International Bond Investing: A Comprehensive Guide

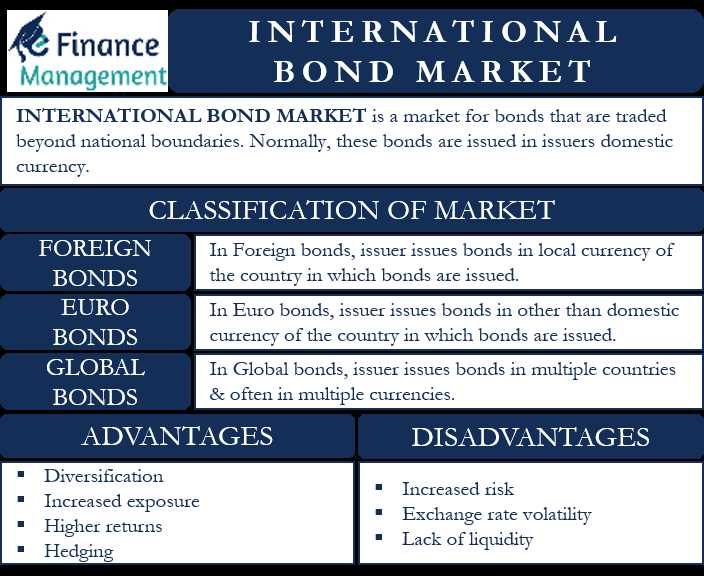

International bond investing is a strategy that involves investing in bonds issued by foreign governments, corporations, or other entities. It offers investors the opportunity to diversify their portfolios and potentially earn higher returns compared to domestic bond investments. However, it also comes with its own set of risks and considerations.

Why Invest in International Bonds?

There are several reasons why investors choose to invest in international bonds:

- Diversification: Investing in international bonds allows investors to diversify their portfolios geographically. By investing in bonds issued by different countries, investors can reduce their exposure to risks associated with a single country or region.

- Higher Returns: International bonds can offer higher yields compared to domestic bonds. This is especially true for bonds issued by emerging market countries, which often offer higher interest rates to attract investors.

- Access to Different Markets: Investing in international bonds provides investors with the opportunity to access markets that may offer unique investment opportunities. For example, investing in bonds issued by emerging market countries allows investors to participate in the growth potential of these economies.

Types of International Bonds

There are several types of international bonds that investors can consider:

- Sovereign Bonds: These are bonds issued by foreign governments. They are considered to have lower default risk compared to corporate bonds, as governments have the ability to raise taxes or print money to repay their debts.

- Corporate Bonds: These are bonds issued by foreign corporations. They offer higher yields compared to sovereign bonds, but also come with higher default risk.

- Emerging Market Bonds: These are bonds issued by countries with developing economies. They offer higher yields compared to bonds issued by developed countries, but also come with higher political and economic risks.

Risks and Considerations

Investing in international bonds comes with certain risks and considerations that investors should be aware of:

- Foreign Exchange Risk: Fluctuations in exchange rates can impact the returns of international bond investments. Changes in currency values can either increase or decrease the returns earned by investors.

- Political and Economic Risks: Investing in bonds issued by foreign governments or corporations exposes investors to political and economic risks specific to those countries. These risks can include changes in government policies, economic instability, or geopolitical tensions.

- Legal and Regulatory Risks: Different countries have different legal and regulatory frameworks, which can impact the rights and protections of bondholders. Investors should carefully consider the legal and regulatory environment of the countries they are investing in.

Before investing in international bonds, investors should carefully assess their risk tolerance, investment objectives, and conduct thorough research on the countries and entities issuing the bonds. It is also advisable to consult with a financial advisor who specializes in international bond investing.

International bond investing refers to the practice of buying and selling bonds issued by foreign governments, corporations, or other entities. It allows investors to diversify their portfolios and potentially earn higher returns compared to domestic bond investments. However, it also comes with its own set of risks and considerations.

Benefits of International Bond Investing

1. Diversification: Investing in international bonds can help spread investment risk across different countries and currencies. This can reduce the impact of any negative events in a single market or economy.

2. Higher Yield Potential: International bonds may offer higher yields compared to domestic bonds due to differences in interest rates and economic conditions. This can be attractive for investors seeking higher returns.

3. Currency Appreciation: Investing in foreign bonds can also provide opportunities for currency appreciation. If the currency of the country where the bond is issued strengthens against the investor’s home currency, it can result in additional returns.

Risks and Considerations

1. Currency Risk: Fluctuations in exchange rates can impact the value of international bond investments. If the investor’s home currency strengthens against the currency of the bond issuer, it can reduce the returns or even result in losses.

2. Political and Economic Risk: Investing in foreign bonds exposes investors to political and economic risks specific to the country where the bond is issued. These risks can include changes in government policies, economic instability, and geopolitical tensions.

3. Interest Rate Risk: Changes in interest rates can affect the value of bonds. International bond investors need to consider the interest rate environment in the country where the bond is issued and how it may impact the bond’s value.

4. Credit Risk: International bond investments are subject to credit risk, which refers to the issuer’s ability to repay the bond’s principal and interest. Investors should carefully assess the creditworthiness of the bond issuer before investing.

5. Liquidity Risk: Some international bond markets may have lower liquidity compared to domestic markets, making it more challenging to buy or sell bonds at desired prices. This can impact the ease of trading and potentially increase transaction costs.

6. Regulatory and Legal Risk: Different countries have varying regulatory frameworks and legal systems, which can impact the rights and protections of international bond investors. It is important to understand and comply with the relevant regulations and laws.

Overall, international bond investing can offer opportunities for diversification and potentially higher returns, but it also comes with various risks and considerations. Investors should carefully evaluate these factors and seek professional advice before making any investment decisions.

Examples of International Bond Investments

1. Government Bonds: These are bonds issued by national governments to finance their operations. Examples include U.S. Treasury bonds, German bunds, and Japanese government bonds.

2. Corporate Bonds: These are bonds issued by corporations to raise capital. International corporations issue bonds in different currencies and markets. Examples include bonds issued by companies like Apple, Microsoft, and Toyota.

3. Emerging Market Bonds: These are bonds issued by governments or corporations in developing countries. They offer higher yields but also come with higher risks. Examples include bonds issued by countries like Brazil, India, and China.

4. Sovereign Wealth Fund Bonds: Sovereign wealth funds are government-owned investment funds that invest in various assets, including bonds. Examples include bonds issued by funds like the Norwegian Government Pension Fund and the Abu Dhabi Investment Authority.

5. Municipal Bonds: These are bonds issued by local governments or municipalities to finance infrastructure projects. Examples include bonds issued by cities like New York, London, and Tokyo.

Risks and Considerations in International Bond Investing

International bond investing can offer attractive opportunities for diversification and potential higher returns. However, it also comes with its own set of risks and considerations that investors should be aware of.

1. Currency Risk

One of the main risks in international bond investing is currency risk. When investing in bonds denominated in foreign currencies, changes in exchange rates can significantly impact the returns. If the value of the foreign currency decreases relative to the investor’s home currency, it can result in lower returns or even losses.

2. Interest Rate Risk

Interest rate risk is another important consideration in international bond investing. Changes in interest rates can affect the value of bonds, especially those with longer maturities. If interest rates rise, the value of existing bonds may decrease, leading to potential capital losses for investors.

3. Sovereign Risk

Investing in international bonds also exposes investors to sovereign risk. This refers to the risk of default by the government or the issuing entity. Some countries may have a higher risk of default due to political instability, economic challenges, or other factors. Investors should carefully assess the creditworthiness of the issuer before investing.

4. Liquidity Risk

Liquidity risk is another consideration in international bond investing. Some international bond markets may have lower trading volumes and less liquidity compared to domestic markets. This can make it more difficult to buy or sell bonds at desired prices, potentially leading to higher transaction costs or delays in executing trades.

5. Regulatory and Legal Risks

Investors in international bonds should also be aware of regulatory and legal risks. Different countries may have different regulations and legal systems that can impact the rights and protections of bondholders. It is important to understand the legal framework and investor protections in the country where the bond is issued.

6. Country-Specific Risks

Lastly, international bond investing exposes investors to country-specific risks. These can include political risks, economic risks, and market risks specific to the country where the bond is issued. Factors such as changes in government policies, economic downturns, or market volatility can impact the performance of international bonds.

Overall, international bond investing can be a valuable addition to an investment portfolio, but it is important to carefully consider and manage the risks involved. Diversification, thorough research, and staying informed about global economic and political developments can help investors make informed decisions and mitigate potential risks.

Emily Bibb simplifies finance through bestselling books and articles, bridging complex concepts for everyday understanding. Engaging audiences via social media, she shares insights for financial success. Active in seminars and philanthropy, Bibb aims to create a more financially informed society, driven by her passion for empowering others.