What is Section 1231 Property?

Section 1231 property refers to a specific classification of assets for tax purposes in the United States. This classification is important because it determines how gains and losses from the sale or exchange of these assets are treated for tax purposes.

Definition and Overview

Section 1231 property includes tangible and intangible assets used in a trade or business, such as real estate, equipment, and certain types of livestock. These assets are held for more than one year and are not considered inventory or held primarily for sale to customers.

The purpose of Section 1231 is to encourage investment in long-term business assets by providing tax benefits for gains and losses associated with these assets.

Examples of Section 1231 Property

Some examples of Section 1231 property include:

- Commercial real estate

- Office buildings

- Machinery and equipment

- Patents and copyrights

- Timber and coal

- Livestock used in farming or ranching

These assets are considered Section 1231 property if they are used in a trade or business and held for more than one year.

Tax Treatment of Section 1231 Property

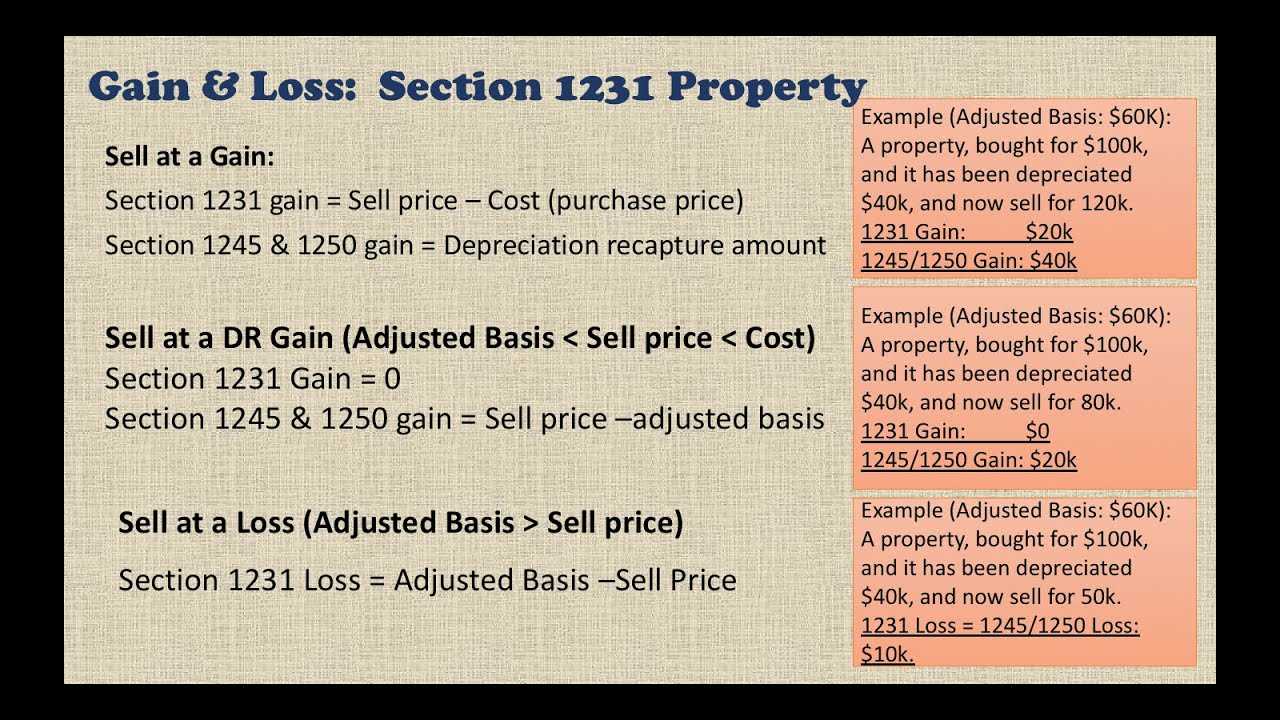

Gains and losses from the sale or exchange of Section 1231 property are treated as either ordinary gains or losses or capital gains or losses, depending on the circumstances.

If the net result of all Section 1231 gains and losses is a net gain, it is treated as long-term capital gain. This means it is subject to lower tax rates than ordinary income. If the net result is a net loss, it is treated as an ordinary loss and can be used to offset other types of income.

However, if the net result is a combination of gains and losses, the gains are treated as long-term capital gains and the losses are treated as ordinary losses. This can result in a more favorable tax treatment compared to solely having ordinary gains or losses.

Benefits of Investing in Section 1231 Property

Investing in Section 1231 property can provide several tax advantages. By holding these assets for more than one year, investors can potentially benefit from lower tax rates on capital gains. Additionally, the ability to offset ordinary income with ordinary losses from Section 1231 property can help reduce overall tax liability.

It is important to consult with a tax professional to fully understand the tax implications and benefits of investing in Section 1231 property, as individual circumstances may vary.

Definition and Overview

Section 1231 property refers to certain types of assets that are used in a trade or business, such as real estate and equipment. This section of the Internal Revenue Code provides special tax treatment for these assets, allowing taxpayers to potentially benefit from capital gains and ordinary losses.

What is Section 1231 Property?

Section 1231 property is defined as property used in a trade or business, held for more than one year, and not classified as a capital asset. This includes assets such as real estate, machinery, equipment, and vehicles. The primary purpose of this section is to distinguish between assets that are held for investment purposes and those that are used in a business.

Assets that qualify as Section 1231 property are subject to specific tax rules, which can result in favorable tax treatment for taxpayers. This can include the ability to offset capital gains with ordinary losses, which can help reduce the overall tax liability.

Examples of Section 1231 Property

Examples of assets that can be classified as Section 1231 property include:

- Commercial buildings

- Rental properties

- Heavy machinery

- Trucks and vehicles used for business purposes

- Office equipment

These assets are typically used in a trade or business and held for more than one year. They are not considered capital assets, which are assets held for investment purposes, such as stocks and bonds.

Tax Treatment of Section 1231 Property

The tax treatment of Section 1231 property is favorable for taxpayers, as it allows for potential capital gains and ordinary losses. When a Section 1231 asset is sold, any resulting gain or loss is classified as either a capital gain or an ordinary loss, depending on the circumstances.

On the other hand, if the sale of a Section 1231 asset results in a net loss, it is treated as an ordinary loss and can be used to offset other sources of income, such as wages or business income. This can help reduce the overall tax liability for taxpayers.

Benefits of Investing in Section 1231 Property

Investing in Section 1231 property can provide several benefits for taxpayers. These include:

- Potential for capital gains: Section 1231 property can appreciate in value over time, allowing taxpayers to potentially realize capital gains when the property is sold.

- Ability to offset ordinary income: If the sale of Section 1231 property results in a net loss, it can be used to offset other sources of income, reducing the overall tax liability.

- Tax deferral: Taxpayers can potentially defer taxes on the sale of Section 1231 property by reinvesting the proceeds in similar property through a like-kind exchange.

Examples of Section 1231 Property

Section 1231 property refers to certain types of assets that are used in a trade or business, and can include both real estate and equipment. Here are some examples of Section 1231 property:

| Asset Type | Examples |

|---|---|

| Real Estate |

|

| Equipment |

|

Real Estate and Equipment

Real estate and equipment are common examples of Section 1231 property. Real estate refers to land and any structures or buildings permanently attached to it. This can include residential properties, commercial buildings, and even vacant land that is held for investment purposes.

Equipment, on the other hand, refers to any tangible assets that are used in a business or income-producing activity. This can include machinery, vehicles, furniture, and fixtures. Essentially, any asset that is used to generate income and has a useful life of more than one year can be considered equipment.

Investing in real estate and equipment can provide several benefits. Firstly, these assets have the potential to appreciate in value over time, allowing investors to earn a profit when they sell the property. Additionally, rental income from real estate can provide a steady stream of cash flow. Equipment can also generate income through its use in a business or by being leased or rented out to others.

Furthermore, Section 1231 property is eligible for favorable tax treatment. When a Section 1231 property is sold at a gain, the profit is treated as a long-term capital gain, which is subject to lower tax rates compared to ordinary income. On the other hand, if a Section 1231 property is sold at a loss, the loss can be deducted as an ordinary loss, which can offset other types of income.

Tax Treatment of Section 1231 Property

One of the key benefits of investing in Section 1231 property is the potential for favorable tax treatment. When a Section 1231 property is sold, the resulting gain or loss is classified as either a capital gain or an ordinary loss, depending on the circumstances.

Capital Gains

If the sale of a Section 1231 property results in a net gain, it is treated as a capital gain. Capital gains are subject to different tax rates than ordinary income. The tax rate for long-term capital gains, which applies to assets held for more than one year, is generally lower than the tax rate for ordinary income. This can result in significant tax savings for investors.

In addition to the potential for lower tax rates, capital gains also offer the opportunity for preferential treatment through the use of tax strategies such as tax-loss harvesting and tax deferral. These strategies can help investors minimize their tax liability and maximize their after-tax returns.

Ordinary Losses

If the sale of a Section 1231 property results in a net loss, it is treated as an ordinary loss. Unlike capital gains, ordinary losses can be fully deducted against ordinary income in the year of the loss. This can provide immediate tax relief for investors and help offset other sources of taxable income.

Conclusion

Capital Gains and Ordinary Losses

Capital gains are the profits made from the sale of a capital asset, such as real estate or equipment, that is held for more than one year. These gains are subject to a lower tax rate than ordinary income. In the case of Section 1231 property, if the net result of all sales of Section 1231 property in a given year is a gain, it is treated as a long-term capital gain.

On the other hand, if the net result is a loss, it is treated as an ordinary loss. Ordinary losses can be used to offset ordinary income, such as wages or business income, and can result in a reduction of taxable income. This can provide significant tax advantages for individuals or businesses that experience losses from the sale of Section 1231 property.

It is worth noting that if the net result of all sales of Section 1231 property is a loss, it can be carried back up to three years or carried forward up to five years to offset any future gains. This allows taxpayers to potentially offset future capital gains with previous losses, reducing their overall tax liability.

Benefits of Investing in Section 1231 Property

1. Tax Treatment

One of the main benefits of investing in Section 1231 property is the favorable tax treatment it receives. When you sell a Section 1231 property, any gains are treated as long-term capital gains, which are typically subject to lower tax rates compared to ordinary income. This can result in significant tax savings for investors.

2. Deductible Losses

If you experience a loss when selling a Section 1231 property, the loss is considered an ordinary loss rather than a capital loss. This means that you can deduct the loss against your ordinary income, potentially reducing your overall tax liability. Deductible losses can help offset gains from other investments and provide tax advantages.

3. Depreciation Benefits

Section 1231 property, such as real estate and equipment, can be depreciated over time. Depreciation allows investors to deduct a portion of the property’s cost each year, reducing taxable income. This can provide ongoing tax benefits throughout the holding period of the property.

4. Potential for Appreciation

5. Diversification

Investing in Section 1231 property allows individuals and businesses to diversify their investment portfolios. By including different types of assets, such as real estate and equipment, investors can spread their risk and potentially achieve higher returns. Diversification is an important strategy for managing investment risk and maximizing overall portfolio performance.

6. Cash Flow

Section 1231 property, particularly rental real estate, can generate regular cash flow in the form of rental income. This can provide a steady stream of income for investors, which can be used for various purposes such as covering expenses, reinvesting in other properties, or funding retirement. Cash flow from Section 1231 property can contribute to financial stability and long-term wealth creation.

Overall, investing in Section 1231 property offers numerous benefits, including favorable tax treatment, deductible losses, depreciation benefits, potential for appreciation, diversification, and cash flow. It is important to consult with a tax professional or financial advisor to fully understand the tax implications and potential benefits of investing in Section 1231 property based on your individual circumstances.

Emily Bibb simplifies finance through bestselling books and articles, bridging complex concepts for everyday understanding. Engaging audiences via social media, she shares insights for financial success. Active in seminars and philanthropy, Bibb aims to create a more financially informed society, driven by her passion for empowering others.