What are Excess Returns?

Expected returns are calculated based on various factors such as historical performance, market conditions, and risk factors. These factors help investors estimate the average returns that they can expect from a particular investment.

Excess returns can be positive or negative. Positive excess returns indicate that the investment has performed better than expected, while negative excess returns indicate underperformance.

Investors often compare the excess returns of different investments to assess their relative performance. This comparison allows them to identify investments that have consistently generated higher returns than others.

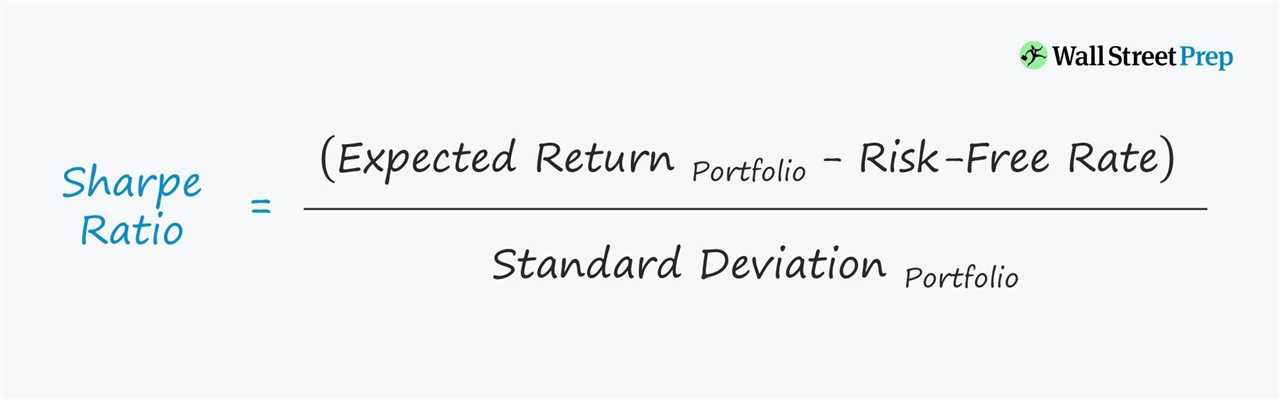

Excess returns are also used to measure the risk-adjusted performance of an investment. By considering the level of risk associated with generating the excess returns, investors can determine whether the investment is worth the risk.

Risk Factors in Excess Returns

When analyzing excess returns, it is important to consider the various risk factors that can affect the performance of an investment. These risk factors can have a significant impact on the excess returns generated by an investment and can help investors understand the potential risks involved.

Market Risk

Market risk is one of the most common risk factors that can affect excess returns. It refers to the overall volatility and fluctuations in the broader market. When the market experiences a downturn, it can negatively impact the excess returns of an investment. On the other hand, during a bull market, excess returns may be higher due to increased investor confidence and positive market sentiment.

Company-Specific Risk

Company-specific risk factors are unique to individual companies and can have a significant impact on their excess returns. These factors include things like management decisions, competitive landscape, industry trends, and financial performance. For example, if a company faces a major lawsuit or experiences a decline in sales, it can negatively impact its excess returns.

Investors need to carefully analyze company-specific risk factors to determine the potential impact on excess returns and make informed investment decisions.

Systematic Risk

Systematic risk refers to risks that are inherent in the overall market or economy and cannot be diversified away. These risks can affect all investments and are not specific to any particular company or industry. Examples of systematic risk include changes in interest rates, inflation, political instability, and natural disasters.

Systematic risk can have a significant impact on excess returns, as it affects the overall market conditions in which investments operate. Investors need to be aware of these risk factors and consider them when analyzing excess returns.

Calculating Excess Returns

To calculate excess returns, you need to have the returns of the investment or portfolio and the returns of the benchmark. The formula for calculating excess returns is:

Here’s a step-by-step guide on how to calculate excess returns:

- Obtain the historical returns of the investment or portfolio for a specific period.

- Obtain the historical returns of the benchmark for the same period.

- Calculate the excess returns by subtracting the benchmark returns from the investment returns.

For example, let’s say you want to calculate the excess returns of a stock compared to the S&P 500 index for the past year. If the stock has returned 15% and the S&P 500 index has returned 10%, the excess returns would be:

A positive excess return indicates that the investment or portfolio has outperformed the benchmark, while a negative excess return indicates underperformance.

Calculating excess returns allows investors to assess the skill or ability of an investment manager in generating returns above the market. It helps in evaluating the performance of different investment strategies and making informed investment decisions.

Interpreting Excess Returns

Factors Affecting Excess Returns

Market conditions play a significant role in determining excess returns. During bull markets, when stock prices are rising, it is easier for investors to achieve excess returns. Conversely, during bear markets, when stock prices are falling, it becomes more challenging to generate excess returns.

Industry trends also impact excess returns. Certain industries may be experiencing growth or facing challenges that can affect the performance of investments within those sectors. By analyzing industry trends, investors can identify opportunities for generating excess returns.

Company-specific factors, such as financial performance, management quality, and competitive advantage, can also contribute to excess returns. A company with strong fundamentals and a competitive edge is more likely to generate excess returns compared to its peers.

Evaluating Skill vs. Luck

When interpreting excess returns, it is essential to distinguish between skill and luck. Skill refers to the ability of an investor or portfolio manager to consistently outperform the market or generate excess returns. Luck, on the other hand, refers to random fluctuations in investment performance that are not attributable to skill.

To evaluate skill, investors can compare the excess returns of an investment or portfolio to a benchmark index that represents the overall market performance. If the excess returns consistently exceed the benchmark, it suggests the presence of skill. However, if the excess returns are sporadic or do not consistently outperform the benchmark, it may indicate that luck plays a significant role.

It is also important to consider the time horizon when evaluating excess returns. Short-term excess returns may be more influenced by luck, while long-term excess returns are more likely to be a result of skill. By analyzing the consistency and sustainability of excess returns over time, investors can gain insights into the skill of the investment manager.

Conclusion

Applications of Excess Returns in Financial Analysis

1. Performance Evaluation: Excess returns are used to evaluate the performance of investment portfolios, mutual funds, and individual securities. By comparing the excess returns of different investments, analysts can assess which investments outperform or underperform the market or their peers.

2. Risk Assessment: Excess returns help in assessing the risk associated with an investment. By analyzing the volatility of excess returns, analysts can determine the level of risk involved in an investment. Higher volatility indicates higher risk, while lower volatility indicates lower risk.

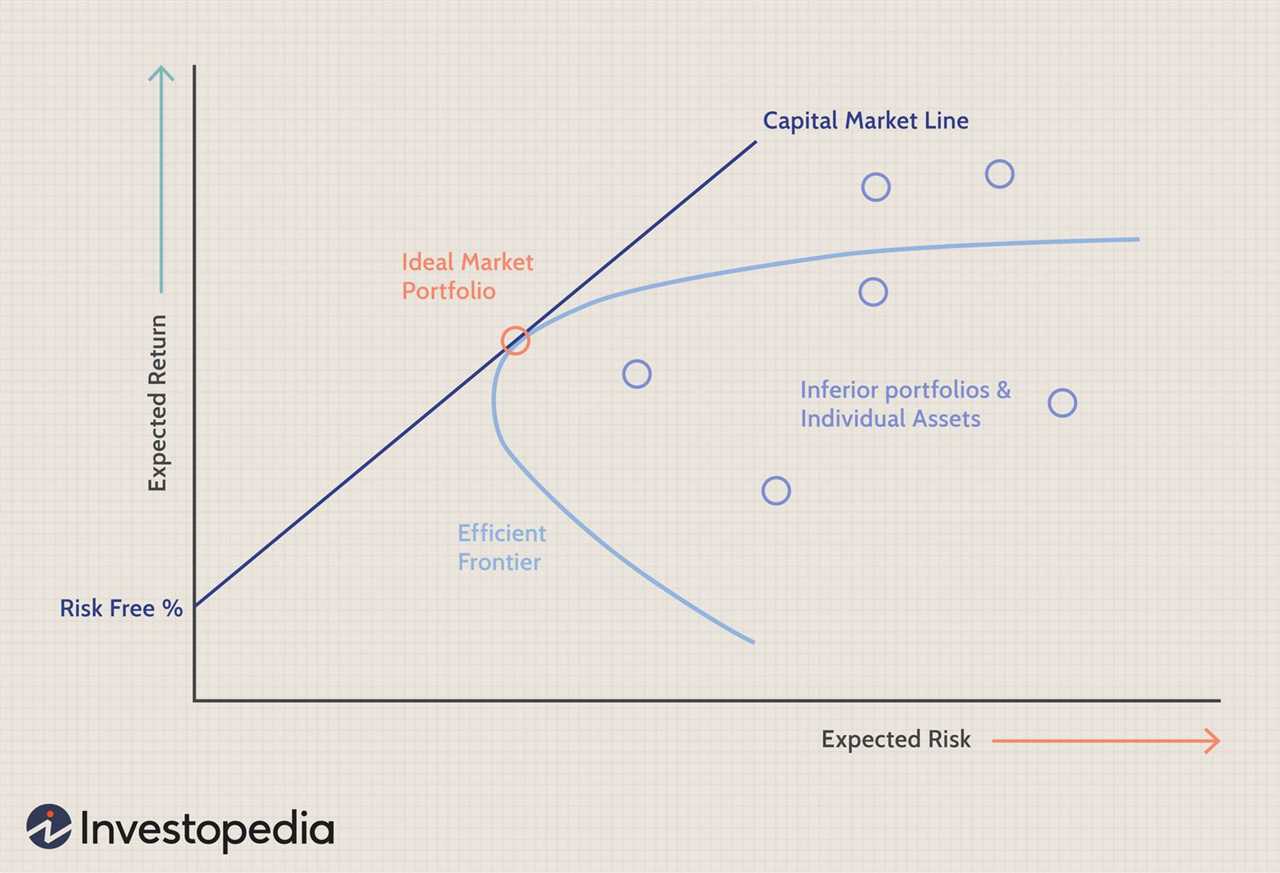

3. Portfolio Construction: Excess returns are used in constructing diversified investment portfolios. Investors aim to achieve a balance between risk and return by selecting investments with positive excess returns and low correlation with each other. This diversification helps in reducing the overall risk of the portfolio.

4. Benchmarking: Excess returns are used as benchmarks to evaluate the performance of investment managers. By comparing the excess returns of a portfolio with a relevant benchmark, investors can determine whether the investment manager is adding value or underperforming.

5. Investment Strategy: Excess returns are used to develop investment strategies. By analyzing historical excess returns, investors can identify patterns and trends that can guide their investment decisions. For example, if a particular investment consistently generates positive excess returns during certain market conditions, investors may choose to allocate more funds to that investment during similar market conditions.

7. Investment Recommendations: Excess returns are used by financial analysts to make investment recommendations to clients. By analyzing the excess returns of different investments, analysts can identify investment opportunities that have the potential to generate above-average returns. These recommendations are based on a thorough analysis of various factors such as market trends, company fundamentals, and risk factors.

Emily Bibb simplifies finance through bestselling books and articles, bridging complex concepts for everyday understanding. Engaging audiences via social media, she shares insights for financial success. Active in seminars and philanthropy, Bibb aims to create a more financially informed society, driven by her passion for empowering others.