What is a Money Purchase Plan?

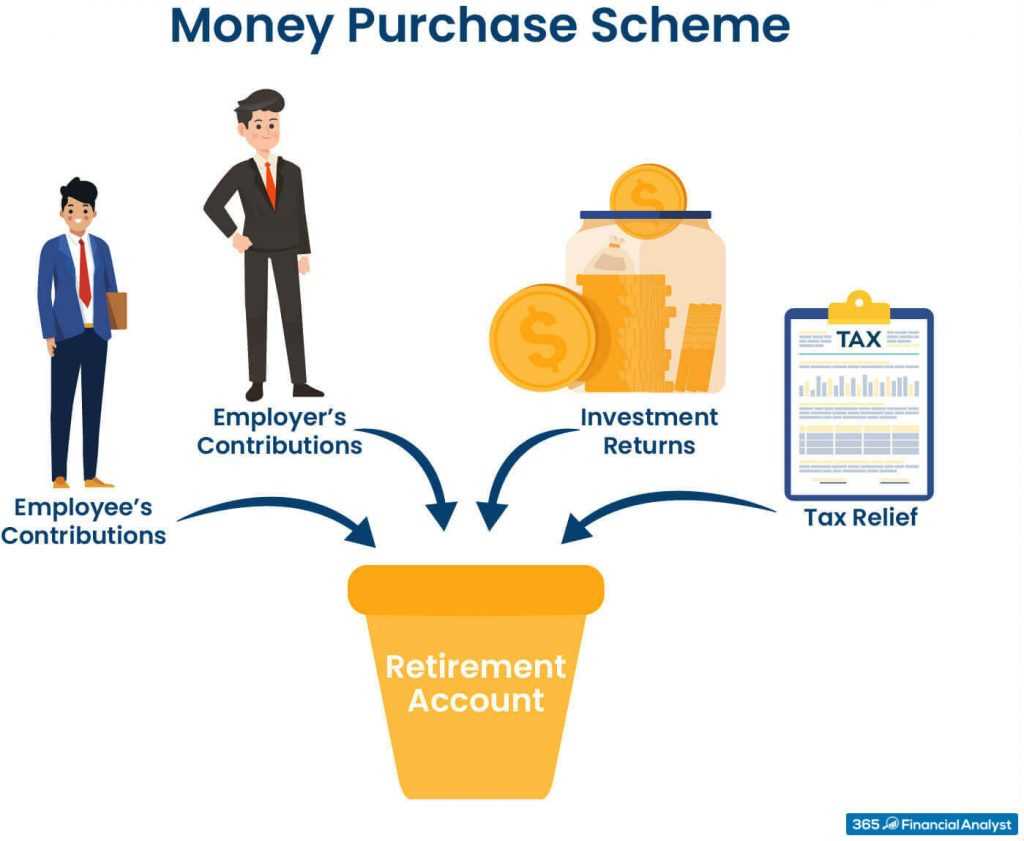

A money purchase plan is a type of retirement savings plan that allows individuals to contribute a certain amount of money to their retirement account on a regular basis. This type of plan is typically offered by employers as a benefit to their employees.

With a money purchase plan, individuals can contribute a fixed percentage of their salary or a specific dollar amount to their retirement account. These contributions are made on a pre-tax basis, which means that individuals do not have to pay taxes on the money they contribute until they withdraw it from their account.

One of the key features of a money purchase plan is that employers can also contribute to their employees’ retirement accounts. This can be done through matching contributions, where the employer matches a certain percentage of the employee’s contributions, or through profit-sharing contributions, where the employer contributes a portion of the company’s profits to the employees’ retirement accounts.

Money purchase plans offer several benefits to individuals. First, they provide a convenient and structured way to save for retirement. By contributing a fixed amount of money to their retirement account on a regular basis, individuals can ensure that they are building a nest egg for their future.

Second, money purchase plans offer tax advantages. Contributions to these plans are made on a pre-tax basis, which means that individuals can reduce their taxable income by the amount they contribute. This can result in significant tax savings, especially for individuals in higher tax brackets.

Another benefit of money purchase plans is the ability to defer taxes. Since contributions to these plans are made on a pre-tax basis, individuals do not have to pay taxes on the money they contribute until they withdraw it from their account. This allows their retirement savings to grow tax-free, potentially resulting in a larger nest egg at retirement.

Finally, money purchase plans often include employer contributions, which can significantly boost individuals’ retirement savings. Whether through matching contributions or profit-sharing contributions, these employer contributions can provide individuals with additional funds to help them achieve their retirement goals.

Definition and Explanation

A money purchase plan is a type of retirement plan in which an employer contributes a fixed amount of money to an employee’s retirement account. The amount of the contribution is determined by a formula specified in the plan, such as a percentage of the employee’s salary or a fixed dollar amount.

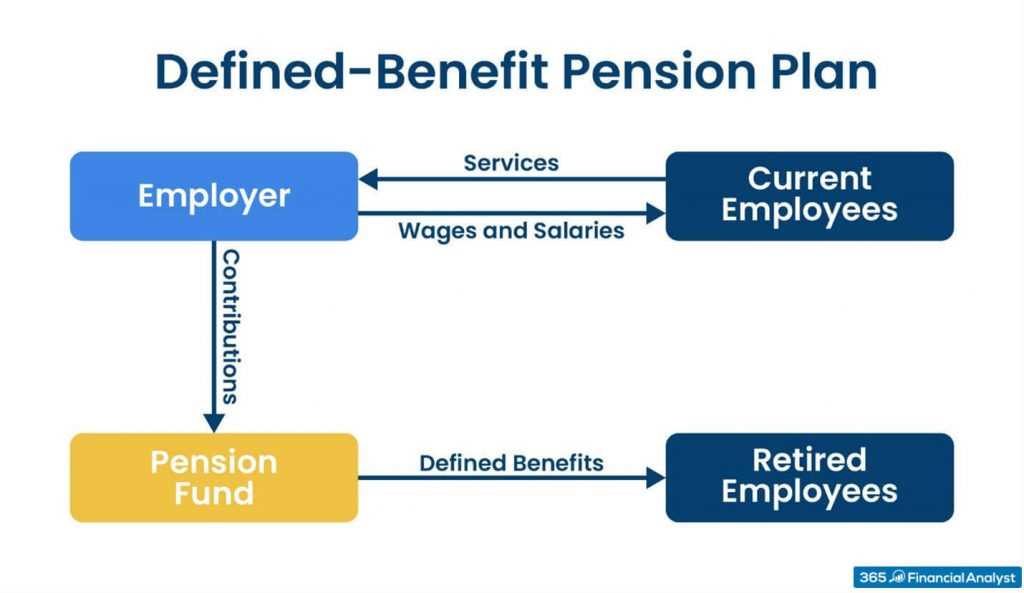

Unlike a defined benefit plan, which guarantees a specific retirement benefit based on factors such as years of service and salary history, a money purchase plan does not provide a guaranteed benefit. Instead, the employee’s retirement benefit is based on the amount of money contributed to the plan and the investment returns earned on those contributions.

Money purchase plans are typically funded through employer contributions only, although some plans may allow employees to make voluntary contributions as well. The contributions are invested in a variety of investment options, such as stocks, bonds, and mutual funds, with the goal of growing the account balance over time.

Upon retirement, the employee can begin withdrawing funds from the money purchase plan. The amount of the withdrawals will depend on the account balance and the chosen withdrawal method, such as a lump sum distribution or periodic payments.

Overall, a money purchase plan provides employees with a way to save for retirement and potentially grow their savings through investment returns. It offers flexibility in terms of contribution amounts and investment options, but does not guarantee a specific retirement benefit like a defined benefit plan.

| Advantages | Disadvantages |

|---|---|

| – Provides a way to save for retirement | – Does not guarantee a specific retirement benefit |

| – Offers flexibility in contribution amounts | – Subject to IRS rules and regulations |

| – Allows for investment growth potential | – Retirement benefit depends on contributions and investment returns |

Benefits of a Money Purchase Plan

A money purchase plan offers several benefits to both employers and employees. This type of retirement plan allows individuals to save for their future while enjoying certain tax advantages.

1. Retirement Savings

One of the main benefits of a money purchase plan is that it provides individuals with a way to save for their retirement. By contributing a portion of their income to the plan, employees can build up a nest egg that will support them during their golden years. This can help alleviate financial stress and provide peace of mind knowing that there will be funds available for retirement.

2. Tax Advantages

Money purchase plans offer tax advantages to both employers and employees. For employees, contributions made to the plan are typically tax-deductible, meaning that they can reduce their taxable income for the year. This can result in significant tax savings, especially for individuals in higher tax brackets.

3. Deferred Taxes

Another benefit of a money purchase plan is that individuals can defer paying taxes on their contributions and earnings until they retire. This can be advantageous because individuals may be in a lower tax bracket during retirement, resulting in lower tax liability on the funds withdrawn.

By deferring taxes, individuals can potentially keep more of their hard-earned money and have greater flexibility in managing their retirement income. They can strategically withdraw funds in a way that minimizes their tax burden and maximizes their overall financial well-being.

4. Employer Contributions

Money purchase plans often include employer contributions, which can provide an additional benefit to employees. Employers may choose to match a certain percentage of the employee’s contributions, effectively increasing the amount of money that is being saved for retirement.

These employer contributions can significantly boost an employee’s retirement savings and help them reach their financial goals faster. It also serves as an incentive for employees to participate in the plan and take advantage of the benefits it offers.

Retirement Savings

A money purchase plan is a type of retirement savings plan that allows individuals to contribute a portion of their income towards their future retirement. This type of plan is typically offered by employers as a benefit to their employees.

With a money purchase plan, individuals can contribute a percentage of their salary or a fixed dollar amount each year. These contributions are then invested in a variety of assets, such as stocks, bonds, and mutual funds, with the goal of growing the account balance over time.

One of the main advantages of a money purchase plan is that it allows individuals to save for retirement on a tax-deferred basis. This means that contributions made to the plan are not taxed until they are withdrawn, allowing the account balance to grow faster over time.

Overall, a money purchase plan is a valuable tool for individuals looking to save for retirement. It provides a tax-advantaged way to grow savings over time and may also include employer contributions, making it an attractive option for many employees.

| Benefits of a Money Purchase Plan |

|---|

| Allows individuals to save for retirement |

| Contributions are tax-deferred |

| May include employer contributions |

| Offers a variety of investment options |

| Provides a reliable source of income in retirement |

Tax Advantages of a Money Purchase Plan

A money purchase plan offers several tax advantages that make it an attractive option for retirement savings. These tax advantages can help individuals maximize their savings and reduce their tax liability.

One of the main tax advantages of a money purchase plan is that contributions made by the employer are tax-deductible. This means that the employer can deduct the contributions they make to the plan from their taxable income. This can result in significant tax savings for the employer.

Additionally, the contributions made by the employee to a money purchase plan are typically made on a pre-tax basis. This means that the employee’s contributions are deducted from their taxable income, reducing their overall tax liability. This can result in immediate tax savings for the employee.

Furthermore, the earnings on the investments within a money purchase plan are tax-deferred. This means that individuals do not have to pay taxes on the investment earnings until they withdraw the funds from the plan. This allows the investments to grow on a tax-free basis, potentially resulting in higher overall returns.

It is important to note that while contributions and earnings within a money purchase plan are tax-deferred, withdrawals from the plan are generally subject to income tax. However, individuals may be able to take advantage of lower tax rates in retirement, potentially reducing their overall tax liability.

Deferred Taxes

One of the key benefits of a Money Purchase Plan is the ability to defer taxes on contributions and investment earnings until retirement. This means that the money you contribute to the plan and any investment gains you earn are not subject to immediate taxation.

By deferring taxes, you can potentially benefit from the power of compound interest. The money you would have paid in taxes can remain invested in the plan, allowing it to grow over time. This can result in significant savings and a larger retirement nest egg.

When you eventually withdraw funds from your Money Purchase Plan during retirement, you will be required to pay taxes on the distributions. However, since most people are in a lower tax bracket during retirement, they may pay a lower tax rate on these funds compared to when they were working.

Tax-Deferred Contributions

In a Money Purchase Plan, both you and your employer can make tax-deferred contributions. This means that the money you contribute to the plan is deducted from your taxable income, reducing your current tax liability. Similarly, any contributions made by your employer on your behalf are also tax-deferred.

Tax-Deferred Investment Earnings

In addition to tax-deferred contributions, the investment earnings within a Money Purchase Plan are also tax-deferred. This means that any dividends, interest, or capital gains generated by the investments in your plan are not subject to immediate taxation.

By allowing your investment earnings to grow tax-free, you can take advantage of compounding returns. This occurs when your investment gains are reinvested and generate additional returns. Over time, this compounding effect can significantly increase the value of your retirement savings.

| Advantages of Deferred Taxes in a Money Purchase Plan |

|---|

| 1. The ability to defer taxes allows your contributions and investment earnings to grow over time. |

| 2. By deferring taxes, you may pay a lower tax rate on your retirement distributions. |

| 3. Tax-deferred contributions reduce your current tax liability. |

| 4. Tax-deferred investment earnings allow for compounding returns. |

| 5. The potential for significant savings and a larger retirement nest egg. |

Employer Contributions

Employer contributions to a Money Purchase Plan can provide a significant boost to an employee’s retirement savings. Not only do these contributions increase the overall value of the plan, but they also offer a valuable incentive for employees to participate in the plan and save for their future.

Furthermore, employer contributions to a Money Purchase Plan are typically tax-deductible for the employer. This means that the employer can deduct the contributions as a business expense, reducing their taxable income. This tax advantage can be a motivating factor for employers to offer this type of retirement plan to their employees.

For employees, employer contributions to a Money Purchase Plan can have a significant impact on their retirement savings. These contributions are typically made on a pre-tax basis, meaning that they are not subject to income tax at the time they are contributed. Instead, taxes are deferred until the funds are withdrawn from the plan during retirement.

Additionally, employer contributions to a Money Purchase Plan may be subject to vesting requirements. Vesting refers to the amount of time an employee must work for the company before they are entitled to the full value of the employer’s contributions. This can vary depending on the specific plan, but it is important for employees to understand the vesting schedule and how it may impact their retirement savings.

Emily Bibb simplifies finance through bestselling books and articles, bridging complex concepts for everyday understanding. Engaging audiences via social media, she shares insights for financial success. Active in seminars and philanthropy, Bibb aims to create a more financially informed society, driven by her passion for empowering others.