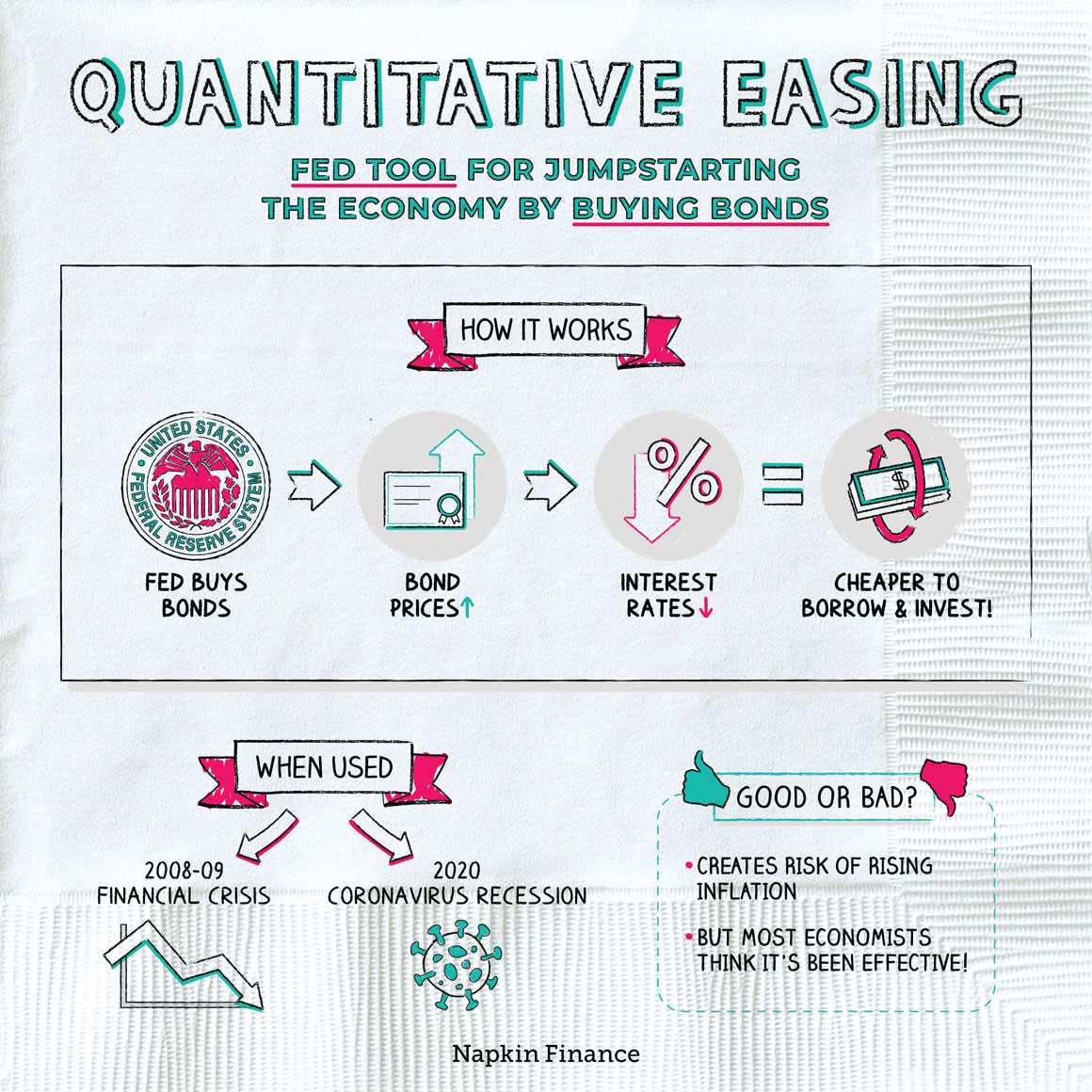

The goal of quantitative easing is to increase the money supply, lower interest rates, and encourage lending and investment. By purchasing government bonds, the central bank increases the demand for these bonds, which in turn lowers their yields or interest rates. This makes borrowing cheaper for businesses and individuals, stimulating economic activity.

Quantitative easing is often used during times of economic downturn or recession when interest rates are already low and the central bank wants to provide additional stimulus. It can also be used to combat deflation, which is a sustained decrease in the general price level of goods and services.

Overall, quantitative easing is a tool used by central banks to increase the money supply, lower interest rates, and stimulate economic activity. It is a non-traditional monetary policy tool that can be effective in certain economic situations.

How Does Quantitative Easing Work?

The process of quantitative easing works as follows:

- The central bank decides to implement quantitative easing as a response to a weak economy or deflationary pressures.

- The central bank creates new money electronically, which is then used to purchase government bonds or other financial assets from commercial banks.

- By purchasing these assets, the central bank increases the reserves of the commercial banks, providing them with additional liquidity.

- The increased liquidity allows the commercial banks to lend more money to businesses and individuals, stimulating economic activity.

- The increased money supply stimulates spending and investment, which can help to boost economic growth and inflation.

Quantitative easing is often used as a last resort measure when traditional monetary policy tools have become ineffective. It is typically implemented during times of economic crisis, such as during the global financial crisis of 2008, to help stimulate economic activity and prevent deflation.

However, quantitative easing is not without risks. One of the main concerns is the potential for inflation to rise as a result of the increased money supply. If the economy recovers too quickly or if the central bank does not withdraw the excess liquidity from the system in a timely manner, it could lead to inflationary pressures.

Overall, quantitative easing is a tool that central banks can use to provide additional liquidity to the economy and stimulate economic activity. However, it should be used cautiously and with careful consideration of the potential risks and consequences.

The Role of the Federal Reserve in Quantitative Easing

One of the primary roles of the Federal Reserve in quantitative easing is the purchase of government securities, such as Treasury bonds and mortgage-backed securities, from financial institutions. These purchases inject liquidity into the financial system, increasing the reserves of banks and other financial institutions.

By increasing the reserves of financial institutions, the Federal Reserve aims to encourage lending and investment, which can stimulate economic activity. When banks have more reserves, they are more willing to lend to businesses and individuals, leading to increased spending and investment in the economy.

The Federal Reserve also plays a crucial role in communicating its monetary policy decisions and intentions to the public and financial markets. Clear and transparent communication is essential to ensure that market participants understand the objectives and expectations of the Federal Reserve regarding quantitative easing.

Furthermore, the Federal Reserve closely monitors and assesses the impact of quantitative easing on the economy. It analyzes various economic indicators, such as inflation, employment, and GDP growth, to evaluate the effectiveness of its policies and make adjustments if necessary.

Overall, the role of the Federal Reserve in quantitative easing is to provide additional stimulus to the economy, increase liquidity in the financial system, and promote lending and investment. Through its actions and communication, the Federal Reserve aims to support economic growth and stability in the United States.

Impact of Quantitative Easing on the Economy

One of the main goals of quantitative easing is to increase the money supply in the economy. By purchasing government bonds and other securities from banks and financial institutions, the central bank injects money into the financial system. This increased liquidity can lead to lower interest rates, making it cheaper for businesses and individuals to borrow money. This, in turn, can stimulate investment and consumption, which are key drivers of economic growth.

Another potential impact of quantitative easing is on inflation. By increasing the money supply, there is a risk of inflationary pressures. However, in times of economic downturn or low inflation, central banks may use quantitative easing to stimulate inflation and prevent deflation. The goal is to achieve a moderate level of inflation, which can be beneficial for economic growth and stability.

However, quantitative easing is not without its risks and limitations. One concern is that it can lead to excessive risk-taking and asset bubbles. As interest rates remain low and liquidity increases, investors may seek higher returns by taking on more risk. This can result in the misallocation of resources and the buildup of financial imbalances. Additionally, quantitative easing may have limited effectiveness if banks and financial institutions are hesitant to lend or if businesses and individuals are reluctant to borrow.

Emily Bibb simplifies finance through bestselling books and articles, bridging complex concepts for everyday understanding. Engaging audiences via social media, she shares insights for financial success. Active in seminars and philanthropy, Bibb aims to create a more financially informed society, driven by her passion for empowering others.