Meaning of GAAP

GAAP, or Generally Accepted Accounting Principles, refers to a set of standard accounting rules and guidelines that companies must follow when preparing and presenting their financial statements. These principles ensure consistency, comparability, and transparency in financial reporting, allowing investors, creditors, and other stakeholders to make informed decisions.

GAAP provides a framework for recording and reporting financial information, ensuring that it is accurate, reliable, and relevant. It sets out the rules for recognizing, measuring, and disclosing various financial transactions, such as revenue recognition, expense recognition, asset valuation, and liability recognition.

Importance of GAAP

GAAP is essential for the smooth functioning of the financial markets and the economy as a whole. It provides a common language for financial reporting, allowing companies to communicate their financial performance and position effectively. This standardization enables investors and creditors to compare the financial statements of different companies and make informed investment decisions.

Moreover, GAAP ensures that financial statements are prepared in a consistent and reliable manner, enhancing the credibility and trustworthiness of the information presented. This is particularly important for attracting investors and accessing capital markets, as investors are more likely to invest in companies that follow recognized accounting principles.

Evolution of GAAP

The concept of GAAP has evolved over time in response to changes in business practices, economic conditions, and regulatory requirements. The Financial Accounting Standards Board (FASB) is the primary body responsible for establishing and updating GAAP in the United States.

As business transactions become more complex and global in nature, GAAP continues to evolve to address new challenges and ensure that financial reporting remains relevant and useful. The FASB regularly issues new accounting standards and updates existing ones to reflect changes in the business environment and improve the quality of financial reporting.

Organization of GAAP

Standard-Setting Bodies

The organization of GAAP begins with the standard-setting bodies that establish and update the accounting principles. In the United States, the Financial Accounting Standards Board (FASB) is the primary standard-setting body responsible for developing and maintaining GAAP. The FASB issues Accounting Standards Updates (ASUs) to address emerging issues and improve the clarity and consistency of financial reporting.

Internationally, the International Financial Reporting Standards (IFRS) Foundation sets the accounting standards used by many countries. The IFRS Foundation works with the International Accounting Standards Board (IASB) to develop and update IFRS. While the United States generally follows GAAP, there is an ongoing convergence project between the FASB and IASB to align the two sets of standards.

Hierarchy of GAAP

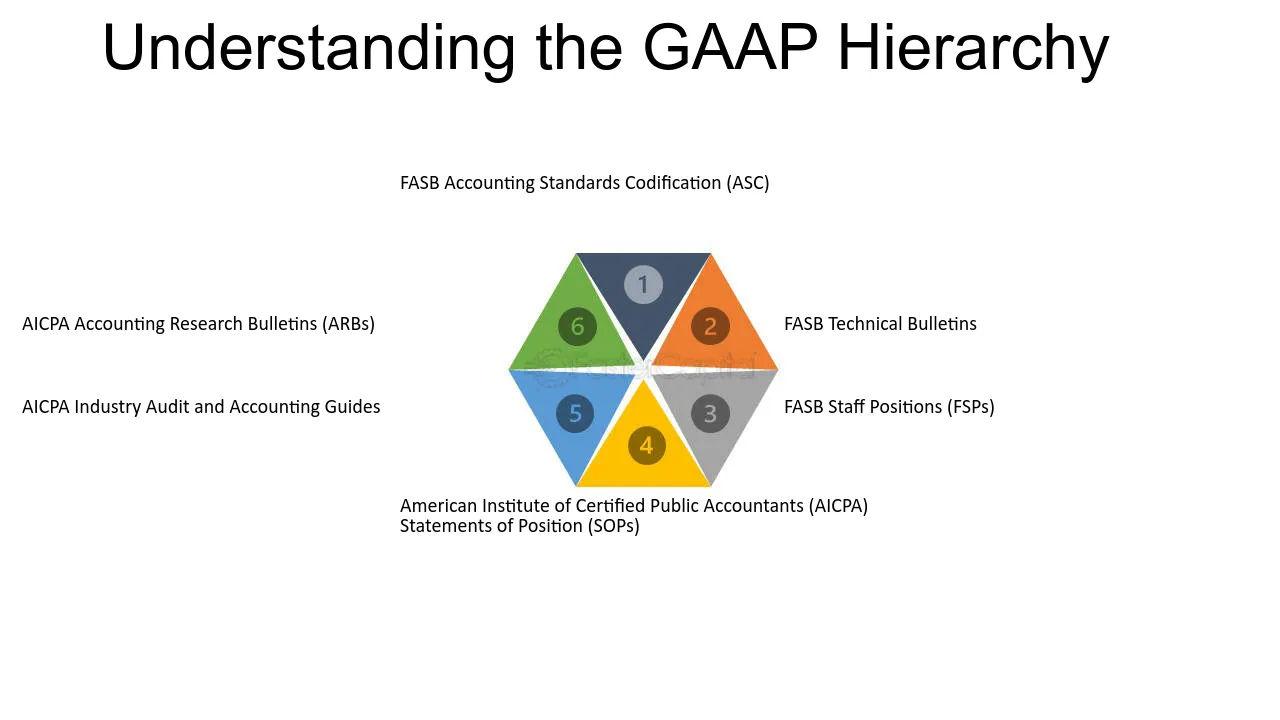

The organization of GAAP also includes a hierarchy that establishes the authority and precedence of different sources of accounting guidance. The hierarchy helps accountants determine which accounting principles to apply when preparing financial statements.

The highest level of the GAAP hierarchy is the FASB Accounting Standards Codification (ASC). The ASC organizes all authoritative U.S. GAAP into a single, searchable database. It provides a comprehensive framework for accountants to access and apply the relevant accounting guidance.

Below the ASC, there are other sources of accounting guidance, such as FASB Statements of Financial Accounting Standards (SFAS) issued before the ASC was established. These statements are still considered authoritative, but they are gradually being superseded by the ASC.

Other sources of accounting guidance include FASB Interpretations, FASB Technical Bulletins, and American Institute of Certified Public Accountants (AICPA) Statements of Position. These sources provide additional guidance on specific accounting issues.

Conclusion

Requirements of GAAP

GAAP, or Generally Accepted Accounting Principles, is a set of accounting standards that govern the preparation and presentation of financial statements. These standards ensure consistency, comparability, and transparency in financial reporting. To comply with GAAP, companies must meet certain requirements.

1. Accrual Basis of Accounting

One of the key requirements of GAAP is the use of accrual basis accounting. This means that revenues and expenses are recognized when they are earned or incurred, regardless of when the cash is received or paid. Accrual accounting provides a more accurate representation of a company’s financial position and performance.

2. Consistency

Consistency is another important requirement of GAAP. Companies must apply the same accounting methods and principles from one period to another, ensuring that financial statements are comparable over time. Any changes in accounting policies or estimates must be disclosed and explained in the financial statements.

3. Materiality

GAAP requires companies to consider materiality when preparing financial statements. Materiality refers to the significance or importance of an item or event in relation to the financial statements as a whole. Companies must disclose all material information that could influence the decisions of users of the financial statements.

4. Full Disclosure

5. Going Concern Assumption

Emily Bibb simplifies finance through bestselling books and articles, bridging complex concepts for everyday understanding. Engaging audiences via social media, she shares insights for financial success. Active in seminars and philanthropy, Bibb aims to create a more financially informed society, driven by her passion for empowering others.