Inventory Financing: Definition

Inventory financing is a type of financing that allows businesses to use their inventory as collateral to secure a loan or line of credit. It is a common financing option for companies that have a large amount of inventory on hand but need additional funds to support their operations.

The main purpose of inventory financing is to provide businesses with the working capital they need to purchase additional inventory, manage cash flow, and meet other operational expenses. It can be particularly beneficial for businesses that experience seasonal fluctuations in demand or need to quickly respond to market trends.

Inventory financing can be obtained from traditional banks, alternative lenders, or specialized inventory financing companies. The terms and conditions of the financing arrangement will vary depending on the lender and the specific needs of the business.

Overall, inventory financing can be a valuable tool for businesses looking to optimize their inventory management and improve their financial flexibility. However, it is important for businesses to carefully consider the pros and cons of this financing option before making a decision.

Inventory financing is a type of financing that allows businesses to use their inventory as collateral to secure a loan. This type of financing is particularly useful for businesses that have a large amount of inventory on hand but need additional capital to fund their operations or expand their business.

Inventory financing works by allowing businesses to borrow money based on the value of their inventory. The lender will typically assess the value of the inventory and provide a loan amount based on a percentage of that value. The inventory serves as collateral for the loan, which means that if the borrower is unable to repay the loan, the lender can seize and sell the inventory to recoup their losses.

One of the key benefits of inventory financing is that it allows businesses to access capital without having to sell their inventory. This is particularly important for businesses that rely on their inventory to generate revenue. By using their inventory as collateral, businesses can obtain the funds they need while still maintaining ownership and control over their inventory.

Inventory financing can be used for a variety of purposes, including purchasing additional inventory, funding marketing campaigns, hiring additional staff, or expanding into new markets. It can also be used to bridge the gap between when inventory is purchased and when it is sold, helping businesses manage their cash flow more effectively.

However, there are also some potential drawbacks to inventory financing. One of the main disadvantages is that it can be more expensive than other forms of financing. Lenders may charge higher interest rates or fees to compensate for the risk of lending against inventory. Additionally, if the value of the inventory decreases, the borrower may be required to provide additional collateral or repay the loan in full.

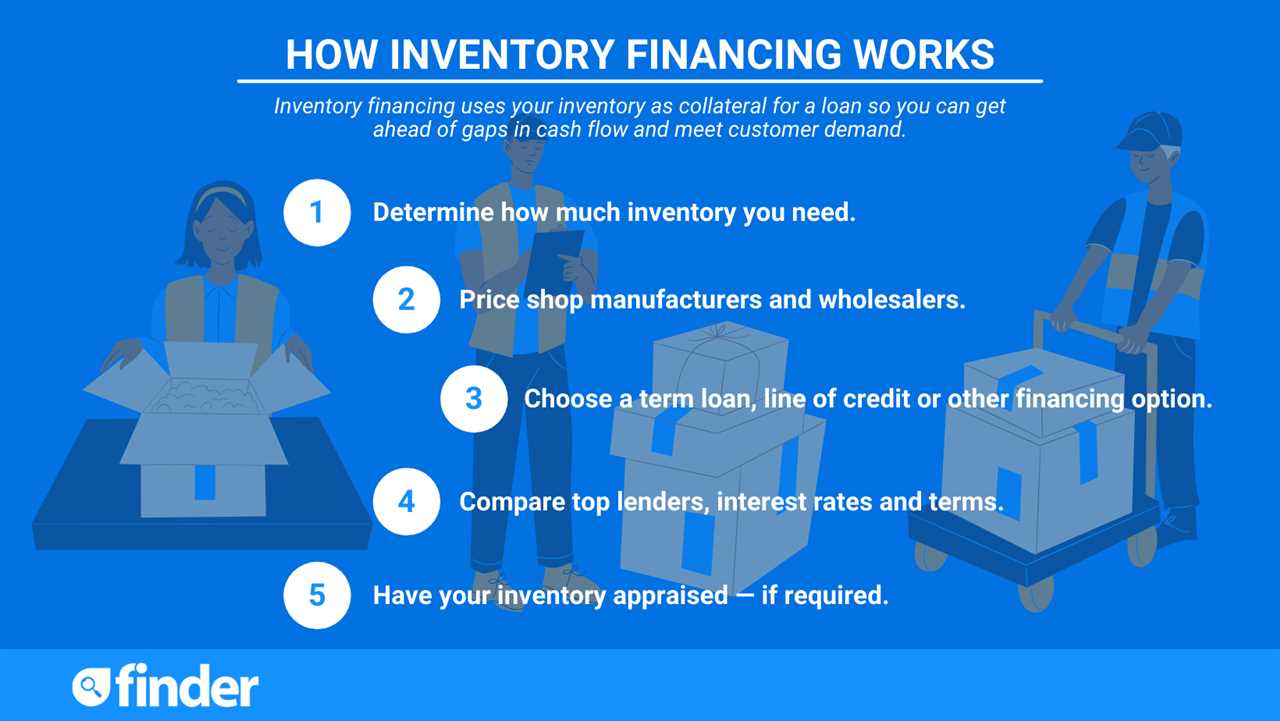

How Inventory Financing Works

Inventory financing is a type of financing that allows businesses to use their inventory as collateral to secure a loan or line of credit. This type of financing is particularly useful for businesses that have a large amount of inventory on hand but need additional capital to fund their operations.

When a business applies for inventory financing, the lender will typically assess the value of the inventory and offer a loan or line of credit based on a percentage of that value. The business can then use the funds to purchase additional inventory, cover operating expenses, or invest in other areas of the business.

The Process

The process of inventory financing typically involves the following steps:

- Application: The business applies for inventory financing and provides information about their inventory, including its value and turnover rate.

- Inventory Assessment: The lender assesses the value and quality of the inventory to determine the loan amount or line of credit that can be offered.

- Loan or Line of Credit Offer: The lender offers a loan or line of credit based on a percentage of the inventory’s value.

- Collateral Agreement: The business and lender enter into a collateral agreement, which allows the lender to take possession of the inventory if the business fails to repay the loan.

- Funds Disbursement: Once the collateral agreement is in place, the funds are disbursed to the business, and they can use the funds as needed.

- Loan Repayment: The business is responsible for repaying the loan or line of credit, typically with interest, over a specified period of time.

Pros and Cons

Inventory financing offers several advantages for businesses, including:

- Access to Capital: Inventory financing provides businesses with the capital they need to purchase additional inventory or cover operating expenses.

- Flexible Repayment Options: Lenders may offer flexible repayment options, such as interest-only payments or longer repayment terms, to accommodate the needs of the business.

- Improved Cash Flow: By using inventory as collateral, businesses can free up cash flow that would otherwise be tied up in inventory.

However, there are also some disadvantages to consider:

- Higher Interest Rates: Inventory financing may come with higher interest rates compared to other types of financing due to the higher risk associated with using inventory as collateral.

- Limited Funding: The amount of funding available through inventory financing may be limited by the value of the inventory, which could restrict the business’s ability to access additional capital.

Overall, inventory financing can be a valuable tool for businesses that need additional capital to support their operations. However, it is important for businesses to carefully consider the pros and cons before deciding to pursue this type of financing.

The Process of Inventory Financing

Inventory financing is a type of loan that allows businesses to use their inventory as collateral to secure funding. The process of inventory financing involves several steps, which are outlined below:

1. Application

The first step in the process is for the business to apply for inventory financing. This typically involves filling out an application form and providing information about the inventory that will be used as collateral.

2. Inventory Evaluation

Once the application is submitted, the lender will evaluate the inventory to determine its value. This may involve assessing the quality, quantity, and marketability of the inventory.

3. Loan Approval

4. Collateral Agreement

Before the loan can be disbursed, the business and the lender will enter into a collateral agreement. This agreement will outline the terms and conditions of using the inventory as collateral.

5. Loan Disbursement

Once the collateral agreement is signed, the lender will disburse the loan amount to the business. The funds can be used to purchase additional inventory, cover operational expenses, or invest in growth opportunities.

6. Inventory Monitoring

Throughout the duration of the loan, the lender will monitor the inventory to ensure that it is being properly managed and maintained. This may involve periodic inspections or audits.

7. Loan Repayment

The business is responsible for repaying the loan according to the agreed-upon terms. This typically involves making regular payments, which may include both principal and interest.

8. Inventory Liquidation

In the event that the business is unable to repay the loan, the lender may have the right to liquidate the inventory to recover their funds. This is a last resort option and is typically only exercised if the business defaults on the loan.

Overall, the process of inventory financing provides businesses with a flexible way to access capital and manage their inventory. However, it is important for businesses to carefully consider the pros and cons before entering into an inventory financing agreement.

Pros and Cons of Inventory Financing

Inventory financing can be a valuable tool for businesses looking to manage their cash flow and grow their operations. However, like any financial strategy, it comes with its own set of pros and cons. Here are some of the advantages and disadvantages of inventory financing:

Advantages:

- Improved cash flow: Inventory financing allows businesses to free up cash that would otherwise be tied up in inventory. This can provide the necessary funds for other business expenses, such as payroll, marketing, or expansion.

- Increased purchasing power: With inventory financing, businesses can purchase larger quantities of inventory, take advantage of bulk discounts, and negotiate better terms with suppliers.

- Flexibility: Inventory financing can be tailored to the specific needs of a business, allowing for flexibility in terms of loan amount, repayment schedule, and interest rates.

- Reduced risk: By using inventory as collateral, businesses can reduce the risk for lenders, making it easier to secure financing even with less-than-perfect credit.

- Opportunity for growth: With the additional funds from inventory financing, businesses can invest in new products, expand their operations, or enter new markets.

Disadvantages:

- Interest costs: Inventory financing typically comes with interest charges, which can add to the overall cost of borrowing and impact the profitability of the business.

- Risk of inventory obsolescence: If the market demand for a business’s inventory decreases or if the inventory becomes outdated, the business may be left with excess inventory that is difficult to sell.

- Dependency on inventory value: The amount of financing a business can secure through inventory financing is directly tied to the value of the inventory. If the value of the inventory decreases, it may limit the amount of financing available.

- Potential loss of control: In some cases, inventory financing may require the business to give up some control over its inventory, such as allowing the lender to have a say in inventory management or requiring regular inventory audits.

Overall, inventory financing can be a useful tool for businesses, but it is important to carefully consider the pros and cons before deciding to pursue this financing option. Businesses should assess their specific needs, financial situation, and risk tolerance to determine if inventory financing is the right choice for them.

Advantages and Disadvantages of Inventory Financing

Inventory financing can provide several advantages for businesses, but it also comes with its fair share of disadvantages. It is important for businesses to carefully consider both the pros and cons before deciding to pursue inventory financing.

| Advantages | Disadvantages |

|---|---|

| 1. Increased Cash Flow: Inventory financing allows businesses to access immediate cash flow by using their inventory as collateral. This can help businesses meet their short-term financial needs and cover expenses such as payroll, rent, and utilities. | 1. Costly Interest Rates: One of the main disadvantages of inventory financing is that it often comes with high interest rates. Businesses may end up paying a significant amount of interest on the borrowed funds, which can impact their overall profitability. |

| 2. Flexibility: Inventory financing provides businesses with flexibility in managing their inventory. It allows them to quickly purchase additional inventory or adjust their inventory levels based on market demand. | 2. Risk of Inventory Depreciation: If businesses are unable to sell their inventory or if the market value of their inventory decreases, they may face the risk of inventory depreciation. This can result in a loss for the business and make it difficult to repay the financing. |

| 3. Limited Funding Options: Inventory financing may not be suitable for all businesses, especially those with limited inventory or businesses that rely heavily on specialized or unique inventory. In such cases, businesses may struggle to find lenders willing to provide inventory financing. | |

| 4. Quick Approval Process: Inventory financing typically has a faster approval process compared to traditional loans. This allows businesses to access the funds they need more quickly, which can be crucial in certain situations. | 4. Potential Loss of Control: When businesses opt for inventory financing, they may have to give up some control over their inventory. Lenders may impose restrictions or require businesses to follow certain inventory management practices, which can limit the business’s autonomy. |

Overall, inventory financing can be a valuable tool for businesses in need of immediate cash flow and flexibility in managing their inventory. However, businesses should carefully weigh the advantages and disadvantages to determine if inventory financing is the right option for their specific needs and circumstances.

Emily Bibb simplifies finance through bestselling books and articles, bridging complex concepts for everyday understanding. Engaging audiences via social media, she shares insights for financial success. Active in seminars and philanthropy, Bibb aims to create a more financially informed society, driven by her passion for empowering others.