Section 1: What is Form 4562?

Form 4562 is a tax form used by businesses to report depreciation and amortization expenses for assets they own. It is filed with the Internal Revenue Service (IRS) as part of the business’s annual tax return.

Depreciation is the process of allocating the cost of an asset over its useful life. It is an accounting method that recognizes the gradual decrease in value of an asset over time due to wear and tear, obsolescence, or other factors. Amortization, on the other hand, is the process of spreading out the cost of intangible assets, such as patents or copyrights, over their useful life.

Form 4562 is important because it allows businesses to deduct the depreciation and amortization expenses from their taxable income, reducing their overall tax liability. By accurately filling out this form, businesses can ensure that they are taking full advantage of the tax benefits associated with owning and using assets.

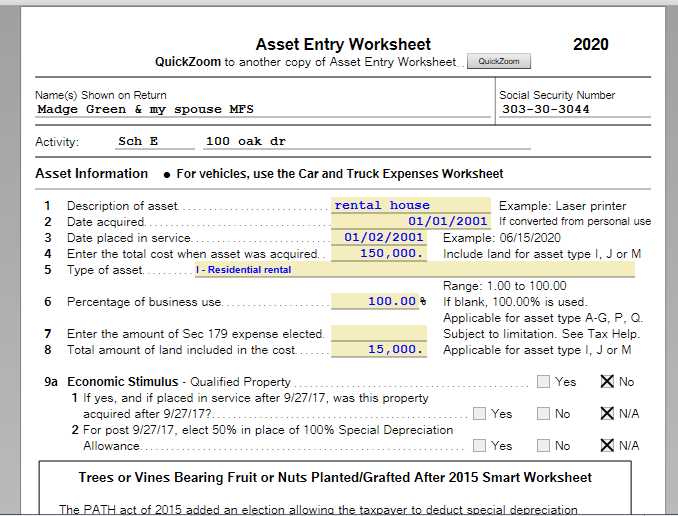

The form requires businesses to provide detailed information about the assets they own, including their description, date acquired, cost, and method of depreciation or amortization. It also requires businesses to calculate the depreciation or amortization deduction for each asset and report the total deduction on their tax return.

Section 4: Importance of Depreciation and Amortization

Depreciation is the systematic allocation of the cost of tangible assets, such as buildings, vehicles, and machinery, over their estimated useful lives. It recognizes the fact that assets lose value over time due to wear and tear, obsolescence, or other factors. By spreading the cost of an asset over its useful life, depreciation helps businesses match expenses with the revenue generated by the asset.

Depreciation is crucial for accurate financial reporting as it allows businesses to reflect the true value of their assets on the balance sheet. It helps prevent overstatement of assets’ values and provides a more realistic picture of the company’s financial health.

Amortization, on the other hand, is the process of allocating the cost of intangible assets, such as patents, copyrights, and trademarks, over their estimated useful lives. Similar to depreciation, amortization recognizes that intangible assets have a limited lifespan and their value diminishes over time.

Amortization is important for businesses as it allows them to accurately reflect the value of intangible assets on their financial statements. It ensures that the costs associated with acquiring these assets are properly accounted for and expensed over their useful lives.

Both depreciation and amortization have significant implications for a company’s profitability, taxes, and financial planning. By accurately recording and reporting these expenses, businesses can determine their true operating costs, calculate taxable income, and make informed decisions regarding asset replacement, capital budgeting, and investment strategies.

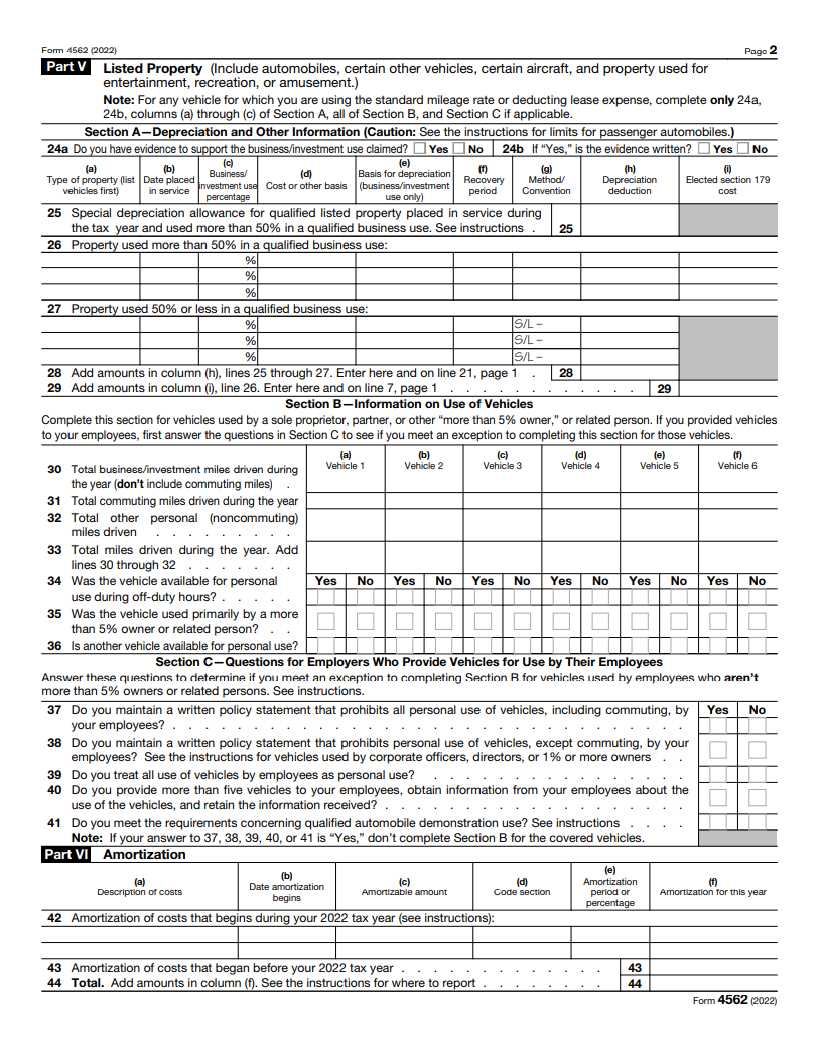

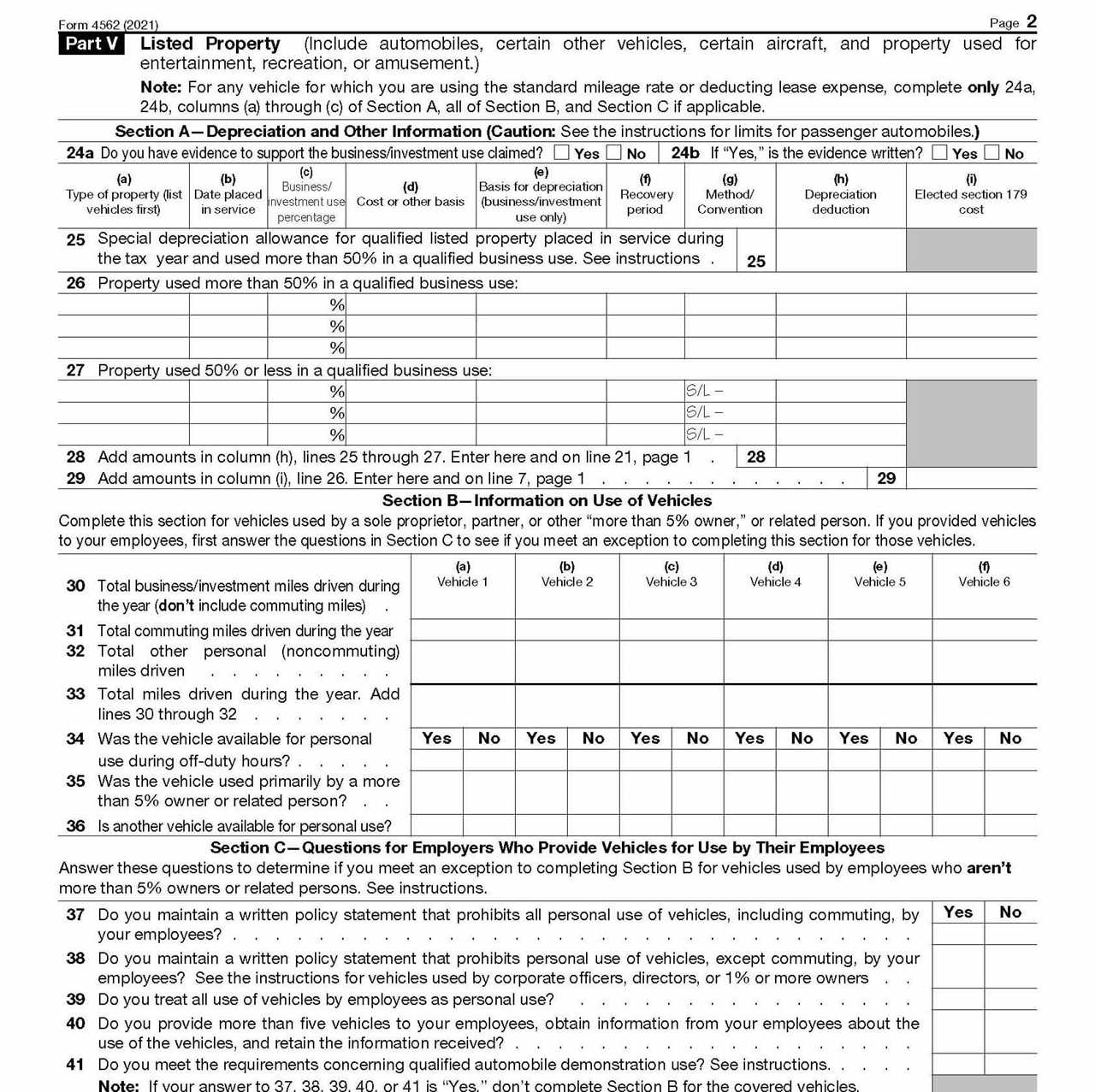

Section 3: How to Fill out Form 4562

Step 1: Provide General Information

Start by entering your name, business name, address, and tax identification number at the top of the form. This information is necessary for identification purposes.

Step 2: Determine the Property Type

Next, you need to determine the type of property for which you are claiming depreciation or amortization. This could include tangible property, such as machinery or equipment, or intangible property, such as patents or copyrights.

Step 3: Calculate the Basis

Calculate the basis of the property, which is the original cost of the property plus any additional costs, such as improvements or installation fees. This will be used to determine the depreciation or amortization deduction.

Step 4: Determine the Depreciation Method

Choose the appropriate depreciation method for your property. The most common methods include the straight-line method, the declining balance method, and the double declining balance method. Each method has its own rules and calculations, so make sure to consult the IRS guidelines or a tax professional for assistance.

Step 5: Complete the Depreciation or Amortization Table

Fill out the depreciation or amortization table provided on Form 4562. This table will require you to enter the property’s basis, the depreciation or amortization method, the recovery period, and the annual deduction. Repeat this process for each property you are claiming depreciation or amortization for.

Step 6: Calculate the Total Deduction

Add up the annual deductions for each property to calculate the total depreciation or amortization deduction. This amount will be transferred to your tax return.

Step 7: Attach Form 4562 to Your Tax Return

Once you have completed Form 4562, make sure to attach it to your tax return. Failure to do so may result in delays or penalties.

Remember, it is always recommended to consult with a tax professional or accountant when filling out tax forms to ensure accuracy and compliance with IRS regulations.

Emily Bibb simplifies finance through bestselling books and articles, bridging complex concepts for everyday understanding. Engaging audiences via social media, she shares insights for financial success. Active in seminars and philanthropy, Bibb aims to create a more financially informed society, driven by her passion for empowering others.