What is Incremental Analysis?

Incremental analysis is based on the principle that only the relevant costs and benefits should be considered when making decisions. It focuses on the additional costs and revenues that arise from a particular decision, rather than considering the total costs and revenues of the entire business.

How Does Incremental Analysis Work?

Incremental analysis involves comparing the costs and benefits of different alternatives to determine which option is the most financially advantageous. It typically involves the following steps:

- Identify the decision to be made and the available alternatives.

- Identify the relevant costs and benefits associated with each alternative.

- Calculate the incremental costs and benefits by subtracting the costs and benefits of the next best alternative from the costs and benefits of the alternative being considered.

- Compare the incremental costs and benefits of each alternative to determine the most financially advantageous option.

Example of Incremental Analysis

Let’s say a company is considering whether to invest in new equipment. The cost of the equipment is $100,000, and it is expected to generate additional revenue of $50,000 per year for the next five years. The company’s alternative option is to continue using the existing equipment, which has no additional costs or benefits.

Based on the incremental analysis, the company would determine that the investment in new equipment is financially advantageous because the incremental revenue of $50,000 per year exceeds the incremental cost of $100,000.

Conclusion

Incremental analysis is a valuable tool for decision-making in business. It allows companies to evaluate the financial impact of different alternatives and make informed choices. By focusing on the relevant costs and benefits, incremental analysis helps businesses optimize their resources and maximize their profitability.

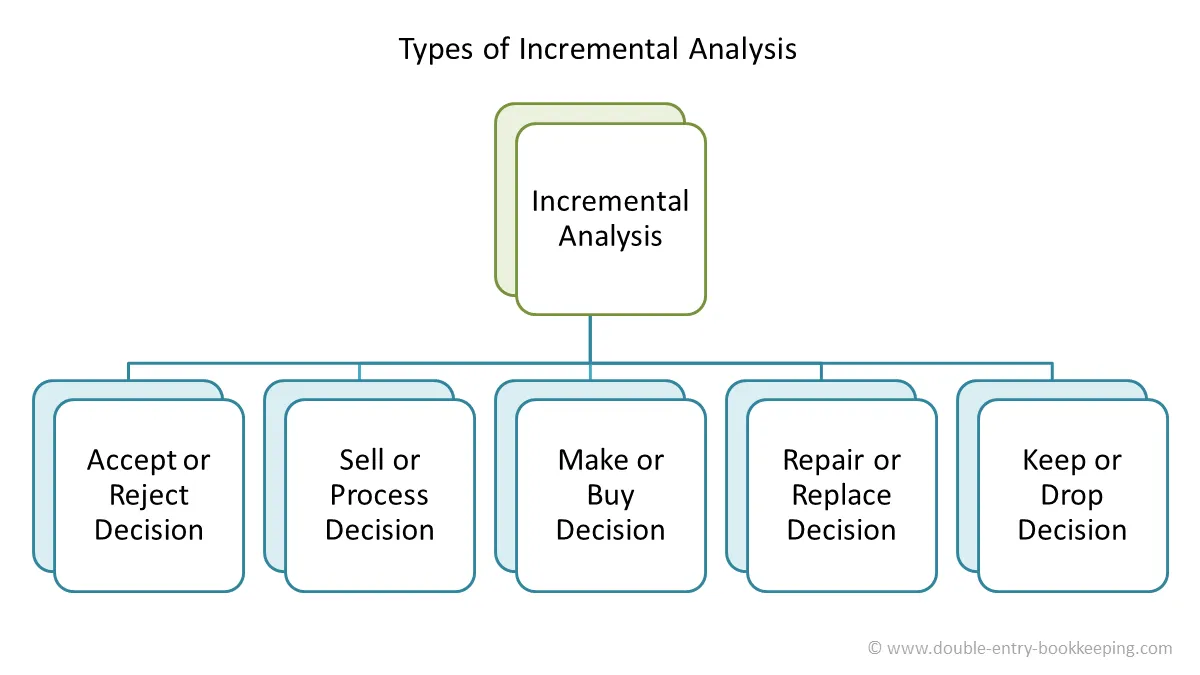

Types of Incremental Analysis

There are several types of incremental analysis that businesses use to make informed decisions:

1. Cost-Benefit Analysis: This type of incremental analysis involves comparing the costs and benefits of different alternatives to determine which option will result in the greatest overall benefit. It takes into account both the monetary and non-monetary costs and benefits associated with each alternative.

2. Break-Even Analysis: This type of incremental analysis is used to determine the point at which a business will neither make a profit nor incur a loss. It involves analyzing the fixed and variable costs associated with a particular alternative and calculating the level of sales or production needed to cover those costs.

3. Opportunity Cost Analysis: This type of incremental analysis involves evaluating the potential benefits that could be gained from choosing one alternative over another. It considers the value of the next best alternative that is forgone when a particular choice is made.

4. Sensitivity Analysis: This type of incremental analysis involves examining how changes in certain variables or assumptions can affect the outcome of a decision. It helps businesses understand the potential risks and uncertainties associated with different alternatives.

5. Risk Analysis: This type of incremental analysis involves evaluating the potential risks and rewards associated with different alternatives. It helps businesses assess the likelihood and impact of various risks and make decisions that minimize potential losses.

By using these types of incremental analysis, businesses can make more informed decisions and choose the alternatives that will result in the greatest financial benefit. Each type of analysis provides a different perspective and helps businesses consider various factors when evaluating alternatives.

Cost-Benefit Analysis

Cost-benefit analysis is a method used in incremental analysis to assess the potential costs and benefits associated with a particular decision or project. It involves comparing the expected costs of implementing a decision or project with the expected benefits that will be generated.

The Process of Cost-Benefit Analysis

Cost-benefit analysis typically involves the following steps:

- Identifying the decision or project under consideration.

- Listing all the costs associated with implementing the decision or project.

- Listing all the benefits that are expected to be generated.

- Assigning a monetary value to each cost and benefit.

- Calculating the net present value (NPV) of the costs and benefits.

- Comparing the NPV of the costs and benefits to determine if the decision or project is financially viable.

Example of Cost-Benefit Analysis

Let’s say a company is considering investing in new technology that will automate certain tasks and improve efficiency. The cost of implementing the technology is $100,000, and it is expected to generate annual cost savings of $30,000 over a period of 5 years. To conduct a cost-benefit analysis, the company would calculate the NPV of the costs and benefits.

Using a discount rate of 10%, the NPV of the costs would be:

| Year | Cost | Discount Factor | Discounted Cost |

|---|---|---|---|

| 0 | $100,000 | 1.000 | $100,000 |

The NPV of the benefits would be:

| Year | Benefit | Discount Factor | Discounted Benefit |

|---|---|---|---|

| 1 | $30,000 | 0.909 | $27,270 |

| 2 | $30,000 | 0.826 | $24,780 |

| 3 | $30,000 | 0.751 | $22,530 |

| 4 | $30,000 | 0.683 | $20,490 |

| 5 | $30,000 | 0.621 | $18,630 |

The total NPV of the costs and benefits would be:

| Year | Net Present Value |

|---|---|

| 0 | $-100,000 |

| 1-5 | $13,600 |

Based on the positive NPV, the company can conclude that the investment in new technology is financially viable and is likely to generate a positive return over the 5-year period.

Cost-benefit analysis is an important tool in decision-making as it helps organizations evaluate the financial viability of different options and make informed choices. By considering both the costs and benefits, organizations can assess the potential risks and rewards associated with a decision and make more effective use of their resources.

Break-Even Analysis

Break-even analysis is a crucial component of incremental analysis in corporate finance. It is a financial tool used to determine the point at which a company’s total revenue equals its total costs, resulting in neither profit nor loss. This analysis helps businesses understand the minimum level of sales needed to cover all expenses and start generating profit.

How Break-Even Analysis Works

Break-even analysis involves calculating the break-even point, which is the level of sales or units sold that covers all fixed and variable costs. This analysis takes into account various factors, including the selling price per unit, fixed costs (such as rent, salaries, and utilities), variable costs (such as raw materials and direct labor), and the contribution margin per unit.

The contribution margin per unit is the difference between the selling price per unit and the variable cost per unit. It represents the amount of revenue that contributes to covering fixed costs and generating profit. By dividing the fixed costs by the contribution margin per unit, the break-even point in units can be determined.

Importance of Break-Even Analysis

Break-even analysis is essential for businesses as it provides valuable insights into their financial performance and helps in making informed decisions. Here are some key reasons why break-even analysis is important:

- Profitability Assessment: Break-even analysis allows businesses to assess their profitability by determining the minimum level of sales needed to cover costs and generate profit. It helps in setting realistic sales targets and pricing strategies.

- Cost Control: By identifying the fixed and variable costs, break-even analysis helps businesses identify areas where cost reduction is possible. It enables them to make informed decisions regarding cost management and resource allocation.

- Business Planning: Break-even analysis is an essential tool in business planning. It helps businesses understand the financial implications of different scenarios and make informed decisions regarding expansion, product development, or cost-cutting measures.

Importance of Incremental Analysis

Incremental analysis plays a crucial role in decision-making processes within an organization. It provides a systematic approach to evaluate the potential benefits and costs associated with different alternatives. By analyzing the incremental changes in revenues, costs, and profits, businesses can make informed decisions that maximize their financial performance.

1. Identifying Relevant Costs and Benefits

One of the key benefits of incremental analysis is its ability to identify relevant costs and benefits. It helps businesses determine which costs and benefits are directly affected by a specific decision. By focusing on the incremental changes, decision-makers can avoid considering irrelevant costs and benefits that do not impact the decision at hand. This allows for a more accurate assessment of the financial implications of different alternatives.

2. Evaluating Alternative Courses of Action

Incremental analysis enables businesses to evaluate different courses of action and determine the most financially viable option. By comparing the incremental costs and benefits of each alternative, decision-makers can assess the potential impact on profitability. This helps businesses make strategic decisions that align with their financial objectives and maximize their long-term success.

3. Assessing Cost-Benefit Trade-Offs

Cost-benefit analysis is an essential component of incremental analysis. It allows businesses to assess the trade-offs between costs and benefits associated with a particular decision. By quantifying the financial impact of each alternative, decision-makers can weigh the costs against the benefits and choose the option that offers the highest net benefit. This helps businesses optimize their resource allocation and allocate resources efficiently.

4. Facilitating Break-Even Analysis

Break-even analysis is another important aspect of incremental analysis. It helps businesses determine the point at which their revenues equal their costs, resulting in neither profit nor loss. By conducting break-even analysis, decision-makers can assess the financial feasibility of a project or investment. This information is crucial for making informed decisions regarding pricing, production levels, and resource allocation.

5. Supporting Strategic Planning

Incremental analysis provides valuable insights that support strategic planning within an organization. By considering the incremental changes in revenues, costs, and profits, decision-makers can align their decisions with the overall strategic goals of the business. This ensures that financial resources are allocated to initiatives that contribute to the long-term success and sustainability of the organization.

| Benefits of Incremental Analysis | Importance |

|---|---|

| Identifies relevant costs and benefits | Ensures accurate assessment of financial implications |

| Evaluates alternative courses of action | Helps make financially viable decisions |

| Assesses cost-benefit trade-offs | Optimizes resource allocation |

| Facilitates break-even analysis | Assesses financial feasibility |

| Supports strategic planning | Aligns decisions with strategic goals |

Overall, incremental analysis is a valuable tool for businesses to make informed decisions and optimize their financial performance. By considering the incremental changes in costs, revenues, and profits, organizations can effectively evaluate different alternatives and choose the option that maximizes their long-term success.

Why is Incremental Analysis Important?

Incremental analysis is an essential tool in corporate finance as it helps businesses make informed decisions by evaluating the costs and benefits of potential changes or alternatives. This analysis allows companies to assess the incremental impact of a decision on their financial performance, helping them optimize their operations and maximize profitability.

One of the key reasons why incremental analysis is important is that it enables businesses to identify and evaluate the relevant costs and benefits associated with a specific decision. By focusing on the incremental changes, rather than the overall costs and benefits, companies can make more accurate and effective decisions. This approach helps avoid the inclusion of irrelevant costs and benefits that may skew the decision-making process.

Moreover, incremental analysis helps businesses assess the financial feasibility of various alternatives. By comparing the incremental costs and benefits of different options, companies can determine which alternative offers the greatest financial advantage. This analysis is particularly valuable in situations where resources are limited, and companies need to prioritize their investments.

Another reason why incremental analysis is important is that it helps businesses understand the potential risks and rewards associated with a decision. By considering the incremental impact on revenue, costs, and profitability, companies can evaluate the potential return on investment and make more informed choices. This analysis also allows businesses to identify potential cost savings or revenue opportunities that may arise from a specific decision.

Furthermore, incremental analysis aids in the evaluation of break-even points. By analyzing the incremental costs and revenues, companies can determine the level of sales or production volume required to cover their costs and start generating profits. This information is crucial for businesses to set realistic goals and make strategic decisions regarding pricing, production levels, and cost management.

Emily Bibb simplifies finance through bestselling books and articles, bridging complex concepts for everyday understanding. Engaging audiences via social media, she shares insights for financial success. Active in seminars and philanthropy, Bibb aims to create a more financially informed society, driven by her passion for empowering others.