Definition and Purpose

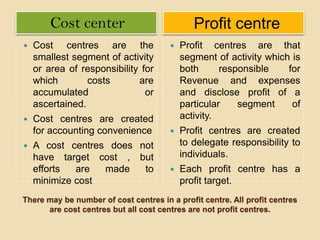

A profit center is a specific division or unit within a company that is responsible for generating revenue and managing costs. It is treated as a separate entity within the organization and is evaluated based on its ability to generate profits.

The purpose of a profit center is to create a clear focus on financial performance and accountability. By assigning specific units or divisions as profit centers, companies can track and measure their profitability, identify areas of improvement, and make informed decisions to maximize overall profitability.

Key Characteristics

Profit centers have several key characteristics that distinguish them from other units within a company:

- Revenue Generation: Profit centers are responsible for generating revenue through the sale of products or services.

- Cost Management: Profit centers are accountable for managing their costs and expenses to ensure profitability.

- Decision-making Autonomy: Profit centers have the authority to make decisions regarding pricing, resource allocation, and other factors that impact their financial performance.

Overall, profit centers play a crucial role in corporate finance by providing a framework for evaluating and improving the financial performance of specific divisions or units within a company. By focusing on profitability, companies can optimize their operations, allocate resources effectively, and drive sustainable growth.

Importance in Corporate Finance

The concept of profit centers is of great importance in corporate finance as it allows companies to effectively manage and evaluate their business units or departments based on their profitability. By designating certain units as profit centers, companies can track and analyze the financial performance of each unit separately, which helps in making informed decisions regarding resource allocation, cost management, and revenue generation.

Profit centers provide a clear framework for assessing the financial impact of various business activities and initiatives. They enable companies to identify which units or departments are contributing the most to the overall profitability of the organization and which ones may require improvement or restructuring. This information is crucial for strategic planning, budgeting, and forecasting purposes.

Furthermore, profit centers promote accountability and responsibility among managers and employees. When a unit is designated as a profit center, its managers are given the autonomy to make decisions related to cost management, pricing, and resource allocation. This decentralization of decision-making authority allows for quicker responses to market changes and customer demands, leading to increased efficiency and effectiveness.

In summary, profit centers play a vital role in corporate finance by providing a structured approach to evaluating and managing the financial performance of different business units. They enable companies to make informed decisions, allocate resources effectively, and improve overall profitability. By implementing profit center analysis, organizations can enhance their strategic planning, budgeting, and forecasting processes, ultimately leading to long-term success and growth.

Characteristics of Profit Center

A profit center is a specific division, department, or business unit within a company that is responsible for generating its own revenue and managing its own costs. It is typically evaluated based on its ability to generate profit and contribute to the overall financial performance of the company.

1. Accountability

One of the key characteristics of a profit center is accountability. It has its own profit and loss statement, which allows for clear tracking and evaluation of its financial performance. This accountability helps in identifying areas of improvement and making informed decisions to enhance profitability.

2. Performance Measurement

Profit centers are measured based on their ability to generate profit. Key performance indicators (KPIs) such as revenue growth, gross margin, and net profit are used to evaluate their performance. This measurement enables management to identify the most profitable areas of the business and allocate resources accordingly.

3. Decision-making Autonomy

Profit centers have a certain level of decision-making autonomy. They have the authority to make decisions regarding pricing, cost management, resource allocation, and investment opportunities. This autonomy allows profit centers to respond quickly to market changes and make decisions that align with their specific goals and objectives.

4. Cost Allocation

Profit centers are responsible for managing their own costs. They are allocated a portion of the company’s overall costs based on their usage and consumption of resources. This cost allocation ensures that profit centers are aware of the costs associated with their operations and encourages them to optimize their cost structure to maximize profitability.

5. Performance-based Incentives

Profit centers often have performance-based incentive systems in place. These incentives can be in the form of bonuses, commissions, or profit-sharing arrangements. By aligning incentives with profitability, profit centers are motivated to achieve financial targets and drive overall company performance.

In summary, profit centers are characterized by their accountability, performance measurement, decision-making autonomy, cost allocation, and performance-based incentives. These characteristics enable profit centers to operate as independent entities within a larger organization, driving their own profitability and contributing to the success of the company as a whole.

Revenue Generation

In a profit center, the primary focus is on generating revenue. This means that the center is responsible for bringing in money for the company through its products or services. The profit center is given the autonomy to make decisions regarding pricing, sales strategies, and marketing efforts to maximize revenue.

Profit centers are often measured based on their ability to increase sales and generate profits. They are expected to identify new revenue opportunities, attract customers, and retain existing ones. This may involve developing innovative products, expanding into new markets, or implementing effective marketing campaigns.

Overall, revenue generation is a crucial aspect of profit centers. Their success is directly linked to their ability to generate profits for the company, making them an essential part of corporate finance.

Cost Management

Cost management is a critical aspect of running a profit center. Profit centers are responsible for managing their own costs and ensuring that expenses are kept under control. This involves analyzing and monitoring various cost drivers, such as labor, materials, and overhead expenses.

Profit centers need to implement effective cost management strategies to optimize their profitability. This can include negotiating better prices with suppliers, implementing cost-saving measures, and finding ways to streamline operations.

One common cost management technique used by profit centers is cost allocation. This involves allocating costs to different products, services, or departments based on their usage or consumption. By accurately allocating costs, profit centers can better understand the profitability of each product or service and make informed decisions about pricing and resource allocation.

Another important aspect of cost management is cost control. Profit centers need to establish budgets and closely monitor their actual expenses against these budgets. By regularly reviewing and analyzing their costs, profit centers can identify areas of overspending or inefficiencies and take corrective actions.

Cost management also involves identifying and managing cost drivers. Profit centers need to understand the factors that contribute to their costs and find ways to minimize or eliminate them. This can involve analyzing production processes, identifying bottlenecks, and implementing process improvements.

Overall, effective cost management is crucial for profit centers to maximize their profitability and contribute to the overall financial success of the organization.

| Benefits of Cost Management for Profit Centers |

|---|

| 1. Improved profitability |

| 2. Better resource allocation |

| 3. Competitive advantage |

| 4. Enhanced decision-making |

| 5. Increased efficiency |

Decision-making Autonomy

Benefits of Decision-making Autonomy

- Faster Decision-making: Profit centers can make decisions quickly without the need for lengthy approval processes, enabling them to seize opportunities and respond to challenges promptly.

- Increased Accountability: With decision-making authority comes accountability. Profit centers are responsible for the outcomes of their decisions, which promotes a sense of ownership and motivation to achieve results.

- Efficient Resource Allocation: Profit centers have the freedom to allocate resources based on their specific needs and priorities. This allows them to optimize resource utilization and drive profitability.

Examples of Decision-making Autonomy

In another example, a manufacturing company may have profit centers based on different product divisions. Each profit center can make decisions regarding production schedules, sourcing of raw materials, and pricing strategies. This autonomy allows them to respond to market demand fluctuations and optimize their operations for maximum profitability.

Overall, decision-making autonomy empowers profit centers to be more agile, accountable, and efficient in achieving their financial goals. It is a crucial characteristic that drives the success of profit centers in corporate finance.

Examples of Profit Centers

Profit centers can be found in various industries and sectors. Here are some examples of profit centers:

- Manufacturing Companies: In manufacturing companies, different departments or divisions can be profit centers. For example, the production department, sales department, and research and development department can be considered profit centers.

- Retail Chains: Each individual store within a retail chain can be considered a profit center. The store manager is responsible for generating revenue and managing costs to ensure profitability.

- Financial Institutions: Banks and other financial institutions often have multiple profit centers. These can include commercial banking, investment banking, wealth management, and insurance divisions.

- Hotels and Resorts: In the hospitality industry, different departments within a hotel or resort can function as profit centers. These can include the rooms division, food and beverage department, and event management department.

- Telecommunication Companies: Telecommunication companies often have profit centers based on different services they offer. For example, the mobile phone division, internet services division, and corporate solutions division can all be profit centers.

- Healthcare Organizations: Hospitals and healthcare organizations can have profit centers based on different departments or specialties. These can include the cardiology department, orthopedics department, and radiology department.

These are just a few examples of profit centers, and there are many more in various industries. The key characteristic of a profit center is that it operates as a separate entity within the larger organization, with its own revenue generation, cost management, and decision-making autonomy.

Emily Bibb simplifies finance through bestselling books and articles, bridging complex concepts for everyday understanding. Engaging audiences via social media, she shares insights for financial success. Active in seminars and philanthropy, Bibb aims to create a more financially informed society, driven by her passion for empowering others.