Regulation A: Definition and Overview

What is Regulation A?

Regulation A provides two tiers of offerings: Tier 1 and Tier 2. Tier 1 allows companies to raise up to $20 million in a 12-month period, while Tier 2 allows companies to raise up to $50 million in a 12-month period. Both tiers have certain eligibility requirements and disclosure obligations that companies must meet.

Regulation A offerings are often referred to as “mini IPOs” because they resemble traditional initial public offerings (IPOs) but with reduced regulatory requirements. This makes Regulation A an attractive option for smaller companies that want to raise capital from the public without going through the full IPO process.

How Does Regulation A Work?

Under Regulation A, companies can offer and sell securities to both accredited and non-accredited investors. This means that anyone, regardless of their income or net worth, can invest in Regulation A offerings. However, there are certain investment limits based on an investor’s income or net worth to protect them from investing more than they can afford to lose.

Companies conducting a Regulation A offering must file an offering statement with the SEC, which includes detailed information about the company, its business, and the securities being offered. This offering statement is subject to SEC review and must be qualified before the company can begin selling securities to the public.

Once the offering is qualified, companies can market and sell their securities to the public through various channels, including online platforms and traditional brokerage firms. They must also provide ongoing reporting to the SEC, including annual and semi-annual reports, to keep investors informed about the company’s financial condition and operations.

Overall, Regulation A provides a streamlined and cost-effective way for smaller companies to raise capital from the public and access the capital markets. It offers investors the opportunity to invest in early-stage companies and potentially benefit from their growth and success.

What is Regulation A and How Does it Work?

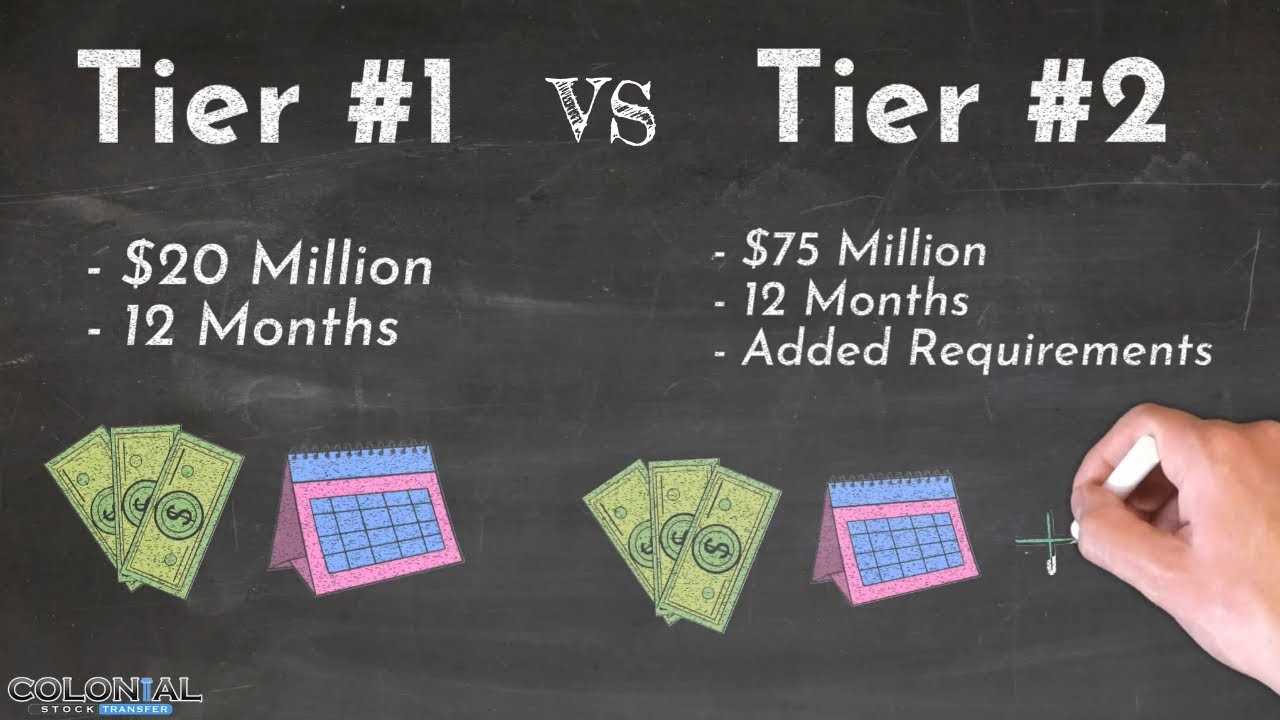

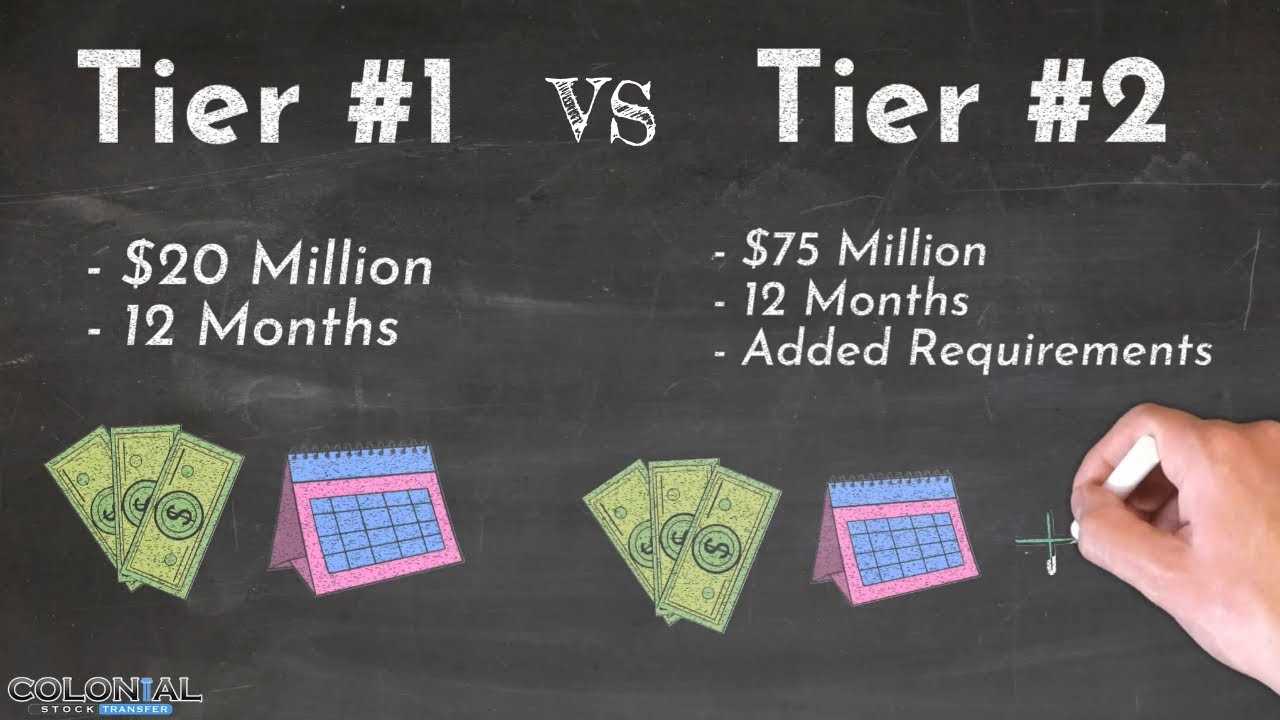

Regulation A offers companies two tiers of offerings, Tier 1 and Tier 2, each with its own set of requirements and limitations. Tier 1 allows companies to raise up to $20 million in a 12-month period, while Tier 2 allows companies to raise up to $75 million. Tier 2 offerings are subject to additional disclosure and ongoing reporting requirements.

How does Regulation A work?

Under Regulation A, companies can offer and sell securities to both accredited and non-accredited investors. This allows them to reach a broader pool of potential investors compared to traditional private placements. The offering can be conducted through various means, including online platforms, which can help companies to reach a larger audience.

Once the offering statement is qualified by the SEC, the company can begin selling securities to investors. The company can advertise and solicit interest in the offering, but it must comply with certain limitations and restrictions to protect investors. The securities sold under Regulation A are freely tradable, meaning investors can buy and sell them on the secondary market.

Benefits of Regulation A

Regulation A offers several benefits to companies looking to raise capital. It provides a more streamlined and cost-effective alternative to a traditional initial public offering (IPO) for smaller companies. It also allows companies to raise funds from both accredited and non-accredited investors, increasing their access to capital.

For investors, Regulation A offers the opportunity to invest in early-stage companies and potentially benefit from their growth. It also provides more transparency and disclosure compared to private placements, as companies are required to provide certain financial statements and ongoing reporting.

| Benefits for Companies | Benefits for Investors |

|---|---|

| Streamlined public offering process | Opportunity to invest in early-stage companies |

| Access to a larger pool of potential investors | Increased transparency and disclosure |

| Cost-effective alternative to traditional IPO | Potential for capital appreciation |

Regulation A: Update and Recent Changes

In recent years, there have been several updates and changes to Regulation A, aimed at improving its effectiveness and expanding its usage. These updates have made Regulation A a more attractive option for companies looking to raise capital.

Increased Offering Limits

One of the significant changes to Regulation A is the increase in offering limits. Previously, Tier 1 offerings were limited to $20 million in a 12-month period, while Tier 2 offerings were limited to $50 million. However, in 2020, the Securities and Exchange Commission (SEC) increased the offering limits to $75 million for Tier 2 offerings. This change allows companies to raise more capital through Regulation A, providing them with greater funding opportunities.

Streamlined Filing Process

Another update to Regulation A is the streamlined filing process. The SEC has made efforts to simplify the filing requirements and reduce the regulatory burden for companies. This includes the introduction of the Electronic Data Gathering, Analysis, and Retrieval (EDGAR) system, which allows companies to submit their offering documents electronically. The streamlined filing process makes it easier and more efficient for companies to comply with the regulatory requirements of Regulation A.

Additionally, the SEC has introduced the concept of “testing the waters” for Regulation A offerings. This allows companies to gauge investor interest before committing to a full offering. By testing the waters, companies can determine if there is sufficient demand for their securities, which can help them make more informed decisions about their fundraising efforts.

Investor Protection Measures

To enhance investor protection, the SEC has implemented certain measures in recent years. Companies conducting Tier 2 offerings are required to provide audited financial statements, which provide investors with more transparency and confidence in the offering. The SEC also requires ongoing reporting for Tier 2 offerings, ensuring that investors have access to updated information about the company’s financials and operations.

Furthermore, the SEC has introduced limitations on the amount of securities that non-accredited investors can purchase in a Tier 2 offering. This helps to mitigate the risk for individual investors and ensures that they do not invest more than they can afford to lose.

Overall, the recent updates and changes to Regulation A have made it a more attractive and accessible option for companies looking to raise capital. The increased offering limits, streamlined filing process, and investor protection measures have improved the effectiveness and efficiency of Regulation A, providing companies with greater opportunities for funding.

Latest Updates on Regulation A

For Tier 2 offerings, which are for offerings of up to $50 million in a 12-month period, the maximum amount that can be sold by affiliates of the issuer increased from $15 million to $30 million. This change provides even more flexibility for companies looking to raise capital through Regulation A.

Another update to Regulation A is the ability for companies to submit draft offering statements to the SEC for non-public review. This allows companies to receive feedback from the SEC before publicly filing their offering statements, which can help streamline the review process and reduce the time it takes to get approval.

Additionally, the SEC has made changes to the qualification and reporting requirements for Regulation A offerings. These changes include allowing companies to use certain financial statements that have been prepared in accordance with international financial reporting standards (IFRS) instead of US generally accepted accounting principles (GAAP). This change provides more flexibility for companies that operate internationally.

Regulation A: Documentation and Requirements

One of the key documents that companies must prepare is the offering circular. This document provides detailed information about the company, its business operations, risks involved, and the terms of the offering. It serves as a prospectus for potential investors to make informed decisions.

In addition to the offering circular, companies also need to submit other required documents to the SEC. This includes financial statements, management’s discussion and analysis (MD&A), and any other relevant disclosures. These documents help provide transparency and give investors a clear picture of the company’s financial health and performance.

Furthermore, companies must also comply with certain ongoing reporting requirements. This includes filing annual reports, semi-annual reports, and current reports with the SEC. These reports provide updates on the company’s financial condition, business operations, and any material events that may impact the investment.

It is important for companies to ensure that all the required documentation is accurate, complete, and filed within the specified deadlines. Failure to comply with these requirements can result in penalties and legal consequences.

Additionally, companies should consider engaging legal and accounting professionals who are experienced in Regulation A offerings to assist with the preparation and filing of the required documentation. These professionals can provide guidance on the specific requirements and help ensure compliance with the regulations.

Overall, the documentation and requirements for Regulation A offerings are designed to protect investors and promote transparency in the market. By adhering to these requirements, companies can demonstrate their commitment to regulatory compliance and build trust with potential investors.

Documents Needed for Regulation A Filing

When filing for Regulation A, there are several important documents that need to be prepared and submitted. These documents are necessary to comply with the requirements set forth by the Securities and Exchange Commission (SEC). Here are the key documents needed for Regulation A filing:

- Offering Statement: This is the main document that needs to be filed with the SEC. It includes important information about the company, its business operations, financial statements, and the terms of the offering. The offering statement should provide a clear and comprehensive overview of the company and its offering.

- Audited Financial Statements: Regulation A requires companies to provide audited financial statements for the past two fiscal years. These financial statements should be prepared by an independent certified public accountant and should provide a clear and accurate picture of the company’s financial position.

- Form 1-A: This is the official form that needs to be filed with the SEC to initiate the Regulation A offering. The form includes various sections that require detailed information about the company, its management team, the offering terms, and any potential risks associated with the investment.

- Marketing Materials: Companies are required to provide marketing materials that will be used to promote the offering. These materials should be clear, accurate, and not misleading. They should provide potential investors with all the necessary information to make an informed investment decision.

- Legal Opinion: It is advisable to obtain a legal opinion from a qualified securities attorney. This opinion should confirm that the offering complies with all applicable securities laws and regulations.

It is important to note that these documents may vary depending on the specific circumstances of the offering and the requirements of the SEC. It is recommended to consult with a securities attorney or a qualified professional to ensure compliance with all applicable regulations.

Regulation A: Tiers and Offering Limits

Regulation A offers two tiers or levels of offerings: Tier 1 and Tier 2. Each tier has its own set of requirements and offering limits.

Tier 1

Tier 1 offerings are for companies looking to raise up to $20 million in a 12-month period. These offerings have fewer disclosure requirements compared to Tier 2 offerings. Under Tier 1, companies are not required to provide audited financial statements, but they must still provide certain financial information to investors.

Companies conducting Tier 1 offerings are subject to state securities laws, which means they must comply with the securities regulations of each state where they intend to offer and sell their securities. This can add complexity and cost to the offering process, as companies need to navigate the different requirements of each state.

Tier 2

Tier 2 offerings are for companies looking to raise up to $50 million in a 12-month period. These offerings have additional requirements compared to Tier 1 offerings, but they also provide certain benefits to companies and investors.

Companies conducting Tier 2 offerings are not subject to state securities laws, which simplifies the offering process and reduces compliance costs. However, they must provide audited financial statements and ongoing reporting to the SEC, including annual and semi-annual reports.

Both Tier 1 and Tier 2 offerings allow companies to raise capital from both accredited and non-accredited investors, although Tier 2 offerings have additional restrictions on the amount non-accredited investors can invest.

Emily Bibb simplifies finance through bestselling books and articles, bridging complex concepts for everyday understanding. Engaging audiences via social media, she shares insights for financial success. Active in seminars and philanthropy, Bibb aims to create a more financially informed society, driven by her passion for empowering others.