Exploring the Importance of Gift Letters in Mortgage Transactions

Why are gift letters important?

Additionally, gift letters help prevent fraud in mortgage transactions. By requiring a gift letter, lenders can ensure that the funds being used for the down payment or closing costs are legitimate and not obtained through illegal means. This helps protect both the lender and the borrower from potential legal issues that may arise from fraudulent activities.

What should be included in a gift letter?

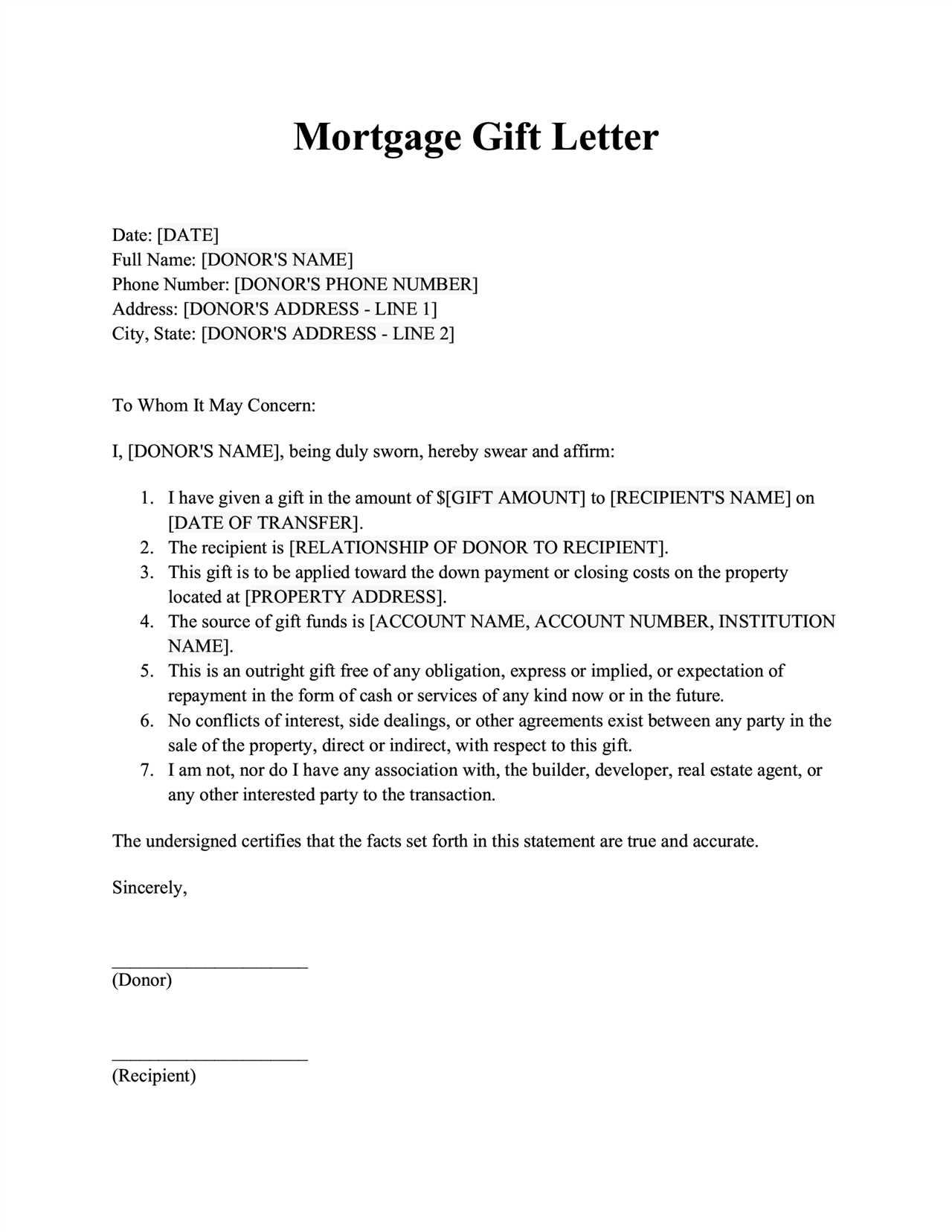

A gift letter should include specific information to be considered valid by lenders. This typically includes:

- The donor’s name, address, and contact information

- The relationship between the donor and the borrower

- The amount of the gift

- A statement confirming that the funds are a gift and not a loan

- The source of the funds (e.g., bank account statement)

- The property address

- The borrower’s name

- The date the gift was given

- The donor’s signature

What happens if a gift letter is not provided?

If a borrower fails to provide a gift letter when using gift funds for a mortgage transaction, it can lead to complications. Lenders may consider the funds as a loan, which can impact the borrower’s debt-to-income ratio and their ability to qualify for the loan. Additionally, without a gift letter, the lender may question the legitimacy of the funds, potentially delaying or even jeopardizing the mortgage approval process.

How Gift Letters Can Help with Down Payments and Debt-to-Income Ratios

A gift letter is a document that confirms that the funds being used for a down payment or closing costs are a gift and not a loan. This letter is typically provided by the person giving the gift, such as a family member or close friend, and is required by most mortgage lenders.

The Importance of Gift Letters

Gift letters are important for several reasons. First, they provide evidence to the mortgage lender that the funds being used for the down payment are not a loan that the borrower will need to repay. This is important because lenders typically have strict guidelines regarding the source of funds for a down payment.

Second, gift letters help lenders assess the borrower’s debt-to-income ratio. The debt-to-income ratio is a measure of the borrower’s monthly debt payments compared to their monthly income. Lenders use this ratio to determine the borrower’s ability to repay the mortgage. By documenting that the down payment funds are a gift, the lender can exclude the monthly repayment of a loan from the borrower’s debt-to-income ratio.

How Gift Letters Can Make a Difference

Gift letters can make a significant difference in the homebuying process. For borrowers who may not have enough savings for a down payment, a gift from a family member or friend can be a lifeline. By providing a gift letter, the donor can help the borrower qualify for a mortgage by providing the necessary down payment funds.

In addition, gift letters can also help borrowers with high debt-to-income ratios. If a borrower has significant monthly debt payments, such as student loans or credit card debt, their debt-to-income ratio may be too high to qualify for a mortgage. However, if a family member or friend provides a gift for the down payment and provides a gift letter, the lender can exclude the monthly repayment of a loan from the borrower’s debt-to-income ratio, potentially improving their chances of loan approval.

Additional Gifting Strategies for Mortgages

1. Family Trusts

One gifting strategy involves utilizing funds from a family trust. If a borrower has a trust set up that allows for gifting, they can use the funds from the trust as a gift for their mortgage. It is important to ensure that the trust documentation clearly states that the funds can be used for this purpose.

2. Intra-family Loans

When utilizing an intra-family loan, it is important to document the loan terms, including the interest rate and repayment schedule, to ensure compliance with mortgage lender requirements.

3. Employer Assistance Programs

Some employers offer assistance programs to help employees with home purchases. These programs may provide funds that can be used as a gift for a mortgage. It is important to check with the employer to understand the specific requirements and documentation needed for this type of gifting strategy.

Employer assistance programs can be a great option for borrowers who have stable employment and are looking to purchase a home.

Overall, there are various gifting strategies that can be utilized to help secure a mortgage. Whether it’s utilizing funds from a family trust, setting up an intra-family loan, or taking advantage of employer assistance programs, these strategies can provide borrowers with the necessary funds to make their homeownership dreams a reality.

Utilizing Gift Funds for Closing Costs and Reserves

A gift letter is a document that outlines the details of a monetary gift from a family member or friend. It serves as proof that the funds are a gift and not a loan that needs to be repaid. This letter is typically required by mortgage lenders to ensure that the borrower is not taking on additional debt to cover these expenses.

Gift funds can be used to cover closing costs, which include fees for services such as appraisals, inspections, and title insurance. These costs can range from 2% to 5% of the total loan amount. By utilizing gift funds, borrowers can avoid having to come up with this money out of pocket.

In addition to closing costs, gift funds can also be used to establish reserves. Reserves are funds set aside to cover future mortgage payments in case of financial hardship. Lenders typically require borrowers to have a certain number of months’ worth of mortgage payments in reserves. By using gift funds, borrowers can meet this requirement without having to deplete their own savings.

Emily Bibb simplifies finance through bestselling books and articles, bridging complex concepts for everyday understanding. Engaging audiences via social media, she shares insights for financial success. Active in seminars and philanthropy, Bibb aims to create a more financially informed society, driven by her passion for empowering others.