Probate Court Definition

In legal terms, a probate court is a specialized court that deals with the administration of estates and the distribution of assets after someone passes away. It is responsible for overseeing the probate process, which involves validating the deceased person’s will, appointing an executor or personal representative, and ensuring that the deceased person’s debts and taxes are paid.

Probate courts have the authority to interpret and enforce the provisions of a will, resolve any disputes that may arise among beneficiaries or heirs, and make decisions regarding the distribution of assets. They play a crucial role in ensuring that the deceased person’s final wishes are carried out and that the estate is settled in a fair and orderly manner.

Probate court proceedings can vary depending on the laws of the jurisdiction and the complexity of the estate. In some cases, the process may be relatively straightforward, while in others, it may involve extensive court hearings and legal proceedings. The court’s primary goal is to protect the rights of all parties involved and ensure that the estate is distributed according to the law and the deceased person’s wishes.

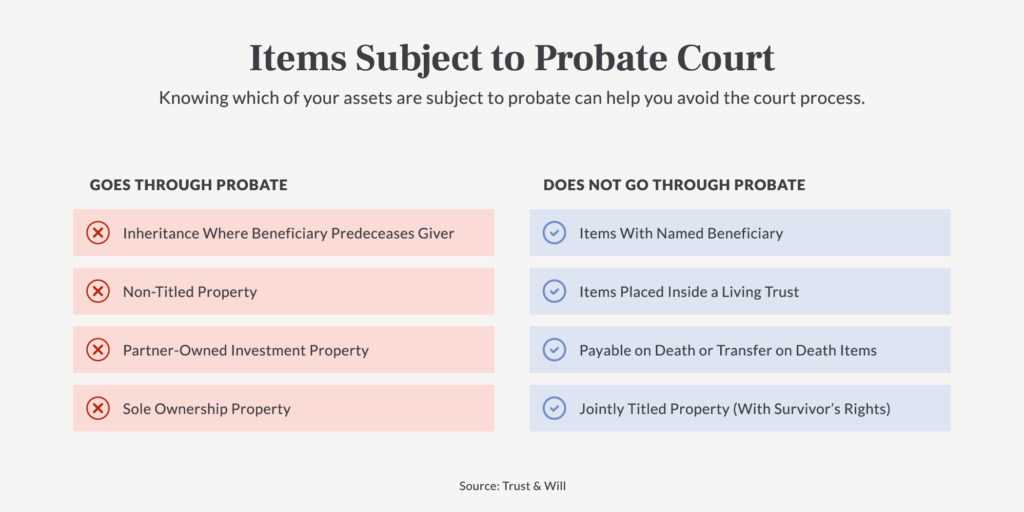

It is important to note that not all assets go through probate. Certain types of assets, such as those held in a trust or with designated beneficiaries, may bypass the probate process and be distributed directly to the intended recipients. However, any assets that are solely owned by the deceased person and do not have a designated beneficiary will typically go through probate.

Overall, probate courts serve a vital role in the legal system by providing oversight and guidance in the administration of estates. They help to ensure that the wishes of the deceased person are respected, debts are paid, and assets are distributed in a fair and orderly manner.

Probate court is a legal process that takes place after a person’s death. It involves the administration of the deceased person’s estate, including the distribution of assets and the payment of debts and taxes. The probate court oversees this process to ensure that it is carried out according to the law and the wishes of the deceased.

When a person dies, their assets and debts become part of their estate. The probate court is responsible for determining the validity of the deceased person’s will, if one exists, and appointing an executor or personal representative to handle the estate. If there is no will, the court will appoint an administrator to carry out the necessary tasks.

Once an executor or administrator is appointed, they must gather and inventory all of the deceased person’s assets. This includes real estate, bank accounts, investments, personal belongings, and any other property owned by the deceased. The executor or administrator is also responsible for identifying and notifying the deceased person’s creditors.

During the probate process, the court will review the deceased person’s will, if one exists, and determine its validity. If the will is deemed valid, the court will ensure that the assets are distributed according to the deceased person’s wishes. If there is no valid will, the court will distribute the assets according to state law.

In addition to distributing assets, the probate court is also responsible for overseeing the payment of debts and taxes. The executor or administrator must notify creditors of the deceased person’s death and pay any outstanding debts using the assets of the estate. They must also file the necessary tax returns and pay any taxes owed by the estate.

The probate process can be complex and time-consuming, often lasting several months or even years. It involves filing various legal documents, attending court hearings, and complying with state laws and regulations. It is important for the executor or administrator to seek legal advice and guidance to ensure that they fulfill their duties properly.

What Goes Through Probate

Probate is the legal process through which a deceased person’s assets are distributed to their heirs and beneficiaries. During probate, the court ensures that the deceased person’s debts are paid and that their assets are distributed according to their will or state law.

Not all assets go through probate. Some assets can be transferred directly to beneficiaries without the need for court involvement. These assets include:

- Jointly Owned Assets: If the deceased person owned property or accounts jointly with another person, such as a spouse or business partner, those assets typically pass directly to the surviving owner.

- Assets with Designated Beneficiaries: Certain assets, such as life insurance policies, retirement accounts, and payable-on-death bank accounts, allow the account or policy holder to name a beneficiary. Upon the account holder’s death, these assets are transferred directly to the designated beneficiary.

- Assets Held in Trust: If the deceased person had a trust, any assets held in the trust will pass to the beneficiaries named in the trust document, bypassing probate.

However, many assets do go through probate. These assets include:

- Real Estate: Any real property solely owned by the deceased person will need to go through probate. This includes houses, land, and other real estate assets.

- Bank Accounts and Investments: If the deceased person had individual bank accounts, stocks, bonds, or other investment accounts solely in their name, these assets will typically go through probate.

- Personal Property: Personal belongings, such as furniture, jewelry, vehicles, and artwork, are typically included in the probate process.

During probate, the court will determine the value of the assets, pay any outstanding debts or taxes, and distribute the remaining assets to the heirs and beneficiaries. It is important to note that the probate process can be time-consuming and costly, as court fees and attorney fees may apply.

If you want to avoid probate for your assets, it is recommended to consult with an estate planning attorney who can help you create a comprehensive estate plan, including the use of trusts and beneficiary designations.

Assets Subject to Probate Process

When a person passes away, their assets are typically distributed to their beneficiaries. However, not all assets go through the probate process. Probate is the legal process of administering a deceased person’s estate, which involves proving the validity of their will, identifying and inventorying their assets, paying off debts and taxes, and distributing the remaining assets to the beneficiaries.

Assets that are subject to the probate process are those that are solely owned by the deceased person and do not have a designated beneficiary. These assets include:

Real Estate

Any real estate that is solely owned by the deceased person will go through probate. This includes properties such as houses, land, and commercial buildings. The probate court will determine how the property will be distributed according to the deceased person’s will or state intestacy laws if there is no will.

Bank Accounts

Investment Accounts

Investment accounts, such as stocks, bonds, and mutual funds, that are solely owned by the deceased person will go through probate. The probate court will determine how these investments will be distributed to the beneficiaries.

Personal Property

Personal property, such as furniture, jewelry, artwork, and vehicles, that is solely owned by the deceased person will also go through probate. The probate court will determine how these assets will be distributed to the beneficiaries.

Business Interests

If the deceased person owned a business, their ownership interest in the business will go through probate. The probate court will determine how the business interest will be distributed to the beneficiaries or handle the transfer of ownership according to the deceased person’s will or state laws.

It is important to note that assets that are jointly owned with rights of survivorship, assets held in a trust, and assets with designated beneficiaries, such as life insurance policies and retirement accounts, do not go through probate. These assets pass directly to the surviving joint owner or designated beneficiary outside of the probate process.

Debts and Claims During Probate

When a person passes away, their debts and claims against their estate must be addressed during the probate process. Debts and claims can include outstanding loans, credit card balances, medical bills, and any other financial obligations the deceased had at the time of their death.

During probate, the executor or personal representative of the estate is responsible for identifying and notifying creditors of the deceased’s passing. This is typically done by publishing a notice in a local newspaper or sending direct notifications to known creditors. Creditors then have a certain period of time, usually a few months, to submit their claims against the estate.

Once the claims are received, the executor reviews them and determines their validity. If a claim is deemed valid, it is paid out of the deceased’s assets. However, if there are insufficient assets to cover all the debts and claims, the estate may be declared insolvent, and the debts may go unpaid.

Challenges to Debts and Claims

In some cases, there may be disputes or challenges to the validity of certain debts or claims. Beneficiaries or other interested parties may argue that a debt is not legitimate or that the amount claimed is incorrect. In such situations, the probate court may need to intervene and make a determination regarding the disputed debt.

The court may require additional documentation or evidence to support or refute the claim. It may also hold hearings or allow interested parties to present their arguments. Ultimately, the court will make a decision based on the available information and applicable laws.

Order of Debt Payment

During probate, debts and claims are typically paid in a specific order. Secured debts, such as mortgages or car loans, are usually given priority and must be paid off before other debts. Unsecured debts, such as credit card balances or medical bills, are typically paid off next. Finally, any remaining assets are distributed to the beneficiaries according to the deceased’s will or the laws of intestate succession if there is no will.

| Debt Priority | Description |

|---|---|

| 1 | Secured Debts |

| 2 | Funeral Expenses |

| 3 | Administrative Expenses (Probate Costs, Attorney Fees, etc.) |

| 4 | Taxes |

| 5 | Unsecured Debts |

| 6 | Claims by Beneficiaries |

Probate Court and Estate Distribution

Probate court plays a crucial role in the distribution of an estate after someone passes away. Once the court determines that a will is valid and appoints an executor, the process of distributing the assets can begin.

During probate, the court oversees the payment of any outstanding debts or claims against the estate. This ensures that all creditors are properly notified and given the opportunity to make a claim. The executor is responsible for managing this process and ensuring that all valid claims are paid.

Once all debts and claims have been addressed, the court can then distribute the remaining assets to the beneficiaries named in the will. If there is no will, the court will follow the state’s intestacy laws to determine who should receive the assets.

The Role of the Executor

The executor is the person named in the will or appointed by the court to manage the estate during probate. Their role is to gather and inventory the assets, pay any outstanding debts, and distribute the remaining assets to the beneficiaries.

The executor has a fiduciary duty to act in the best interests of the estate and its beneficiaries. They must follow the instructions laid out in the will and ensure that the distribution of assets is done in accordance with the law.

Challenges in Estate Distribution

While probate court is designed to ensure a fair and orderly distribution of assets, there can be challenges that arise during the process. Disputes among beneficiaries, contested wills, and complex estates can all lead to delays and complications.

In some cases, the court may need to resolve disputes through mediation or litigation. This can prolong the probate process and increase the costs involved. It is important for all parties involved to work together and communicate effectively to minimize these challenges.

Additionally, the probate process can be time-consuming and expensive. Court fees, attorney fees, and other costs can eat into the value of the estate. It is important for individuals to consider estate planning options, such as trusts, to avoid probate or simplify the process.

Conclusion

Emily Bibb simplifies finance through bestselling books and articles, bridging complex concepts for everyday understanding. Engaging audiences via social media, she shares insights for financial success. Active in seminars and philanthropy, Bibb aims to create a more financially informed society, driven by her passion for empowering others.