Tax Accounting: Definition

Tax accounting is a specialized branch of accounting that focuses on the preparation, analysis, and presentation of tax-related information. It involves the application of tax laws and regulations to ensure compliance and minimize tax liabilities for individuals and businesses.

What is Tax Accounting?

Tax accounting involves the calculation and reporting of taxes owed to the government. It encompasses various activities, such as maintaining tax records, preparing tax returns, and advising on tax planning strategies. Tax accountants play a crucial role in helping individuals and businesses navigate the complex and ever-changing tax landscape.

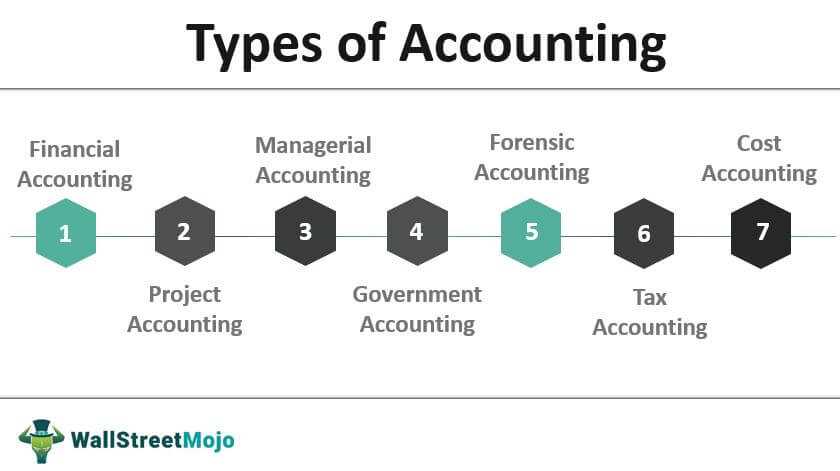

Types of Tax Accounting

There are different types of tax accounting, each catering to specific needs and requirements:

1. Individual Tax Accounting: This type of tax accounting focuses on the tax obligations of individuals, including income tax, capital gains tax, and estate tax. Individual tax accountants assist individuals in preparing and filing their tax returns accurately and in a timely manner.

2. Corporate Tax Accounting: Corporate tax accounting deals with the tax obligations of businesses, including income tax, sales tax, and payroll tax. Corporate tax accountants ensure that businesses comply with tax laws and regulations while minimizing their tax liabilities through effective tax planning strategies.

What is Tax Accounting?

Tax accounting is a specialized branch of accounting that focuses on the preparation and filing of tax returns for individuals and businesses. It involves the analysis, interpretation, and application of tax laws and regulations to ensure compliance and minimize tax liabilities.

Importance of Tax Accounting

Tax accounting plays a crucial role in the financial management of individuals and businesses. It helps in determining the amount of taxes owed, identifying tax-saving opportunities, and ensuring compliance with tax laws and regulations. By accurately calculating and reporting taxes, tax accounting helps individuals and businesses avoid penalties, audits, and legal issues.

Responsibilities of Tax Accountants

Tax accountants are professionals who specialize in tax accounting. They have the knowledge and expertise to navigate the complex tax laws and regulations. Some of the key responsibilities of tax accountants include:

- Preparing and filing tax returns

- Ensuring compliance with tax laws and regulations

- Advising clients on tax planning and strategies

- Identifying tax-saving opportunities

- Representing clients in tax audits and disputes

Types of Tax Accounting

1. Income Tax Accounting

Income tax accounting focuses on the calculation and reporting of an individual’s or business’s taxable income. This includes tracking income, deductions, and credits to determine the amount of tax owed to the government.

2. Sales Tax Accounting

Sales tax accounting involves the collection, reporting, and remittance of sales tax on goods and services sold by a business. This type of accounting ensures that businesses comply with state and local tax laws and accurately calculate the amount of sales tax owed.

3. Property Tax Accounting

Property tax accounting deals with the assessment and payment of taxes on real estate and other property. This includes determining the value of the property, calculating the tax liability, and ensuring timely payment to the appropriate tax authorities.

4. Payroll Tax Accounting

Payroll tax accounting involves the calculation and reporting of taxes withheld from employee wages, such as federal income tax, Social Security tax, and Medicare tax. This type of accounting ensures that businesses accurately withhold and remit the correct amount of taxes on behalf of their employees.

5. International Tax Accounting

International tax accounting deals with the complex tax rules and regulations that apply to businesses operating in multiple countries. This includes issues such as transfer pricing, foreign tax credits, and tax treaties.

Individual Tax Accounting

Individual tax accounting is a branch of tax accounting that focuses on the tax obligations and responsibilities of individual taxpayers. It involves the preparation, calculation, and filing of tax returns for individuals.

Individual tax accountants work closely with their clients to ensure compliance with tax laws and regulations. They gather relevant financial information, such as income, deductions, and credits, to accurately calculate the tax liability of individuals.

Some key aspects of individual tax accounting include:

- Tax planning: Individual tax accountants help individuals plan their finances in a way that minimizes their tax liability. They provide advice on various tax-saving strategies, such as maximizing deductions and credits.

- Tax return preparation: Individual tax accountants prepare and file tax returns on behalf of their clients. They ensure that all necessary forms and schedules are completed accurately and submitted on time.

- Tax compliance: Individual tax accountants ensure that their clients comply with all tax laws and regulations. They stay updated on changes in tax laws and inform their clients about any new requirements or obligations.

- Tax audits: In the event of a tax audit, individual tax accountants represent their clients and assist them in responding to inquiries from tax authorities. They help gather supporting documentation and provide explanations for any discrepancies.

Overall, individual tax accounting plays a crucial role in helping individuals meet their tax obligations and minimize their tax burden. It provides valuable guidance and support to ensure compliance with tax laws and regulations.

Corporate Tax Accounting

Importance of Corporate Tax Accounting

Corporate tax accounting is important for several reasons:

- Compliance: Corporations are required by law to file tax returns and pay taxes on their income. Failure to comply with tax laws can result in penalties and legal consequences.

- Transparency: Accurate tax accounting provides transparency to stakeholders, including shareholders, investors, and regulators. It allows them to assess the financial health and tax compliance of a corporation.

Process of Corporate Tax Accounting

The process of corporate tax accounting involves several steps:

- Recordkeeping: Corporations must maintain detailed records of their financial transactions, including income, expenses, assets, and liabilities.

- Income Calculation: Corporations calculate their taxable income by subtracting allowable deductions and exemptions from their total revenue.

- Tax Return Preparation: Based on the calculated taxable income, corporations prepare and file their tax returns with the appropriate tax authorities.

- Tax Payment: Corporations are required to pay the taxes owed to the government by the specified deadlines.

- Tax Planning: Corporate tax accountants also engage in tax planning activities to minimize a company’s tax liability legally. This may involve taking advantage of tax credits, deductions, and incentives provided by tax laws.

Overall, corporate tax accounting plays a crucial role in ensuring that corporations meet their tax obligations, maintain financial transparency, and optimize their tax position. It requires specialized knowledge and expertise in tax laws and regulations.

Emily Bibb simplifies finance through bestselling books and articles, bridging complex concepts for everyday understanding. Engaging audiences via social media, she shares insights for financial success. Active in seminars and philanthropy, Bibb aims to create a more financially informed society, driven by her passion for empowering others.