What is Contingent Liability?

A contingent liability refers to a potential obligation that may arise in the future, depending on the outcome of a specific event. It is a liability that is uncertain and contingent upon the occurrence or non-occurrence of a particular event. This means that the liability may or may not materialize, depending on the circumstances.

Contingent liabilities are not recorded as actual liabilities on a company’s balance sheet, but they are disclosed in the notes to the financial statements. This is because the outcome of the contingent liability is uncertain, and it may have a significant impact on the financial position and performance of the company.

Definition and Explanation

A contingent liability can arise from various situations, such as pending lawsuits, warranty claims, or potential tax assessments. It represents a potential financial obligation that may need to be fulfilled in the future if certain conditions are met.

For example, if a company is facing a lawsuit, it may have to pay damages if it loses the case. However, until the court makes a decision, the liability is considered contingent because it is uncertain whether the company will be held responsible for the damages.

Contingent liabilities are typically classified into two categories: probable and possible. A probable contingent liability is likely to occur based on available information, while a possible contingent liability has a lower likelihood of occurring.

Examples of Contingent Liability

Some common examples of contingent liabilities include:

- Pending lawsuits

- Product warranties

- Potential tax assessments

- Guarantees or warranties provided by the company

- Environmental liabilities

These examples illustrate situations where a company may have a potential financial obligation that is contingent upon the outcome of a specific event.

It is important for companies to disclose contingent liabilities in their financial statements to provide transparency to investors and stakeholders. This allows them to assess the potential impact of these liabilities on the company’s financial position and performance.

Definition and Explanation

When a contingent liability is probable and the amount can be reasonably estimated, it is recorded in the financial statements as a disclosure. However, if the likelihood of occurrence is remote, or if the amount cannot be reasonably estimated, the contingent liability may not be disclosed in the financial statements.

It is important for companies to disclose contingent liabilities in their financial statements because they provide information to investors and stakeholders about potential risks that may affect the company’s financial position. This allows users of the financial statements to make informed decisions about the company’s future prospects and potential liabilities.

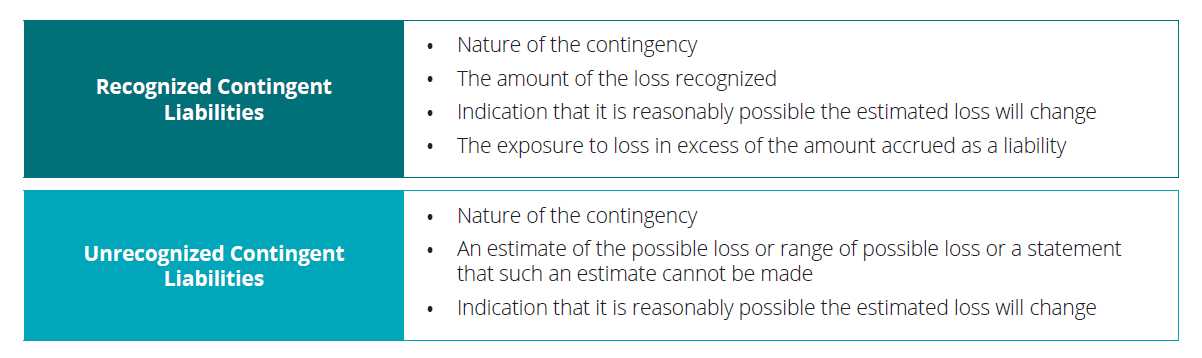

Contingent liabilities are typically disclosed in the footnotes to the financial statements, where they are described in detail, including the nature of the liability, the potential amount, and the likelihood of occurrence. This information helps users of the financial statements to assess the potential impact of the contingent liability on the company’s financial position and performance.

Examples of Contingent Liability

A contingent liability is a potential obligation that may or may not occur depending on the outcome of a future event. Here are some examples of contingent liabilities:

Lawsuits and Legal Claims

Companies may face lawsuits or legal claims that could result in financial obligations. For example, a company might be sued for product liability, breach of contract, or intellectual property infringement. Until the court makes a decision or a settlement is reached, the outcome and potential financial impact of the lawsuit remain uncertain.

Warranties and Guarantees

When a company offers warranties or guarantees on its products or services, it creates a contingent liability. If a product fails or a service is not delivered as promised, the company may be required to provide compensation or replacements. The amount of potential liability depends on the terms and duration of the warranties or guarantees.

Environmental Cleanup

Companies that operate in industries with potential environmental impact, such as manufacturing or mining, may face contingent liabilities related to environmental cleanup. If a company is responsible for pollution or contamination, it may be required to bear the costs of remediation and restoration.

Pending Tax Audits

When a company is subjected to a tax audit, it faces a contingent liability. If the audit results in additional tax assessments or penalties, the company may be required to pay the amount owed. Until the audit is completed and the final tax liability is determined, the potential financial impact remains uncertain.

These are just a few examples of contingent liabilities that companies may encounter. It is important for businesses to disclose and evaluate these potential obligations in their financial statements to provide transparency and help investors and stakeholders make informed decisions.

Real-life Situations

Contingent liabilities can arise in various real-life situations, impacting a company’s financial statements. Here are some examples:

Lawsuits: A company may face legal claims or lawsuits that could result in significant financial obligations. For example, a product liability lawsuit can lead to potential damages and legal costs. These contingent liabilities need to be disclosed in the financial statements, even if the outcome is uncertain.

Warranties and Guarantees: Companies often provide warranties or guarantees for their products or services. If there is a possibility of future costs associated with honoring these warranties or guarantees, they are considered contingent liabilities. For instance, a car manufacturer may offer a warranty for a certain period, and if there are defects in the vehicles, the company may have to incur repair costs.

Environmental Liabilities: Companies that operate in industries with potential environmental risks, such as oil and gas or manufacturing, may face contingent liabilities related to environmental cleanup and remediation. These liabilities can arise from past or ongoing operations and may have a significant financial impact on the company.

Tax Disputes: Companies may be involved in tax disputes with tax authorities, which can result in additional tax liabilities. These disputes can arise due to differences in interpretation of tax laws or disagreements on the amount of taxes owed. Until the resolution of the dispute, the potential tax liability is considered a contingent liability.

Contractual Obligations: Companies may enter into contracts that contain provisions for potential penalties or fines in case of non-compliance. These contractual obligations are considered contingent liabilities until the conditions triggering the penalties are met. For example, a construction company may have a contract with a penalty clause if the project is not completed on time.

Importance of Contingent Liability in Financial Statements

Contingent liability plays a crucial role in financial statements as it provides important information about potential obligations and risks that a company may face in the future. It helps investors, creditors, and other stakeholders in making informed decisions regarding the financial health and stability of the company.

1. Assessing Financial Risk

Contingent liabilities provide insights into the potential financial risks that a company may encounter. By disclosing these liabilities in financial statements, companies allow stakeholders to assess the impact of these risks on the company’s financial position and performance. This information is particularly important for investors who want to evaluate the risk-return trade-off before making investment decisions.

2. Evaluating Business Performance

Contingent liabilities can affect a company’s profitability and cash flow. By disclosing these liabilities, financial statements provide a more accurate picture of the company’s performance. Stakeholders can evaluate the company’s ability to generate profits and manage potential risks. This information is vital for creditors who need to assess the company’s ability to meet its financial obligations.

Moreover, contingent liabilities can influence the valuation of a company. Potential legal claims, warranties, or environmental liabilities can significantly impact the company’s value. By disclosing these contingencies, financial statements provide transparency and enable stakeholders to make more accurate valuations.

3. Making Informed Decisions

Contingent liabilities help stakeholders make informed decisions. Investors can assess the potential risks and rewards associated with investing in a particular company. Creditors can evaluate the company’s creditworthiness and decide whether to extend credit or provide loans. Other stakeholders, such as suppliers and customers, can also use this information to evaluate the company’s financial stability and make decisions regarding their business relationships.

By disclosing contingent liabilities, companies demonstrate transparency and accountability. This fosters trust among stakeholders and enhances the overall credibility of the company. It also aligns with the principles of good corporate governance and ethical business practices.

Emily Bibb simplifies finance through bestselling books and articles, bridging complex concepts for everyday understanding. Engaging audiences via social media, she shares insights for financial success. Active in seminars and philanthropy, Bibb aims to create a more financially informed society, driven by her passion for empowering others.