What is a Residential Mortgage-Backed Security?

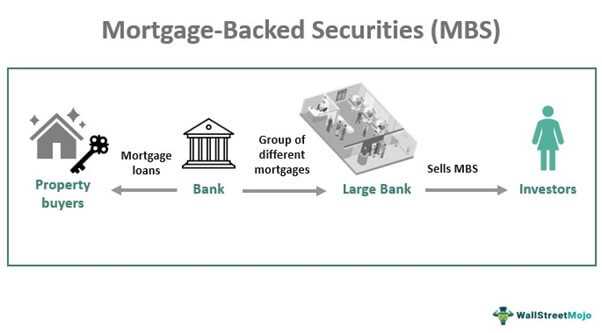

A Residential Mortgage-Backed Security (RMBS) is a type of financial instrument that represents a pool of residential mortgage loans. These loans are typically originated by banks, credit unions, or other financial institutions and are then packaged together and sold to investors. The cash flows from the mortgage loans, such as principal and interest payments, are used to pay the investors who hold the RMBS.

RMBS can be thought of as a way for lenders to transfer the risk associated with residential mortgage loans to investors. By pooling together a large number of mortgages, the risk is spread out among many investors, reducing the potential impact of default or foreclosure on any single loan. This allows lenders to free up capital and continue lending, while investors have the opportunity to earn a return on their investment.

How do Residential Mortgage-Backed Securities work?

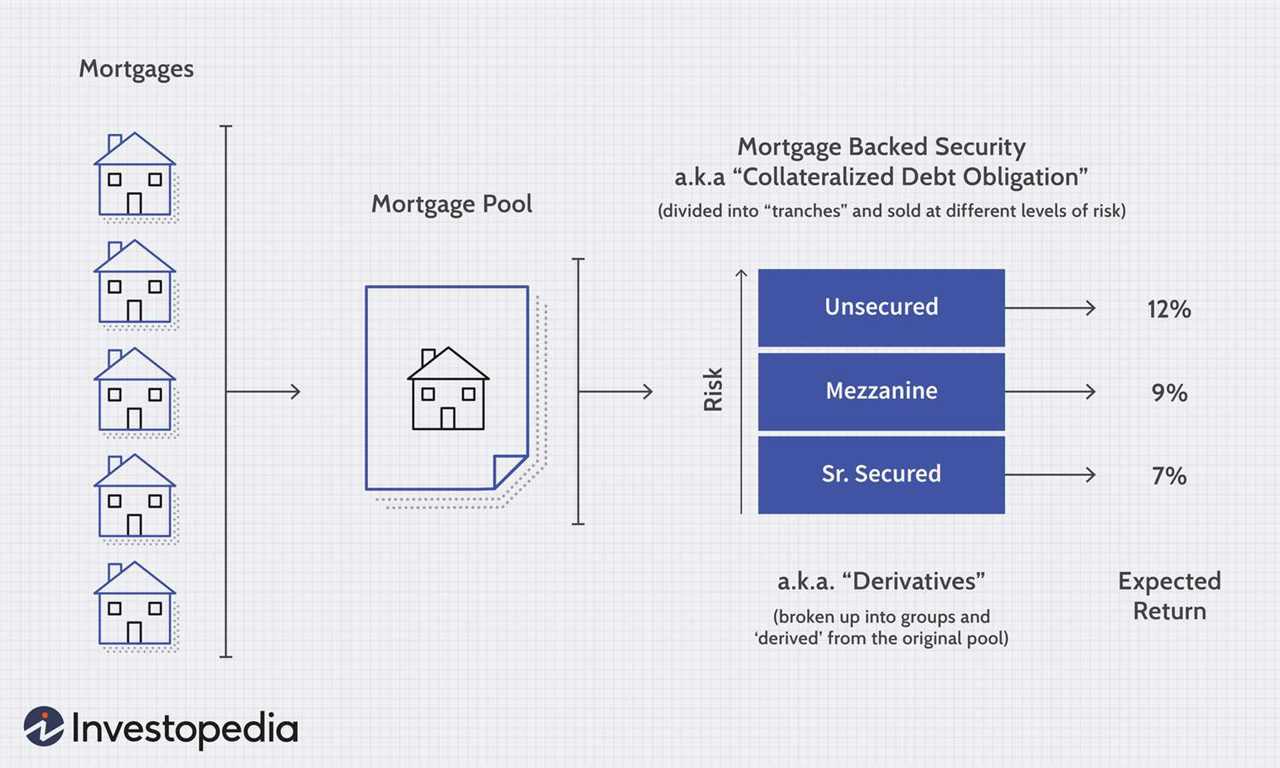

When a bank or other financial institution originates a residential mortgage loan, they have the option to keep the loan on their balance sheet or sell it to investors through an RMBS issuance. If they choose to sell the loan, they will package it together with other similar loans and create a pool of mortgages. This pool is then divided into different tranches, each with its own risk and return characteristics.

Investors can then purchase one or more tranches of the RMBS, depending on their risk appetite and investment objectives. The cash flows from the mortgage loans, such as monthly mortgage payments, are distributed to the investors based on the terms of the RMBS. The senior tranches, which have a higher priority in receiving payments, typically offer lower returns but are considered less risky. On the other hand, the junior tranches, which have a lower priority, offer higher returns but are more exposed to the risk of default.

Why invest in Residential Mortgage-Backed Securities?

However, it is important to note that investing in RMBS also carries certain drawbacks. The performance of the underlying mortgage loans is influenced by factors such as interest rates, housing market conditions, and borrower behavior. These factors can introduce volatility and uncertainty into the investment. Additionally, the complexity of RMBS structures and the potential for prepayment or default can make it difficult for investors to accurately assess and manage the risks involved.

Definition and Explanation

A Residential Mortgage-Backed Security (RMBS) is a type of asset-backed security that is created by pooling together a group of residential mortgages. These mortgages are then sold to investors in the form of bonds or notes. The cash flows from the mortgage payments made by homeowners are used to pay interest and principal to the investors.

RMBS are typically issued by financial institutions such as banks, mortgage lenders, or government-sponsored enterprises. They provide these institutions with a way to transfer the risk associated with residential mortgages to investors, allowing them to free up capital for additional lending.

When a homeowner takes out a mortgage, they make regular payments to the mortgage lender. These payments consist of both interest and principal. The lender then packages a group of these mortgages together and sells them to investors as RMBS. The investors receive a share of the cash flows generated by the mortgage payments, which are typically passed through a trustee.

One of the key features of RMBS is the process of securitization. This involves the pooling of mortgages with similar characteristics, such as interest rates, loan-to-value ratios, and credit scores. By diversifying the pool of mortgages, the risk is spread across multiple borrowers, reducing the overall risk for investors.

How RMBS Work

When a homeowner makes their mortgage payment, the cash flows are passed through the trustee to the investors in the RMBS. The trustee is responsible for collecting the mortgage payments from the homeowners and distributing them to the investors.

The investors in RMBS receive regular interest payments, which are based on the interest rates of the underlying mortgages. They also receive principal payments, which are based on the amount of principal that is repaid by the homeowners.

Risk and Return

Investing in RMBS carries both benefits and drawbacks. On the one hand, RMBS provide investors with a way to diversify their investment portfolio and potentially earn a higher return than traditional fixed-income investments. They also allow financial institutions to manage their risk exposure to residential mortgages.

However, investing in RMBS also carries certain risks. The performance of the underlying mortgages can be affected by factors such as changes in interest rates, economic conditions, and borrower defaults. If homeowners are unable to make their mortgage payments, the cash flows to the investors may be disrupted.

It is important for investors to carefully evaluate the credit quality of the underlying mortgages and the structure of the RMBS before investing. They should also consider their risk tolerance and investment objectives.

| Benefits of RMBS | Drawbacks of RMBS |

|---|---|

| Diversification | Risk of borrower defaults |

| Potential for higher returns | Interest rate risk |

| Risk transfer for financial institutions | Economic and market risk |

Benefits and Drawbacks of Residential Mortgage-Backed Securities

Residential Mortgage-Backed Securities (RMBS) offer several benefits to investors:

1. Diversification:

Investing in RMBS allows investors to diversify their portfolios by gaining exposure to a pool of mortgage loans. This diversification can help reduce risk by spreading investments across different types of mortgages and geographic locations.

2. Regular Income:

RMBS provide investors with a steady stream of income in the form of interest payments. These payments are typically made on a monthly basis, providing investors with a reliable source of cash flow.

3. Potential for High Yields:

RMBS have the potential to offer higher yields compared to other fixed-income investments. This is because the interest rates on mortgage loans are generally higher than those on other types of debt securities.

4. Liquidity:

RMBS are traded on secondary markets, which means that investors can easily buy and sell these securities. This liquidity provides investors with the flexibility to adjust their portfolios as market conditions change.

However, it is important to consider the drawbacks of investing in RMBS:

1. Credit Risk:

2. Prepayment Risk:

RMBS are subject to prepayment risk, which occurs when borrowers pay off their mortgage loans before the maturity date. This can result in a loss of future interest payments for investors and may impact the overall yield of the securities.

3. Interest Rate Risk:

Changes in interest rates can affect the value of RMBS. When interest rates rise, the value of existing RMBS may decline, as investors demand higher yields. Conversely, when interest rates fall, the value of RMBS may increase.

4. Complexity:

Advantages and Opportunities

Residential Mortgage-Backed Securities (RMBS) offer several advantages and opportunities for investors. Here are some key benefits:

1. Diversification:

Investing in RMBS allows investors to diversify their portfolios by adding an asset class that is not directly correlated with traditional stocks and bonds. This can help reduce overall portfolio risk and potentially enhance returns.

2. Regular Income:

RMBS provide a steady stream of income in the form of interest payments. These payments are typically made monthly or quarterly, providing investors with a consistent cash flow.

3. Potential for High Yields:

RMBS can offer attractive yields compared to other fixed-income investments. The underlying mortgage loans generate interest payments, which are passed on to investors in the form of coupon payments. Depending on the specific RMBS, these yields can be higher than those offered by government bonds or corporate bonds.

4. Risk Mitigation:

RMBS are typically structured with different tranches, each with varying levels of risk and return. This allows investors to choose the tranche that aligns with their risk tolerance and investment objectives. By diversifying across tranches, investors can mitigate the risk of default and potential losses.

5. Liquidity:

RMBS are traded on secondary markets, providing investors with the opportunity to buy and sell these securities easily. This liquidity allows investors to adjust their portfolios as market conditions change or to take advantage of new investment opportunities.

6. Access to the Mortgage Market:

Investing in RMBS provides investors with exposure to the mortgage market, which is a significant sector of the economy. By investing in RMBS, investors can participate in the performance of the housing market and potentially benefit from its growth.

7. Professional Management:

Emily Bibb simplifies finance through bestselling books and articles, bridging complex concepts for everyday understanding. Engaging audiences via social media, she shares insights for financial success. Active in seminars and philanthropy, Bibb aims to create a more financially informed society, driven by her passion for empowering others.