What is Loan Servicing?

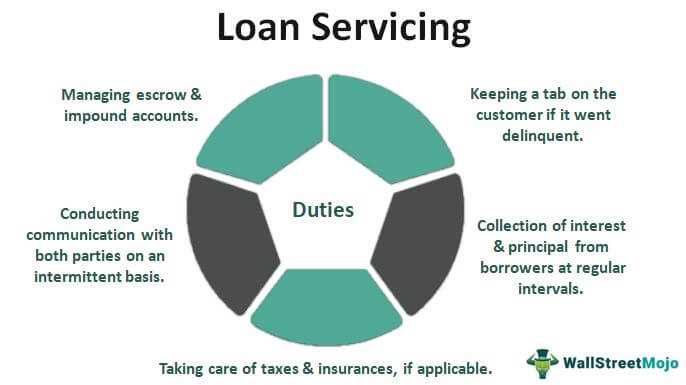

Loan servicing refers to the process of managing and administering a loan after it has been disbursed to the borrower. It involves the collection of loan payments, maintenance of loan records, and handling of any issues or inquiries related to the loan.

Functions of Loan Servicing

The primary functions of loan servicing include:

- Collecting loan payments: Loan servicers are responsible for collecting monthly payments from borrowers. They ensure that payments are made on time and in the correct amount.

- Maintaining loan records: Loan servicers keep detailed records of each loan, including payment history, outstanding balance, and any changes to the loan terms.

- Handling customer inquiries: Borrowers may have questions or concerns about their loan, such as requesting a payment schedule or addressing issues with their account. Loan servicers are responsible for addressing these inquiries and providing assistance.

- Escrow management: In some cases, loan servicers may be responsible for managing escrow accounts, which are used to pay property taxes and insurance on behalf of the borrower.

- Default management: If a borrower fails to make payments on time or defaults on the loan, loan servicers are responsible for managing the default process, which may include initiating foreclosure proceedings.

Benefits of Loan Servicing

Loan servicing provides several benefits for both borrowers and lenders:

- Convenience: Borrowers can make loan payments and address any loan-related inquiries or issues through a single point of contact, making the process more convenient and efficient.

- Accuracy: Loan servicers ensure that loan payments are accurately recorded and applied to the borrower’s account, reducing the risk of errors or discrepancies.

- Compliance: Loan servicers ensure that loan servicing practices comply with applicable laws and regulations, protecting both borrowers and lenders.

- Expertise: Loan servicers have specialized knowledge and experience in loan management, allowing them to effectively handle complex loan-related tasks and provide guidance to borrowers.

- Risk management: Loan servicers help lenders mitigate the risk of loan defaults by closely monitoring borrower payments and taking appropriate actions in case of delinquency.

Loan servicing is a critical aspect of the lending industry that involves the management and administration of loans after they have been originated. It is the process by which a loan is maintained, including collecting payments, managing escrow accounts, and handling any customer inquiries or issues that may arise.

When a borrower takes out a loan, whether it be a mortgage, auto loan, or personal loan, the lender typically sells the loan to a loan servicer. The loan servicer then becomes responsible for managing the loan on behalf of the lender. This includes tasks such as sending out monthly statements, processing payments, and ensuring that the loan is in compliance with all applicable regulations.

One of the key functions of loan servicing is collecting payments from borrowers. This involves sending out monthly statements that detail the amount due, the due date, and any additional fees or charges that may apply. The loan servicer is responsible for processing these payments and ensuring that they are applied correctly to the borrower’s account.

In addition to collecting payments, loan servicers also manage escrow accounts for borrowers. An escrow account is a separate account that is used to hold funds for the payment of property taxes and insurance premiums. The loan servicer is responsible for collecting these funds from the borrower and making the necessary payments on their behalf.

Loan servicing also involves handling any customer inquiries or issues that may arise throughout the life of the loan. This can include answering questions about the loan terms, providing information on how to make payments, or assisting with any problems or concerns that the borrower may have. The loan servicer acts as a point of contact for the borrower and is responsible for ensuring that their needs are met.

In summary, loan servicing is a crucial part of the lending industry that involves the management and administration of loans after they have been originated. It includes tasks such as collecting payments, managing escrow accounts, and handling customer inquiries. Loan servicers play a vital role in ensuring that loans are properly managed and that borrowers receive the necessary support throughout the life of their loan.

The Importance of Loan Servicing

Loan servicing plays a crucial role in the lending industry, benefiting both borrowers and lenders. It involves the management and administration of loans after they have been originated and disbursed. Here are some key reasons why loan servicing is important:

- Payment Collection: Loan servicing ensures that borrowers make timely payments towards their loans. This includes sending out payment reminders, collecting payments, and updating the borrower’s account.

- Account Management: Loan servicers handle various aspects of account management, such as maintaining borrower records, processing loan modifications, and managing escrow accounts for taxes and insurance.

- Customer Support: Loan servicers provide customer support to borrowers, helping them with any inquiries or issues related to their loans. This includes answering questions, providing loan statements, and assisting with payment options.

- Risk Mitigation: Loan servicing helps mitigate risks for lenders by ensuring that loans are properly managed and monitored. This includes conducting regular audits, verifying borrower information, and identifying potential delinquencies or defaults.

In summary, loan servicing is important for maintaining the financial health of both borrowers and lenders. It ensures that loans are managed effectively, payments are collected on time, and customer support is provided. By mitigating risks and ensuring compliance, loan servicing contributes to a stable and transparent lending industry.

Why Loan Servicing is Crucial for Borrowers and Lenders

Loan servicing plays a crucial role in the lending industry, benefiting both borrowers and lenders. It ensures the smooth management of loans throughout their lifecycle, from origination to repayment. Here are some reasons why loan servicing is crucial:

1. Efficient Loan Administration

Loan servicing ensures efficient loan administration by handling various tasks such as loan setup, payment processing, and account maintenance. This allows lenders to focus on their core business activities while borrowers can rely on a professional team to manage their loan accounts.

2. Timely and Accurate Payment Processing

Loan servicers are responsible for collecting loan payments from borrowers and ensuring that they are processed accurately and on time. This helps borrowers avoid late fees and penalties, while lenders can rely on a steady stream of income from their loan portfolios.

3. Customer Service and Support

Loan servicers provide customer service and support to borrowers, answering their queries, addressing concerns, and providing guidance throughout the loan repayment process. This helps borrowers stay informed and confident about their loan obligations.

4. Compliance with Regulations

5. Default Management and Loss Mitigation

In the unfortunate event of a borrower defaulting on their loan, loan servicers play a crucial role in managing the default process and implementing loss mitigation strategies. This includes working with borrowers to find alternative repayment options and minimizing losses for lenders.

6. Reporting and Recordkeeping

Loan servicers maintain detailed records of loan transactions, payments, and borrower information. This helps lenders track the performance of their loan portfolios, analyze trends, and make informed decisions regarding their lending strategies.

Loan Servicing Process

Loan servicing is a critical aspect of the lending industry, ensuring that borrowers and lenders have a smooth and efficient experience throughout the life of a loan. The loan servicing process involves several steps that are essential for managing and maintaining the loan.

1. Loan Setup

2. Loan Disbursement

Once the loan is set up, the next step is the disbursement of funds to the borrower. This involves transferring the agreed-upon loan amount to the borrower’s designated bank account. The loan disbursement process may vary depending on the type of loan and the lender’s policies.

3. Payment Collection

After the loan is disbursed, the loan servicing company is responsible for collecting the loan payments from the borrower. This includes sending out payment reminders, processing the payments, and updating the loan account with the received payments. The loan servicing company may also handle any late payments or delinquencies, including assessing late fees or initiating collection actions if necessary.

4. Account Management

Throughout the life of the loan, the loan servicing company manages the borrower’s loan account. This includes keeping track of the loan balance, interest accrual, and any changes to the loan terms. The loan servicing company also provides the borrower with regular statements that detail their loan activity, including the principal and interest payments made, any fees charged, and the remaining loan balance.

5. Customer Support

Loan servicing companies also provide customer support to borrowers throughout the loan term. This includes addressing any inquiries or concerns the borrower may have, providing assistance with loan-related issues, and offering guidance on loan repayment options or refinancing opportunities.

Step-by-Step Guide to Loan Servicing

Loan servicing is a complex process that involves several steps. Here is a step-by-step guide to help you understand the loan servicing process:

Step 1: Loan Origination

The loan origination process involves the borrower applying for a loan and the lender evaluating the borrower’s creditworthiness. Once the loan is approved, the terms and conditions are finalized, and the loan is funded.

Step 2: Loan Setup

Step 3: Loan Disbursement

Once the loan is set up, the funds are disbursed to the borrower. This can be done through various methods, such as a direct deposit into the borrower’s bank account or a check issued to the borrower.

Step 4: Payment Processing

Once the borrower starts making payments, the loan servicer is responsible for processing those payments. This involves recording the payment amount, allocating it to the principal and interest, and updating the borrower’s account balance.

Step 5: Escrow Management (if applicable)

If the loan includes an escrow account for taxes and insurance, the loan servicer is responsible for managing that account. This involves collecting the necessary funds from the borrower and making payments to the appropriate parties on the borrower’s behalf.

Step 6: Customer Service

The loan servicer is the main point of contact for the borrower throughout the life of the loan. They handle any inquiries or issues the borrower may have, such as changes in payment schedule, loan modifications, or refinancing options.

Step 7: Default Management

If the borrower fails to make payments as agreed, the loan servicer is responsible for managing the default process. This may involve sending delinquency notices, working with the borrower to find a solution, or initiating foreclosure proceedings if necessary.

Step 8: Loan Payoff

When the borrower has paid off the loan in full, the loan servicer is responsible for processing the loan payoff. This involves calculating the final payment amount, releasing any liens on the property, and providing the borrower with a satisfaction of mortgage or deed of trust.

Overall, loan servicing plays a crucial role in ensuring that loans are managed effectively and borrowers receive the necessary support throughout the life of the loan. By following this step-by-step guide, loan servicers can navigate the complex loan servicing process with ease.

Common Challenges in Loan Servicing

1. Communication Issues

2. Payment Processing Problems

3. Escrow Management

Managing escrow accounts can also be a challenge in loan servicing. Escrow accounts are used to hold funds for property taxes and insurance. However, miscalculations or changes in tax or insurance rates can lead to discrepancies in escrow balances. This can result in unexpected increases in monthly mortgage payments for borrowers or shortages in escrow funds for lenders.

4. Regulatory Compliance

Loan servicing is subject to various regulations and compliance requirements. Both borrowers and lenders must ensure that they are in compliance with these regulations, which can be complex and ever-changing. Failure to comply with regulations can result in penalties or legal issues.

5. Loan Modifications and Restructuring

In some cases, borrowers may face financial difficulties and need to modify or restructure their loans. This can be a challenging process, as it requires careful evaluation of the borrower’s financial situation and negotiation between the borrower and lender. Loan servicers play a crucial role in facilitating these modifications and ensuring that they are implemented correctly.

Emily Bibb simplifies finance through bestselling books and articles, bridging complex concepts for everyday understanding. Engaging audiences via social media, she shares insights for financial success. Active in seminars and philanthropy, Bibb aims to create a more financially informed society, driven by her passion for empowering others.