What is Common Equity Tier?

Common Equity Tier (CET) is a key measure used in the banking industry to assess a bank’s financial strength and ability to absorb losses. It represents the highest quality capital that a bank holds and serves as a buffer to protect against potential losses.

Definition and Calculation

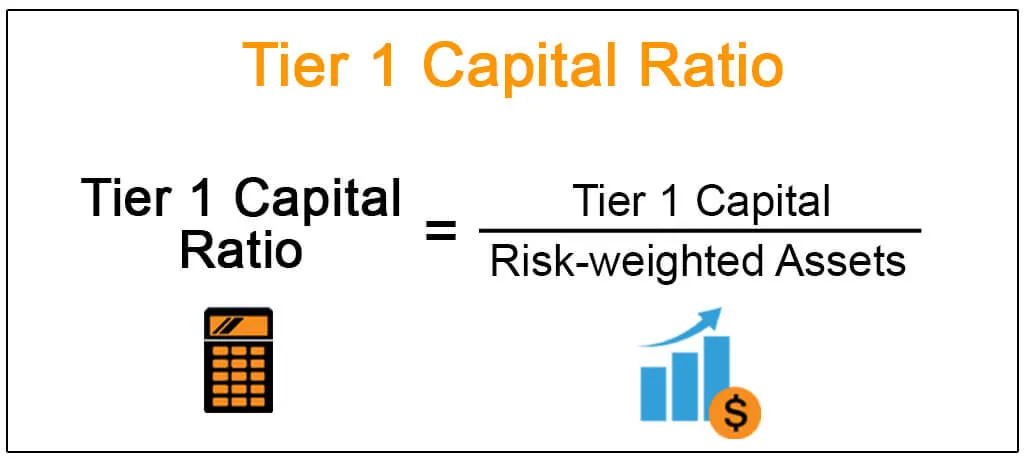

CET is calculated as a percentage of a bank’s risk-weighted assets (RWA). It includes common shares, retained earnings, and other comprehensive income. To calculate CET, the bank’s total capital is divided by its RWA and multiplied by 100.

The formula for calculating CET is as follows:

| CET Ratio | = | (Common Equity + Retained Earnings + Other Comprehensive Income) | / | Risk-Weighted Assets | * | 100 |

|---|

Importance of Common Equity Tier

CET is important because it indicates the level of financial stability and resilience of a bank. A higher CET ratio suggests that a bank has a stronger capital base and is better able to withstand financial shocks or economic downturns. It also provides confidence to depositors, investors, and regulators that the bank is well-capitalized and can meet its obligations.

Regulators often set minimum CET requirements to ensure the stability of the banking system and protect depositors. Banks that fail to meet these requirements may face restrictions on their operations or be required to raise additional capital.

Additionally, a higher CET ratio can also lead to lower borrowing costs for a bank, as it demonstrates a lower level of risk to lenders. This can help the bank to access funding at more favorable terms and improve its profitability.

In summary, Common Equity Tier is a crucial measure of a bank’s financial strength and stability. It provides an indication of the bank’s ability to absorb losses and meet its obligations, and is closely monitored by regulators, investors, and other stakeholders in the banking industry.

Definition and Calculation

Common Equity Tier (CET) is a key measure used in the banking industry to assess a bank’s financial strength and stability. It represents the portion of a bank’s capital that is primarily composed of common equity, which includes common shares and retained earnings.

The calculation of CET involves subtracting certain deductions and adjustments from a bank’s total capital. These deductions may include intangible assets, deferred tax assets, and certain investments. The resulting figure represents the bank’s CET capital.

The CET ratio is then calculated by dividing the bank’s CET capital by its risk-weighted assets (RWA). The RWA is a measure of the bank’s exposure to credit, market, and operational risks. The higher the CET ratio, the stronger the bank’s capital position and ability to absorb losses.

Regulatory authorities, such as central banks, often set minimum CET ratio requirements for banks to ensure financial stability and protect depositors. These requirements may vary across jurisdictions and are typically higher for systemically important banks.

By calculating and monitoring their CET ratio, banks can assess their ability to withstand financial shocks and meet regulatory requirements. A higher CET ratio not only enhances a bank’s resilience but also instills confidence in its stakeholders, including investors, depositors, and regulators.

Importance of Common Equity Tier

The Common Equity Tier (CET) is a crucial measure of a bank’s financial strength and stability. It represents the highest quality capital that a bank holds and serves as a buffer to absorb losses during times of financial stress. The importance of CET cannot be overstated, as it plays a vital role in ensuring the resilience and stability of the banking system.

Here are some key reasons why the Common Equity Tier is of utmost importance:

- Enhances Financial Stability: CET provides a solid foundation for a bank’s financial stability by ensuring that it has a sufficient capital cushion to absorb potential losses. This helps to protect depositors and maintain public confidence in the banking system.

- Supports Risk Management: CET serves as a risk management tool by incentivizing banks to maintain a healthy balance between risk-taking and capital adequacy. It encourages banks to adopt prudent lending practices and avoid excessive risk exposure, reducing the likelihood of financial crises.

- Facilitates Regulatory Compliance: CET is a regulatory requirement imposed by financial authorities to ensure that banks have a minimum level of capital to withstand adverse economic conditions. By meeting CET standards, banks demonstrate their compliance with regulatory guidelines and contribute to the overall stability of the financial system.

- Enables Business Expansion: Having a strong CET ratio allows banks to expand their business activities, such as lending and investment, with confidence. It provides a solid foundation for growth and enables banks to seize opportunities in the market while maintaining financial resilience.

- Attracts Investor Confidence: A high CET ratio signals to investors that a bank is well-capitalized and financially sound. This attracts investor confidence and enhances the bank’s ability to raise capital in the market, enabling it to fund its operations, invest in new technologies, and support economic growth.

In summary, the Common Equity Tier is of paramount importance as it ensures the financial stability of banks, supports risk management, facilitates regulatory compliance, enables business expansion, and attracts investor confidence. By maintaining a strong CET ratio, banks can navigate economic uncertainties, protect their stakeholders, and contribute to the overall stability of the financial system.

Monetary policy can be implemented through various measures, including adjusting interest rates, buying or selling government securities, and changing reserve requirements for banks. These actions are aimed at influencing borrowing and spending behavior, which in turn affects the overall level of economic activity.

One of the key goals of monetary policy is to maintain price stability, which means keeping inflation at a low and stable level. By controlling the money supply and interest rates, central banks can help prevent excessive inflation or deflation, which can have negative consequences for the economy.

Monetary policy also plays a role in promoting economic growth and employment. By lowering interest rates, central banks can encourage borrowing and investment, which can stimulate economic activity and create jobs. Conversely, raising interest rates can help cool down an overheating economy and prevent excessive borrowing and inflation.

Impact on Common Equity Tier

Monetary policy decisions, such as changes in interest rates or reserve requirements, can have a direct impact on a bank’s common equity tier. When interest rates are lowered, borrowing costs decrease, which can stimulate economic activity and increase the demand for loans. As a result, banks may experience an increase in loan portfolios, leading to a higher risk exposure.

This increase in risk exposure can potentially lower a bank’s common equity tier ratio. Banks must carefully manage their risk exposure to ensure that their common equity tier remains above regulatory requirements. Failure to maintain an adequate common equity tier ratio can result in regulatory penalties and restrictions on the bank’s operations.

The Role of Risk Management

Effective risk management practices are essential for maintaining a healthy common equity tier. Banks must carefully assess and monitor the risks associated with their loan portfolios, investments, and other activities. This includes conducting stress tests and scenario analyses to evaluate the potential impact of adverse events on the bank’s common equity tier.

Additionally, banks should have robust risk mitigation strategies in place, such as diversifying their loan portfolios, maintaining sufficient capital buffers, and implementing effective risk controls and monitoring systems. By proactively managing risks, banks can ensure the stability and resilience of their common equity tier.

Regulatory Compliance

Non-compliance with regulatory standards can have severe consequences for a bank, including reputational damage, financial penalties, and restrictions on business activities. Therefore, banks must stay informed about regulatory changes and adapt their strategies and operations accordingly to maintain a healthy common equity tier.

Emily Bibb simplifies finance through bestselling books and articles, bridging complex concepts for everyday understanding. Engaging audiences via social media, she shares insights for financial success. Active in seminars and philanthropy, Bibb aims to create a more financially informed society, driven by her passion for empowering others.