What is Loan to Cost Ratio?

The Loan to Cost Ratio (LTC) is a financial ratio that is commonly used in real estate financing. It is a measure of the amount of money borrowed relative to the total cost of a project or investment property. In simple terms, it shows the percentage of the total cost that is financed through a loan.

Calculation

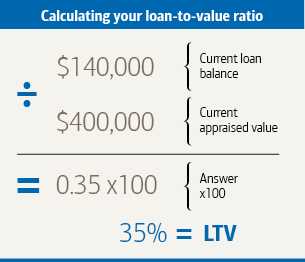

The Loan to Cost Ratio is calculated by dividing the loan amount by the total cost of the project or investment property, and then multiplying the result by 100 to express it as a percentage. The formula is as follows:

LTC = (Loan Amount / Total Cost) * 100

Importance

The Loan to Cost Ratio is an important metric for lenders and investors as it helps assess the risk associated with a project or investment property. A higher LTC ratio indicates a higher level of leverage and potentially higher risk, while a lower ratio suggests a lower level of risk. Lenders typically have maximum LTC ratios that they are willing to lend against, and investors use the ratio to determine the feasibility and profitability of a project.

Additionally, the LTC ratio can also be used to compare different financing options and determine the most cost-effective solution for a project. It allows borrowers to evaluate the amount of equity they need to contribute and the amount of debt they can take on.

What Loan to Cost Ratio Tells You

The Loan to Cost Ratio provides insights into the financing structure of a project or investment property. It shows the proportion of the total cost that is funded through debt, which can indicate the level of risk and potential returns. A higher LTC ratio suggests a higher level of leverage and potentially higher returns, but also higher risk. A lower ratio indicates a lower level of leverage and potentially lower risk, but also lower returns.

By analyzing the LTC ratio, lenders and investors can assess the feasibility and profitability of a project, determine the appropriate financing structure, and make informed decisions about lending or investing.

Overall, the Loan to Cost Ratio is a valuable tool in real estate financing that helps assess risk, determine financing options, and make informed decisions about projects and investment properties.

Calculation

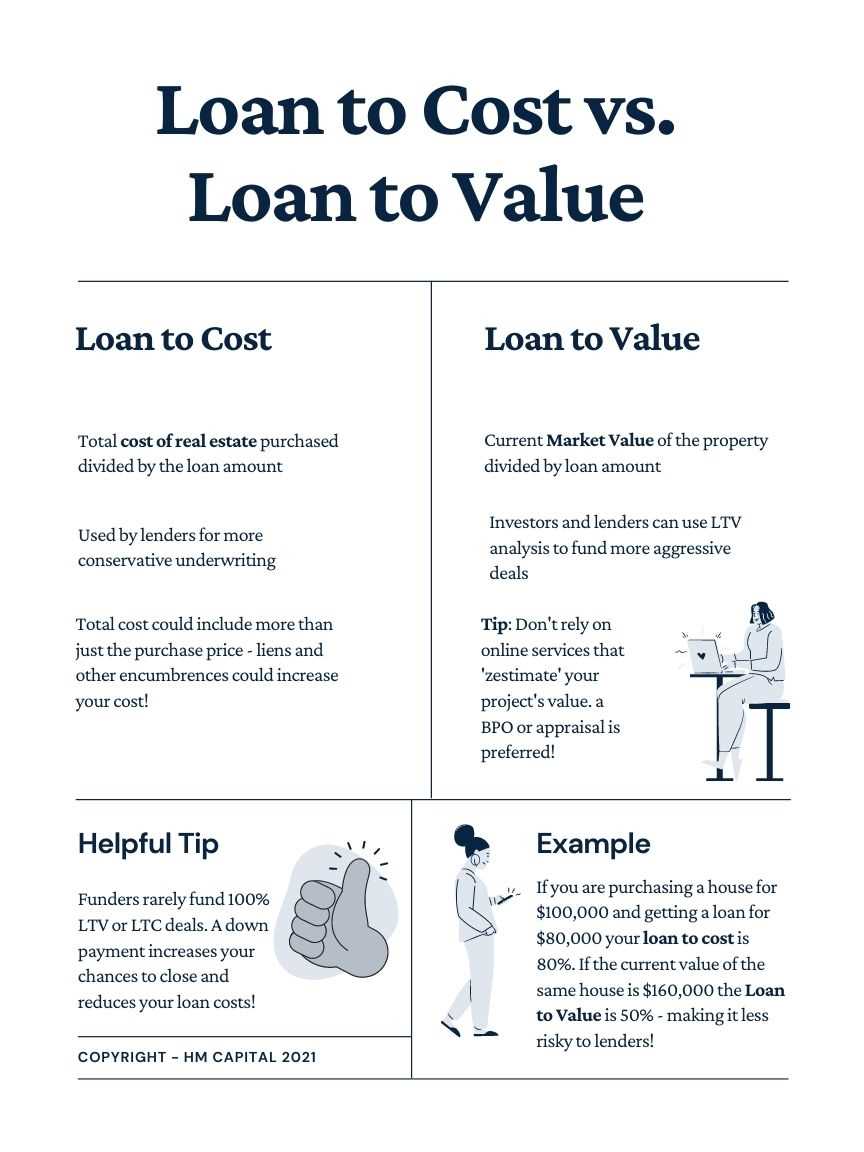

The loan to cost ratio is calculated by dividing the loan amount by the total cost of the project. The loan amount includes the principal amount borrowed, as well as any additional fees or costs associated with obtaining the loan. The total cost of the project includes the purchase price of the property, as well as any renovation or construction costs.

To calculate the loan to cost ratio, you can use the following formula:

Loan to Cost Ratio = Loan Amount / Total Cost of Project

For example, if you are borrowing $500,000 to finance a project with a total cost of $1,000,000, the loan to cost ratio would be:

Loan to Cost Ratio = $500,000 / $1,000,000 = 0.5

This means that the loan amount represents 50% of the total cost of the project. A higher loan to cost ratio indicates that a larger portion of the project is being financed through debt, while a lower ratio indicates that a smaller portion is being financed through debt.

How to Calculate Loan to Cost Ratio

Calculating the Loan to Cost (LTC) ratio is a crucial step in determining the feasibility and profitability of a real estate investment. This ratio helps lenders and investors assess the level of risk associated with financing a particular project. To calculate the LTC ratio, you need to follow these steps:

Step 1: Determine the Total Project Cost

The first step in calculating the LTC ratio is to determine the total project cost. This includes all the costs associated with acquiring, developing, and improving the property. It typically includes the purchase price, construction costs, renovation expenses, and any other related costs.

Step 2: Calculate the Loan Amount

Step 3: Divide the Loan Amount by the Total Project Cost

Once you have determined the loan amount and the total project cost, you can calculate the LTC ratio by dividing the loan amount by the total project cost. The formula for calculating the LTC ratio is as follows:

LTC Ratio = Loan Amount / Total Project Cost

For example, if the loan amount is $500,000 and the total project cost is $1,000,000, the LTC ratio would be 0.5 or 50%.

It is important to note that a higher LTC ratio indicates a higher level of risk for the lender or investor. A lower ratio, on the other hand, suggests a lower level of risk. Lenders and investors typically have their own threshold for acceptable LTC ratios based on their risk tolerance and lending criteria.

By calculating the LTC ratio, you can assess the financial viability of a real estate project and make informed decisions about financing options. It is a valuable tool for both lenders and investors in evaluating the risk and potential returns of an investment.

Importance of Loan to Cost Ratio

The Loan to Cost Ratio is an important financial metric that lenders and investors use to assess the risk and profitability of a real estate project. It provides valuable insights into the amount of financing required and the potential return on investment.

1. Risk Assessment

2. Financing Requirement

The Loan to Cost Ratio helps determine the amount of financing needed for a project. By comparing the loan amount to the total project cost, borrowers can assess how much additional capital they need to secure. This information is crucial for planning and budgeting purposes.

3. Profitability Analysis

Overall, the Loan to Cost Ratio is a key metric that helps lenders and investors make informed decisions about real estate projects. It provides a comprehensive view of the project’s risk, financing requirements, and potential profitability, allowing stakeholders to assess the feasibility and attractiveness of the investment.

What Loan to Cost Ratio Tells You

The Loan to Cost (LTC) ratio is a financial metric that provides insight into the level of financing a borrower is seeking relative to the total cost of a project. It is commonly used in the real estate industry to assess the risk and feasibility of a development project.

The LTC ratio is calculated by dividing the loan amount by the total cost of the project, including land acquisition, construction costs, and other associated expenses. The resulting ratio represents the percentage of the project cost that is being financed by the loan.

A higher LTC ratio indicates a greater reliance on debt financing, which can increase the risk for both the borrower and the lender. On the other hand, a lower LTC ratio suggests a lower level of debt and a higher level of equity investment, which can be seen as a positive sign of financial stability.

By analyzing the LTC ratio, lenders can assess the borrower’s ability to cover the project costs and repay the loan. It helps them determine the level of risk associated with the project and make informed decisions about lending terms and conditions.

In summary, the Loan to Cost ratio provides valuable insights into the financing structure of a project and helps both lenders and borrowers assess the risk and feasibility of a development project. It is an essential metric in the real estate industry and plays a crucial role in making informed financial decisions.

Application

The Loan to Cost Ratio (LTC) is a crucial metric used by lenders and investors to assess the feasibility and profitability of a real estate project. It helps them determine the maximum loan amount they are willing to provide based on the total cost of the project.

When applying for a loan, borrowers must provide detailed information about the project, including the estimated total cost, construction plans, and expected timeline. Lenders use this information to calculate the Loan to Cost Ratio and evaluate the risk associated with the project.

Benefits for Borrowers

Additionally, a lower Loan to Cost Ratio may indicate a lower level of risk for lenders, making it easier for borrowers to secure financing at favorable terms and conditions.

Benefits for Lenders

For lenders, the Loan to Cost Ratio serves as a risk assessment tool. By analyzing the ratio, lenders can evaluate the level of financial commitment from the borrower and assess the project’s profitability. A lower Loan to Cost Ratio indicates a lower level of risk for lenders, as it suggests that the borrower has a significant amount of equity invested in the project.

Furthermore, lenders can use the Loan to Cost Ratio to compare different projects and prioritize their lending decisions. Projects with a higher Loan to Cost Ratio may be considered riskier, requiring additional due diligence and potentially higher interest rates.

How Loan to Cost Ratio is Used

The Loan to Cost Ratio (LTC) is a crucial financial ratio used by lenders, investors, and developers in the real estate industry. It provides valuable insights into the feasibility and profitability of a construction or development project.

Here are some key ways in which the Loan to Cost Ratio is used:

1. Lender Decision Making: Lenders use the LTC ratio to assess the risk associated with providing financing for a construction project. A lower LTC ratio indicates a lower risk for the lender, as it suggests that the borrower has a significant amount of equity invested in the project. Lenders typically prefer lower LTC ratios as it provides them with a cushion in case of default.

2. Borrower Planning: Developers and borrowers use the LTC ratio to determine the amount of financing they can secure for a project. By calculating the LTC ratio, they can estimate the maximum loan amount they can expect to receive based on the total cost of the project. This helps them plan their budget and make informed decisions about the feasibility of the project.

3. Project Evaluation: The LTC ratio is also used to evaluate the financial viability of a construction project. A higher LTC ratio may indicate a higher level of risk, as it suggests that the borrower has less equity invested in the project. Investors and developers use this ratio to assess the profitability and potential return on investment of a project before committing their resources.

4. Risk Management: The LTC ratio is an essential tool for risk management in the real estate industry. By analyzing the LTC ratio, lenders and investors can identify potential risks and take necessary measures to mitigate them. They can adjust the loan terms, require additional collateral, or impose stricter conditions to minimize the risk associated with a project.

5. Comparisons and Benchmarking: The LTC ratio is used to compare different projects and benchmark against industry standards. Developers and investors can assess the competitiveness of their project by comparing the LTC ratio with similar projects in the market. It helps them identify areas for improvement and make informed decisions about project financing.

Overall, the Loan to Cost Ratio is a powerful tool that provides valuable insights into the financial aspects of a construction or development project. It is widely used in the real estate industry to assess risk, plan budgets, evaluate profitability, and make informed decisions about project financing.

Emily Bibb simplifies finance through bestselling books and articles, bridging complex concepts for everyday understanding. Engaging audiences via social media, she shares insights for financial success. Active in seminars and philanthropy, Bibb aims to create a more financially informed society, driven by her passion for empowering others.