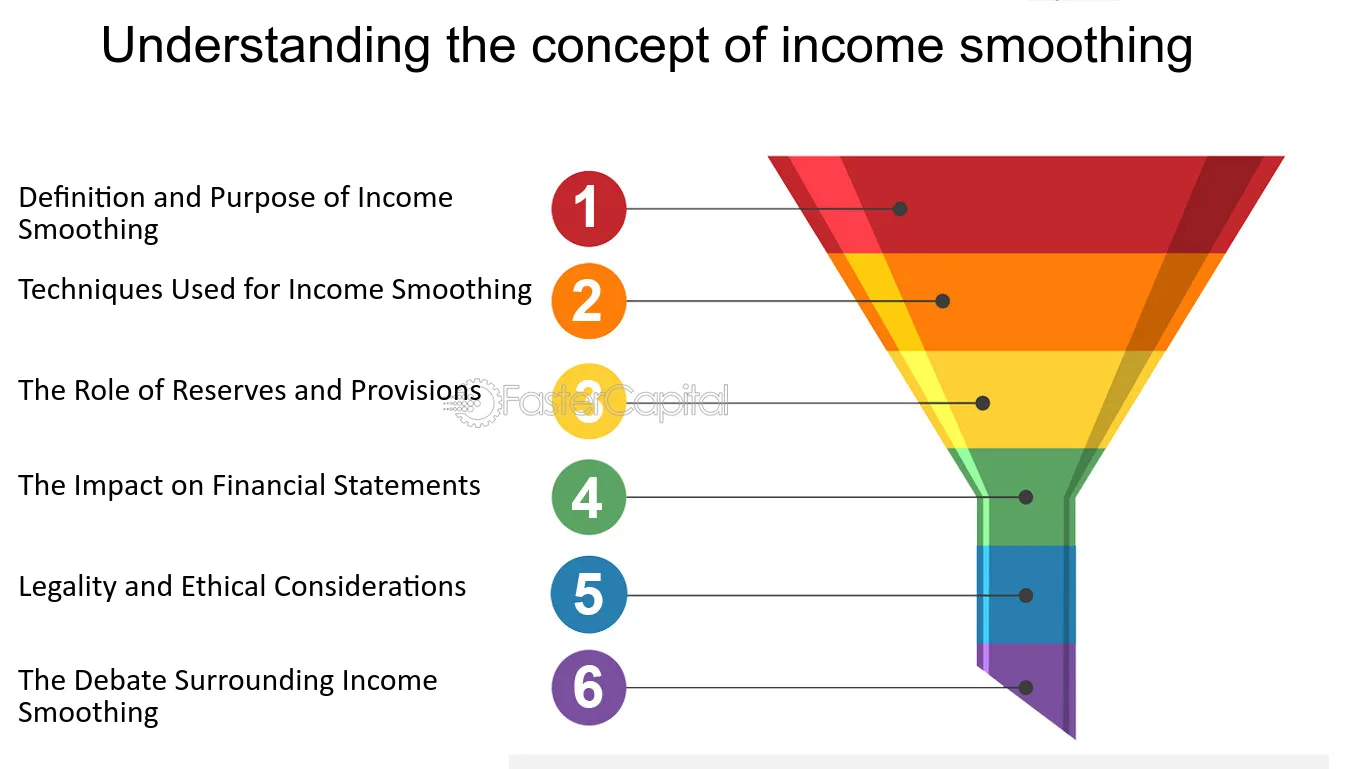

Income Smoothing: Definition

Income smoothing is a financial practice used by companies to manipulate their reported earnings in order to create a more consistent and predictable pattern of income over time. This is done by shifting revenues and expenses between different accounting periods, smoothing out any fluctuations that may occur naturally.

The goal of income smoothing is to present a more stable financial picture to investors, creditors, and other stakeholders. By smoothing out the peaks and valleys of earnings, companies can create the perception of a more reliable and less risky business. This can help attract investors, lower borrowing costs, and improve the overall valuation of the company.

However, income smoothing is a controversial practice and its legality is subject to scrutiny. While some forms of income smoothing may be considered acceptable and within the boundaries of accounting rules and regulations, others may be seen as fraudulent or misleading.

Overall, income smoothing can be a useful tool for companies to manage their financial performance and present a more consistent picture to stakeholders. However, it is important for companies to exercise transparency and adhere to legal and ethical standards when engaging in income smoothing practices.

| Pros of Income Smoothing | Cons of Income Smoothing |

|---|---|

| – Creates a more stable financial picture | – May be seen as fraudulent or misleading |

| – Attracts investors and lowers borrowing costs | – Can undermine the credibility of financial statements |

| – Improves the overall valuation of the company | – May result in legal and regulatory consequences |

Income smoothing is a financial management technique used by companies to manipulate their reported earnings in order to create a more consistent and predictable stream of income over time. It involves the deliberate adjustment of accounting practices and financial transactions to smooth out fluctuations in earnings.

The main objective of income smoothing is to present a stable and steady income pattern to investors, creditors, and other stakeholders. By reducing the volatility of earnings, companies can create a perception of stability and reliability, which may attract more investors and improve their overall financial standing.

There are various methods and strategies that companies can employ to smooth their income. One common technique is to shift income or expenses between different accounting periods. For example, a company may choose to recognize revenue earlier or delay the recognition of expenses to manipulate their earnings in a particular reporting period.

Another method is to create reserves or provisions to absorb future losses or expenses. By setting aside funds in advance, companies can smooth out the impact of unexpected events or fluctuations in income. This allows them to maintain a more consistent level of earnings over time.

However, it is important to note that income smoothing is a controversial practice and may raise ethical and legal concerns. While it is not illegal in some jurisdictions, it can be considered misleading or deceptive if used to intentionally misrepresent a company’s financial performance.

Investors and regulators are becoming increasingly vigilant in detecting and scrutinizing income smoothing practices. They rely on financial analysis, audit procedures, and disclosure requirements to identify any potential manipulation of earnings. Companies found to be engaging in fraudulent income smoothing may face legal consequences and damage to their reputation.

Income Smoothing: Legality

Income smoothing is a financial practice that involves manipulating a company’s financial statements to even out fluctuations in its reported earnings. While it may seem like a harmless strategy to some, income smoothing can raise legal concerns and may be considered illegal in certain circumstances.

The legality of income smoothing depends on the methods used and the intention behind it. In general, income smoothing is not illegal as long as it is done within the boundaries of accounting principles and regulations. However, if a company engages in fraudulent practices or manipulates its financial statements to deceive investors, it can be considered illegal.

One of the key factors in determining the legality of income smoothing is the transparency and disclosure of the practice. Companies are required to provide accurate and transparent financial information to their stakeholders, including investors, creditors, and regulatory authorities. If a company fails to disclose its income smoothing activities or misrepresents its financial performance, it can be held liable for securities fraud.

It is important to note that not all income smoothing practices are illegal. Some companies may engage in income smoothing to manage the impact of temporary fluctuations in their earnings, which can be considered a legitimate financial management strategy. However, companies must exercise caution and ensure that their income smoothing practices comply with accounting standards and regulations.

Examining the Legal Implications of Income Smoothing

Income smoothing is a practice that involves manipulating a company’s financial statements to create a more consistent and predictable pattern of earnings over time. While it may seem like a harmless strategy to some, income smoothing can have serious legal implications.

One of the main legal concerns with income smoothing is the potential violation of accounting principles and regulations. Companies are required to follow generally accepted accounting principles (GAAP) or international financial reporting standards (IFRS) when preparing their financial statements. These standards require companies to provide accurate and transparent financial information to investors and stakeholders.

By manipulating their financial statements, companies engaging in income smoothing may be misrepresenting their true financial performance. This can mislead investors and stakeholders, potentially leading to legal consequences such as lawsuits or regulatory investigations.

Another legal implication of income smoothing is the violation of securities laws. Companies that engage in income smoothing may be artificially inflating their earnings, which can affect the market value of their securities. This can be seen as a form of securities fraud, as it misrepresents the true value of the company’s securities and can deceive investors.

Furthermore, income smoothing can also raise concerns about insider trading. If company insiders are aware of the income smoothing practices and use this information to their advantage, it can be considered illegal insider trading. Insider trading involves trading securities based on non-public information, which is prohibited by securities laws.

Income smoothing can also have tax implications. By manipulating their earnings, companies may be able to reduce their tax liabilities. However, if these practices are deemed illegal or fraudulent, companies can face penalties and fines from tax authorities.

Overall, income smoothing may seem like a strategy to create stability and predictability in a company’s earnings, but it comes with significant legal risks. Companies need to be aware of the potential legal implications and ensure that their financial statements accurately reflect their true financial performance.

Income Smoothing: Process

Income smoothing is a technique used by companies to manipulate their financial statements in order to create a more consistent pattern of earnings. This process involves various steps that are aimed at reducing the volatility of reported earnings and presenting a more stable financial performance.

1. Identification of Discretionary Items

The first step in the income smoothing process is to identify discretionary items in the company’s financial statements. These are the items that can be easily manipulated or adjusted to achieve the desired level of earnings. Examples of discretionary items include provisions for bad debts, inventory write-downs, and restructuring charges.

2. Adjusting Discretionary Items

Once the discretionary items are identified, the next step is to adjust them in a way that smooths out the earnings. This can be done by either increasing or decreasing the reported amounts of these items. For example, a company can increase its provision for bad debts in a good year to reduce its reported earnings, and decrease it in a bad year to increase the reported earnings.

3. Timing of Revenue Recognition

Another important aspect of income smoothing is the timing of revenue recognition. Companies can manipulate the timing of recognizing revenue by either accelerating or delaying the recognition of sales. For example, a company can delay the recognition of sales in a good year to increase the reported earnings in a future year.

4. Managing Expenses

Managing expenses is also a key part of the income smoothing process. Companies can control their expenses by either reducing or deferring certain costs. For example, a company can defer maintenance expenses to a future period to increase the reported earnings in the current period.

5. Disclosures and Footnotes

Companies engaging in income smoothing often provide additional disclosures and footnotes in their financial statements to explain the adjustments made and the reasons behind them. This is done to ensure transparency and to comply with accounting standards and regulations.

6. Monitoring and Evaluation

The final step in the income smoothing process is monitoring and evaluating the effectiveness of the smoothing techniques used. Companies need to continuously monitor their financial performance and assess whether the income smoothing strategies are achieving the desired results. This involves analyzing financial ratios, comparing actual results to projected results, and making adjustments if necessary.

Exploring the Steps Involved in Income Smoothing

Income smoothing is a practice used by companies to manipulate their financial statements in order to create a more consistent and predictable pattern of earnings. This can be done through various methods, such as delaying the recognition of revenue or accelerating the recognition of expenses. While income smoothing is not illegal, it can raise ethical concerns and may be subject to scrutiny by regulators and investors.

Step 1: Identifying the Need for Income Smoothing

The first step in the income smoothing process is for a company to identify the need for income smoothing. This typically occurs when a company’s earnings are volatile or unpredictable, which can create uncertainty among investors and stakeholders. By smoothing out the fluctuations in earnings, a company can create a more stable financial picture.

Step 2: Analyzing Financial Data

Once the need for income smoothing is identified, the next step is to analyze the company’s financial data. This involves reviewing the income statement, balance sheet, and cash flow statement to identify any areas where earnings can be manipulated. Companies may look for opportunities to defer revenue recognition or accelerate expense recognition in order to smooth out their earnings.

Step 3: Implementing Income Smoothing Techniques

After analyzing the financial data, the company can begin implementing income smoothing techniques. This may involve adjusting the timing of revenue recognition, such as delaying the recognition of sales until a later period. It may also involve manipulating expenses, such as accelerating the recognition of expenses to reduce current earnings.

Step 4: Monitoring and Evaluating Results

Once income smoothing techniques are implemented, it is important for the company to monitor and evaluate the results. This involves comparing the smoothed earnings to the original volatile earnings to determine the effectiveness of the income smoothing process. Companies may also need to make adjustments or refinements to their income smoothing techniques based on the results.

Step 5: Disclosing Income Smoothing Practices

Finally, companies should disclose their income smoothing practices in their financial statements and other regulatory filings. This is important to provide transparency to investors and stakeholders and to ensure compliance with accounting standards and regulations. Failure to disclose income smoothing practices can lead to legal and reputational consequences for the company.

| Step | Description |

|---|---|

| 1 | Identifying the Need for Income Smoothing |

| 2 | Analyzing Financial Data |

| 3 | Implementing Income Smoothing Techniques |

| 4 | Monitoring and Evaluating Results |

| 5 | Disclosing Income Smoothing Practices |

Emily Bibb simplifies finance through bestselling books and articles, bridging complex concepts for everyday understanding. Engaging audiences via social media, she shares insights for financial success. Active in seminars and philanthropy, Bibb aims to create a more financially informed society, driven by her passion for empowering others.