Capital Loss Carryover: Definition, Rules, and Example

A capital loss carryover is a tax deduction that allows individuals or businesses to offset their capital losses from previous years against their capital gains in the current year. This deduction helps to reduce the overall tax liability and can be a valuable tool for minimizing tax obligations.

Definition

A capital loss occurs when the sale of an asset results in a decrease in value compared to its original purchase price. This loss can be used to offset capital gains, which are the profits made from the sale of assets. If the total capital losses exceed the capital gains in a given year, the excess loss can be carried forward to future years and used to offset future capital gains.

Rules

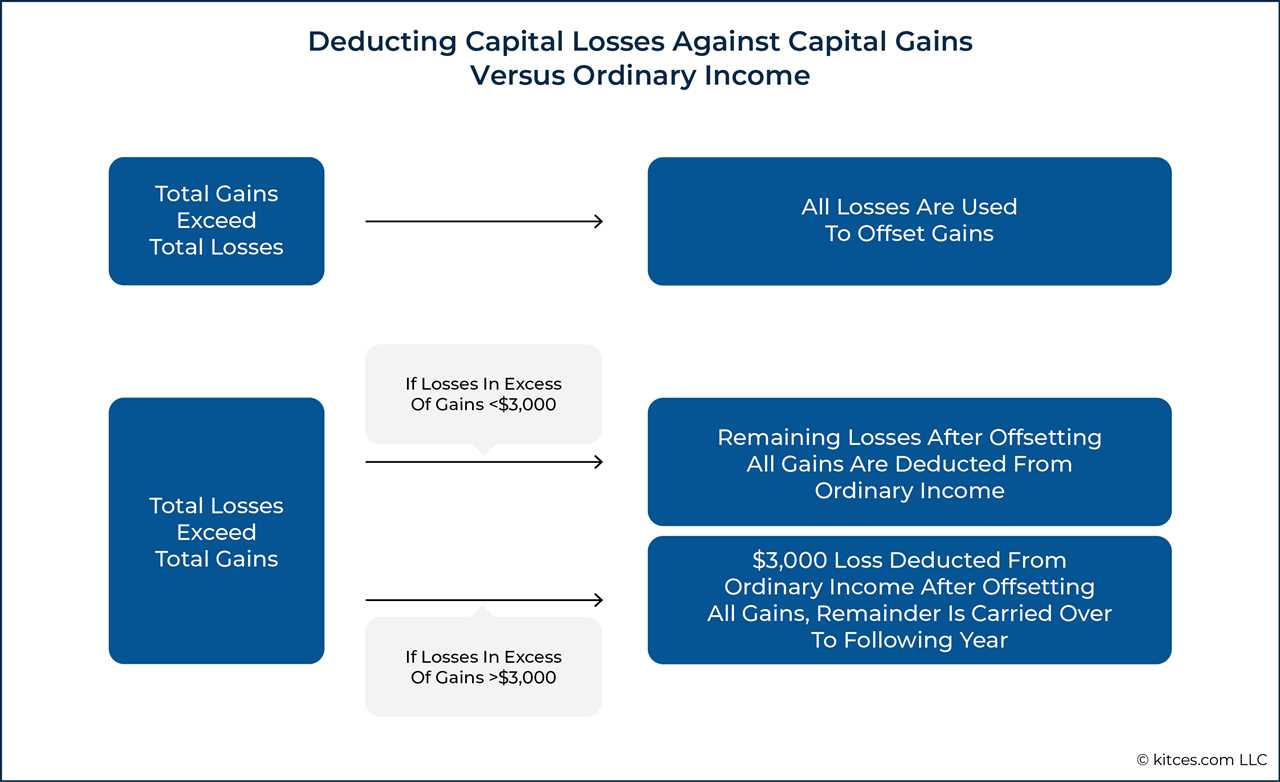

- Capital losses can only be used to offset capital gains. They cannot be used to offset ordinary income.

- Short-term capital losses can be used to offset both short-term and long-term capital gains, while long-term capital losses can only be used to offset long-term capital gains.

- Capital losses can be carried forward indefinitely until they are fully utilized. However, they can only be used to offset up to $3,000 of ordinary income per year.

- If there are still unused capital losses after offsetting capital gains and ordinary income, they can be carried forward to future years.

Example

Let’s consider an example to illustrate how a capital loss carryover works:

By carrying forward the capital loss from Year 1, the individual was able to reduce their tax liability in Year 2 by offsetting their capital gains.

Benefits of Capital Loss Carryover

The capital loss carryover provides several benefits to taxpayers:

- Reduces tax liability: By offsetting capital gains with capital losses, individuals and businesses can reduce their overall tax liability.

- Allows for flexibility: The ability to carry forward capital losses allows taxpayers to offset future gains and potentially reduce their tax burden in the future.

- Encourages investment: The availability of the capital loss carryover deduction can incentivize individuals and businesses to invest in assets with potential capital gains, knowing that any losses can be offset in the future.

What is Capital Loss Carryover?

Capital loss carryover is a tax provision that allows individuals and businesses to offset their capital losses against capital gains in future years. When an individual or business sells an asset for less than its original purchase price, it results in a capital loss. This loss can be used to reduce the taxable income in the year it occurred, and if the loss exceeds the capital gains for that year, it can be carried forward to offset future capital gains.

Capital losses can occur from the sale of various assets, such as stocks, bonds, real estate, or other investments. These losses can be deducted from capital gains to reduce the overall tax liability. However, if the capital losses exceed the capital gains in a given year, the excess loss can be carried over to future years.

Rules for Capital Loss Carryover

There are specific rules and limitations for capital loss carryover:

- Capital losses can only be carried forward, not carried back. This means that any unused capital losses from a given year can only be applied to future capital gains.

- Capital losses can be carried forward indefinitely. There is no expiration date for capital loss carryovers, allowing individuals and businesses to use them in future years when they have capital gains.

- Capital losses can only be used to offset capital gains. They cannot be used to offset ordinary income or other types of income.

- Capital loss carryovers are subject to annual limitations. In the United States, individuals can use capital loss carryovers to offset up to $3,000 of ordinary income each year. Any remaining carryover can be used to offset future capital gains.

How to Calculate Capital Loss Carryover

To calculate the capital loss carryover, individuals and businesses need to determine their capital gains and losses for the year. If the capital losses exceed the capital gains, the excess loss can be carried over to future years.

For example, if an individual has $10,000 in capital losses and $5,000 in capital gains in a given year, they can use $5,000 to offset the capital gains and carry over the remaining $5,000 to future years. This carryover can be used to offset future capital gains until it is fully utilized.

Example of Capital Loss Carryover

By carrying over capital losses, individuals and businesses can effectively reduce their tax liability and potentially save money on their overall tax bill. It is important to keep track of capital losses and consult with a tax professional to ensure compliance with the specific rules and regulations regarding capital loss carryovers.

Rules for Capital Loss Carryover

1. Limitations on offsetting capital gains:

Capital losses can only be used to offset capital gains. If you have more capital losses than capital gains in a given tax year, you can use the excess losses to offset up to $3,000 of ordinary income. Any remaining losses can be carried forward to future years.

2. Carryover period:

Capital losses can be carried forward indefinitely until they are fully utilized. There is no expiration date for capital loss carryover, so you can use the losses to offset capital gains in future years.

3. Netting rules:

When calculating capital gains and losses, you need to follow the netting rules. This means that you need to offset short-term capital gains with short-term capital losses and long-term capital gains with long-term capital losses. Netting allows you to determine the net capital gain or loss for the tax year.

4. Wash sale rules:

Wash sale rules prevent taxpayers from claiming a capital loss if they repurchase the same or substantially identical security within 30 days of selling it at a loss. If you violate the wash sale rules, the loss is disallowed, and you cannot use it to offset capital gains.

5. Documentation requirements:

To claim capital loss carryover, you need to keep accurate records of your capital gains and losses. This includes documentation of the purchase and sale of securities, as well as any adjustments or wash sales. Having proper documentation is essential in case of an audit by the IRS.

How to Calculate Capital Loss Carryover

Calculating capital loss carryover is an important step in managing your taxes and maximizing your deductions. Here are the steps to calculate your capital loss carryover:

- Start by determining your total capital losses for the current tax year. This includes any losses from the sale of stocks, bonds, real estate, or other capital assets.

- Next, subtract any capital gains you have for the current tax year. This includes any profits from the sale of capital assets.

- If your total capital losses exceed your capital gains, you have a net capital loss for the year. This net loss can be used to offset other income, such as wages or business income.

- If your net capital loss exceeds the maximum allowable deduction for the current tax year, you can carry over the remaining loss to future tax years.

- To calculate the capital loss carryover, subtract the maximum allowable deduction for the current tax year from your net capital loss. The maximum allowable deduction is typically $3,000 for individuals and $1,500 for married individuals filing separately.

- The resulting amount is your capital loss carryover, which can be used to offset capital gains in future tax years.

Example of Capital Loss Carryover

For the following tax year, you can again deduct up to $3,000 from this remaining capital loss, leaving you with a remaining capital loss of $0. If you still have capital losses remaining after deducting $3,000 each year, you can continue to carry them forward to future tax years until they are fully utilized.

In summary, the capital loss carryover allows you to offset capital gains in the current tax year and future tax years, reducing your taxable income and potentially lowering your overall tax liability.

Benefits of Capital Loss Carryover

Capital loss carryover is a valuable tax strategy that can provide several benefits to taxpayers. Here are some of the key advantages of utilizing capital loss carryover:

1. Tax Savings:

One of the primary benefits of capital loss carryover is the potential for tax savings. By offsetting capital gains with capital losses from previous years, taxpayers can reduce their overall tax liability. This can result in significant savings, especially for individuals with substantial capital losses.

2. Extended Tax Relief:

Capital loss carryover allows taxpayers to extend the tax relief provided by capital losses beyond the current tax year. If an individual has more capital losses than capital gains in a given year, the excess losses can be carried forward to offset future capital gains. This provides an opportunity to reduce taxes in future years and potentially recover losses over time.

3. Flexibility in Timing:

Capital loss carryover offers flexibility in timing the recognition of capital gains. Taxpayers can choose to offset gains in a year when they have significant losses, which can help minimize their tax liability. This flexibility allows individuals to strategically manage their capital gains and losses to optimize their tax situation.

Capital loss carryover can also influence investment decisions. Knowing that capital losses can be carried forward can provide investors with more confidence to take risks and make long-term investments. This can lead to a more diversified and potentially more profitable investment portfolio.

5. Estate Planning:

Capital loss carryover can be an important tool in estate planning. By utilizing capital loss carryover, individuals can effectively transfer their unused losses to their heirs. This can help reduce the tax burden on the estate and provide financial benefits to future generations.

Emily Bibb simplifies finance through bestselling books and articles, bridging complex concepts for everyday understanding. Engaging audiences via social media, she shares insights for financial success. Active in seminars and philanthropy, Bibb aims to create a more financially informed society, driven by her passion for empowering others.