Loan Note Definition

A loan note is a legal document that outlines the terms and conditions of a loan agreement between a borrower and a lender. It serves as evidence of the debt and specifies the repayment terms, including the interest rate, payment schedule, and any collateral or security provided by the borrower.

How It Works

Example

For example, let’s say a small business owner needs to borrow $50,000 to purchase new equipment for their business. They approach a bank and negotiate the terms of the loan, including the interest rate of 5% per annum and a repayment period of 5 years.

The bank prepares a loan note that outlines these terms and specifies that the borrower will make monthly payments of $943.34 for the next 5 years. The loan note also includes provisions for late payment penalties and the bank’s right to seize the equipment as collateral if the borrower defaults on the loan.

Both the borrower and the bank sign the loan note, and the borrower receives the funds. From that point forward, the borrower is responsible for making the monthly payments as specified in the loan note.

In summary, a loan note is a legal document that defines the terms of a loan agreement. It provides clarity and protection for both the borrower and the lender, ensuring that both parties understand their rights and obligations.

Loan notes are financial instruments that are commonly used in business transactions. They are a form of debt that is issued by a borrower to a lender. In simple terms, a loan note is a promise to repay a loan at a future date, along with any interest that has accrued.

Loan notes are typically used when a company or individual needs to borrow money for a specific purpose. They can be issued by both private and public entities, and can be structured in various ways depending on the needs of the borrower and the lender.

When a borrower issues a loan note, they are essentially borrowing money from the lender and agreeing to repay it over a specified period of time. The terms of the loan, including the interest rate and repayment schedule, are outlined in the loan note. This document serves as a legally binding agreement between the borrower and the lender.

Key Features of Loan Notes

Loan notes have several key features that distinguish them from other forms of debt:

- Interest Rate: Loan notes typically have a fixed or variable interest rate, which determines the amount of interest that the borrower will pay over the life of the loan.

- Repayment Schedule: Loan notes specify the repayment schedule, including the frequency and amount of payments that the borrower must make to the lender.

- Security: In some cases, loan notes may be secured by collateral, such as real estate or other assets, which can provide additional protection for the lender in the event of default.

- Transferability: Loan notes can often be transferred or sold to other investors, providing the borrower with flexibility and the lender with the ability to potentially recoup their investment before the loan is fully repaid.

Benefits and Risks of Loan Notes

Loan notes offer several benefits for both borrowers and lenders. For borrowers, loan notes can provide a source of funding that may be more flexible and accessible than traditional bank loans. They can also offer lower interest rates and longer repayment terms, depending on the borrower’s creditworthiness and the terms of the loan.

For lenders, loan notes can provide a fixed income stream and the potential for higher returns compared to other types of investments. They can also offer diversification and the ability to invest in different industries and sectors.

However, loan notes also come with risks. For borrowers, the main risk is the obligation to repay the loan and the potential for default if they are unable to meet their repayment obligations. For lenders, the main risk is the potential for default and the loss of their investment.

Overall, loan notes can be a useful tool for both borrowers and lenders, providing a flexible and accessible form of financing. However, it is important for both parties to carefully consider the terms and risks associated with loan notes before entering into an agreement.

How Loan Notes Work

Loan notes are a type of debt instrument that companies use to raise capital. They are essentially a promise to repay a loan, similar to a bond or a promissory note. Loan notes are typically issued by companies that are looking to finance their operations or fund specific projects.

Issuing Loan Notes

When a company decides to issue loan notes, they will typically set the terms and conditions of the loan, including the interest rate, maturity date, and repayment schedule. These terms are outlined in a loan agreement, which is a legal document that governs the relationship between the company and the investor.

Once the loan notes are issued, investors can purchase them either directly from the company or through a broker. The company will use the funds raised from the sale of the loan notes to finance its operations or projects.

Interest and Repayment

Loan notes typically pay interest to investors at a fixed rate, which is determined at the time of issuance. The interest payments are usually made on a regular basis, such as monthly or annually, depending on the terms of the loan agreement.

At the maturity date, which is the date when the loan notes are due to be repaid, the company will repay the principal amount to the investors. This repayment can be made in a lump sum or in installments, depending on the terms of the loan agreement.

If the company fails to repay the loan notes as agreed, it may be considered in default, and the investors may have the right to take legal action to recover their investment.

Risk and Return

Investing in loan notes carries both risks and potential returns. The main risk is that the company may default on its repayment obligations, which could result in the loss of the investor’s principal investment. However, loan notes are often secured by the company’s assets, which can provide some protection to investors in the event of default.

The potential returns from investing in loan notes come in the form of interest payments. The interest rate on loan notes is typically higher than that of traditional bank loans, which can make them an attractive investment option for investors seeking higher yields.

Overall, loan notes can be a useful tool for companies to raise capital and for investors to earn a return on their investment. However, it is important for both parties to carefully consider the terms and risks associated with loan notes before entering into an agreement.

Loan Note Example

A loan note is a legal document that outlines the terms and conditions of a loan agreement between a borrower and a lender. It serves as evidence of the debt and specifies the amount borrowed, the interest rate, the repayment schedule, and any other relevant details.

Here is an example of a loan note:

Loan Note Agreement

This Loan Note Agreement (the “Agreement”) is made and entered into on [date] by and between [borrower’s name], a [borrower’s legal status] (the “Borrower”), and [lender’s name], a [lender’s legal status] (the “Lender”).

Loan Amount: The Borrower agrees to borrow the sum of [loan amount] from the Lender.

Interest Rate: The loan shall accrue interest at a rate of [interest rate] per annum, compounded [compounding frequency].

Repayment Schedule: The Borrower shall repay the loan in [number of installments] equal monthly installments of [installment amount] each, starting on [start date] and ending on [end date].

Security: The Borrower shall provide [type of security] as collateral for the loan.

Default: In the event of default, the Lender shall have the right to [remedies in case of default].

Governing Law: This Agreement shall be governed by and construed in accordance with the laws of [jurisdiction].

Entire Agreement: This Agreement constitutes the entire agreement between the parties and supersedes all prior discussions, negotiations, and agreements.

Execution: This Agreement may be executed in counterparts, each of which shall be deemed an original, but all of which together shall constitute one and the same instrument.

Signatures:

Borrower: [signature]

Lender: [signature]

By signing below, the parties acknowledge that they have read and understood the terms and conditions of this Agreement and agree to be bound by them.

In witness whereof, the parties hereto have executed this Loan Note Agreement as of the date first above written.

[Borrower’s Name]

[Lender’s Name]

It is important to note that this is just a sample loan note and the actual terms and conditions may vary depending on the specific loan agreement. It is always recommended to consult with a legal professional when drafting or entering into a loan note agreement.

Business Essentials: Loan Notes

Loan notes can be an attractive option for both the borrower and the lender. For the borrower, they offer flexibility in terms of repayment and can be used to finance various business activities. For the lender, loan notes can provide a fixed income stream and the potential for higher returns compared to other investment options.

How Loan Notes Work

When a company issues loan notes, it is essentially borrowing money from investors or lenders. The company agrees to repay the principal amount plus interest over a specified period of time. The interest rate on loan notes can be fixed or variable, depending on the terms of the agreement.

Loan notes can be secured or unsecured. Secured loan notes are backed by specific assets of the company, such as property or equipment. This provides an added layer of security for the lender. Unsecured loan notes, on the other hand, are not backed by specific assets and are considered riskier for the lender.

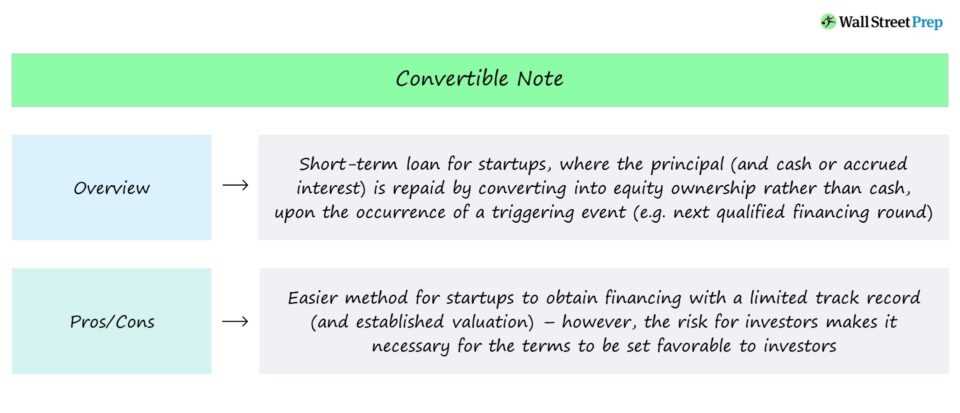

Loan notes can also be convertible or non-convertible. Convertible loan notes give the lender the option to convert the debt into equity in the company at a later date. This can be beneficial for the lender if the company’s value increases over time. Non-convertible loan notes, on the other hand, do not offer this option.

Loan Note Example

Let’s consider a hypothetical example to illustrate how loan notes work. Company XYZ needs to raise $1 million to fund a new project. They decide to issue loan notes with a fixed interest rate of 5% per year and a repayment period of 5 years.

Investor A purchases $100,000 worth of loan notes from Company XYZ. As per the terms of the agreement, Company XYZ will repay Investor A the principal amount of $100,000 plus interest at a rate of 5% per year over the next 5 years.

At the end of the 5-year period, Investor A will have received a total of $125,000 ($100,000 principal + $25,000 interest). This represents a 25% return on investment for Investor A.

Conclusion

| Loan Note Definition | How It Works | Example |

|---|---|---|

| A legal document outlining the terms and conditions of a loan | A company borrows money from investors or lenders and agrees to repay the principal amount plus interest over a specified period of time | Company XYZ issues $100,000 worth of loan notes with a fixed interest rate of 5% per year and a repayment period of 5 years |

Emily Bibb simplifies finance through bestselling books and articles, bridging complex concepts for everyday understanding. Engaging audiences via social media, she shares insights for financial success. Active in seminars and philanthropy, Bibb aims to create a more financially informed society, driven by her passion for empowering others.