What Are Other Current Assets (OCA)? Examples and Definition

Other Current Assets (OCA) are a category of assets that are expected to be converted into cash within one year or the normal operating cycle of a business, whichever is longer. They are listed on a company’s balance sheet and are considered part of the current assets section.

Definition of Other Current Assets

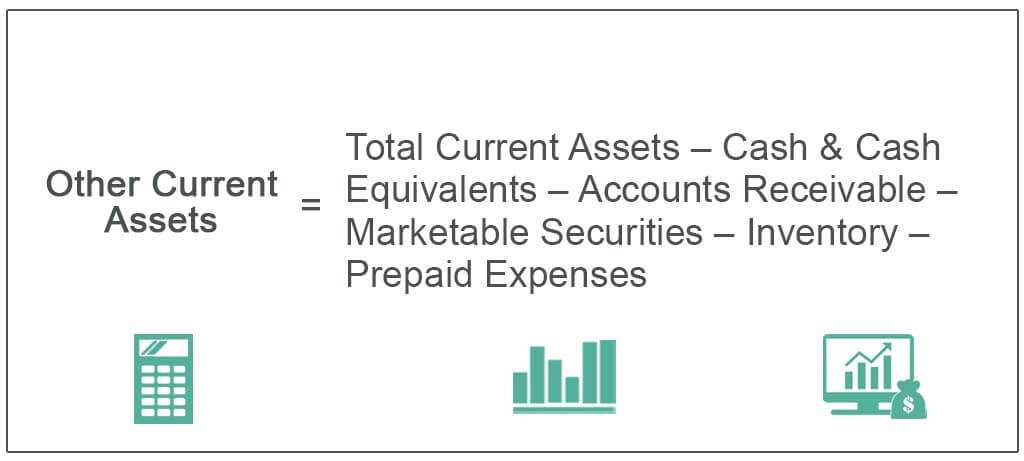

Other Current Assets include any assets that do not fit into the categories of cash, accounts receivable, inventory, or prepaid expenses. They are typically short-term in nature and can be easily converted into cash. Examples of Other Current Assets include:

- Short-term investments

- Notes receivable

- Prepaid expenses not classified as such

- Advances to suppliers or employees

- Deferred tax assets

- Other miscellaneous assets

Valuation and Reporting of Other Current Assets

Other Current Assets are typically reported at their fair market value or cost, whichever is lower. They are usually listed on the balance sheet in order of liquidity, with the most liquid assets appearing first. The specific valuation method used may vary depending on the accounting standards and policies followed by the company.

It is important for companies to accurately classify and report their Other Current Assets in order to provide transparent and reliable financial information to stakeholders. This helps investors, creditors, and other interested parties assess the company’s financial position and make informed decisions.

Overview of Other Current Assets

Other Current Assets (OCA) are a category of assets that represent the short-term resources of a company that are expected to be converted into cash within one year. These assets are typically used in the day-to-day operations of the business and are not intended for long-term use or investment.

Other Current Assets include a wide range of items that can vary depending on the nature of the business. Some common examples of Other Current Assets include:

| Examples of Other Current Assets |

|---|

| Prepaid expenses |

| Short-term investments |

| Inventory |

| Accounts receivable |

| Notes receivable |

| Deferred tax assets |

| Other receivables |

These assets are reported on the balance sheet under the Current Assets section, which also includes cash, cash equivalents, and marketable securities. The value of Other Current Assets is determined by their original cost or fair market value, whichever is lower.

Importance of Other Current Assets in Accounting

Furthermore, Other Current Assets can also provide valuable insights into a company’s operational efficiency. For example, if a company has a high level of inventory as an Other Current Asset, it may indicate that the company is not effectively managing its inventory levels or is experiencing difficulties in selling its products. On the other hand, if a company has a significant amount of accounts receivable as an Other Current Asset, it may suggest that the company has a strong customer base but is facing challenges in collecting payments.

In addition, Other Current Assets can also impact a company’s ability to obtain financing. Lenders and investors often consider a company’s Other Current Assets when assessing its creditworthiness and financial stability. A company with a healthy level of Other Current Assets may be seen as less risky and more likely to meet its financial obligations.

Overall, Other Current Assets are an integral part of a company’s financial statements and provide valuable information about its liquidity, operational efficiency, and financial health. By accurately valuing and reporting these assets, companies can make informed decisions, attract investors, and maintain a strong financial position in the market.

Examples of Other Current Assets

Other current assets (OCA) are a category of assets that are expected to be converted into cash within one year or within the normal operating cycle of a business. These assets are not classified as cash, accounts receivable, inventory, or prepaid expenses. Here are some examples of other current assets:

- Short-term investments: These are investments that can be easily converted into cash within a year. Examples include marketable securities, certificates of deposit, and treasury bills.

- Prepaid expenses: These are expenses that have been paid in advance but have not yet been used or consumed. Examples include prepaid rent, prepaid insurance, and prepaid advertising.

- Deferred tax assets: These are tax assets that arise from temporary differences between the book and tax basis of assets and liabilities. They represent future tax benefits that can be used to offset future tax liabilities.

- Advances to suppliers: These are payments made to suppliers in advance for goods or services that will be delivered in the future. They are recorded as assets until the goods or services are received.

- Other receivables: These are amounts owed to the company that are not classified as accounts receivable. Examples include loans to employees, deposits with vendors, and refunds due from suppliers.

- Restricted cash: This is cash that is set aside for a specific purpose and cannot be used for general business operations. Examples include cash held in escrow, cash held as collateral, and cash held in trust accounts.

These are just a few examples of other current assets that a company may have. The specific types and amounts of other current assets will vary depending on the nature of the business and its operations.

How Other Current Assets are Valued and Reported

Valuing and reporting other current assets is an important aspect of accounting for businesses. These assets are typically reported on a company’s balance sheet, which provides a snapshot of its financial health at a given point in time.

The valuation of other current assets is based on their fair market value, which is the price that would be received to sell an asset in an orderly transaction between market participants at the measurement date. This valuation is important because it helps determine the overall financial position of a company.

Other current assets are typically reported at their net realizable value, which is the estimated amount that a company expects to receive from the sale of the asset, less any estimated costs of disposal. This value takes into account any potential losses or expenses associated with selling the asset.

When reporting other current assets, companies may also need to disclose any significant restrictions or limitations on their use. For example, if an asset is pledged as collateral for a loan, the company may need to disclose this information in the notes to the financial statements.

It is important for companies to regularly review and update the valuation of their other current assets to ensure accuracy and compliance with accounting standards. Changes in market conditions or the financial health of the company may require adjustments to the valuation of these assets.

Emily Bibb simplifies finance through bestselling books and articles, bridging complex concepts for everyday understanding. Engaging audiences via social media, she shares insights for financial success. Active in seminars and philanthropy, Bibb aims to create a more financially informed society, driven by her passion for empowering others.