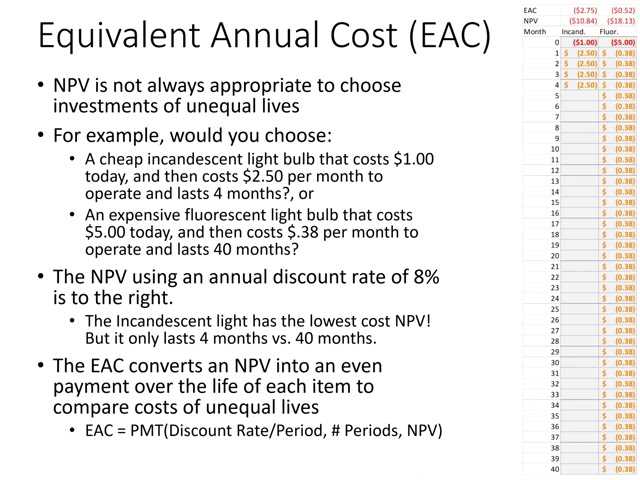

Equivalent Annual Cost (EAC): What It Is and How It Works

Equivalent Annual Cost (EAC) is a financial metric used to determine the annual cost of owning or maintaining an asset over its useful life. It takes into account the initial cost, maintenance expenses, and salvage value of the asset to provide a more accurate representation of the total cost of ownership.

Definition and Explanation of EAC

The formula for calculating EAC takes into account the initial cost of the asset, the expected useful life, the discount rate, and any salvage value at the end of the asset’s life. It is calculated as follows:

- Calculate the present value of all the costs associated with the asset over its useful life.

- Divide the present value by the annuity factor, which is calculated using the discount rate and the useful life of the asset.

Calculation of EAC

The formula for calculating EAC is as follows:

EAC = PV / AF

Where:

- EAC is the equivalent annual cost

- PV is the present value of all costs

- AF is the annuity factor

Example of EAC Calculation

Let’s say you are considering purchasing a piece of machinery for $50,000. The expected useful life of the machinery is 5 years, and you estimate that the maintenance expenses will amount to $10,000 per year. The salvage value of the machinery at the end of its useful life is estimated to be $5,000. The discount rate is 10%.

To calculate the EAC, you would first calculate the present value of all the costs:

- Present value of initial cost: $50,000

- Present value of maintenance expenses: $10,000 x (1 + 0.10)^-1 + $10,000 x (1 + 0.10)^-2 + $10,000 x (1 + 0.10)^-3 + $10,000 x (1 + 0.10)^-4 + $10,000 x (1 + 0.10)^-5 = $39,669

- Present value of salvage value: $5,000 x (1 + 0.10)^-5 = $3,170

Next, you would calculate the annuity factor using the discount rate and the useful life of the asset:

Finally, you would divide the present value by the annuity factor to calculate the EAC:

EAC = $86,499 / 3.7908 = $22,820

Advantages and Disadvantages of EAC

The use of EAC provides several advantages:

- Allows for easier comparison of different assets or investment options based on their annual costs.

- Takes into account the time value of money, providing a more accurate representation of the total cost of ownership.

- Helps in decision-making by considering all costs associated with an asset over its useful life.

However, there are some limitations to consider:

- EAC calculations rely on accurate estimations of costs, useful life, and salvage value, which may be challenging.

- The discount rate used in the calculation may vary depending on the organization’s cost of capital.

- EAC does not consider other factors such as inflation or changes in technology.

Definition and Explanation of EAC

The Equivalent Annual Cost (EAC) is a financial metric used to compare the costs of different investment options over a specified period of time. It takes into account the initial investment cost, operating costs, maintenance costs, and salvage value of an investment, and converts them into an equivalent annual cost.

EAC is particularly useful when comparing investment options that have different lifespans or require different levels of ongoing expenses. By converting all costs into an annual equivalent, it allows for a more accurate comparison of the total cost of each option.

To calculate the EAC, the following steps are typically followed:

- Determine the initial investment cost, which includes any upfront expenses such as purchase price or installation costs.

- Estimate the annual operating costs, which may include expenses such as maintenance, repairs, and utilities.

- Consider the salvage value, which is the estimated value of the investment at the end of its useful life. This value is subtracted from the total cost to determine the net cost.

- Calculate the present value of the net cost using an appropriate discount rate. This step takes into account the time value of money and adjusts the future costs to their present value.

- Convert the present value of the net cost back to an equivalent annual cost using the formula:

EAC = (PV of Net Cost) / (Present Value Factor)

It is important to note that the EAC is just one factor to consider when evaluating investment options. Other factors such as potential return on investment, risk, and strategic objectives should also be taken into account.

Calculation of EAC

The Equivalent Annual Cost (EAC) is a financial metric used to compare the costs of different projects or investments over their useful life. It takes into account the initial investment, operating costs, and salvage value to determine the annual cost of the project.

Formula for EAC Calculation

The formula for calculating the EAC is as follows:

Where:

- EAC is the Equivalent Annual Cost

- C is the initial investment or cost

- S is the salvage value or resale value of the project

- r is the discount rate or cost of capital

- n is the useful life of the project in years

Steps to Calculate EAC

To calculate the EAC, follow these steps:

- Determine the initial investment or cost (C) of the project.

- Determine the salvage value or resale value (S) of the project.

- Determine the discount rate or cost of capital (r).

- Determine the useful life (n) of the project in years.

- Plug the values into the EAC formula and calculate the result.

Example of EAC Calculation

Let’s say we are considering two investment projects: Project A and Project B. Project A has an initial cost of $10,000, a salvage value of $2,000, a discount rate of 5%, and a useful life of 5 years. Project B has an initial cost of $15,000, a salvage value of $3,000, a discount rate of 7%, and a useful life of 8 years.

To calculate the EAC for Project A:

| EAC = $2,876.84 |

|---|

To calculate the EAC for Project B:

| EAC = $2,705.74 |

|---|

Based on the EAC calculation, Project A has a lower annual cost compared to Project B. Therefore, Project A may be a more cost-effective investment.

Example of EAC Calculation

Let’s consider an example to understand how to calculate the Equivalent Annual Cost (EAC). Suppose a company is evaluating two options for purchasing a new machine. Option A costs $10,000 and has an expected life of 5 years, while Option B costs $15,000 and has an expected life of 8 years.

Step 1: Calculate the Present Value (PV) of each option

To calculate the PV, we need to discount the future cash flows of each option to their present value. Let’s assume a discount rate of 10% for this example.

For Option A:

The annual cash flow is $2,500 ($10,000 divided by 5 years).

The PV of each year’s cash flow is calculated as follows:

Year 1: $2,500 / (1 + 0.10)^1 = $2,272.73

Year 2: $2,500 / (1 + 0.10)^2 = $2,066.12

Year 3: $2,500 / (1 + 0.10)^3 = $1,878.29

Year 4: $2,500 / (1 + 0.10)^4 = $1,707.54

Year 5: $2,500 / (1 + 0.10)^5 = $1,552.31

The PV of Option A is the sum of these present values:

PV of Option A = $2,272.73 + $2,066.12 + $1,878.29 + $1,707.54 + $1,552.31 = $9,476.99

For Option B:

The annual cash flow is $1,875 ($15,000 divided by 8 years).

The PV of each year’s cash flow is calculated as follows:

Year 1: $1,875 / (1 + 0.10)^1 = $1,704.55

Year 2: $1,875 / (1 + 0.10)^2 = $1,549.59

Year 3: $1,875 / (1 + 0.10)^3 = $1,408.72

Year 4: $1,875 / (1 + 0.10)^4 = $1,280.65

Year 5: $1,875 / (1 + 0.10)^5 = $1,164.23

Year 6: $1,875 / (1 + 0.10)^6 = $1,058.39

Year 7: $1,875 / (1 + 0.10)^7 = $961.27

Year 8: $1,875 / (1 + 0.10)^8 = $871.15

The PV of Option B is the sum of these present values:

PV of Option B = $1,704.55 + $1,549.59 + $1,408.72 + $1,280.65 + $1,164.23 + $1,058.39 + $961.27 + $871.15 = $9,988.55

Step 2: Calculate the Equivalent Annual Cost (EAC)

The EAC is calculated by dividing the PV of each option by the annuity factor, which is calculated using the discount rate and the number of years.

For Option A:

EAC of Option A = $9,476.99 / 3.7908 = $2,501.41

For Option B:

EAC of Option B = $9,988.55 / 5.3349 = $1,874.98

Step 3: Compare and make a decision

Comparing the EAC of Option A ($2,501.41) and Option B ($1,874.98), we can see that Option B has a lower EAC. Therefore, based on the Equivalent Annual Cost, Option B is the more cost-effective choice.

It is important to note that the EAC calculation considers the time value of money and allows for a fair comparison of different options with varying cash flows and lifespans.

Advantages and Disadvantages of EAC

Advantages:

EAC, or Equivalent Annual Cost, is a useful financial metric that can help businesses make informed decisions when comparing different investment options. Here are some advantages of using EAC:

1. Simplifies comparison: EAC allows for a simplified comparison between projects or investments with different lifespans and cash flow patterns. By converting all costs and benefits into an equivalent annual amount, it becomes easier to evaluate and compare the financial viability of different options.

2. Considers time value of money: EAC takes into account the time value of money by discounting future cash flows to their present value. This ensures that the EAC calculation reflects the true cost of an investment over its entire lifespan.

3. Provides a comprehensive view: EAC considers all relevant costs and benefits associated with an investment, including initial investment costs, maintenance costs, salvage value, and any other cash flows. This comprehensive view helps in making more accurate financial decisions.

4. Helps in long-term planning: EAC provides insights into the long-term financial implications of an investment. It helps businesses assess the sustainability and profitability of an investment over its entire lifespan, allowing for better long-term planning and resource allocation.

Disadvantages:

While EAC offers several advantages, it also has some limitations that should be considered:

1. Assumes constant cash flows: EAC assumes that cash flows remain constant throughout the lifespan of an investment. In reality, cash flows can fluctuate due to various factors such as market conditions, inflation, and changes in demand. This assumption may not accurately reflect the actual financial performance of an investment.

2. Relies on accurate data: EAC calculations heavily rely on accurate and reliable data. Any errors or inaccuracies in the input data can lead to incorrect EAC calculations, potentially resulting in flawed financial decisions.

3. Ignores qualitative factors: EAC is a purely quantitative financial metric that does not consider qualitative factors such as market trends, competition, and strategic considerations. These qualitative factors can significantly impact the success or failure of an investment and should be considered alongside EAC.

Overall, EAC is a valuable tool for financial analysis and decision-making. However, it should be used in conjunction with other financial and non-financial metrics to ensure a comprehensive evaluation of investment options.

Emily Bibb simplifies finance through bestselling books and articles, bridging complex concepts for everyday understanding. Engaging audiences via social media, she shares insights for financial success. Active in seminars and philanthropy, Bibb aims to create a more financially informed society, driven by her passion for empowering others.