Master-Feeder Structure: Explained, Benefits, and Drawbacks

A master-feeder structure is a common setup in the hedge fund industry, where multiple feeder funds pool their assets into a single master fund. This structure allows investors to gain exposure to a diversified portfolio of investments managed by the master fund, while still benefiting from the tax advantages and regulatory exemptions offered by the feeder funds.

What is a Master-Feeder Structure?

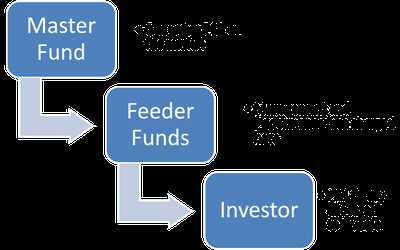

In a master-feeder structure, the feeder funds act as intermediaries between the investors and the master fund. The feeder funds pool the investments from their respective investors and then invest the funds into the master fund. The master fund, in turn, manages the combined assets of all the feeder funds and makes investment decisions on behalf of the investors.

This structure is particularly beneficial for hedge fund managers who want to attract investors from different jurisdictions or with different investment preferences. By setting up feeder funds in different locations or with different investment strategies, the manager can cater to a broader range of investors while still managing the assets centrally through the master fund.

The Benefits of a Master-Feeder Structure

There are several benefits to using a master-feeder structure:

- Tax Efficiency: One of the main advantages of a master-feeder structure is the potential for tax efficiency. By pooling the investments into a single master fund, the feeder funds can minimize the tax liabilities for their investors. The master fund can also take advantage of tax treaties and other tax planning strategies to optimize the overall tax burden.

- Regulatory Exemptions: Feeder funds are often subject to different regulatory requirements compared to the master fund. By investing through feeder funds, investors can benefit from certain exemptions or reduced regulatory oversight. This can result in cost savings and increased operational flexibility for both the investors and the fund manager.

- Diversification: A master-feeder structure allows investors to gain exposure to a diversified portfolio of investments managed by the master fund. The master fund can allocate the pooled assets across different strategies, asset classes, and geographic regions, providing investors with a broader range of investment opportunities and risk diversification.

The Drawbacks of a Master-Feeder Structure

While a master-feeder structure offers many benefits, there are also some drawbacks to consider:

- Complexity: Setting up and maintaining a master-feeder structure can be complex and time-consuming. It requires coordination between multiple entities, compliance with different regulatory regimes, and the implementation of robust operational and reporting systems.

- Costs: The additional administrative and legal requirements associated with a master-feeder structure can result in higher costs for both the fund manager and the investors. These costs include legal fees, accounting fees, regulatory fees, and ongoing operational expenses.

- Restrictions: Depending on the jurisdiction and the specific structure, a master-feeder arrangement may impose certain restrictions on the investors. For example, some jurisdictions may limit the types of investors or the minimum investment amounts for feeder funds.

What is a Master-Feeder Structure?

A master-feeder structure is a common setup used in the hedge fund industry. It involves the creation of two separate entities: a master fund and one or more feeder funds. The master fund is the main entity that manages the investment strategy and holds the assets, while the feeder funds pool investor capital and invest it into the master fund.

The purpose of this structure is to allow different types of investors, such as individuals, institutions, or foreign investors, to invest in the same investment strategy through different feeder funds. Each feeder fund may have its own unique characteristics, such as different fee structures or regulatory requirements, to cater to the specific needs of its investors.

The master-feeder structure offers several advantages. Firstly, it allows for efficient management of investor capital by consolidating it into a single master fund. This can lead to cost savings and economies of scale. Secondly, it provides flexibility in terms of investor eligibility and regulatory compliance. Different feeder funds can be set up to comply with specific regulations or to cater to specific types of investors. Thirdly, it simplifies the reporting and administration process, as all investor capital is managed within the master fund.

However, there are also drawbacks to consider. One potential drawback is the complexity of setting up and maintaining the master-feeder structure. It requires careful legal and regulatory considerations, as well as ongoing coordination between the master fund and feeder funds. Additionally, the master-feeder structure may limit the ability of investors to directly access the underlying assets held by the master fund. This can reduce transparency and control for investors.

The Benefits of a Master-Feeder Structure

A master-feeder structure is a common investment structure used by hedge funds. It involves the creation of two separate entities: a master fund and feeder funds. The master fund is the main vehicle that holds the investment assets, while the feeder funds are the vehicles through which investors can invest in the master fund.

There are several benefits to using a master-feeder structure:

| Diversification: | One of the key benefits of a master-feeder structure is the ability to achieve diversification. The master fund can invest in a wide range of assets and strategies, allowing investors to access a diversified portfolio. This can help to mitigate risk and potentially enhance returns. |

| Tax Efficiency: | Another advantage of a master-feeder structure is the potential for tax efficiency. By pooling the assets of multiple feeder funds into a single master fund, investors can benefit from economies of scale and potentially reduce their tax liabilities. This can be particularly beneficial for high-net-worth individuals and institutional investors. |

| Cost Savings: | A master-feeder structure can also lead to cost savings. By consolidating the investment assets into a single master fund, hedge fund managers can streamline operations and reduce administrative and operational expenses. This can result in lower fees for investors and potentially higher net returns. |

| Access to Expertise: | Feeder funds in a master-feeder structure can provide investors with access to specialized investment expertise. Each feeder fund can be managed by a different investment manager or team, allowing investors to choose the strategy or expertise that aligns with their investment goals. This can provide investors with a greater level of customization and flexibility. |

| Regulatory Compliance: | A master-feeder structure can also help hedge funds comply with regulatory requirements. By separating the investment assets into different entities, hedge fund managers can navigate complex regulatory frameworks more effectively. This can help to ensure compliance with applicable laws and regulations, reducing the risk of regulatory scrutiny or penalties. |

The Drawbacks of a Master-Feeder Structure

The master-feeder structure, while offering several benefits, also has some drawbacks that investors and fund managers should consider:

- Complexity: The master-feeder structure can be complex to set up and maintain. It requires careful coordination between the master fund and the feeder funds, as well as compliance with various regulatory requirements. This complexity can increase operational costs and administrative burden for fund managers.

- Increased costs: The use of a master-feeder structure can result in increased costs for investors. Each feeder fund may have its own set of fees, including management fees, performance fees, and administrative fees. These fees can add up and reduce overall investment returns.

- Limited investment options: The master-feeder structure limits the investment options available to investors. Feeder funds typically invest only in the master fund, which means that investors may not have access to certain investment strategies or asset classes that are not offered by the master fund.

- Lack of transparency: The master-feeder structure can result in a lack of transparency for investors. Since the feeder funds pool their assets into the master fund, investors may not have a clear view of the underlying investments held by the master fund. This lack of transparency can make it difficult for investors to assess the risk and performance of their investments.

- Tax implications: The use of a master-feeder structure can have tax implications for investors. Depending on the jurisdiction and the specific tax laws, investors may be subject to different tax treatments based on their investments in the master fund and the feeder funds. It is important for investors to understand the tax implications and consult with tax professionals before investing in a master-feeder structure.

Despite these drawbacks, the master-feeder structure remains a popular choice for hedge funds and other investment vehicles. It offers benefits such as operational efficiency, cost savings, and access to a wider investor base. However, investors and fund managers should carefully consider the drawbacks and assess whether the advantages outweigh the disadvantages in their specific circumstances.

HEDGE FUNDS catname

In the world of hedge funds, the master-feeder structure is a popular and widely used investment vehicle. This structure allows investors to pool their assets together and invest in a single master fund, which then allocates the capital to various feeder funds. The feeder funds, in turn, invest in different strategies or asset classes.

The master-feeder structure offers several benefits for both fund managers and investors. Firstly, it allows for efficient management of multiple investment strategies. By pooling assets together in a master fund, fund managers can easily allocate capital to different feeder funds based on their investment objectives and risk profiles.

Secondly, the master-feeder structure provides tax advantages. The master fund can be structured as a tax-efficient entity, such as a limited partnership or a corporation, which can help minimize tax liabilities for investors. Additionally, the structure allows for tax-efficient repatriation of profits and capital gains.

Furthermore, the master-feeder structure offers operational efficiencies. By consolidating assets in a single master fund, fund managers can streamline administrative tasks, such as reporting and compliance, which can lead to cost savings and improved operational effectiveness.

However, there are also drawbacks to consider. One of the main drawbacks is the complexity of the structure. The master-feeder structure involves multiple legal entities and can be subject to regulatory requirements and compliance obligations. This complexity can increase the administrative burden and costs for fund managers.

Another drawback is the potential for conflicts of interest. The master-feeder structure can create conflicts between the interests of the master fund and the feeder funds. For example, the master fund may allocate a disproportionate amount of capital to certain feeder funds, which can disadvantage other investors.

Emily Bibb simplifies finance through bestselling books and articles, bridging complex concepts for everyday understanding. Engaging audiences via social media, she shares insights for financial success. Active in seminars and philanthropy, Bibb aims to create a more financially informed society, driven by her passion for empowering others.