Benefits of Using OCBOA

Using Other Comprehensive Basis of Accounting (OCBOA) can provide several benefits for businesses and organizations. Here are some of the key advantages:

1. Simplicity:

OCBOA offers a simpler alternative to Generally Accepted Accounting Principles (GAAP) for businesses that do not require complex financial reporting. It allows for a more straightforward approach to accounting, which can save time and resources.

2. Cost-Effectiveness:

Since OCBOA does not require adherence to all the rules and regulations of GAAP, it can be more cost-effective for small businesses and organizations. It eliminates the need for expensive accounting software and specialized training.

3. Flexibility:

OCBOA provides flexibility in financial reporting, allowing businesses to tailor their accounting methods to better suit their specific needs. It allows for customization and adaptation to unique circumstances, such as industry-specific practices or specific reporting requirements.

4. Industry-Specific Standards:

For certain industries, OCBOA may be more applicable and relevant than GAAP. It allows businesses to follow industry-specific accounting standards that better reflect their operations and financial performance.

5. Reduced Disclosure Requirements:

Compared to GAAP, OCBOA has fewer disclosure requirements. This can be beneficial for businesses that do not want to disclose sensitive financial information to the public or competitors.

6. Ease of Transition:

For businesses transitioning from cash basis accounting to accrual basis accounting, OCBOA can serve as an intermediate step. It provides a bridge between the two methods, allowing for a smoother transition and easier adoption of more complex accounting practices.

Key Differences Between OCBOA and GAAP

1. Basis of Accounting

The most significant difference between OCBOA and GAAP is the basis of accounting they follow. GAAP is based on accrual accounting, which means that transactions are recorded when they occur, regardless of when the cash is received or paid. On the other hand, OCBOA allows for different bases of accounting, such as cash basis or modified cash basis, where transactions are recorded when cash is received or paid.

2. Reporting Standards

Another key difference is the reporting standards. GAAP has a set of comprehensive rules and guidelines that businesses must follow when preparing financial statements. These standards ensure consistency and comparability across different companies. In contrast, OCBOA does not have a specific set of reporting standards. Instead, it allows businesses to use alternative methods that are appropriate for their specific industry or circumstances.

3. Complexity

GAAP is known for its complexity and detailed rules. It requires businesses to follow specific accounting treatments for various transactions and events. This complexity can be challenging for small businesses or those with limited resources. In contrast, OCBOA provides more flexibility and simplicity. It allows businesses to use simplified accounting methods that are easier to understand and implement.

4. Auditing Requirements

GAAP requires businesses to undergo external audits by certified public accountants (CPAs) to ensure compliance with the accounting standards. These audits provide assurance to stakeholders that the financial statements are reliable and accurate. On the other hand, OCBOA does not have specific auditing requirements. Businesses using OCBOA may choose to have their financial statements audited, reviewed, or compiled by a CPA, depending on their needs and the requirements of external parties.

Overall, the choice between OCBOA and GAAP depends on the specific needs and circumstances of a business. While GAAP provides a comprehensive and standardized framework, OCBOA offers more flexibility and simplicity. It is important for businesses to carefully consider these key differences and consult with accounting professionals to determine the most suitable framework for their financial reporting needs.

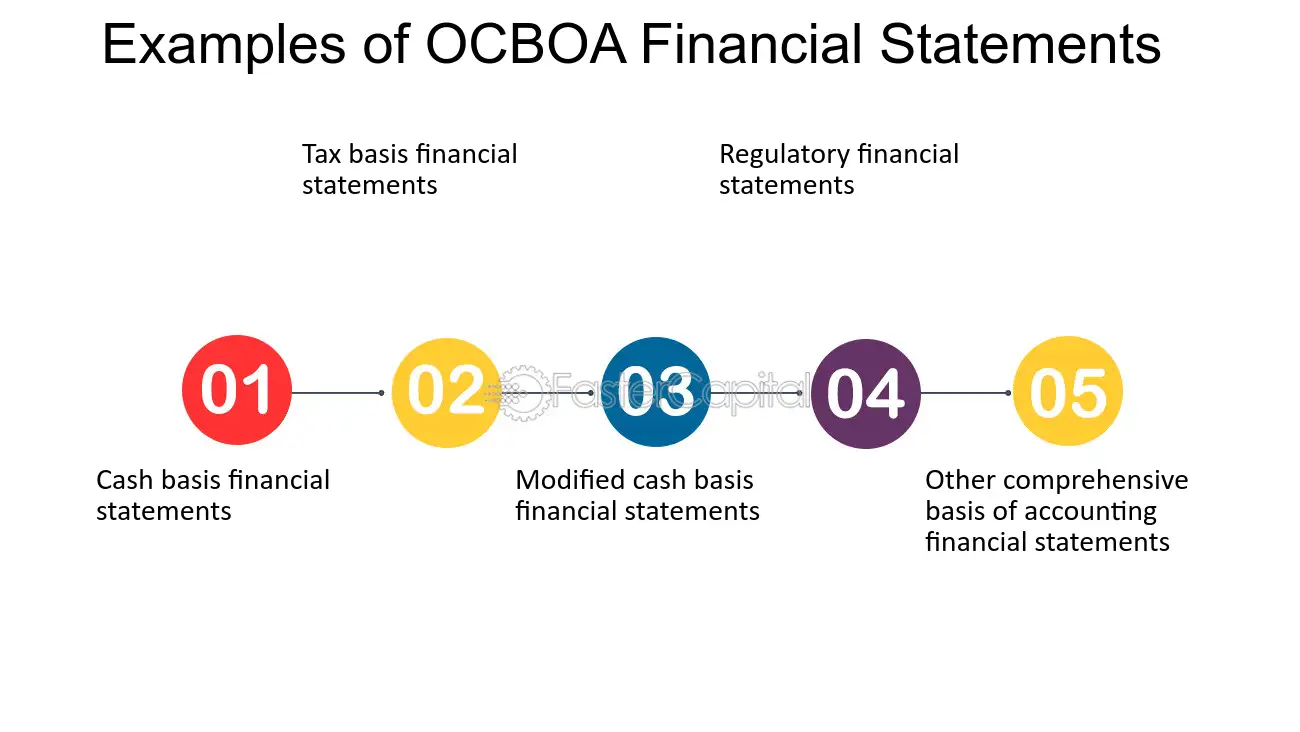

Examples of OCBOA Financial Statements

Other Comprehensive Basis of Accounting (OCBOA) is a set of accounting principles that are used as an alternative to Generally Accepted Accounting Principles (GAAP). OCBOA is often used by small businesses, non-profit organizations, and government entities that do not require financial statements prepared in accordance with GAAP.

Here are a few examples of OCBOA financial statements:

| 1. Cash Basis Financial Statements |

|---|

| Cash basis financial statements are prepared using the cash method of accounting, where revenue is recognized when cash is received and expenses are recognized when cash is paid. These statements provide a simple and straightforward view of a company’s financial position and performance. |

| 2. Modified Cash Basis Financial Statements |

| Modified cash basis financial statements are similar to cash basis financial statements, but they may include certain accruals or adjustments to provide a more accurate representation of a company’s financial position and performance. |

| 3. Income Tax Basis Financial Statements |

| Income tax basis financial statements are prepared using the tax rules and regulations of the applicable jurisdiction. These statements are often used by small businesses for tax reporting purposes and may differ from financial statements prepared under GAAP. |

| 4. Regulatory Basis Financial Statements |

| Regulatory basis financial statements are prepared in accordance with specific regulations or requirements imposed by regulatory bodies. These statements are often used by entities operating in regulated industries, such as utilities or financial institutions. |

| 5. Contractual Basis Financial Statements |

| Contractual basis financial statements are prepared in accordance with the terms and conditions of a specific contract or agreement. These statements are often used in situations where a company has entered into a contract that requires the preparation of financial statements based on a specific set of accounting principles. |

Emily Bibb simplifies finance through bestselling books and articles, bridging complex concepts for everyday understanding. Engaging audiences via social media, she shares insights for financial success. Active in seminars and philanthropy, Bibb aims to create a more financially informed society, driven by her passion for empowering others.