What Is OTCQX

OTCQX is a premier tier of the OTC Markets Group, which provides a marketplace for over-the-counter (OTC) securities. It is designed for established and investor-focused companies that meet certain financial and corporate governance standards.

OTCQX is known for its high-quality companies and provides investors with a transparent and efficient trading platform. It offers a range of benefits, including increased visibility, enhanced liquidity, and access to a broader investor base.

To be listed on OTCQX, companies must meet specific criteria, including a minimum bid price, minimum market capitalization, and financial standards. They are also required to have audited financial statements, meet corporate governance requirements, and provide timely disclosure of material news and information.

OTCQX is part of a tiered structure within the OTC Markets Group, which also includes OTCQB and Pink. OTCQB is designed for early-stage and developing companies, while Pink is the most speculative tier.

Trading on OTCQX offers several benefits for investors. It provides access to a diverse range of companies, including international companies that may not be listed on traditional exchanges. It also allows investors to trade in smaller increments, which can be advantageous for those looking to invest smaller amounts.

Definition and Overview

The OTCQX is a premier tier of the OTC Markets Group, which provides a platform for trading over-the-counter (OTC) securities. OTCQX is specifically designed for established, investor-focused companies that meet certain financial and corporate governance standards.

Unlike the OTC Pink and OTCQB tiers, which have fewer requirements, the OTCQX tier is known for its higher standards and stricter listing criteria. Companies listed on the OTCQX must meet stringent financial and disclosure requirements, ensuring transparency and credibility for investors.

Companies listed on the OTCQX are required to provide comprehensive financial information, including audited financial statements, annual reports, and current financial disclosures. This level of transparency allows investors to make informed decisions and reduces the risk of fraudulent activities.

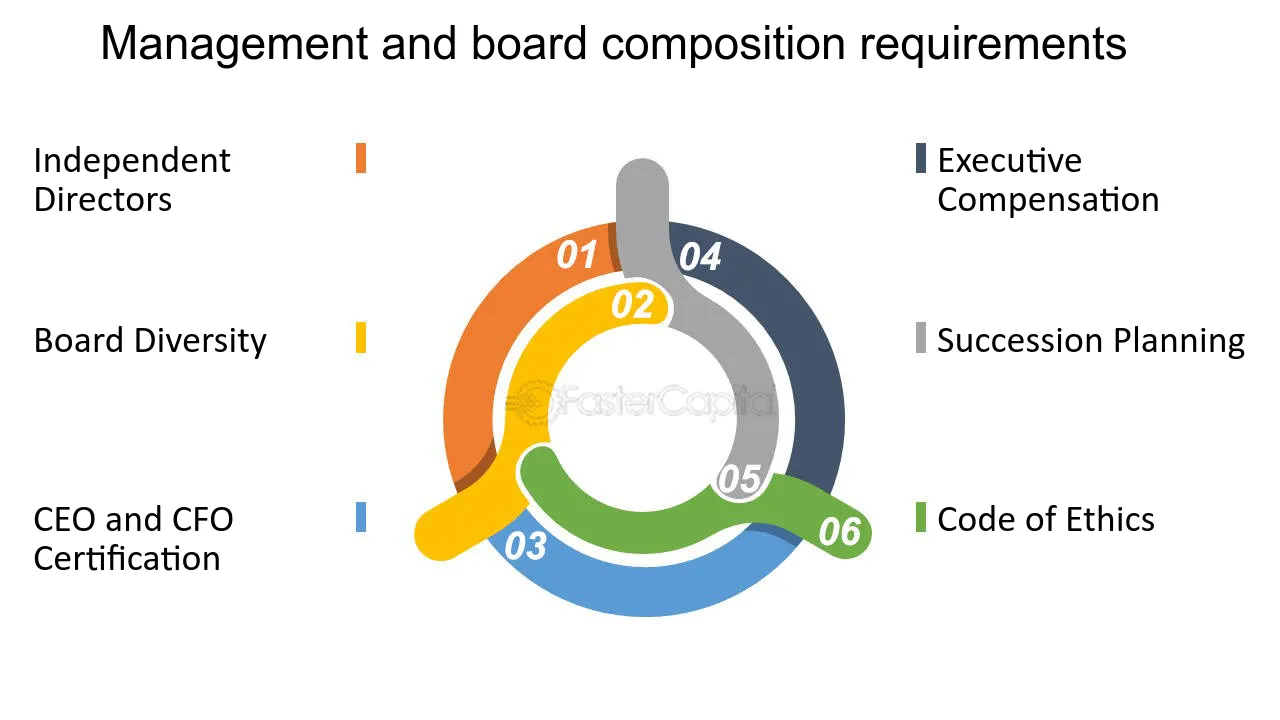

In addition to financial requirements, companies listed on the OTCQX must also meet certain corporate governance standards. This includes having a majority-independent board of directors, maintaining an audit committee composed entirely of independent directors, and adhering to strict reporting and compliance obligations.

Overall, the OTCQX provides a trusted marketplace for investors to trade OTC securities of high-quality companies. It offers a level of transparency, credibility, and investor protection that is often lacking in other OTC markets. By meeting the rigorous listing criteria and maintaining ongoing compliance, companies listed on the OTCQX demonstrate their commitment to transparency and investor confidence.

Criteria for Stocks on OTCQX

OTCQX is a premier tier of the OTC Markets Group, which provides a transparent and efficient marketplace for over-the-counter securities. To be listed on OTCQX, companies must meet certain criteria that ensure the quality and credibility of the stocks traded on the platform.

1. Financial Standards:

| Requirement | Description |

|---|---|

| Minimum Bid Price | The stock must have a minimum bid price of $0.25 for at least 30 consecutive calendar days. |

| Shareholder Equity | The company must have a minimum shareholder equity of $2 million. |

| Market Value of Public Float | The market value of the company’s public float must be at least $2 million. |

2. Corporate Governance Standards:

| Requirement | Description |

|---|---|

| Corporate Structure | The company must have a minimum of 50 beneficial shareholders, with no more than 50% of the shares held by insiders or affiliates. |

| Financial Reporting | The company must be current in its financial reporting, including filing annual and quarterly reports with the SEC or other regulatory bodies. |

| Management Team | The management team must have a track record of integrity and experience in managing public companies. |

3. Compliance Standards:

| Requirement | Description |

|---|---|

| Compliance with Securities Laws | The company must comply with all applicable securities laws and regulations. |

| Good Standing | The company must be in good standing with its state of incorporation and any other jurisdictions where it conducts business. |

| Transfer Agent | The company must engage a transfer agent that is registered with the SEC. |

By meeting these criteria, companies can demonstrate their commitment to transparency, financial stability, and good corporate governance. This provides investors with confidence in the stocks listed on OTCQX and promotes a fair and efficient trading environment.

Other Tiers of OTC Markets

Aside from OTCQX, there are two other tiers of the OTC Markets: OTCQB and Pink. Each tier represents a different level of reporting and compliance requirements.

OTCQB

OTCQB is the middle tier of the OTC Markets and is designed for early-stage and developing companies. To be listed on the OTCQB, a company must meet certain financial and reporting standards, including audited financial statements and ongoing disclosure requirements. Companies listed on the OTCQB are also subject to an annual verification and management certification process.

While the OTCQB has less stringent requirements compared to OTCQX, it still provides investors with a higher level of transparency and information compared to the Pink tier.

Pink

While some legitimate companies may choose to be listed on the Pink tier due to the lower cost and regulatory burden, it is important for investors to exercise caution when trading stocks on this tier. The lack of reporting requirements and oversight means that there is a higher potential for fraud and manipulation.

It is worth noting that the OTC Markets has implemented a system called “Pink Current” to distinguish companies that provide current financial information from those that do not. Companies that provide current financial information are designated as “Pink Current Information,” while those that do not are designated as “Pink Limited Information” or “Pink No Information.”

Benefits of Trading on OTCQX

Trading on OTCQX can offer several benefits for investors and companies alike. Here are some of the key advantages:

1. Enhanced Visibility and Credibility

OTCQX is known for its high-quality listing standards, which require companies to meet stringent financial and disclosure requirements. By trading on OTCQX, companies can enhance their visibility and credibility in the market, attracting more investors and potentially increasing their stock price.

2. Access to a Broader Investor Base

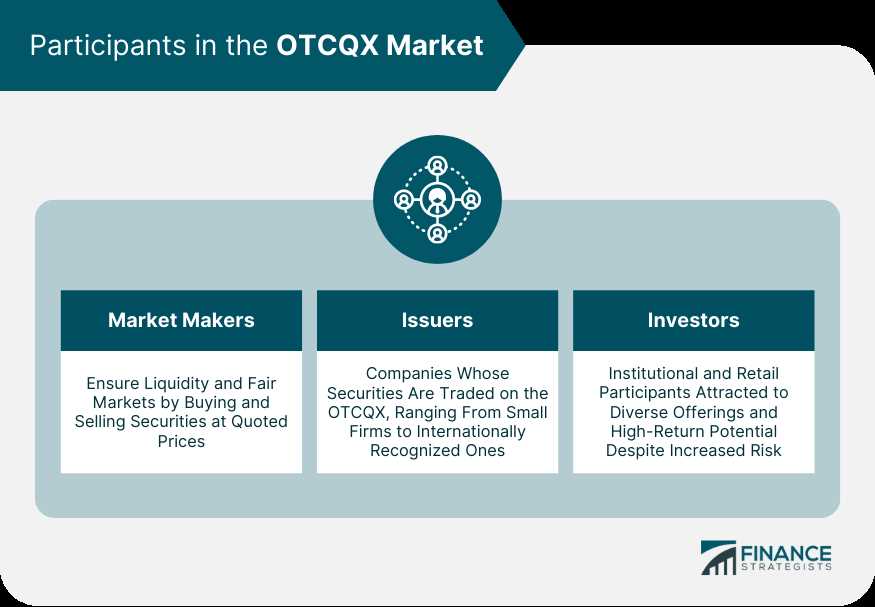

OTCQX provides companies with access to a wider pool of investors, including institutional investors, retail investors, and international investors. This can increase liquidity and trading volume for the company’s stock, making it easier for investors to buy and sell shares.

3. Cost-effective Alternative to Traditional Exchanges

Listing on traditional stock exchanges can be expensive, with high listing fees and ongoing compliance costs. OTCQX offers a cost-effective alternative, allowing companies to save on listing fees and reduce compliance expenses while still maintaining a reputable trading platform.

4. Streamlined Regulatory Compliance

OTCQX has established a set of rigorous compliance standards that companies must meet to maintain their listing. By adhering to these standards, companies can demonstrate their commitment to transparency and investor protection, which can help build trust with shareholders and potential investors.

5. Market Maker Support

OTCQX provides market maker support, which helps ensure a liquid market for the company’s stock. Market makers are responsible for maintaining bid and ask prices, facilitating trading, and providing liquidity. This support can help attract more investors and improve the overall trading experience for shareholders.

6. Flexibility for International Companies

OTCQX allows international companies to trade their stocks in the U.S. market without the need for a full U.S. listing. This provides flexibility for companies looking to expand their investor base and access U.S. capital markets without the regulatory burdens associated with a traditional U.S. listing.

7. Investor Protection

OTCQX prioritizes investor protection by requiring companies to provide timely and accurate financial information, meet disclosure requirements, and adhere to best practices in corporate governance. This commitment to transparency and investor protection can help attract more investors and build long-term shareholder value.

| Benefits of Trading on OTCQX |

|---|

| Enhanced Visibility and Credibility |

| Access to a Broader Investor Base |

| Cost-effective Alternative to Traditional Exchanges |

| Streamlined Regulatory Compliance |

| Market Maker Support |

| Flexibility for International Companies |

| Investor Protection |

Stock Trading Strategy and Education

Developing a successful stock trading strategy is essential for traders looking to trade on the OTCQX market. With its unique characteristics and requirements, it is important to understand the nuances of trading on this exchange. Additionally, continuous education is crucial for staying updated with the latest market trends and developments.

1. Research and Analysis

Prior to making any investment decisions, thorough research and analysis should be conducted. This includes studying the financial statements, news releases, and market trends of the companies listed on the OTCQX. Traders should also consider the overall economic and industry-specific factors that can impact the performance of these stocks.

2. Risk Management

Implementing effective risk management strategies is vital in stock trading. Traders should set clear stop-loss levels to limit potential losses and establish profit targets to secure gains. Diversification is another key aspect of risk management, as it helps to spread out investments across different stocks and sectors.

3. Technical Analysis

Utilizing technical analysis tools and indicators can provide valuable insights into the price movements and trends of OTCQX-listed stocks. Traders can use charts, trend lines, and moving averages to identify potential entry and exit points. It is important to understand the limitations of technical analysis and combine it with fundamental analysis for a comprehensive trading strategy.

4. Stay Informed

Keeping up with the latest news and developments in the OTCQX market is crucial for making informed trading decisions. Traders should regularly monitor company announcements, industry news, and macroeconomic factors that can impact the overall market sentiment. This information can help traders identify potential opportunities and adjust their strategies accordingly.

5. Utilize Trading Tools

There are various trading tools and platforms available that can assist traders in executing their strategies effectively. These tools provide real-time market data, advanced charting capabilities, and order execution options. Traders should explore and utilize these tools to enhance their trading experience and improve their chances of success.

6. Continuous Learning

Stock trading is a dynamic and ever-evolving field. Traders should invest in continuous learning and education to stay updated with the latest trading techniques, strategies, and regulations. This can be achieved through reading books, attending seminars, participating in online courses, and engaging with other experienced traders.

| Benefits of a Well-Developed Strategy and Education |

|---|

| 1. Increased probability of making profitable trades |

| 2. Better risk management and preservation of capital |

| 3. Ability to adapt to changing market conditions |

| 4. Improved decision-making based on thorough analysis |

| 5. Enhanced confidence and discipline in trading |

Emily Bibb simplifies finance through bestselling books and articles, bridging complex concepts for everyday understanding. Engaging audiences via social media, she shares insights for financial success. Active in seminars and philanthropy, Bibb aims to create a more financially informed society, driven by her passion for empowering others.