What are Interest Rate Options?

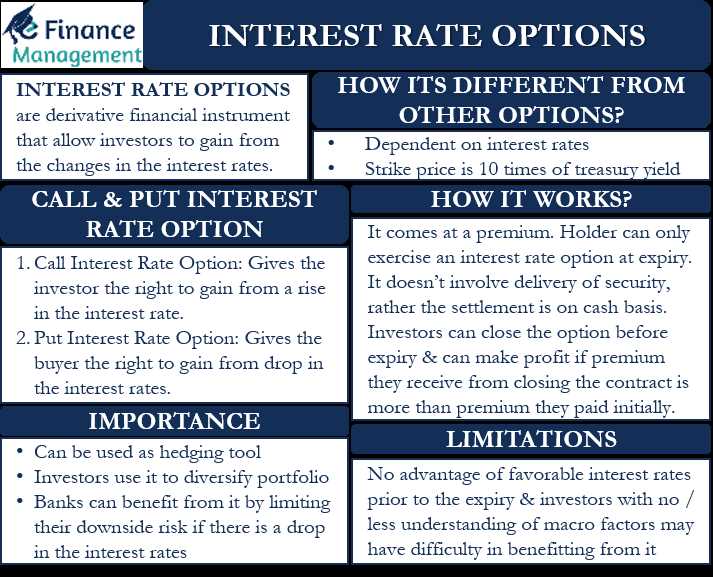

Interest rate options are financial derivatives that give the holder the right, but not the obligation, to buy or sell an underlying interest rate security at a predetermined price (strike price) within a specified period of time. These options are commonly used by investors and traders to manage their exposure to interest rate fluctuations.

Interest rate options are typically based on interest rate futures contracts, which represent the expected future value of a specific interest rate. The underlying interest rate securities can include government bonds, corporate bonds, or other debt instruments.

There are two types of interest rate options: call options and put options. A call option gives the holder the right to buy the underlying interest rate security at the strike price, while a put option gives the holder the right to sell the underlying interest rate security at the strike price.

Interest rate options can be used for various purposes, including speculation, hedging, and arbitrage. Speculators use these options to profit from their predictions of interest rate movements. Hedgers use them to protect against adverse interest rate movements that could negatively impact their investments. Arbitrageurs use interest rate options to exploit price discrepancies between different markets or instruments.

Overall, interest rate options provide investors and traders with a flexible tool to manage their interest rate risk and potentially profit from interest rate movements. However, like any financial instrument, they also carry risks and should be used with caution.

| Advantages | Disadvantages |

|---|---|

| – Flexibility in managing interest rate risk | – Potential for loss if interest rate movements are unfavorable |

| – Potential for profit from interest rate predictions | – Premium costs |

| – Ability to hedge against adverse interest rate movements | – Limited time to expiration |

| – Opportunities for arbitrage | – Complex pricing factors |

Interest Rate Options: Mechanics

Interest rate options are financial derivatives that give the holder the right, but not the obligation, to buy or sell an underlying asset at a predetermined interest rate within a specified period of time. These options are commonly used by investors and traders to manage interest rate risk and speculate on future interest rate movements.

How do Interest Rate Options Work?

There are two types of interest rate options: call options and put options. A call option gives the holder the right to buy the underlying asset at the strike rate, while a put option gives the holder the right to sell the underlying asset at the strike rate.

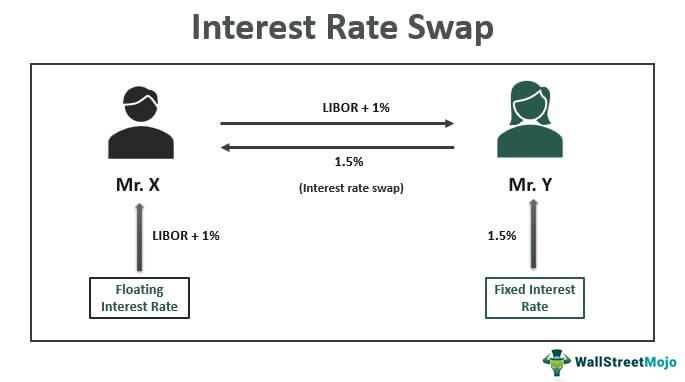

Interest rate options can be settled in two ways: physically or cash-settled. In a physically settled option, the buyer and seller exchange the underlying asset at the agreed-upon interest rate. In a cash-settled option, the buyer receives a cash payment based on the difference between the market interest rate and the strike rate.

An Illustrative Example of Interest Rate Options

Let’s say an investor believes that interest rates will rise in the future. They could purchase a call option on a government bond with a strike rate of 3%. If interest rates do indeed rise above 3%, the investor can exercise the option and buy the bond at the lower strike rate, potentially profiting from the increase in interest rates.

Interest rate options can be complex financial instruments, and it is important for investors to understand the mechanics and risks involved before trading them. It is recommended to consult with a financial advisor or conduct thorough research before engaging in interest rate options trading.

How do Interest Rate Options Work?

When trading interest rate options, there are two main types: call options and put options. A call option gives the holder the right to buy the underlying asset at the strike rate, while a put option gives the holder the right to sell the underlying asset at the strike rate.

Interest rate options can be used in various ways. For example, a bond investor who expects interest rates to rise may buy put options to protect against potential losses in the value of their bond portfolio. Conversely, a bond investor who expects interest rates to fall may buy call options to profit from potential gains in the value of their bond portfolio.

Interest Rate Options: Example

Interest rate options are financial derivatives that give the holder the right, but not the obligation, to buy or sell an underlying interest rate instrument at a specified strike price on or before a specified expiration date. To better understand how interest rate options work, let’s consider an example.

Suppose you are a bond trader and you own a portfolio of bonds with fixed interest rates. You are concerned about the possibility of interest rates increasing in the future, which would decrease the value of your bond portfolio. To protect yourself against this risk, you decide to purchase interest rate put options.

Let’s say the current interest rate is 5% and you believe that it may increase to 7% in the next six months. You decide to purchase a six-month put option with a strike price of 6%. This means that if the interest rate increases to 7% within the next six months, you have the right to sell your interest rate instrument at a price of 6%.

If the interest rate does increase to 7%, the value of your bond portfolio will decrease. However, the put option will increase in value, offsetting the losses in your portfolio. You can exercise the put option and sell your interest rate instrument at the strike price of 6%, effectively locking in your profits.

On the other hand, if the interest rate remains at 5% or decreases, the put option will expire worthless and you will only lose the premium paid for the option.

An Illustrative Example of Interest Rate Options

Let’s consider an illustrative example to understand how interest rate options work. Suppose you are a bond investor and you are concerned about the possibility of interest rates increasing in the future. To protect yourself from this risk, you decide to purchase an interest rate call option.

First, you need to understand the mechanics of an interest rate call option. An interest rate call option gives you the right, but not the obligation, to buy a specific bond at a predetermined interest rate (strike rate) on or before a specified date (expiration date).

Now, let’s say you purchase an interest rate call option on a 10-year bond with a strike rate of 3% and an expiration date of one year from now. This means that if interest rates increase above 3% within the next year, you have the option to buy the bond at the lower 3% rate.

Suppose that after six months, interest rates have indeed increased to 4%. At this point, you can exercise your option and buy the bond at the lower 3% rate, even though the current market rate is 4%. This allows you to lock in a lower interest rate and protect yourself from the increase in rates.

In summary, interest rate options provide investors with a way to protect themselves from potential increases in interest rates. By purchasing a call option, investors can lock in a lower interest rate for a specific bond, providing them with a hedge against rising rates.

Interest Rate Options: Strategy

| Strategy | Description |

|---|---|

| Bullish Strategy | This strategy involves taking a bullish view on interest rates. Investors who believe that interest rates will rise can use this strategy to profit from the increase. One common bullish strategy is buying call options on interest rate futures. |

| Bearish Strategy | On the other hand, a bearish strategy is used when investors anticipate a decline in interest rates. This strategy allows investors to profit from falling interest rates. One popular bearish strategy is buying put options on interest rate futures. |

| Neutral Strategy | If an investor is uncertain about the direction of interest rates, they can employ a neutral strategy. This strategy aims to profit from low volatility and stable interest rates. One common neutral strategy is using a straddle, which involves buying both call and put options with the same strike price and expiration date. |

| Spread Strategy | A spread strategy involves taking positions in multiple interest rate options with different strike prices or expiration dates. This strategy allows investors to take advantage of relative price movements between different options. Common spread strategies include the butterfly spread and the calendar spread. |

It is important to note that these strategies are not exhaustive, and there are many other strategies that can be employed depending on an investor’s risk tolerance, market outlook, and investment goals. It is recommended to thoroughly research and understand each strategy before implementing it in the market.

Additionally, risk management is a crucial aspect of any interest rate options strategy. Investors should carefully consider their risk tolerance and set appropriate stop-loss orders to limit potential losses. Regular monitoring and adjustment of the strategy may also be necessary to adapt to changing market conditions.

Emily Bibb simplifies finance through bestselling books and articles, bridging complex concepts for everyday understanding. Engaging audiences via social media, she shares insights for financial success. Active in seminars and philanthropy, Bibb aims to create a more financially informed society, driven by her passion for empowering others.