What is the Financial Accounting Standards Board (FASB)?

Definition and Role

The FASB operates under a due process system, which involves extensive research, public consultations, and deliberations before issuing new accounting standards or making revisions to existing ones. This process ensures that the standards are based on sound principles and reflect the needs and perspectives of various stakeholders.

The FASB also collaborates with international standard-setting bodies to promote global convergence of accounting standards. This helps to enhance the comparability and consistency of financial reporting across different countries, making it easier for investors and analysts to evaluate and compare companies operating in different jurisdictions.

How the FASB Works

The FASB consists of seven full-time members who are appointed by the Financial Accounting Foundation (FAF). These members are experts in accounting, finance, and other related fields. The FASB also has a dedicated staff that supports its activities.

When developing new accounting standards or making revisions, the FASB follows a comprehensive process that includes research, analysis, and extensive stakeholder input. The board conducts public meetings to discuss proposed standards and solicits feedback from various stakeholders, including investors, preparers, auditors, and regulators.

After considering all relevant input, the FASB issues an Accounting Standards Update (ASU) that outlines the changes to the accounting standards. Companies are required to adopt these standards within a specified timeframe, allowing for a smooth transition and consistent application across the industry.

Overall, the FASB plays a crucial role in ensuring the transparency and reliability of financial reporting in the United States. Its standards help to maintain the integrity of the financial markets and facilitate the flow of capital by providing investors and stakeholders with accurate and comparable financial information.

Definition and Role of the Financial Accounting Standards Board (FASB)

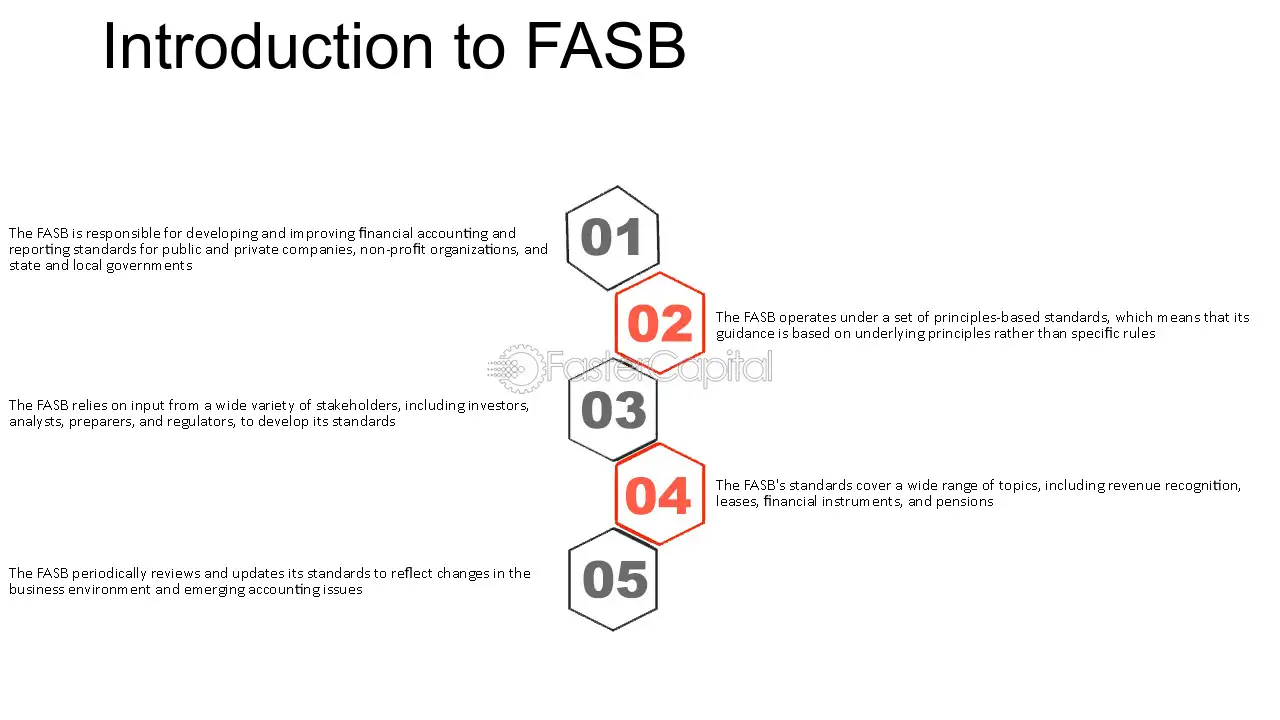

The Financial Accounting Standards Board (FASB) is an independent, private-sector organization that establishes and improves financial accounting and reporting standards for public and private companies in the United States. Its main goal is to provide investors and other users of financial statements with reliable and relevant information to make informed decisions.

Definition

The FASB’s mission is to develop and improve accounting standards that result in useful financial information for decision-making. It aims to ensure transparency, comparability, and consistency in financial reporting, allowing investors and other stakeholders to have confidence in the accuracy and reliability of financial statements.

Role

The FASB plays a crucial role in the accounting profession and financial markets. Its primary responsibilities include:

- Standard Setting: The FASB establishes and updates accounting standards through a transparent and inclusive process. It considers input from various stakeholders, including investors, preparers, auditors, and regulators, to develop standards that address emerging issues and improve financial reporting.

- Guidance Interpretation: The FASB provides guidance and interpretations on accounting standards to help preparers and users of financial statements understand and apply the rules effectively. This ensures consistency and reduces ambiguity in financial reporting.

- Monitoring and Enforcement: The FASB monitors the implementation and compliance with accounting standards. It works closely with the Securities and Exchange Commission (SEC) to enforce compliance and address any issues that may arise.

Overall, the FASB’s role is vital in ensuring the integrity and transparency of financial reporting in the United States. Its standards and guidance provide a consistent framework for companies to prepare and present their financial statements, enabling investors and stakeholders to make informed decisions based on reliable information.

How the FASB Works

The Financial Accounting Standards Board (FASB) is responsible for establishing and improving financial accounting and reporting standards for public and private companies in the United States. The FASB operates through a transparent and inclusive process that involves input from various stakeholders, including investors, auditors, and preparers of financial statements.

Standard-Setting Process

The FASB follows a rigorous standard-setting process to develop accounting standards. This process includes the following steps:

- Identification and prioritization of accounting issues: The FASB identifies and prioritizes accounting issues based on the feedback received from stakeholders and its own research.

- Project initiation: Once an accounting issue is identified, the FASB initiates a project to address the issue. This involves conducting research, gathering information, and consulting with experts.

- Exposure draft: The FASB develops an exposure draft that proposes the new accounting standard or amendment to an existing standard. The exposure draft is made available for public comment, allowing stakeholders to provide feedback.

- Deliberations and redeliberations: The FASB carefully considers the feedback received on the exposure draft and conducts further deliberations to refine the proposed accounting standard.

- Issuance of the final standard: After considering all the feedback and making necessary revisions, the FASB issues the final accounting standard. The standard becomes effective after a specified transition period.

Stakeholder Involvement

The FASB values input from stakeholders throughout the standard-setting process. It actively seeks feedback through public comment periods, public roundtable discussions, and meetings with stakeholders. This ensures that the accounting standards reflect the needs and perspectives of various users of financial statements.

Collaboration with International Accounting Standards Board (IASB)

The FASB collaborates with the International Accounting Standards Board (IASB) to promote the convergence of accounting standards globally. The two boards work together to develop consistent and high-quality accounting standards that can be used by companies operating in different jurisdictions.

| Benefits of the FASB | Challenges Faced by the FASB |

|---|---|

|

|

Emily Bibb simplifies finance through bestselling books and articles, bridging complex concepts for everyday understanding. Engaging audiences via social media, she shares insights for financial success. Active in seminars and philanthropy, Bibb aims to create a more financially informed society, driven by her passion for empowering others.