Lehman Brothers: The History

Lehman Brothers was a prominent American financial services firm that played a significant role in the global financial markets for over 150 years. Founded in 1850 by German immigrants Henry, Emanuel, and Mayer Lehman, the firm started as a small general store in Montgomery, Alabama.

From Founding to Global Expansion

Lehman Brothers experienced steady growth throughout the early 20th century, establishing a strong presence in the financial markets. The firm weathered several economic downturns, including the Great Depression, and emerged as a trusted and respected institution.

In the 1970s and 1980s, Lehman Brothers embarked on a period of rapid expansion, fueled by the deregulation of the financial industry. The firm expanded its operations globally, opening offices in major financial centers such as London, Tokyo, and Hong Kong.

Key Moments and Milestones

Lehman Brothers achieved several significant milestones throughout its history. In 1969, the firm became a publicly traded company, listing its shares on the New York Stock Exchange. This move allowed Lehman Brothers to raise capital and further expand its business.

In the 1980s and 1990s, the firm played a crucial role in the development of the mortgage-backed securities market. Lehman Brothers was one of the pioneers in securitizing mortgages, packaging them into tradable securities and selling them to investors.

However, Lehman Brothers’ history also includes some controversial moments. In the early 2000s, the firm was involved in accounting scandals and faced allegations of misleading investors. These incidents tarnished the firm’s reputation and raised concerns about its financial practices.

Despite these challenges, Lehman Brothers remained a major player in the financial industry and continued to expand its business globally.

| Year | Event |

|---|---|

| 1850 | Lehman Brothers founded as a small general store in Alabama |

| 1969 | Lehman Brothers becomes a publicly traded company |

| 1980s-1990s | Lehman Brothers pioneers the mortgage-backed securities market |

Overall, Lehman Brothers’ history is marked by growth, innovation, and controversy. The firm played a vital role in shaping the financial industry and became a symbol of Wall Street’s power and influence. However, its ultimate collapse in 2008 would have far-reaching consequences for the global economy and the Great Recession.

From Founding to Global Expansion

Lehman Brothers, originally founded in 1850 by Henry Lehman, started as a small dry goods store in Montgomery, Alabama. Over the years, the firm transitioned into a successful cotton trading business, capitalizing on the booming cotton industry in the Southern United States.

In 1867, Henry Lehman’s two brothers, Emanuel and Mayer, joined the business, and the firm was renamed Lehman Brothers. With the addition of Emanuel and Mayer, the firm expanded its operations and began offering financial services to its clients.

During the early 20th century, Lehman Brothers continued to expand its operations and establish a global presence. The firm opened offices in New York City, London, and other major financial centers around the world. This expansion allowed Lehman Brothers to tap into international markets and serve a broader range of clients.

Expansion into Investment Banking

Lehman Brothers focused on providing services such as underwriting securities, advising on mergers and acquisitions, and assisting clients with raising capital. The firm successfully completed several high-profile deals and gained a reputation for its expertise in investment banking.

Challenges and Restructuring

However, Lehman Brothers faced challenges and setbacks along the way. In the 1980s, the firm experienced financial difficulties due to its involvement in risky investments and excessive leverage. To overcome these challenges, Lehman Brothers underwent a significant restructuring, which involved selling off non-core assets and refocusing its business on core investment banking activities.

The restructuring efforts proved successful, and Lehman Brothers regained its financial stability. The firm continued to thrive in the 1990s and early 2000s, capitalizing on the booming financial markets and expanding its global reach.

Overall, Lehman Brothers’ journey from a small dry goods store to a global investment bank was marked by significant milestones and challenges. The firm played a crucial role in financing the growth of the United States and became a prominent player in the global financial industry.

| Year | Key Milestone |

|---|---|

| 1850 | Lehman Brothers founded as a small dry goods store |

| 1867 | Emanuel and Mayer Lehman join the business, firm renamed Lehman Brothers |

| 1970s | Strategic shift towards investment banking |

| 1980s | Financial difficulties and restructuring |

| 2000s | Expansion and global reach |

Key Moments and Milestones

Throughout its history, Lehman Brothers experienced several key moments and milestones that contributed to its rise as a prominent financial institution. These events shaped the company and set the stage for its eventual collapse during the Great Recession.

| Year | Event |

|---|---|

| 1850 | Henry Lehman, a German immigrant, establishes a small general store in Montgomery, Alabama. |

| 1858 | The Lehman brothers expand their business into cotton trading, establishing Lehman Brothers. |

| 1906 | Lehman Brothers underwrites its first public offering, marking its entry into investment banking. |

| 1929 | The stock market crash and the onset of the Great Depression greatly impact Lehman Brothers, leading to the firm’s reorganization. |

| 1950s-1970s | Lehman Brothers expands its operations globally, opening offices in London, Tokyo, and other major financial centers. |

| 1984 | Lehman Brothers becomes a publicly traded company, listing its shares on the New York Stock Exchange. |

| 1993 | Lehman Brothers acquires the fixed-income division of Shearson Lehman/American Express, becoming a major player in the bond market. |

| 2003 | Richard Fuld becomes CEO of Lehman Brothers, leading the firm through a period of significant growth and profitability. |

| 2007 | Lehman Brothers reports record earnings, but its exposure to subprime mortgages and complex financial instruments begins to raise concerns. |

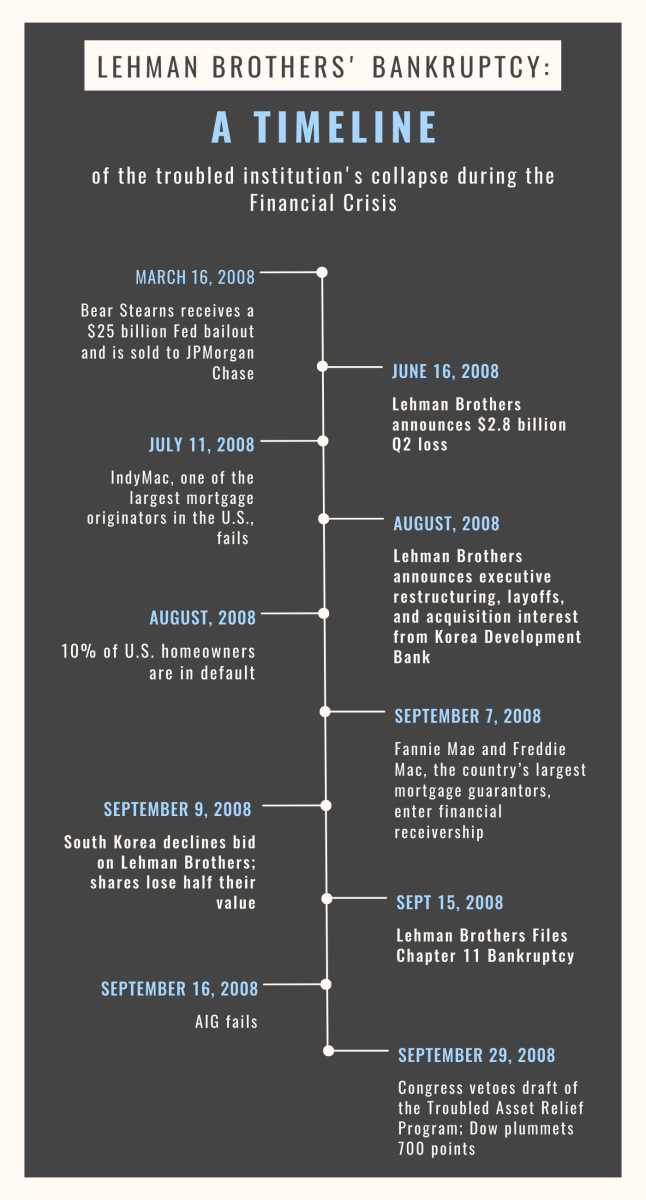

| September 15, 2008 | Lehman Brothers files for bankruptcy, marking the largest bankruptcy filing in U.S. history and triggering a global financial crisis. |

Lehman Brothers: The Collapse

The collapse of Lehman Brothers had far-reaching consequences. It caused a crisis of confidence in the financial markets, leading to a freeze in credit and a sharp decline in economic activity. Banks and other financial institutions became reluctant to lend to each other, which severely disrupted the functioning of the global financial system. Stock markets around the world plummeted, wiping out trillions of dollars in wealth.

The collapse of Lehman Brothers also had a profound impact on the real economy. Businesses struggled to access credit, leading to layoffs and bankruptcies. Unemployment rates soared, and housing prices plummeted. Governments around the world were forced to intervene with massive bailouts and stimulus packages to prevent a complete collapse of the global economy.

The collapse of Lehman Brothers served as a wake-up call for regulators, policymakers, and financial institutions. It exposed the vulnerabilities and flaws in the financial system and highlighted the need for stronger regulations and risk management practices. In the aftermath of the collapse, governments implemented significant reforms aimed at preventing a similar crisis in the future.

| Key Takeaways |

|---|

| The collapse of Lehman Brothers in September 2008 was a major catalyst of the Great Recession. |

| Excessive risk-taking, poor risk management, and a highly leveraged business model contributed to the collapse. |

| The collapse led to a crisis of confidence in the financial markets, freezing credit and causing a sharp decline in economic activity. |

| Governments implemented significant reforms in the aftermath of the collapse to strengthen the financial system and prevent future crises. |

Causes and Warning Signs

In addition to these internal factors, there were also external factors that contributed to Lehman Brothers’ collapse. The global financial crisis, which was triggered by the bursting of the housing bubble in the United States, created a liquidity crunch and a loss of confidence in financial institutions. As a result, Lehman Brothers found it increasingly difficult to raise capital and refinance its debt.

Despite these warning signs, Lehman Brothers and regulators failed to take appropriate action. The company continued to take on risky investments and rely heavily on short-term funding, while regulators did not adequately monitor or regulate the company’s activities. This lack of oversight and accountability ultimately led to the collapse of Lehman Brothers and the subsequent global financial crisis.

The Impact on Financial Markets

Following the collapse of Lehman Brothers, financial markets experienced extreme volatility and panic. Stock markets plummeted, credit markets froze, and banks faced a crisis of confidence. The interconnectedness of the global financial system meant that the effects of Lehman’s collapse were felt far beyond Wall Street.

Central banks and governments around the world were forced to intervene to stabilize the financial system and prevent a complete collapse. They injected massive amounts of liquidity into the markets, implemented emergency measures to support banks, and enacted stimulus packages to stimulate economic growth.

The collapse of Lehman Brothers served as a wake-up call for regulators and policymakers, highlighting the need for stronger oversight and regulation of the financial sector. It led to significant reforms in the banking industry, including stricter capital requirements, increased transparency, and improved risk management practices.

Lehman Brothers: Role in the Great Recession

The collapse of Lehman Brothers in 2008 played a significant role in triggering the Great Recession, one of the most severe economic downturns in modern history. As one of the largest investment banks in the United States, Lehman Brothers’ failure sent shockwaves throughout the global financial system, leading to widespread panic and a domino effect of financial institution failures.

Despite facing mounting losses and a deteriorating financial position, Lehman Brothers’ management failed to take decisive action to address the firm’s problems. The bank’s executives underestimated the severity of the crisis and believed that they could weather the storm. However, as investor confidence waned and liquidity dried up, Lehman Brothers found itself unable to meet its financial obligations.

On September 15, 2008, Lehman Brothers filed for bankruptcy, marking the largest bankruptcy filing in U.S. history. The collapse of such a prominent financial institution sent shockwaves throughout the global financial markets. Stock markets plummeted, credit markets froze, and financial institutions faced a crisis of confidence.

The failure of Lehman Brothers had a cascading effect on the global economy. The interconnectedness of the financial system meant that Lehman Brothers’ collapse reverberated across the globe, leading to a credit crunch and a severe contraction in economic activity. Banks and other financial institutions faced significant losses, leading to a wave of layoffs and a contraction in lending.

Central banks and governments around the world were forced to intervene to stabilize the financial system and prevent a complete meltdown. Massive bailouts and liquidity injections were implemented to restore confidence and prevent further contagion. However, the damage was already done, and the global economy plunged into a deep recession.

Emily Bibb simplifies finance through bestselling books and articles, bridging complex concepts for everyday understanding. Engaging audiences via social media, she shares insights for financial success. Active in seminars and philanthropy, Bibb aims to create a more financially informed society, driven by her passion for empowering others.