Overview of Qualified Exchange Accommodation Arrangements

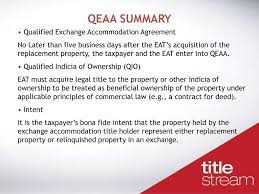

Under Section 1031, investors can exchange one investment property for another of like-kind and defer the recognition of capital gains taxes. However, in order to qualify for this tax deferral, investors must meet certain requirements, one of which is the use of a Qualified Intermediary (QI) and a Qualified Exchange Accommodation (QEA).

The QI is a third-party intermediary who facilitates the exchange process. They hold the proceeds from the sale of the relinquished property and use them to acquire the replacement property. The QEA, on the other hand, is a property that is used as a temporary holding for the investor’s funds during the exchange process.

The QEA must meet certain criteria to be considered a qualified accommodation. It must be a property that is held for investment or business purposes, and it must be identified by the investor as a potential replacement property within 45 days of the sale of the relinquished property.

During the exchange process, the investor has a limited timeframe to identify and acquire the replacement property. The QEA provides a temporary solution by allowing the investor to park their funds in a qualified property while they search for a suitable replacement property.

Once the replacement property is identified, the investor can direct the QI to transfer the funds from the QEA to complete the exchange. By utilizing a QEAA, investors can effectively defer their capital gains taxes and potentially increase their investment returns.

It is important to note that QEAA is a complex investment strategy that requires careful planning and adherence to IRS regulations. Investors should consult with a qualified tax advisor or attorney before engaging in a Qualified Exchange Accommodation Arrangement.

Real estate investing is a lucrative and popular investment strategy that involves the purchase, ownership, management, rental, or sale of real estate for profit. It can be a long-term investment strategy or a short-term venture, depending on the investor’s goals and objectives.

Benefits of Real Estate Investing

There are several benefits to investing in real estate:

- Appreciation: Real estate properties have the potential to appreciate in value over time. This can result in significant profits when the property is sold.

- Tax Advantages: Real estate investors can take advantage of various tax benefits, such as deductions for mortgage interest, property taxes, and depreciation.

- Diversification: Investing in real estate allows investors to diversify their investment portfolio, reducing risk by spreading investments across different asset classes.

- Inflation Hedge: Real estate is often considered a hedge against inflation, as property values and rental income tend to increase with inflation.

Types of Real Estate Investments

There are various types of real estate investments that investors can consider:

- Residential Properties: This includes single-family homes, apartments, condominiums, and townhouses. Residential properties are popular among investors due to the demand for housing.

- Commercial Properties: Commercial properties include office buildings, retail spaces, industrial properties, and warehouses. These properties can provide higher rental income but may require more management.

- Vacation Rentals: Investors can purchase properties in popular vacation destinations and rent them out to tourists. This can be a profitable investment strategy, especially in areas with high tourism demand.

- Real Estate Investment Trusts (REITs): REITs are companies that own, operate, or finance income-generating real estate. Investors can buy shares of REITs, providing them with exposure to real estate without directly owning properties.

Key Considerations for Real Estate Investing

Before investing in real estate, it is important to consider the following factors:

- Market Research: Conduct thorough market research to understand the local real estate market, including property prices, rental rates, vacancy rates, and demand.

- Financial Analysis: Perform a detailed financial analysis to determine the potential return on investment (ROI), including rental income, expenses, and potential appreciation.

- Risk Assessment: Assess the risks associated with the investment, such as market volatility, property management challenges, and potential legal or regulatory issues.

- Property Management: Consider whether to manage the property yourself or hire a professional property management company to handle tenant screening, rent collection, and maintenance.

- Exit Strategy: Have a clear exit strategy in mind, whether it is selling the property for profit, refinancing, or holding it for long-term rental income.

Conclusion

Emily Bibb simplifies finance through bestselling books and articles, bridging complex concepts for everyday understanding. Engaging audiences via social media, she shares insights for financial success. Active in seminars and philanthropy, Bibb aims to create a more financially informed society, driven by her passion for empowering others.