Tangible Net Worth Definition

Tangible net worth is a financial metric that represents the value of a company’s assets minus its liabilities, excluding intangible assets such as patents, trademarks, and goodwill. It provides a more accurate measure of a company’s financial health by focusing on the tangible assets that can be easily liquidated in case of bankruptcy or financial distress.

Tangible net worth is an important indicator for investors and lenders as it helps them assess the true value of a company’s assets that can be used to cover its debts. By excluding intangible assets, which are often difficult to value and liquidate, tangible net worth provides a clearer picture of a company’s ability to repay its obligations.

The formula for calculating tangible net worth is:

By subtracting intangible assets from the equation, tangible net worth focuses on the tangible assets that can be easily sold or used as collateral to generate cash. These assets typically include property, plant, and equipment, inventory, and other physical assets.

Importance of Tangible Net Worth

Tangible net worth is particularly important in industries where tangible assets play a significant role, such as manufacturing, construction, and real estate. It helps investors and lenders assess the financial stability and risk profile of a company, as well as its ability to generate cash flow.

A higher tangible net worth indicates that a company has a stronger financial position and is better equipped to weather economic downturns or unexpected expenses. On the other hand, a lower tangible net worth may indicate higher financial risk and potential difficulties in meeting financial obligations.

Overall, tangible net worth provides a more accurate measure of a company’s financial health by focusing on the tangible assets that can be easily liquidated. It helps investors and lenders make informed decisions and assess the risk and potential return associated with investing or lending to a particular company.

What is Tangible Net Worth?

Tangible Net Worth is a financial metric that measures the value of a company’s tangible assets after subtracting its liabilities. It provides a clear picture of the company’s financial health by focusing on the assets that can be physically seen or touched, such as buildings, equipment, and inventory.

To calculate Tangible Net Worth, you need to subtract the total liabilities from the total tangible assets. Tangible assets include property, plant, and equipment, as well as inventory and other physical assets. Liabilities include debts, loans, and other financial obligations.

Tangible Net Worth is an important indicator for investors and lenders as it shows the company’s ability to cover its debts and withstand financial challenges. A higher Tangible Net Worth indicates a stronger financial position and lower risk for investors.

Companies with a negative Tangible Net Worth may face difficulties in obtaining financing or may be considered high-risk investments. It is important for businesses to regularly monitor and improve their Tangible Net Worth to ensure long-term financial stability.

- Tangible Net Worth measures the value of a company’s tangible assets after subtracting its liabilities.

- It focuses on assets that can be physically seen or touched.

- To calculate Tangible Net Worth, subtract total liabilities from total tangible assets.

- Tangible Net Worth is an important indicator for investors and lenders.

- A higher Tangible Net Worth indicates a stronger financial position and lower risk.

- Companies with negative Tangible Net Worth may face difficulties in obtaining financing.

Overall, Tangible Net Worth provides valuable insights into a company’s financial health and is an essential metric for assessing its stability and potential for growth.

Meaning of Tangible Net Worth

Tangible net worth is a financial metric that measures the value of a company’s tangible assets after subtracting its liabilities. It represents the net value of a company’s physical assets, such as buildings, equipment, and inventory, that can be used to generate income or be sold in case of liquidation.

Tangible net worth is an important indicator of a company’s financial health and stability. It provides insights into the company’s ability to cover its debts and obligations using its tangible assets. A higher tangible net worth indicates a stronger financial position and a lower risk of insolvency.

To calculate tangible net worth, you need to subtract a company’s total liabilities from its total tangible assets. Tangible assets include physical assets like property, plant, and equipment, as well as inventory and other tangible resources. Liabilities include debts, loans, and other financial obligations.

Investors and lenders often use tangible net worth as a measure of a company’s value and creditworthiness. It helps them assess the company’s ability to generate returns on its tangible assets and repay its debts. A higher tangible net worth can also make it easier for a company to secure financing or attract investors.

Overall, tangible net worth provides a snapshot of a company’s financial position and its ability to withstand financial challenges. It is an essential metric for evaluating the strength and stability of a company and is often used in financial analysis and decision-making processes.

Tangible Net Worth Formula

Tangible net worth is a financial metric that measures the value of a company’s tangible assets minus its liabilities. It provides a snapshot of a company’s financial health and can be used to assess its ability to meet its financial obligations.

Definition of Tangible Net Worth

Tangible net worth is the value of a company’s tangible assets, such as buildings, equipment, and inventory, minus its liabilities, such as loans and accounts payable. It represents the net value of a company’s tangible assets that can be used to generate income or be sold to pay off debts.

Tangible Net Worth Formula

The formula to calculate tangible net worth is:

| Tangible Net Worth | = | Tangible Assets | – | Liabilities |

Tangible assets include physical assets that have a measurable value, such as real estate, vehicles, and equipment. Liabilities include debts and obligations that the company owes to creditors and suppliers.

By subtracting the liabilities from the tangible assets, you can determine the net value of the company’s tangible assets. This value represents the amount of equity that the company has in its tangible assets.

Tangible net worth is an important metric for investors and lenders as it provides insight into a company’s financial stability and ability to generate value from its tangible assets. It can be used to assess the company’s ability to repay debts and make investments.

It is important to note that tangible net worth does not include intangible assets, such as patents, trademarks, and goodwill. These assets are not physical in nature and are typically not included in the calculation of tangible net worth.

How to Calculate Tangible Net Worth

Tangible net worth is a financial metric used to assess the value of a company or individual’s assets after deducting liabilities. It provides a more accurate picture of the true value of an entity, as it excludes intangible assets such as goodwill or intellectual property.

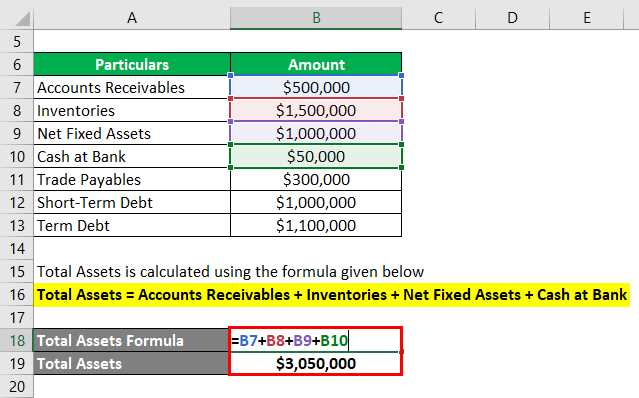

Step 1: Determine Total Assets

The first step in calculating tangible net worth is to determine the total value of all assets owned by the entity. This includes physical assets such as property, equipment, and inventory, as well as financial assets like cash, investments, and accounts receivable. Add up the value of all these assets to get the total asset value.

Step 2: Deduct Liabilities

Next, deduct all liabilities from the total asset value. Liabilities include debts, loans, mortgages, and any other financial obligations. Subtracting the liabilities from the total assets gives you the net worth of the entity.

Step 3: Exclude Intangible Assets

To calculate the tangible net worth, you need to exclude any intangible assets from the net worth value. Intangible assets include things like patents, copyrights, trademarks, and brand value. These assets are not physical in nature and cannot be easily converted into cash. Subtract the value of intangible assets from the net worth to get the tangible net worth.

Step 4: Calculate Tangible Net Worth

The final step is to divide the tangible net worth by the total assets and multiply by 100 to get the tangible net worth percentage. This percentage represents the proportion of an entity’s net worth that is made up of tangible assets.

For example, if a company has a net worth of $1,000,000 and intangible assets worth $200,000, and its total assets are valued at $2,000,000, the tangible net worth would be:

Emily Bibb simplifies finance through bestselling books and articles, bridging complex concepts for everyday understanding. Engaging audiences via social media, she shares insights for financial success. Active in seminars and philanthropy, Bibb aims to create a more financially informed society, driven by her passion for empowering others.