What is an Accounting Method?

An accounting method is a set of rules and procedures that a company uses to record and report its financial transactions. It is a systematic approach to organizing and analyzing financial information, which allows businesses to track their income, expenses, assets, and liabilities accurately.

Types of Accounting Methods

There are several types of accounting methods, each with its own set of rules and principles. The most common types include:

- Cash Basis Accounting: This method records transactions when cash is received or paid out. It is straightforward and suitable for small businesses with simple financial transactions.

- Accrual Basis Accounting: This method records transactions when they occur, regardless of when cash is received or paid out. It provides a more accurate picture of a company’s financial position and is commonly used by larger businesses.

- Hybrid Accounting: This method combines elements of both cash basis and accrual basis accounting. It allows businesses to use different methods for different aspects of their financial reporting.

Each accounting method has its advantages and disadvantages, and businesses should choose the method that best suits their needs and complies with applicable accounting standards and regulations.

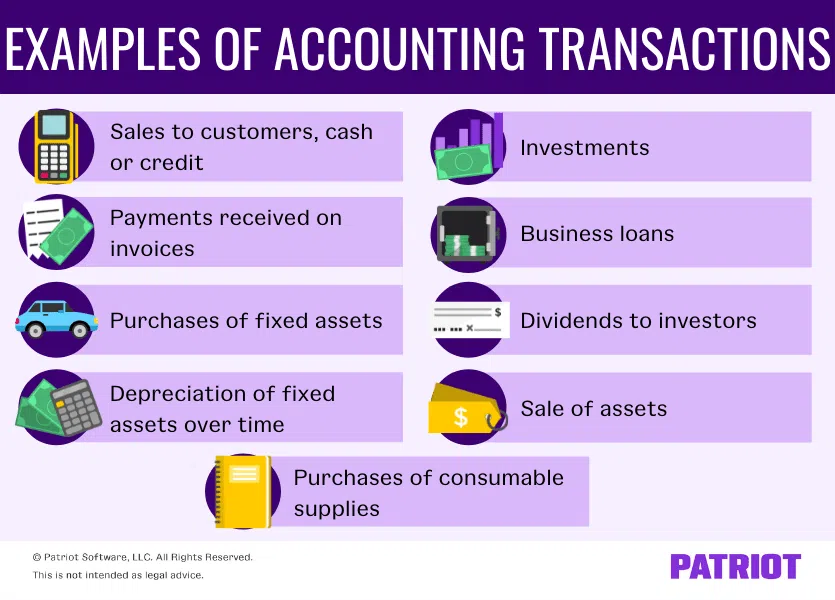

Example of Accounting Methods

Let’s consider an example to understand how different accounting methods can affect financial reporting:

Company XYZ sells a product for $1,000 to a customer on December 31, 2021. The customer pays in cash on January 15, 2022.

- Under the cash basis accounting method, Company XYZ would record the revenue of $1,000 on January 15, 2022, when the cash is received.

- Under the accrual basis accounting method, Company XYZ would record the revenue of $1,000 on December 31, 2021, when the sale occurs.

- Under the hybrid accounting method, Company XYZ could choose to record the revenue on December 31, 2021, but record the cash receipt on January 15, 2022.

As you can see, the choice of accounting method can impact when revenue is recognized, which can affect financial statements and performance metrics.

Types of Accounting Methods

Accounting methods refer to the specific rules and guidelines that businesses use to record and report their financial transactions. There are several types of accounting methods that can be used, depending on the nature of the business and its reporting requirements. Here are some of the most common types:

| Method | Description | Example |

|---|---|---|

| Cash Basis | This method records revenue and expenses when cash is received or paid out. It is simple and straightforward, but it may not accurately reflect the financial position of a business. | A small retail store that records sales when customers pay in cash. |

| Accrual Basis | This method records revenue and expenses when they are earned or incurred, regardless of when cash is received or paid out. It provides a more accurate picture of a business’s financial performance. | A consulting firm that records revenue when services are provided, even if payment is received at a later date. |

| Hybrid Method | This method combines elements of both cash basis and accrual basis accounting. It allows businesses to use cash basis for certain transactions and accrual basis for others. | A construction company that uses cash basis for recording expenses but accrual basis for recording revenue. |

| Inventory Method | This method is used by businesses that carry inventory. It determines how the cost of inventory is accounted for and includes methods such as FIFO (first-in, first-out) and LIFO (last-in, first-out). | A grocery store that uses the FIFO method to determine the cost of goods sold. |

| Percentage of Completion Method | This method is used in long-term construction projects. It recognizes revenue and expenses based on the percentage of completion of the project. | A construction company that recognizes revenue and expenses based on the percentage of completion of a building project. |

Example of Accounting Methods

Scenario:

ABC Company is a small retail business that sells clothing. They use the accrual accounting method to record their financial transactions.

Example:

On January 1st, ABC Company purchases inventory worth $10,000 to sell in their store. They pay for the inventory in cash.

Under the accrual accounting method, ABC Company would record this transaction as follows:

1. Journal Entry:

Date: January 1st

Account Debit Credit

Inventory $10,000

Cash $10,000

2. Income Statement:

ABC Company would not immediately recognize the expense of purchasing the inventory on their income statement. Instead, they would record the cost of goods sold (COGS) when the inventory is sold.

3. Balance Sheet:

The inventory purchased would be recorded as an asset on ABC Company’s balance sheet. It would increase their inventory account by $10,000.

The cash used to pay for the inventory would decrease their cash account by $10,000.

When ABC Company sells the inventory, they would record the revenue on their income statement and reduce the inventory on their balance sheet.

For example, if they sell $5,000 worth of inventory, the journal entry would be:

Date: January 15th

Account Debit Credit

Accounts Receivable $5,000

Revenue $5,000

Cost of Goods Sold $5,000

Inventory $5,000

5. Financial Statements:

At the end of the accounting period, ABC Company would prepare their financial statements, including the income statement, balance sheet, and cash flow statement. These statements would provide a comprehensive overview of their financial performance and position.

By using the accrual accounting method, ABC Company can accurately match their expenses with their revenues, providing a more realistic representation of their financial situation.

It is important for businesses to choose the accounting method that best suits their needs and complies with accounting standards and regulations.

Emily Bibb simplifies finance through bestselling books and articles, bridging complex concepts for everyday understanding. Engaging audiences via social media, she shares insights for financial success. Active in seminars and philanthropy, Bibb aims to create a more financially informed society, driven by her passion for empowering others.