Types of Investment Funds

Investment funds are a popular choice for investors looking to diversify their portfolios and achieve long-term financial goals. There are various types of investment funds available, each with its own unique characteristics and investment strategies. Here are some of the most common types of investment funds:

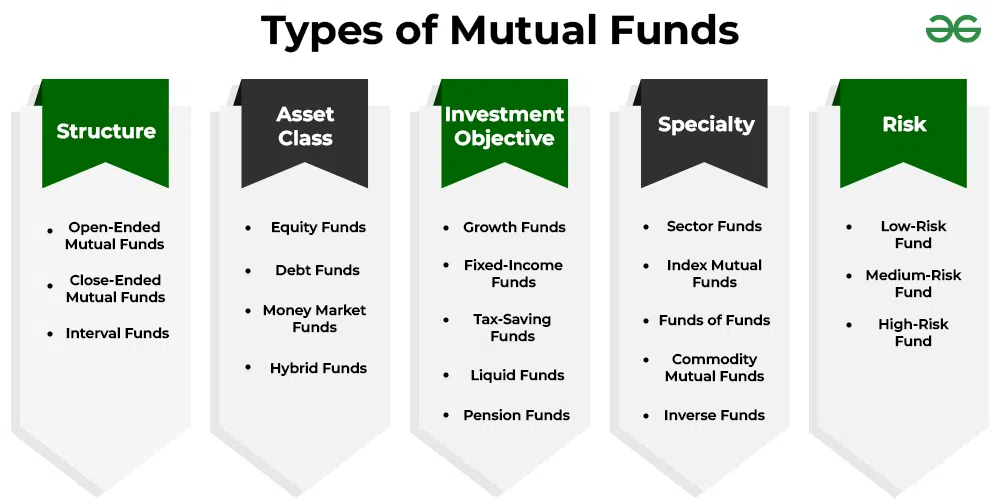

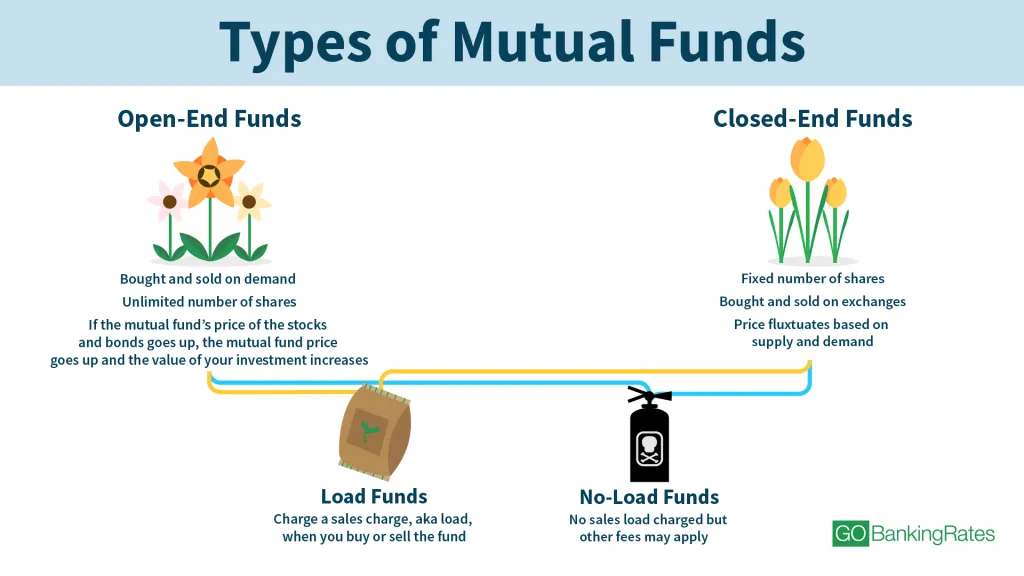

Mutual funds are one of the most popular types of investment funds. They pool money from multiple investors and invest in a diversified portfolio of stocks, bonds, and other securities. Mutual funds are managed by professional fund managers who make investment decisions on behalf of the investors. They offer a wide range of investment options, including equity funds, bond funds, balanced funds, and sector-specific funds.

Exchange-Traded Funds (ETFs):

ETFs are similar to mutual funds but trade on stock exchanges like individual stocks. They are designed to track the performance of a specific index, sector, or asset class. ETFs offer investors the flexibility to buy and sell shares throughout the trading day at market prices. They provide diversification, transparency, and lower costs compared to traditional mutual funds.

Hedge Funds:

Hedge funds are alternative investment vehicles that are typically available only to accredited investors. They employ sophisticated investment strategies, such as leverage, derivatives, and short-selling, to generate high returns. Hedge funds have more flexibility in terms of investment options and can invest in a wide range of assets, including stocks, bonds, commodities, and real estate.

Index Funds:

Money Market Funds:

Money market funds invest in short-term, low-risk securities, such as Treasury bills, certificates of deposit, and commercial paper. They aim to provide investors with a stable value and liquidity. Money market funds are considered to be a safer investment option compared to other types of funds, making them suitable for conservative investors or those with a short-term investment horizon.

Real Estate Investment Trusts (REITs):

REITs are investment funds that own and operate income-generating real estate properties, such as office buildings, shopping malls, and residential complexes. They offer investors the opportunity to invest in real estate without the need to directly own and manage properties. REITs provide regular income through rental payments and potential capital appreciation.

Historical Overview of Investment Funds

Investment funds have a long and rich history that dates back several centuries. The concept of pooling money together to invest in various assets can be traced back to the early 18th century. However, it wasn’t until the 20th century that investment funds became widely popular and accessible to individual investors.

Early Origins

The origins of investment funds can be traced back to the Netherlands in the 18th century. Dutch merchant ships were often funded by groups of investors who pooled their money together to finance these ventures. This early form of investment fund allowed individuals to invest in risky but potentially profitable expeditions.

Growth and Evolution

The growth of investment funds accelerated in the second half of the 20th century. The introduction of the 401(k) retirement plan in the 1970s further fueled the popularity of mutual funds. This retirement plan allowed employees to contribute a portion of their salary to a mutual fund, providing them with a tax-advantaged way to save for retirement.

Regulation and Transparency

Over the years, investment funds have become subject to increased regulation to protect investors and ensure transparency. In the United States, the Securities and Exchange Commission (SEC) regulates mutual funds and other investment vehicles. This regulatory oversight helps to maintain the integrity of the industry and provides investors with confidence in the funds they invest in.

Additionally, advancements in technology have made it easier for investors to access information about investment funds. Online platforms and financial websites provide detailed information about fund performance, fees, and holdings, allowing investors to make informed decisions.

Emily Bibb simplifies finance through bestselling books and articles, bridging complex concepts for everyday understanding. Engaging audiences via social media, she shares insights for financial success. Active in seminars and philanthropy, Bibb aims to create a more financially informed society, driven by her passion for empowering others.