Key Rate Definition Types

A key rate is a benchmark interest rate that is set by a central bank or monetary authority. It is used to influence the overall level of interest rates in an economy. Key rates are important because they affect the cost of borrowing and lending for banks, businesses, and individuals.

There are several types of key rates that central banks use to manage monetary policy:

2. Overnight Rate: This is the interest rate at which banks lend and borrow funds from each other on an overnight basis. It is used to manage short-term liquidity in the banking system. Changes in the overnight rate can have a ripple effect on other interest rates, including mortgage rates and consumer loan rates.

3. Discount Rate: This is the interest rate that a central bank charges commercial banks for short-term loans. It is used as a last resort for banks that are experiencing a liquidity shortage. The discount rate is typically higher than the policy rate and the overnight rate.

4. Prime Rate: This is the interest rate that commercial banks charge their most creditworthy customers. It is typically lower than the policy rate and the overnight rate. The prime rate serves as a benchmark for other lending rates, such as mortgage rates and business loan rates.

5. Libor Rate: This is the interest rate at which banks in the London interbank market lend to each other. It is used as a benchmark for a wide range of financial products, including adjustable-rate mortgages, corporate loans, and derivatives. The Libor rate is determined by a panel of banks and is based on their estimates of borrowing costs.

What are Key Rates?

There are different types of key rates, including the prime rate, the federal funds rate, and the LIBOR (London Interbank Offered Rate). Each of these rates serves a specific purpose and is used in different financial markets.

The prime rate is the interest rate that commercial banks charge their most creditworthy customers. It is often used as a benchmark for consumer loans, such as credit cards and home equity lines of credit. The federal funds rate, on the other hand, is the interest rate at which banks lend reserves to each other overnight. It is set by the Federal Reserve and is used to influence short-term interest rates in the economy.

The LIBOR is an interest rate that banks charge each other for short-term loans. It is widely used as a benchmark for various financial products, including adjustable-rate mortgages, student loans, and derivatives. The LIBOR is set by a panel of banks and is based on their estimates of borrowing costs.

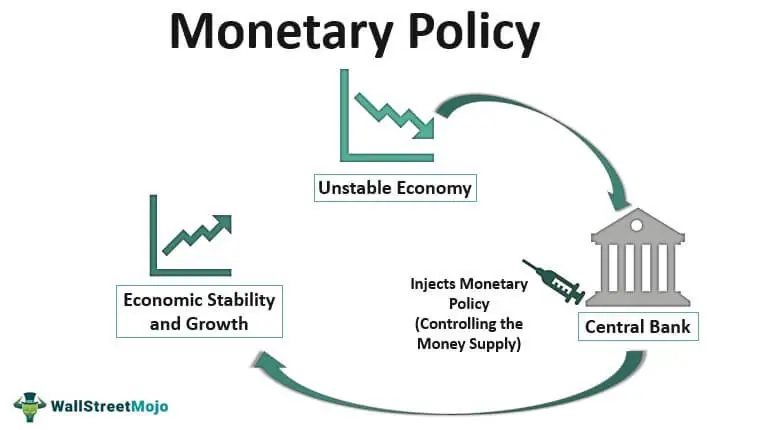

Key rates play a crucial role in the functioning of financial markets and the overall economy. They help determine the cost of borrowing for businesses and individuals, which can affect consumer spending, investment, and economic growth. Central banks use key rates as a tool to manage inflation and stabilize the economy. By adjusting key rates, central banks can influence the level of economic activity and maintain price stability.

Types of Key Rates

Key rates are an important tool used by central banks to influence the economy and control inflation. There are several types of key rates that central banks use, each with its own specific purpose and impact on the economy.

2. Deposit Rate: The deposit rate is the interest rate paid by central banks on deposits made by commercial banks. It is used to influence the amount of money that banks keep in reserve and can be adjusted to encourage or discourage lending and spending. A lower deposit rate encourages banks to lend more, while a higher rate incentivizes them to hold onto their reserves.

3. Discount Rate: The discount rate is the interest rate at which commercial banks can borrow directly from the central bank. It is typically higher than the policy rate and serves as a penalty for banks that cannot borrow from other banks or the interbank market. By adjusting the discount rate, central banks can control the availability of credit and liquidity in the banking system.

4. Prime Rate: The prime rate is the interest rate that commercial banks charge their most creditworthy customers. It is influenced by the policy rate and serves as a benchmark for other lending rates in the economy. Changes in the prime rate can affect borrowing costs for businesses and individuals, making it an important key rate for economic activity.

5. Libor Rate: The London Interbank Offered Rate (Libor) is an interest rate at which banks can borrow funds from other banks in the London interbank market. It is used as a reference rate for various financial products, such as adjustable-rate mortgages and corporate loans. Changes in Libor can have a significant impact on borrowing costs and financial markets globally.

Each type of key rate plays a crucial role in shaping the overall interest rate environment and influencing economic activity. Central banks carefully monitor and adjust these rates to achieve their monetary policy objectives and maintain price stability in the economy.

Importance of Key Rates

1. Monetary Policy

2. Investment Decisions

3. Borrowing Costs

Key rates directly impact borrowing costs for individuals and businesses. When key rates are low, borrowing costs decrease, making it more affordable for individuals to take out loans for various purposes, such as buying a home or starting a business. This can stimulate economic growth and increase consumer spending.

Conversely, when key rates are high, borrowing costs increase, making it more expensive for individuals and businesses to borrow money. This can lead to a decrease in consumer spending and a slowdown in economic activity. Therefore, individuals and businesses need to monitor key rates to assess the affordability of borrowing and plan their financial decisions accordingly.

4. Exchange Rates

Key rates also have an impact on exchange rates. When a country’s key rates are higher than those of other countries, its currency tends to appreciate, making imports cheaper and exports more expensive. Conversely, when a country’s key rates are lower than those of other countries, its currency tends to depreciate, making imports more expensive and exports cheaper.

Emily Bibb simplifies finance through bestselling books and articles, bridging complex concepts for everyday understanding. Engaging audiences via social media, she shares insights for financial success. Active in seminars and philanthropy, Bibb aims to create a more financially informed society, driven by her passion for empowering others.