EBITDA-to-Interest Coverage Ratio Definition and Calculation

The EBITDA-to-Interest Coverage Ratio is a financial ratio that measures a company’s ability to cover its interest expenses with its earnings before interest, taxes, depreciation, and amortization (EBITDA). It is an important indicator of a company’s financial health and its ability to meet its debt obligations.

Definition

The EBITDA-to-Interest Coverage Ratio is calculated by dividing a company’s EBITDA by its interest expenses. EBITDA represents a company’s operating income before deducting interest, taxes, depreciation, and amortization. Interest expenses include the interest paid on the company’s debt, such as loans and bonds.

Calculation

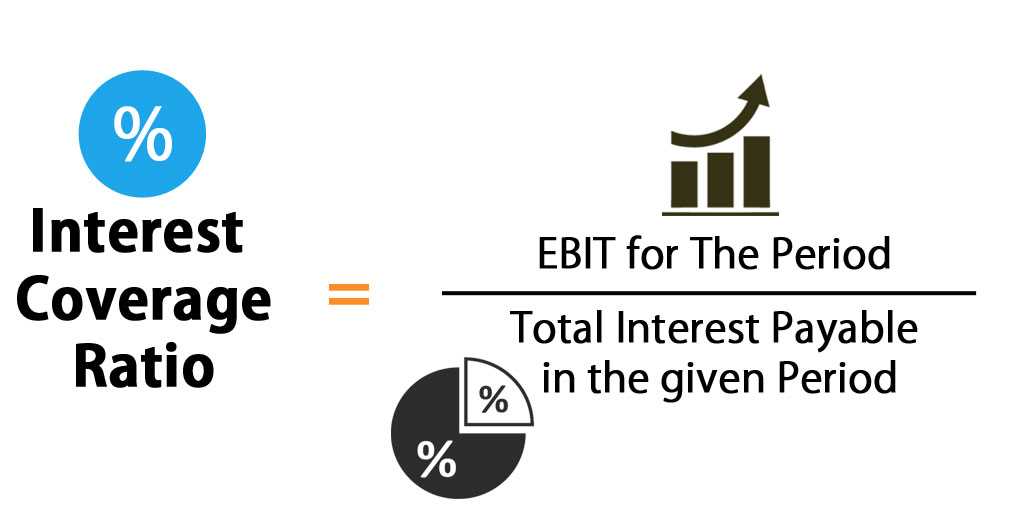

The formula to calculate the EBITDA-to-Interest Coverage Ratio is as follows:

EBITDA-to-Interest Coverage Ratio = EBITDA / Interest Expenses

For example, if a company has an EBITDA of $1,000,000 and interest expenses of $200,000, the EBITDA-to-Interest Coverage Ratio would be 5 ($1,000,000 / $200,000).

The EBITDA-to-Interest Coverage Ratio provides insight into a company’s ability to generate enough earnings to cover its interest expenses. A higher ratio indicates that the company is more capable of meeting its interest obligations, while a lower ratio suggests a higher risk of defaulting on its debt.

This ratio is particularly useful when comparing companies in the same industry or when analyzing a company’s financial performance over time. It helps investors and analysts assess the financial health and stability of a company and make informed investment decisions.

Importance of the EBITDA-to-Interest Coverage Ratio

The EBITDA-to-Interest Coverage Ratio is important for several reasons:

- It helps lenders and creditors evaluate a company’s creditworthiness and determine the risk of lending to or investing in the company.

- It provides insights into a company’s ability to generate sufficient cash flow to cover its interest expenses, which is crucial for its long-term financial stability.

- It helps investors assess the risk associated with investing in a particular company and make informed investment decisions.

Calculating the EBITDA-to-Interest Coverage Ratio

To calculate the EBITDA-to-Interest Coverage Ratio, you need to gather the necessary financial information from a company’s financial statements. You will need the EBITDA and interest expenses figures, which can be found in the income statement or the notes to the financial statements.

Once you have the EBITDA and interest expenses figures, simply divide the EBITDA by the interest expenses to calculate the ratio.

Interpreting the EBITDA-to-Interest Coverage Ratio

The interpretation of the EBITDA-to-Interest Coverage Ratio depends on the industry and the specific circumstances of the company. In general, a higher ratio indicates a stronger financial position and a lower risk of defaulting on debt obligations. Conversely, a lower ratio suggests a higher risk of default.

Limitations of the EBITDA-to-Interest Coverage Ratio

While the EBITDA-to-Interest Coverage Ratio is a useful financial ratio, it has its limitations:

- It does not consider the timing of interest payments or the company’s cash flow position.

- It may not be applicable to companies with significant non-operating income or expenses.

Therefore, it is important to consider other financial ratios and factors when evaluating a company’s financial health and stability.

The EBITDA-to-Interest Coverage Ratio is a financial metric that measures a company’s ability to cover its interest expenses with its earnings before interest, taxes, depreciation, and amortization (EBITDA). It is used by investors, creditors, and analysts to assess a company’s financial health and its ability to meet its debt obligations.

EBITDA is a measure of a company’s operating performance and represents its earnings before taking into account interest expenses, taxes, depreciation, and amortization. By excluding these non-operating expenses, EBITDA provides a clearer picture of a company’s core profitability and cash flow generation.

The EBITDA-to-Interest Coverage Ratio is calculated by dividing a company’s EBITDA by its interest expenses. The resulting ratio indicates how many times a company’s EBITDA can cover its interest expenses. A higher ratio indicates a stronger ability to cover interest payments, while a lower ratio suggests a higher risk of defaulting on debt obligations.

Importance of the EBITDA-to-Interest Coverage Ratio

The EBITDA-to-Interest Coverage Ratio is an important indicator of a company’s financial stability and creditworthiness. It provides insights into a company’s ability to generate enough cash flow to cover its interest payments. A higher ratio indicates that a company has a healthier financial position and is less likely to default on its debt obligations.

Investors and creditors use the EBITDA-to-Interest Coverage Ratio to assess the risk associated with lending money to a company or investing in its securities. A low ratio may indicate that a company is highly leveraged and may struggle to make interest payments, increasing the risk of default. On the other hand, a high ratio suggests that a company has sufficient cash flow to comfortably meet its interest obligations.

Interpreting the EBITDA-to-Interest Coverage Ratio

When interpreting the EBITDA-to-Interest Coverage Ratio, it is important to consider industry norms and compare the ratio to those of similar companies. Different industries have different levels of leverage and interest rate sensitivity, so what may be considered a healthy ratio in one industry may be considered weak in another.

A ratio of less than 1 indicates that a company’s EBITDA is insufficient to cover its interest expenses, which is a red flag for investors and creditors. A ratio between 1 and 2 suggests that a company has a moderate ability to cover its interest payments, while a ratio above 2 indicates a strong ability to meet its debt obligations.

It is also important to analyze trends in the EBITDA-to-Interest Coverage Ratio over time. A declining ratio may indicate deteriorating financial health and an increasing risk of default, while an improving ratio suggests a strengthening financial position.

Conclusion

The EBITDA-to-Interest Coverage Ratio is a valuable tool for assessing a company’s financial health and its ability to meet its debt obligations. By analyzing this ratio, investors, creditors, and analysts can gain insights into a company’s cash flow generation and its capacity to cover interest expenses. However, it is important to consider industry norms and trends in the ratio to make an accurate assessment of a company’s financial stability.

Importance of the EBITDA-to-Interest Coverage Ratio

The EBITDA-to-Interest Coverage Ratio is an important financial metric that helps investors and creditors assess a company’s ability to meet its interest payment obligations. It provides insight into the company’s financial health and its ability to generate enough cash flow to cover its interest expenses.

By calculating this ratio, investors and creditors can evaluate the company’s ability to service its debt and make informed decisions about lending or investing in the company. A high ratio indicates that the company has a strong ability to cover its interest expenses, which is a positive sign for investors and creditors.

On the other hand, a low ratio suggests that the company may have difficulty meeting its interest obligations, which could be a warning sign of financial distress. It could indicate that the company is highly leveraged or experiencing declining profitability.

The EBITDA-to-Interest Coverage Ratio is particularly useful when comparing companies within the same industry or when assessing a company’s performance over time. It allows for a standardized comparison, as it eliminates the impact of different capital structures and tax rates.

Furthermore, this ratio can also be helpful in identifying potential investment opportunities or risks. For example, a company with a high ratio may be considered a low-risk investment, as it has a strong ability to generate cash flow and meet its interest obligations. On the other hand, a company with a low ratio may be considered a higher-risk investment, as it may struggle to cover its interest expenses.

In summary, the EBITDA-to-Interest Coverage Ratio is an important tool for investors and creditors to assess a company’s financial health and ability to meet its interest payment obligations. It provides valuable insights into a company’s ability to generate cash flow and can help inform investment and lending decisions.

Calculating the EBITDA-to-Interest Coverage Ratio

The EBITDA-to-Interest Coverage Ratio is a financial metric used to assess a company’s ability to cover its interest expenses with its earnings before interest, taxes, depreciation, and amortization (EBITDA). This ratio is important for both lenders and investors as it provides insight into a company’s ability to meet its interest obligations.

To calculate the EBITDA-to-Interest Coverage Ratio, you need to gather the necessary financial information from a company’s income statement and balance sheet. Here is the step-by-step process:

Step 1: Calculate EBITDA

Start by finding the company’s EBITDA, which is calculated by adding back interest, taxes, depreciation, and amortization to the net income. The formula for EBITDA is:

EBITDA = Net Income + Interest + Taxes + Depreciation + Amortization

Step 2: Calculate Interest Expense

Next, determine the company’s interest expense, which can be found on the income statement or the notes to the financial statements.

Step 3: Calculate the EBITDA-to-Interest Coverage Ratio

Finally, divide the EBITDA by the interest expense to calculate the EBITDA-to-Interest Coverage Ratio. The formula is:

EBITDA-to-Interest Coverage Ratio = EBITDA / Interest Expense

For example, let’s say a company has an EBITDA of $500,000 and an interest expense of $100,000. The EBITDA-to-Interest Coverage Ratio would be:

EBITDA-to-Interest Coverage Ratio = $500,000 / $100,000 = 5

A ratio of 5 indicates that the company’s EBITDA is sufficient to cover its interest expenses five times over. A higher ratio suggests a stronger ability to meet interest obligations, while a lower ratio may indicate a higher risk of defaulting on interest payments.

Interpreting the EBITDA-to-Interest Coverage Ratio

The EBITDA-to-Interest Coverage Ratio is a financial metric that provides insight into a company’s ability to cover its interest expenses using its earnings before interest, taxes, depreciation, and amortization (EBITDA). This ratio is used by investors, lenders, and analysts to assess a company’s financial health and its ability to meet its debt obligations.

A higher EBITDA-to-Interest Coverage Ratio indicates that a company has a greater ability to cover its interest expenses with its operating earnings. This is generally seen as a positive sign, as it suggests that the company has a strong cash flow and is less likely to default on its debt payments.

On the other hand, a lower EBITDA-to-Interest Coverage Ratio indicates that a company may have difficulty meeting its interest obligations. This could be a red flag for investors and lenders, as it suggests that the company may be at a higher risk of defaulting on its debt.

Comparing the EBITDA-to-Interest Coverage Ratio

Additionally, comparing the ratio to the company’s historical performance can provide insights into its financial trends. If the ratio has been consistently improving over time, it suggests that the company’s financial health is improving. Conversely, a declining ratio may indicate deteriorating financial performance.

Limitations of the EBITDA-to-Interest Coverage Ratio

Limitations of the EBITDA-to-Interest Coverage Ratio

Here are some of the limitations of the EBITDA-to-Interest Coverage Ratio:

| 1. Excludes non-cash expenses: | |

| 2. Ignores taxes: | This ratio also does not consider the impact of taxes on a company’s earnings. Taxes can have a substantial effect on a company’s profitability and ability to generate cash flow. Ignoring taxes can lead to an inaccurate assessment of a company’s ability to cover its interest expenses. |

| 3. Does not account for changes in working capital: | |

| 4. Does not consider debt maturity: | This ratio does not consider the maturity of a company’s debt. A company may have a high EBITDA-to-Interest Coverage Ratio, but if its debt is coming due in the near future, it may still face challenges in meeting its interest obligations. |

| 5. Industry-specific factors: | The EBITDA-to-Interest Coverage Ratio may not be directly comparable across different industries. Each industry has its own unique characteristics and financial dynamics that can impact a company’s ability to cover its interest expenses. It is important to consider industry-specific factors when interpreting this ratio. |

Emily Bibb simplifies finance through bestselling books and articles, bridging complex concepts for everyday understanding. Engaging audiences via social media, she shares insights for financial success. Active in seminars and philanthropy, Bibb aims to create a more financially informed society, driven by her passion for empowering others.