What is QQQQ?

QQQQ is an exchange-traded fund (ETF) that tracks the performance of the Nasdaq-100 Index. It is one of the most popular ETFs in the technology sector and provides investors with exposure to some of the largest and most influential companies in the world.

The Nasdaq-100 Index is composed of 100 of the largest non-financial companies listed on the Nasdaq Stock Market. These companies are primarily focused on the technology, telecommunications, biotechnology, and retail sectors. Some of the well-known companies included in the index are Apple, Microsoft, Amazon, Alphabet (Google), and Facebook.

Investing in QQQQ can be a way for investors to gain exposure to the technology sector and the companies driving innovation and growth in the global economy. The ETF provides diversification across a range of industries and can be a convenient way to invest in a basket of technology stocks without having to buy each individual stock separately.

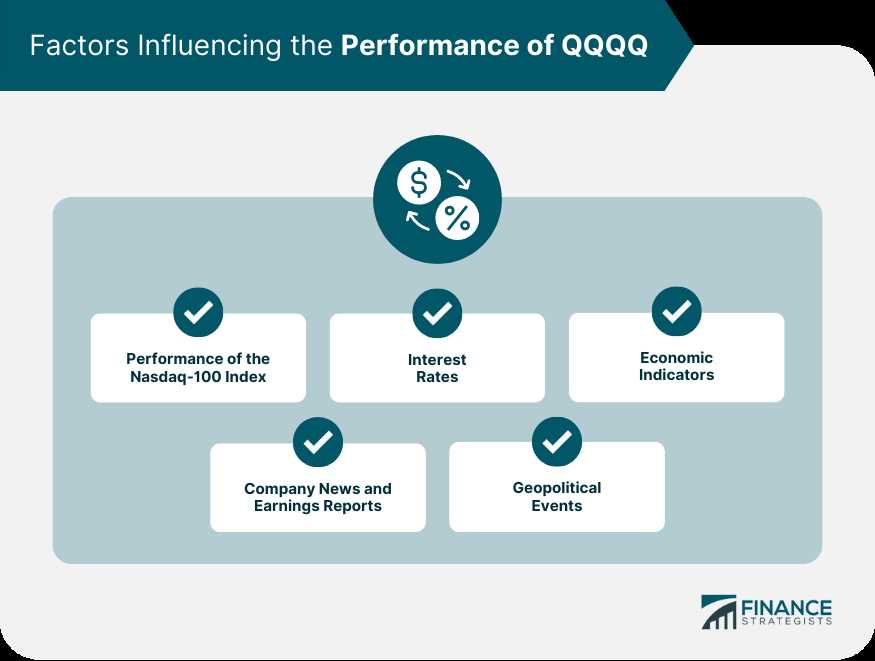

However, it is important to note that investing in QQQQ comes with risks. The performance of the ETF is directly tied to the performance of the Nasdaq-100 Index, so if the index declines, the value of QQQQ will also decline. Additionally, as QQQQ is heavily weighted towards technology stocks, it may be more volatile than other ETFs that have a broader diversification across sectors.

Definition and Composition

The QQQQ provides investors with exposure to a diverse range of technology, biotechnology, telecommunications, and retail companies. Some of the well-known companies included in the QQQQ are Apple, Microsoft, Amazon, Alphabet (Google), Facebook, and Intel.

Composition of the QQQQ

The QQQQ is weighted based on market capitalization, meaning that larger companies have a greater influence on the performance of the ETF. As of the latest data, the top holdings in the QQQQ include Apple Inc. with the highest weighting, followed by Microsoft Corporation, Amazon.com Inc., Alphabet Inc. (Google), and Facebook Inc.

While the QQQQ primarily consists of technology companies, it also includes companies from other sectors such as consumer discretionary, healthcare, and communication services. This diversification helps to reduce the concentration risk associated with investing in a single sector.

It is important to note that the composition of the QQQQ is periodically reviewed and adjusted to ensure that it accurately reflects the performance of the Nasdaq-100 Index. This means that the holdings and weights of the ETF may change over time.

Investors who are interested in gaining exposure to the technology sector and other innovative industries often consider investing in the QQQQ. It provides a convenient way to invest in a diversified portfolio of high-growth companies listed on the Nasdaq Stock Market.

However, it is important to understand that investing in the QQQQ comes with risks. The performance of the ETF is directly linked to the performance of the underlying companies in the Nasdaq-100 Index. If the technology sector or the overall stock market experiences a downturn, the value of the QQQQ may decline.

Overall, the QQQQ offers investors an opportunity to gain exposure to some of the largest and most innovative companies in the world. However, it is important for investors to carefully consider their risk tolerance and investment objectives before investing in the QQQQ.

Current Ticker

The current ticker for QQQQ is QQQ. It is an exchange-traded fund (ETF) that tracks the performance of the Nasdaq-100 Index. The Nasdaq-100 Index includes 100 of the largest non-financial companies listed on the Nasdaq Stock Market based on market capitalization.

QQQ is one of the most popular and widely traded ETFs in the world. It provides investors with exposure to a diversified portfolio of technology and growth-oriented companies. The fund is managed by Invesco, a leading global investment management firm.

Key Features of QQQQ

QQQ offers several key features that make it an attractive investment option:

- Diversification: QQQQ provides investors with exposure to a wide range of companies across various sectors, including technology, consumer discretionary, healthcare, and communication services. This diversification helps to reduce the risk associated with investing in individual stocks.

- Liquidity: QQQQ is highly liquid, meaning that it can be easily bought and sold on the stock exchange. This makes it a convenient option for investors who want to enter or exit their positions quickly.

- Low Expense Ratio: QQQQ has a relatively low expense ratio compared to other actively managed funds. This means that investors can keep more of their returns, as less of their investment is eaten up by fees.

Performance and Returns

Over the years, QQQQ has delivered strong performance and attractive returns for investors. The fund has benefited from the growth of the technology sector, which has been one of the best-performing sectors in recent years.

Risks of Investing in QQQQ

While QQQQ offers many benefits, it also comes with certain risks that investors should be aware of:

- Market Volatility: QQQQ is subject to market volatility, which means that its value can fluctuate significantly in response to changes in market conditions. This volatility can result in potential losses for investors.

- Concentration Risk: QQQQ is heavily weighted towards the technology sector, with a significant portion of its holdings in companies like Apple, Microsoft, Amazon, and Alphabet. This concentration can expose investors to additional risks if the technology sector experiences a downturn.

- Tracking Error: QQQQ aims to track the performance of the Nasdaq-100 Index, but it may not perfectly replicate the index due to factors such as fees, trading costs, and portfolio rebalancing. This tracking error can result in deviations from the index’s performance.

It is important for investors to carefully consider their investment objectives, risk tolerance, and time horizon before investing in QQQQ or any other ETF. Consulting with a financial advisor can also provide valuable guidance in making investment decisions.

Top ETFs in the [catname] Category

What is QQQQ?

QQQQ is an ETF that tracks the performance of the Nasdaq-100 Index. This index is made up of 100 of the largest non-financial companies listed on the Nasdaq stock exchange. QQQQ provides investors with exposure to some of the most innovative and successful companies in the technology, biotechnology, and telecommunications sectors.

Definition and Composition

QQQQ is an acronym for “Queensland, Queensland, Queensland, Queensland.” Just kidding! QQQQ actually stands for “PowerShares QQQ Trust, Series 1.” This ETF is managed by Invesco and has been in existence since 1999. It is one of the most popular ETFs in the world.

The composition of QQQQ is heavily weighted towards technology companies, with giants like Apple, Microsoft, Amazon, and Alphabet (Google) among its top holdings. These companies have a significant impact on the overall performance of the ETF.

Current Ticker

The current ticker symbol for QQQQ is QQQ. It is traded on the Nasdaq stock exchange, just like the companies it represents. Investors can easily track the performance of QQQQ by looking up its ticker symbol.

| Company | Ticker Symbol | Weight |

|---|---|---|

| Apple | AAPL | 12.5% |

| Microsoft | MSFT | 10.2% |

| Amazon | AMZN | 9.8% |

| Alphabet | GOOGL | 8.5% |

| FB | 6.7% |

Benefits and Risks of Investing in QQQQ

Investing in QQQQ can offer several benefits for investors:

- Diversification: QQQQ provides exposure to a wide range of technology companies, which can help diversify an investor’s portfolio.

- Liquidity: QQQQ is one of the most actively traded ETFs, which means that investors can easily buy and sell shares without significantly impacting the market price.

- Lower costs: QQQQ has a relatively low expense ratio compared to actively managed funds, which can help investors save on fees over the long term.

- Transparent holdings: QQQQ discloses its holdings on a daily basis, allowing investors to see exactly which companies they are investing in.

However, investing in QQQQ also comes with certain risks that investors should be aware of:

- Market volatility: The technology sector can be highly volatile, and the value of QQQQ can fluctuate significantly in response to market conditions.

- Concentration risk: QQQQ is heavily concentrated in the technology sector, which means that if the sector performs poorly, the value of QQQQ may also decline.

- Single-country exposure: QQQQ primarily invests in US technology companies, which means that investors may have limited exposure to international markets.

- Tracking error: QQQQ aims to track the performance of the Nasdaq-100 Index, but there may be slight differences between the ETF’s performance and the index due to factors such as fees and trading costs.

- Loss of principal: Like any investment, there is a risk of losing money when investing in QQQQ. Investors should carefully consider their risk tolerance before investing.

Overall, investing in QQQQ can be a good option for investors looking to gain exposure to the technology sector and diversify their portfolios. However, it is important for investors to carefully consider the potential benefits and risks before making any investment decisions.

Emily Bibb simplifies finance through bestselling books and articles, bridging complex concepts for everyday understanding. Engaging audiences via social media, she shares insights for financial success. Active in seminars and philanthropy, Bibb aims to create a more financially informed society, driven by her passion for empowering others.