Definition

In the world of health insurance, group health insurance refers to a type of insurance coverage that is provided to a group of people, typically employees of a company or members of an organization. This type of insurance is often offered as a benefit by employers to attract and retain talented employees.

Group health insurance works by pooling the risk of a large group of individuals together, which allows for more affordable premiums and better coverage options compared to individual health insurance plans. The cost of the insurance is typically shared between the employer and the employees, with the employer usually covering a significant portion of the premium.

Key Features of Group Health Insurance

Group health insurance plans typically have several key features that make them attractive to both employers and employees:

1. Coverage for Pre-existing Conditions: Group health insurance plans are required to cover pre-existing conditions, which means that individuals with existing health conditions cannot be denied coverage or charged higher premiums based on their health status.

2. Comprehensive Coverage: Group health insurance plans often provide comprehensive coverage for a wide range of medical services, including doctor visits, hospital stays, prescription drugs, and preventive care.

4. Employer Contributions: Employers typically contribute towards the cost of group health insurance premiums, making it more affordable for employees to obtain coverage.

Benefits and Coverage

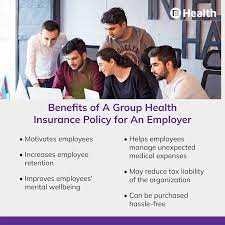

Group health insurance offers a wide range of benefits and coverage options for both employers and employees. Here are some of the key advantages:

1. Cost savings: Group health insurance plans are typically more affordable than individual plans. By pooling the risk and spreading the costs among a larger group of people, premiums can be lower for everyone.

2. Comprehensive coverage: Group health insurance plans often provide comprehensive coverage for a wide range of medical services, including doctor visits, hospital stays, prescription drugs, and preventive care. This ensures that employees have access to the care they need without facing significant out-of-pocket expenses.

3. Employer contributions: Many employers contribute a portion of the premium costs for their employees’ group health insurance. This can help offset the cost of coverage and make it more affordable for employees.

4. Tax advantages: Group health insurance premiums are typically tax-deductible for employers, and employees’ contributions are often made with pre-tax dollars. This can result in significant tax savings for both employers and employees.

5. Health and wellness programs: Group health insurance plans often include wellness programs and resources to help employees improve their health and well-being. This can lead to lower healthcare costs and increased productivity in the workplace.

6. Continuity of coverage: With group health insurance, employees can usually maintain coverage even if they leave their job or experience a change in employment status. This provides peace of mind and ensures that individuals and their families are protected.

7. Negotiated rates: Group health insurance plans often have negotiated rates with healthcare providers, which can result in lower costs for medical services. This can help employees save money and make healthcare more affordable.

8. Flexibility: Group health insurance plans can be tailored to meet the specific needs of an organization and its employees. Employers can choose from a variety of coverage options and benefit levels to create a plan that best suits their workforce.

Overall, group health insurance offers a range of benefits and coverage options that can help employers attract and retain top talent, while also providing employees with access to quality healthcare at an affordable cost.

Emily Bibb simplifies finance through bestselling books and articles, bridging complex concepts for everyday understanding. Engaging audiences via social media, she shares insights for financial success. Active in seminars and philanthropy, Bibb aims to create a more financially informed society, driven by her passion for empowering others.