What is a Trading Account?

A trading account is a type of financial account that allows individuals and businesses to buy and sell various financial instruments, such as stocks, bonds, commodities, and currencies. It serves as a platform for investors to participate in the financial markets and engage in trading activities.

Definition and Explanation

A trading account is typically opened with a brokerage firm or an online trading platform. It provides access to the financial markets and allows investors to execute trades based on their investment strategies and goals. The account holds the funds and securities needed for trading, and it also keeps track of the investor’s portfolio and transactions.

Trading accounts can be used for various types of trading, including day trading, swing trading, and long-term investing. They offer flexibility and convenience, as investors can trade from anywhere with an internet connection.

How to Open a Trading Account

Opening a trading account is a straightforward process. Here are the general steps:

- Choose a reputable brokerage firm or online trading platform.

- Complete the account application form, providing personal information and financial details.

- Submit any required identification documents, such as a passport or driver’s license.

- Deposit funds into the trading account to start trading.

- Read and understand the terms and conditions of the trading account.

- Start trading by placing buy or sell orders through the trading platform.

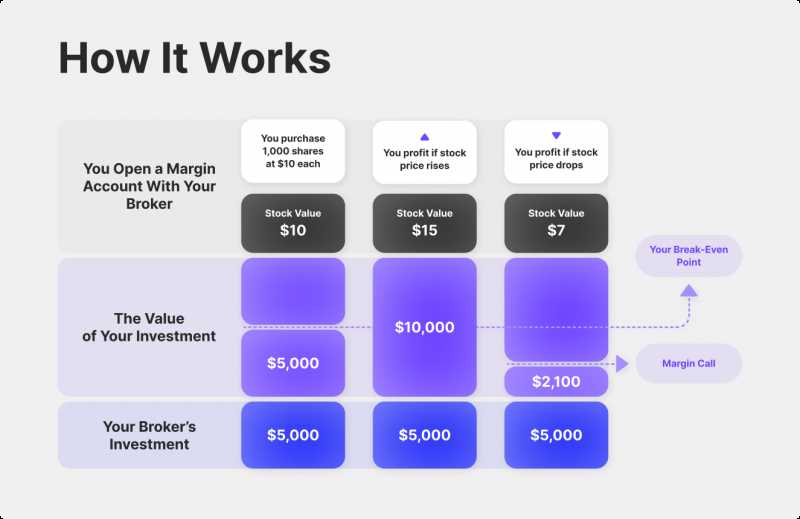

Margin requirements are an essential aspect of trading accounts, especially for leveraged trading. Margin is the amount of money or collateral that traders must deposit to open and maintain positions in the financial markets. It acts as a form of security for the brokerage firm.

Margin requirements vary depending on the financial instrument and the broker’s policies. They are typically expressed as a percentage of the total trade value. For example, if the margin requirement is 10%, and you want to trade $10,000 worth of a particular stock, you would need to deposit $1,000 as margin.

It’s crucial to understand and manage margin requirements effectively to avoid margin calls and potential losses. Traders should always consider their risk tolerance and financial situation before engaging in leveraged trading.

| Advantages of a Trading Account | Disadvantages of a Trading Account |

|---|---|

|

|

Overall, a trading account provides individuals and businesses with the opportunity to participate in the financial markets and potentially generate profits. However, it’s essential to approach trading with caution, conduct thorough research, and manage risks effectively.

Definition and Explanation

A trading account is a type of financial account that allows individuals or businesses to buy and sell various financial instruments, such as stocks, bonds, currencies, and commodities. It is used to facilitate the buying and selling of these instruments in the financial markets.

Trading accounts are typically offered by brokerage firms or financial institutions, which act as intermediaries between the traders and the financial markets. These accounts provide traders with access to the necessary tools and platforms to execute trades and monitor their investments.

Benefits of a Trading Account

There are several benefits to having a trading account:

- Access to financial markets: A trading account allows individuals and businesses to participate in the global financial markets, giving them the opportunity to profit from price movements in various financial instruments.

- Diversification of investments: With a trading account, traders can invest in a wide range of financial instruments, spreading their risk and potentially increasing their chances of earning returns.

- Leverage: Many trading accounts offer leverage, which allows traders to control larger positions with a smaller amount of capital. This can amplify potential profits, but also increases the risk of losses.

- Access to research and analysis: Brokerage firms often provide traders with access to research reports, market analysis, and other tools that can help inform their trading decisions.

Conclusion

A trading account is an essential tool for individuals and businesses looking to participate in the financial markets. It provides access to a wide range of financial instruments and offers various benefits, including diversification, leverage, and flexibility. By opening a trading account, traders can take advantage of market opportunities and potentially earn profits from their investments.

How to Open a Trading Account

Opening a trading account is a straightforward process that can be done online or through a brokerage firm. Here are the steps to open a trading account:

- Choose a brokerage firm: Research and compare different brokerage firms to find one that suits your needs. Consider factors such as fees, customer service, and the range of investment options available.

- Complete the application: Once you have chosen a brokerage firm, you will need to fill out an application form. This form will require personal information such as your name, address, and social security number.

- Provide identification: To open a trading account, you will need to provide identification documents such as a passport or driver’s license. This is to verify your identity and comply with anti-money laundering regulations.

- Choose an account type: There are different types of trading accounts available, such as cash accounts and margin accounts. Consider your trading goals and risk tolerance when choosing the account type.

- Deposit funds: Once your application is approved, you will need to deposit funds into your trading account. The minimum deposit requirement varies depending on the brokerage firm.

- Start trading: After your account is funded, you can start trading. Familiarize yourself with the trading platform provided by the brokerage firm and begin executing trades.

Opening a trading account is the first step towards participating in the financial markets. It provides you with the necessary tools and access to start buying and selling securities. Make sure to do thorough research and choose a reputable brokerage firm that meets your trading needs.

Step-by-Step Guide to Opening a Trading Account

Opening a trading account is an essential step for anyone looking to participate in financial markets. Whether you are interested in stocks, forex, or commodities, having a trading account allows you to buy and sell assets and potentially make a profit. Here is a step-by-step guide to help you open a trading account:

- Research and choose a reputable broker: Start by researching different brokers and selecting one that suits your needs. Look for a broker that offers a user-friendly platform, competitive fees, and a wide range of tradable assets.

- Visit the broker’s website: Once you have chosen a broker, visit their website and look for the “Open an Account” or “Sign Up” button. Click on it to start the account opening process.

- Fill out the application form: The broker will ask you to fill out an application form with personal information such as your name, address, and contact details. Make sure to provide accurate information.

- Verify your identity: To comply with regulatory requirements, brokers usually require you to verify your identity. This can be done by providing a copy of your passport or driver’s license and a proof of address, such as a utility bill or bank statement.

- Choose your account type: Brokers typically offer different types of trading accounts, such as individual, joint, or corporate accounts. Select the account type that suits your needs.

- Read and accept the terms and conditions: Before finalizing the account opening process, make sure to read and understand the broker’s terms and conditions. This includes important information about fees, trading rules, and account security.

- Deposit funds: To start trading, you will need to deposit funds into your trading account. The minimum deposit requirement varies depending on the broker and account type. Choose a convenient payment method and follow the instructions to make a deposit.

- Download and set up the trading platform: Once your account is funded, you can download and set up the trading platform provided by the broker. This platform will allow you to access the financial markets, place trades, and monitor your positions.

- Start trading: With your trading account set up and funded, you are ready to start trading. Before placing any trades, it is important to educate yourself about the markets and develop a trading strategy.

Remember, opening a trading account is just the first step. Successful trading requires knowledge, skills, and discipline. Take the time to learn about different trading strategies, risk management techniques, and market analysis methods to increase your chances of success.

Margin requirements are an important aspect of trading accounts that every trader should understand. In simple terms, margin refers to the amount of money that a trader needs to deposit in their trading account in order to open and maintain positions.

Margin requirements vary depending on the financial instrument being traded and the broker’s policies. It is important to note that margin requirements can change, so it is crucial to stay updated with the latest information from your broker.

Margin requirements serve two main purposes:

1. Risk Management:

Margin requirements help to manage the risk associated with trading. By requiring traders to deposit a certain amount of money as margin, brokers ensure that traders have enough funds to cover potential losses. This helps to protect both the trader and the broker from excessive losses.

2. Leverage:

Margin requirements also enable traders to leverage their positions. Leverage allows traders to control larger positions with a smaller amount of capital. For example, if the leverage ratio is 1:100, it means that for every $1 of margin deposited, the trader can control $100 worth of positions.

It is important to understand that while leverage can amplify profits, it can also amplify losses. Therefore, it is crucial to use leverage responsibly and to have a solid risk management strategy in place.

Emily Bibb simplifies finance through bestselling books and articles, bridging complex concepts for everyday understanding. Engaging audiences via social media, she shares insights for financial success. Active in seminars and philanthropy, Bibb aims to create a more financially informed society, driven by her passion for empowering others.