Benefits of Investing in Real Estate Investment Trusts

Investing in Real Estate Investment Trusts (REITs) can offer numerous benefits to investors. Here are some of the key advantages:

1. Diversification:

REITs provide investors with the opportunity to diversify their investment portfolio. By investing in different types of properties, such as residential, commercial, or industrial, investors can spread their risk and potentially increase their returns.

2. Passive Income:

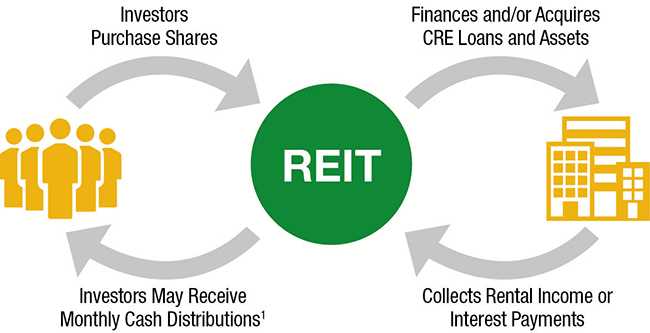

One of the main attractions of investing in REITs is the potential for passive income. REITs are required to distribute a significant portion of their income to shareholders in the form of dividends. This can provide investors with a steady stream of income without the need for active management.

3. Professional Management:

REITs are managed by professionals who have expertise in real estate investment and management. This can be particularly beneficial for investors who do not have the time or knowledge to invest directly in real estate. The professional management team can handle property acquisition, leasing, and maintenance, allowing investors to enjoy the benefits of real estate ownership without the hassle.

4. Liquidity:

Unlike direct real estate investments, REITs offer a high level of liquidity. Shares of REITs can be bought and sold on stock exchanges, providing investors with the ability to easily convert their investment into cash when needed.

5. Potential for Capital Appreciation:

Overall, investing in REITs can be a smart choice for investors looking to diversify their portfolio, generate passive income, and benefit from professional management. Before investing, it is important to carefully research and evaluate different REITs to ensure they align with your investment goals and risk tolerance.

How to Invest in Real Estate Investment Trusts

Investing in Real Estate Investment Trusts (REITs) can be a lucrative way to diversify your investment portfolio and generate passive income. Here are some steps to help you get started:

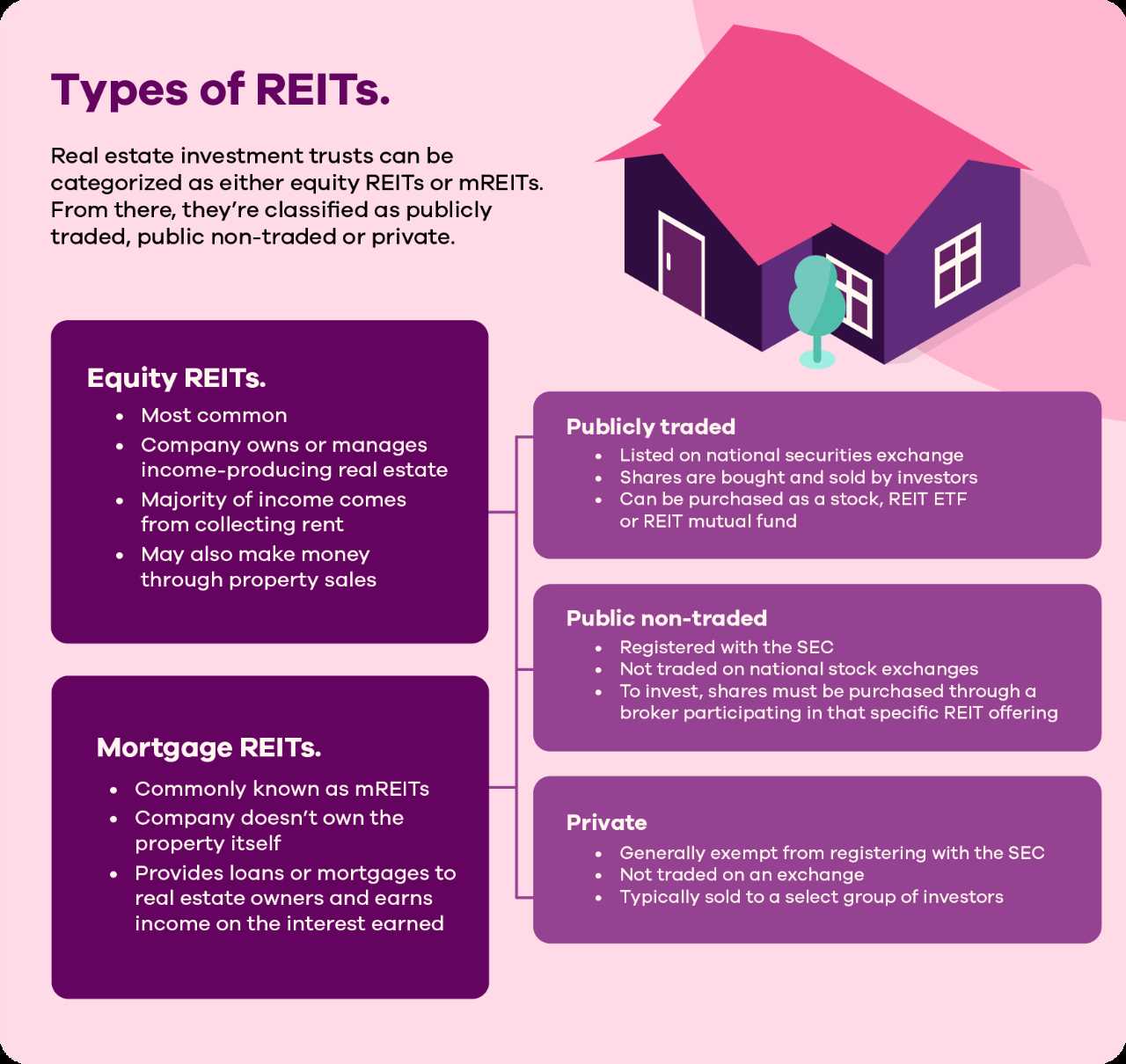

1. Research Different Types of REITs

There are various types of REITs available, including equity REITs, mortgage REITs, and hybrid REITs. Each type has its own investment strategy and risk profile. Take the time to understand the differences and determine which type aligns with your investment goals.

2. Evaluate the REIT’s Performance

3. Assess the REIT’s Portfolio

Examine the properties and assets owned by the REIT. Consider factors such as location, property type, and tenant mix. A well-diversified portfolio with properties in different markets and sectors can help mitigate risk. Additionally, a strong tenant base with long-term leases can provide stability and consistent income.

4. Understand the REIT’s Distribution Policy

5. Consider the Fees and Expenses

REITs often have fees and expenses associated with their operation. These can include management fees, acquisition fees, and administrative expenses. Make sure to understand the fee structure and how it may impact your investment returns.

6. Diversify Your REIT Investments

As with any investment, diversification is key. Consider investing in multiple REITs to spread your risk across different properties, sectors, and geographies. This can help protect your investment from any potential downturns in a specific market or sector.

By following these steps and conducting thorough research, you can make informed decisions when investing in Real Estate Investment Trusts. Remember to consult with a financial advisor or professional before making any investment decisions.

Emily Bibb simplifies finance through bestselling books and articles, bridging complex concepts for everyday understanding. Engaging audiences via social media, she shares insights for financial success. Active in seminars and philanthropy, Bibb aims to create a more financially informed society, driven by her passion for empowering others.