Quant Fund: Definition

A quant fund, short for quantitative fund, is a type of investment fund that utilizes quantitative analysis and mathematical models to make investment decisions. These funds rely heavily on data and algorithms to identify patterns and trends in the financial markets.

Quantitative analysis involves the use of mathematical and statistical techniques to analyze financial data and develop models that can be used to predict future market movements. This approach is based on the belief that financial markets are not completely random and can be analyzed and predicted to some extent.

How They Work

Quant funds use sophisticated computer algorithms to process large amounts of data and identify trading opportunities. These algorithms are designed to analyze various factors such as price movements, volume, volatility, and other market indicators.

Once the algorithms identify potential trades, the fund’s portfolio managers review the recommendations and make the final investment decisions. The trades are executed automatically by the computer systems, often with minimal human intervention.

Quant funds can employ a variety of investment strategies, including statistical arbitrage, trend following, mean reversion, and others. These strategies aim to exploit market inefficiencies and generate profits by taking advantage of price discrepancies and patterns.

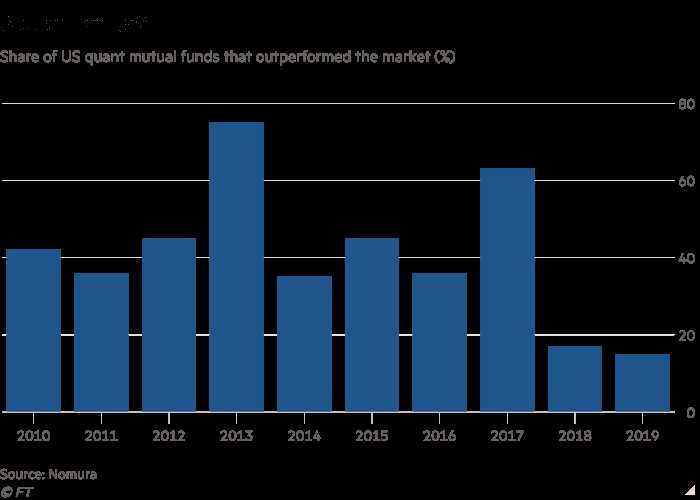

Performance

One of the key challenges for quant funds is adapting to changing market conditions. The models and algorithms used by these funds may not always be able to accurately predict market movements during periods of high volatility or unusual events.

Quantitative analysis is widely used in various fields, including finance, economics, marketing, and scientific research. In the context of finance, quantitative analysis plays a crucial role in investment decision-making, risk management, and portfolio optimization.

Key Principles of Quantitative Analysis

Quantitative analysis is based on several key principles:

- Objectivity: Quantitative analysis relies on objective data and mathematical models, reducing the impact of subjective opinions and biases.

- Systematic Approach: It follows a structured and systematic approach, ensuring consistency and replicability in the analysis process.

- Quantification: It involves converting qualitative data into quantitative measures, allowing for easier comparison and analysis.

- Statistical Techniques: Quantitative analysis utilizes various statistical techniques, such as regression analysis, correlation analysis, and hypothesis testing, to uncover meaningful insights from data.

Applications of Quantitative Analysis

Quantitative analysis has a wide range of applications, including:

- Financial Modeling: Quantitative analysis is extensively used in financial modeling to forecast asset prices, evaluate investment strategies, and assess risk.

- Algorithmic Trading: Quantitative analysis plays a crucial role in algorithmic trading, where computer algorithms execute trades based on predefined quantitative rules.

- Portfolio Management: Quantitative analysis helps portfolio managers optimize their investment portfolios by identifying the most efficient asset allocation strategies.

- Risk Management: Quantitative analysis is essential in assessing and managing various types of risks, such as market risk, credit risk, and operational risk.

- Market Research: Quantitative analysis is used in market research to analyze consumer behavior, identify market trends, and evaluate the effectiveness of marketing campaigns.

The Role of Technology in Quantitative Analysis

Advancements in technology have greatly facilitated the use of quantitative analysis. Powerful computers and sophisticated software enable analysts to process and analyze vast amounts of data quickly and accurately.

Additionally, the availability of historical data, real-time market data, and various financial databases allows analysts to access a wealth of information for their quantitative analysis. This data-driven approach provides valuable insights and helps in making informed decisions.

Challenges and Limitations of Quantitative Analysis

While quantitative analysis offers numerous benefits, it also has its challenges and limitations. Some of the key challenges include:

- Data Quality: The accuracy and reliability of the data used for quantitative analysis are crucial. Inaccurate or incomplete data can lead to erroneous conclusions and flawed models.

- Model Assumptions: Quantitative models are based on certain assumptions, and deviations from these assumptions can impact the accuracy of the analysis.

- Overfitting: Overfitting occurs when a model is overly complex and fits the historical data perfectly but fails to perform well on new, unseen data.

- Human Judgment: While quantitative analysis reduces the impact of human biases, it still requires human judgment in selecting appropriate models, interpreting results, and making decisions.

Despite these challenges, quantitative analysis continues to play a crucial role in decision-making and is an indispensable tool for professionals in various fields.

| Benefits of Quantitative Analysis | Limitations of Quantitative Analysis |

|---|---|

|

|

How Quant Funds Work

Quantitative Analysis

Quantitative analysis is the process of using mathematical and statistical models to analyze financial data and make investment decisions. It involves collecting and analyzing large amounts of data, such as stock prices, interest rates, and economic indicators, to identify patterns and relationships that can be used to predict future market movements.

The Role of Algorithms

Algorithms play a crucial role in the operation of quant funds. These funds use algorithms to process and analyze large amounts of financial data in real time. The algorithms are designed to identify patterns and trends in the data, and then generate trading signals based on these patterns.

Quant funds often employ multiple algorithms that work together to generate trading signals. These algorithms may be based on different mathematical models or use different data sources. By using multiple algorithms, quant funds can reduce the risk of relying on a single model or data source.

Once the algorithms generate trading signals, the quant fund’s computer program automatically executes trades based on these signals. The program can place trades within milliseconds, allowing the fund to take advantage of even small market inefficiencies.

Overall, the use of algorithms and quantitative analysis allows quant funds to make data-driven investment decisions and take advantage of market inefficiencies. These funds can analyze vast amounts of data quickly and efficiently, giving them a potential edge over traditional investment strategies.

The Role of Algorithms in Quantitative Trading

In quantitative trading, algorithms play a crucial role in making investment decisions. These algorithms are computer programs that use mathematical models and statistical analysis to identify patterns and trends in financial markets. By analyzing vast amounts of data and executing trades automatically, algorithms enable quantitative funds to make quick and informed investment decisions.

One of the key advantages of using algorithms in quantitative trading is their ability to process large amounts of data in real-time. These algorithms can analyze market data, such as price movements, volume, and volatility, across multiple asset classes and markets simultaneously. This allows quantitative funds to identify trading opportunities and execute trades at high speeds, giving them a competitive edge in the market.

Algorithms in quantitative trading are designed to follow predefined rules and strategies. These rules are based on mathematical models and historical data analysis, which help identify profitable trading opportunities. For example, an algorithm may be programmed to buy a particular stock when its price crosses a certain moving average or sell a stock when its price falls below a specific threshold. These rules help remove human emotions and biases from the trading process, ensuring consistent and disciplined investment decisions.

Another important aspect of algorithms in quantitative trading is risk management. These algorithms can incorporate risk models and parameters to control the level of risk in a portfolio. By setting limits on position sizes, leverage, and exposure, algorithms can help mitigate potential losses and protect the fund from excessive risk. This risk management aspect is crucial in quantitative trading, as it helps maintain the stability and profitability of the fund.

Furthermore, algorithms in quantitative trading can adapt and learn from market conditions. They can be programmed to continuously monitor and adjust their strategies based on changing market dynamics. For example, if a certain trading strategy is not performing well in current market conditions, the algorithm can automatically switch to a different strategy or modify its parameters to adapt to the new environment. This adaptability allows quantitative funds to stay competitive and optimize their performance in different market conditions.

The Role of Algorithms in Quantitative Trading

Benefits of Algorithmic Trading

Algorithmic trading offers several advantages over traditional manual trading:

- Speed and Efficiency: Algorithms can analyze market data and execute trades much faster than human traders, allowing for quick response to changing market conditions and taking advantage of short-lived opportunities.

- Accuracy and Consistency: Algorithms are not subject to human emotions or biases, ensuring consistent and objective decision-making. They can also execute trades with precision, minimizing errors and slippage.

- Scalability: Algorithms can handle large volumes of data and execute trades across multiple markets and securities simultaneously, providing scalability and diversification.

- Backtesting and Optimization: Algorithms can be backtested using historical data to evaluate their performance and optimize their parameters. This allows for fine-tuning and improvement of trading strategies.

Types of Trading Algorithms

There are various types of algorithms used in quantitative trading:

- Trend-following algorithms: These algorithms identify and exploit trends in the market, buying when prices are rising and selling when prices are falling.

- Mean-reversion algorithms: These algorithms take advantage of the tendency of prices to revert to their mean or average value, buying when prices are low and selling when prices are high.

- Arbitrage algorithms: These algorithms exploit price discrepancies between different markets or securities, buying at a lower price and selling at a higher price to make a profit.

- Statistical arbitrage algorithms: These algorithms use statistical models to identify mispriced securities and take advantage of the price discrepancies.

- Market-making algorithms: These algorithms provide liquidity to the market by continuously quoting bid and ask prices, profiting from the bid-ask spread.

These algorithms can be combined and customized to create sophisticated trading strategies that suit the investment objectives and risk tolerance of the quant fund.

Risks and Challenges

While algorithmic trading offers many benefits, it also comes with its own set of risks and challenges:

- Technical failures: Algorithmic trading relies on complex computer systems, and any technical glitch or malfunction can lead to significant losses.

- Model risk: The performance of algorithms depends on the accuracy and reliability of the underlying models. If the models are flawed or based on incorrect assumptions, the trading strategy may fail.

- Market volatility: Rapid market movements and extreme volatility can lead to unexpected outcomes and losses, as algorithms may not be able to react quickly enough or may exacerbate market movements.

- Regulatory and compliance risks: Algorithmic trading is subject to regulations and compliance requirements, and any violation can result in legal and financial consequences.

It is important for quant funds to have robust risk management systems in place to mitigate these risks and ensure the long-term success of their trading strategies.

Evaluating the Success of Quantitative Funds

1. Performance Metrics

One way to evaluate the success of a quant fund is by analyzing its performance metrics. These metrics include the fund’s annualized return, volatility, Sharpe ratio, and maximum drawdown. The annualized return measures the average rate of return over a specific period, while volatility measures the fund’s price fluctuations. The Sharpe ratio assesses the fund’s risk-adjusted return, taking into account the volatility. The maximum drawdown represents the largest peak-to-trough decline in the fund’s value. By analyzing these metrics, investors can assess the fund’s historical performance and compare it to its peers.

2. Risk Management

Another important aspect to consider when evaluating the success of a quant fund is its risk management strategy. Quant funds typically employ sophisticated risk management techniques to mitigate potential losses. These techniques may include diversification, position sizing, stop-loss orders, and risk limits. By assessing the fund’s risk management practices, investors can gain insights into its ability to preserve capital during market downturns and manage downside risk.

3. Consistency of Returns

Consistency of returns is a crucial factor in evaluating the success of a quant fund. Investors look for funds that can deliver consistent returns over time, rather than those that exhibit sporadic performance. A fund that consistently outperforms its benchmark or peers is considered successful. However, it is important to note that past performance is not indicative of future results, and investors should consider the fund’s track record over multiple market cycles.

Overall, evaluating the success of a quant fund requires a comprehensive analysis of its performance metrics, risk management practices, and consistency of returns. By considering these factors, investors can make informed decisions when selecting a quant fund for their investment portfolio.

Emily Bibb simplifies finance through bestselling books and articles, bridging complex concepts for everyday understanding. Engaging audiences via social media, she shares insights for financial success. Active in seminars and philanthropy, Bibb aims to create a more financially informed society, driven by her passion for empowering others.