Pattern Day Trader (PDT) Definition

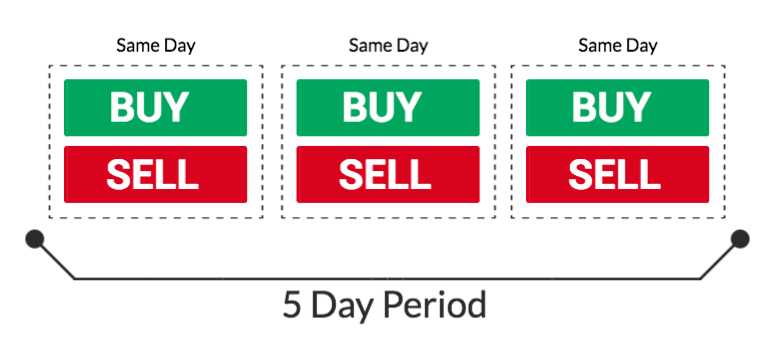

A Pattern Day Trader (PDT) is a classification given to traders who execute four or more day trades within a five business day period using a margin account. The PDT rule was implemented by the U.S. Securities and Exchange Commission (SEC) to regulate and monitor traders who engage in frequent day trading.

Once classified as a Pattern Day Trader, the trader is subject to certain rules and requirements. They must maintain a minimum account balance of $25,000 in their margin account at all times. If the account balance falls below this threshold, the trader will be restricted from day trading until the balance is brought back up to $25,000.

Pattern Day Traders also have access to additional leverage, allowing them to trade with more buying power than non-PDT traders. This increased leverage can be beneficial for experienced traders who are able to effectively manage their risk and take advantage of short-term trading opportunities.

What is a Pattern Day Trader?

A Pattern Day Trader (PDT) is an individual who executes four or more day trades within a five-business-day period using a margin account. Day trading refers to the practice of buying and selling financial instruments, such as stocks or options, within the same trading day with the goal of profiting from short-term price fluctuations.

Pattern Day Traders are subject to specific rules and requirements set by the U.S. Securities and Exchange Commission (SEC) and the Financial Industry Regulatory Authority (FINRA). These regulations aim to protect individual investors from the risks associated with day trading and ensure that traders have sufficient capital to cover potential losses.

How does Pattern Day Trading work?

Pattern Day Trading works by allowing traders to take advantage of short-term price movements in the financial markets. Traders can buy and sell securities multiple times within a single trading day, aiming to profit from small price changes. However, the PDT rule imposes certain restrictions on traders to mitigate the risks involved.

Under the PDT rule, if a trader executes four or more day trades within a five-business-day period and the total value of those trades exceeds 6% of their total trading activity during that period, they will be classified as a Pattern Day Trader. Once classified as a PDT, the trader must maintain a minimum account balance of $25,000 in order to continue day trading.

Failure to meet the minimum account balance requirement will result in the trader being restricted to trading on a cash-available basis for 90 days or until the account balance is brought back up to $25,000. This restriction means that the trader can only trade with settled funds and cannot use margin or short-selling strategies.

Benefits of Pattern Day Trading

Pattern Day Trading offers several potential benefits for traders. Firstly, it allows for increased liquidity as traders can enter and exit positions quickly, taking advantage of short-term price movements. Secondly, day trading provides the opportunity for higher potential returns compared to long-term investing strategies.

Additionally, day trading can be a flexible career option for individuals who prefer a more active approach to investing. Traders can work from anywhere with an internet connection and have the potential to generate income on a daily basis.

How Pattern Day Trading Works

Pattern day trading is a strategy used by active traders in the stock market. It involves buying and selling stocks within the same trading day to take advantage of short-term price movements. The goal is to make quick profits by capitalizing on small price fluctuations.

When engaging in pattern day trading, traders must adhere to certain rules and requirements set by the Securities and Exchange Commission (SEC) and the Financial Industry Regulatory Authority (FINRA). These rules are in place to protect traders and ensure the integrity of the market.

In addition to the account balance requirement, pattern day traders are also subject to certain trading restrictions. They are only allowed to make a maximum of three day trades within a rolling five-business-day period. If a trader exceeds this limit, they will be classified as a pattern day trader and will be subject to additional restrictions.

Pattern day traders also have access to certain benefits. They have the ability to trade on margin, which means they can borrow money from their broker to increase their buying power. This can potentially lead to higher profits, but it also comes with increased risk.

Overall, pattern day trading can be a lucrative strategy for experienced traders who are able to effectively analyze market trends and make quick decisions. However, it is important to understand and adhere to the rules and requirements set by regulatory authorities to avoid any penalties or restrictions.

Rules and Requirements for Pattern Day Traders

Pattern Day Traders (PDTs) are subject to certain rules and requirements set by the U.S. Securities and Exchange Commission (SEC) and the Financial Industry Regulatory Authority (FINRA). These rules are designed to protect individual investors and maintain the integrity of the financial markets.

1. Minimum Account Balance: To qualify as a Pattern Day Trader, you must maintain a minimum account balance of $25,000 in your margin account. This balance must be maintained at all times, and if it falls below the threshold, you will be restricted from day trading until the balance is restored.

3. Margin Requirements: Pattern Day Traders are required to maintain a minimum margin requirement of $25,000 in their account. This means that you must have enough equity in your account to cover any potential losses. If your account falls below the margin requirement, you may be issued a margin call and required to deposit additional funds or close positions to meet the requirement.

4. Pattern Day Trader Designation: Once you meet the criteria of a Pattern Day Trader, your account will be designated as such. This designation comes with certain privileges, such as increased buying power and access to margin trading. However, it also comes with added responsibilities and restrictions.

5. Reporting and Record-Keeping: As a Pattern Day Trader, you are required to maintain detailed records of your trades, including the date, time, security, quantity, and price of each trade. These records must be kept for a minimum of three years and made available to regulators upon request.

It is important to note that these rules and requirements apply specifically to Pattern Day Traders and may not apply to other types of traders or investors. It is crucial to understand and comply with these regulations to avoid any potential penalties or restrictions on your trading activities.

Benefits of Pattern Day Trading

1. Increased Trading Opportunities

Pattern Day Trading allows traders to take advantage of multiple trading opportunities within a single day. Since PDT traders are required to make at least four day trades within a five-day period, they have the opportunity to capitalize on short-term price movements and profit from intraday volatility.

2. Access to Leverage

Pattern Day Traders have access to increased leverage, which allows them to control larger positions with a smaller amount of capital. This can amplify potential profits, but it is important to note that it also increases the risk of losses. Traders must exercise caution and have a solid risk management strategy in place.

3. Ability to Take Advantage of Market Swings

Pattern Day Trading enables traders to take advantage of both upward and downward market swings. By actively monitoring the market and executing trades based on patterns and technical indicators, PDT traders can profit from both bullish and bearish market conditions.

4. Faster Learning Curve

Engaging in Pattern Day Trading can help traders develop their skills and gain experience at a faster pace. Since PDT traders are actively trading on a daily basis, they have more opportunities to learn from their trades, analyze market patterns, and refine their trading strategies.

5. Potential for Higher Returns

Advantages of Being a Pattern Day Trader

Pattern day trading can offer several advantages for traders who meet the requirements and are able to actively engage in day trading activities. Some of the key advantages of being a pattern day trader include:

1. Increased Potential for Profits:

Pattern day traders have the ability to take advantage of short-term price movements in the market, allowing them to potentially generate profits on a daily basis. By actively trading throughout the day, pattern day traders can capitalize on market volatility and make multiple trades to increase their chances of making profitable trades.

2. Access to Leverage:

Pattern day traders have access to increased leverage, which allows them to control larger positions with a smaller amount of capital. This can amplify potential profits, but it is important to note that it also increases the risk of losses. Traders must be careful when using leverage and have a solid risk management strategy in place.

3. Ability to Take Advantage of Intraday Trends:

Pattern day traders can take advantage of intraday trends and capitalize on short-term price movements. By closely monitoring the market and identifying patterns, day traders can enter and exit trades at optimal times to maximize their profits.

4. Increased Trading Opportunities:

As a pattern day trader, you have the ability to actively trade throughout the day, which can lead to increased trading opportunities. This allows you to take advantage of various market conditions and potentially profit from different trading strategies.

5. Ability to Trade a Variety of Securities:

Pattern day traders have the flexibility to trade a wide range of securities, including stocks, options, futures, and currencies. This allows traders to diversify their trading portfolio and take advantage of various market opportunities.

6. Access to Advanced Trading Tools and Platforms:

Pattern day traders often have access to advanced trading tools and platforms that provide real-time market data, advanced charting features, and customizable trading strategies. These tools can help traders make informed decisions and execute trades more efficiently.

Overall, being a pattern day trader can provide traders with increased potential for profits, access to leverage, the ability to take advantage of intraday trends, increased trading opportunities, the ability to trade a variety of securities, and access to advanced trading tools and platforms. However, it is important to note that day trading involves significant risks and requires careful planning, discipline, and risk management.

Emily Bibb simplifies finance through bestselling books and articles, bridging complex concepts for everyday understanding. Engaging audiences via social media, she shares insights for financial success. Active in seminars and philanthropy, Bibb aims to create a more financially informed society, driven by her passion for empowering others.