What are Accruals?

Accruals are an important concept in accounting that helps businesses accurately record and report their financial transactions. They are used to recognize revenue and expenses in the period in which they are earned or incurred, regardless of when the cash is received or paid.

Accruals are based on the accrual accounting method, which is the most widely used method of accounting in the business world. This method requires businesses to record transactions when they occur, rather than when cash is exchanged. This provides a more accurate picture of a company’s financial health and performance.

How do Accruals work?

Accruals work by matching revenues and expenses to the period in which they are earned or incurred. This is done through the use of accrual entries, which record the transaction in the appropriate accounting period, regardless of when the cash is received or paid.

For example, let’s say a company provides services to a customer in December, but the customer doesn’t pay until January. Under the accrual accounting method, the company would recognize the revenue in December, when the services were provided, rather than in January when the cash is received.

Similarly, if a company incurs an expense in December but doesn’t pay until January, the expense would be recognized in December, when it was incurred, rather than in January when the cash is paid.

Why are Accruals important?

Accruals are important because they provide a more accurate representation of a company’s financial position and performance. By recognizing revenues and expenses in the period in which they are earned or incurred, accrual accounting allows businesses to better match their revenues and expenses, providing a more realistic view of their profitability.

This is particularly important for businesses that operate on a credit basis, where cash is not immediately exchanged for goods or services. Accrual accounting ensures that these businesses accurately reflect their financial transactions, even if the cash is not received or paid until a later date.

Accruals also help to provide a more consistent and comparable financial statement. By using the accrual accounting method, businesses can ensure that their financial statements are prepared in a consistent manner, allowing for easier comparison between different periods and companies.

Accrual accounting is a method of recording financial transactions based on the accrual principle. This principle states that revenues and expenses should be recognized when they are earned or incurred, regardless of when the cash is received or paid.

Accrual Principle

The accrual principle is based on the concept of matching revenues with expenses. It ensures that financial statements provide a more accurate representation of a company’s financial position and performance by recording revenues and expenses in the period in which they are earned or incurred, rather than when the cash is received or paid.

Under the accrual principle, revenues are recognized when they are earned, meaning when goods are delivered or services are provided to customers, regardless of when the cash is received. Expenses, on the other hand, are recognized when they are incurred, meaning when goods or services are received from suppliers or when obligations are fulfilled, regardless of when the cash is paid.

Accrual Basis vs. Cash Basis

Accrual accounting differs from cash accounting, which recognizes revenues and expenses only when cash is received or paid. While cash accounting is simpler and easier to understand, it may not provide an accurate picture of a company’s financial position and performance, especially for businesses that extend credit to customers or receive credit from suppliers.

Accrual accounting, on the other hand, provides a more comprehensive view of a company’s financial activities by recognizing revenues and expenses when they are earned or incurred, even if the cash transactions have not yet occurred. This allows for a more accurate assessment of a company’s profitability and financial health.

Accrual Accounting and Financial Statements

Accrual accounting is used to prepare financial statements, including the income statement, balance sheet, and statement of cash flows. These statements provide a snapshot of a company’s financial position and performance, and are essential for decision-making by investors, creditors, and other stakeholders.

The income statement shows the revenues earned and expenses incurred during a specific period, regardless of when the cash is received or paid. This allows for a more accurate determination of the company’s profitability.

The balance sheet provides a snapshot of a company’s financial position at a specific point in time, including its assets, liabilities, and shareholders’ equity. Accrual accounting ensures that all relevant assets and liabilities are recorded, even if the cash transactions have not yet occurred.

The statement of cash flows shows the cash inflows and outflows during a specific period, classified into operating, investing, and financing activities. Accrual accounting allows for a reconciliation between the income statement and the statement of cash flows, providing a more comprehensive view of a company’s cash position.

Conclusion

Accrual accounting is a fundamental principle in financial reporting that ensures revenues and expenses are recognized when they are earned or incurred, regardless of when the cash is received or paid. This method provides a more accurate representation of a company’s financial position and performance, and is essential for decision-making by investors, creditors, and other stakeholders.

Accruals in Financial Statements

Accruals play a crucial role in financial statements, providing a more accurate representation of a company’s financial position and performance. Unlike cash accounting, which only records transactions when cash is received or paid, accrual accounting recognizes revenue and expenses when they are earned or incurred, regardless of when the cash is exchanged.

Accruals are reflected in various financial statements, including the income statement, balance sheet, and statement of cash flows. Let’s take a closer look at how accruals are presented in each of these statements:

Income Statement

For example, if a company provides services to a customer in December but does not receive payment until January, the revenue from that service will still be recognized in December’s income statement. This allows for a more accurate depiction of the company’s financial performance during that period.

Balance Sheet

The balance sheet provides a snapshot of a company’s financial position at a specific point in time. Accruals are crucial in determining the company’s assets, liabilities, and equity. Accrued revenue and expenses are included on the balance sheet to reflect the company’s obligations and potential future cash flows.

Accrued revenue represents revenue that has been earned but not yet received. For example, if a company provides a service to a customer but has not yet invoiced them, the revenue from that service will be recorded as accrued revenue on the balance sheet.

Accrued expenses, on the other hand, represent expenses that have been incurred but not yet paid. For instance, if a company receives a utility bill but has not yet made the payment, the expense will be recorded as accrued expenses on the balance sheet.

Statement of Cash Flows

When preparing the statement of cash flows, the net income is adjusted for non-cash items, such as depreciation and changes in accruals. This adjustment ensures that the cash flow from operating activities reflects the actual cash generated or used by the company during the period.

Overall, accruals are essential in providing a more accurate and comprehensive view of a company’s financial position and performance. They allow for the recognition of revenue and expenses when they are earned or incurred, providing a more realistic representation of a company’s financial activities.

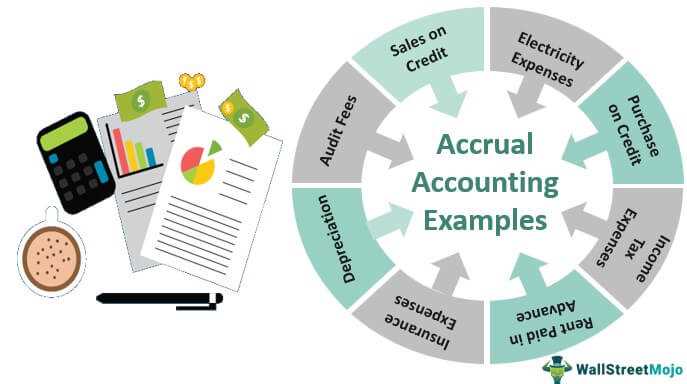

Accrual Examples

Accrual accounting is a method of recording financial transactions that occur over a period of time, rather than at the time the cash is exchanged. This allows for a more accurate representation of a company’s financial position and performance. Here are some examples of accruals in accounting:

- Accrued Revenue: This occurs when a company provides goods or services to a customer but has not yet received payment. The revenue is recognized in the financial statements as an accounts receivable.

- Accrued Expenses: These are expenses that a company has incurred but has not yet paid. Examples include salaries and wages, interest, and utilities. The expenses are recognized in the financial statements as accounts payable.

- Accrued Interest: When a company borrows money and accrues interest over time, the interest expense is recognized even if the payment has not been made.

- Accrued Taxes: Taxes, such as income tax or sales tax, are often accrued based on the estimated amount owed for the period.

- Accrued Depreciation: Depreciation is the allocation of the cost of an asset over its useful life. Accrued depreciation represents the portion of the asset’s cost that has been allocated but not yet recorded as an expense.

These examples illustrate how accrual accounting captures the economic activity of a business, even if the cash flow has not yet occurred. By recognizing revenues and expenses when they are earned or incurred, rather than when the cash is received or paid, accrual accounting provides a more accurate picture of a company’s financial performance.

Benefits of Accrual Accounting

Accrual accounting is a method of recording financial transactions that focuses on recognizing revenue and expenses when they are earned or incurred, regardless of when the cash is actually received or paid. This method provides several benefits for businesses and investors.

One of the main benefits of accrual accounting is that it provides a more accurate picture of a company’s financial performance. By recognizing revenue and expenses when they are earned or incurred, rather than when the cash is received or paid, accrual accounting reflects the economic reality of a business. This allows for a more accurate assessment of a company’s profitability and financial health.

Accrual accounting also provides better comparability between different periods. Since revenue and expenses are recognized when they are earned or incurred, rather than when the cash is received or paid, accrual accounting allows for a more consistent comparison of financial statements over time. This makes it easier to identify trends and patterns in a company’s financial performance.

Furthermore, accrual accounting helps businesses manage their cash flow more effectively. By recognizing revenue and expenses when they are earned or incurred, businesses can anticipate future cash flows and plan accordingly. This allows for better financial planning and decision-making, as businesses can identify potential cash shortages or surpluses in advance.

Accrual accounting also provides transparency and accountability. By recording revenue and expenses when they are earned or incurred, accrual accounting ensures that all financial transactions are properly accounted for. This helps prevent fraud and misrepresentation, as it provides a clear and accurate record of a company’s financial activities.

Finally, accrual accounting is required by generally accepted accounting principles (GAAP) for most businesses. By following accrual accounting principles, businesses can ensure compliance with accounting standards and regulations. This helps build trust and credibility with investors, lenders, and other stakeholders.

Emily Bibb simplifies finance through bestselling books and articles, bridging complex concepts for everyday understanding. Engaging audiences via social media, she shares insights for financial success. Active in seminars and philanthropy, Bibb aims to create a more financially informed society, driven by her passion for empowering others.