Future Value: Definition, Formula, Calculation, Example, and Applications

The future value is a financial concept that calculates the value of an investment or cash flow at a specified date in the future. It is based on the principle of compounding, which takes into account the interest earned on the initial investment or cash flow over time.

Definition

The future value represents the worth of an investment or cash flow at a future date, taking into consideration the interest or return it will earn over time. It is an essential concept in finance and helps individuals and businesses make informed decisions about their investments.

Formula

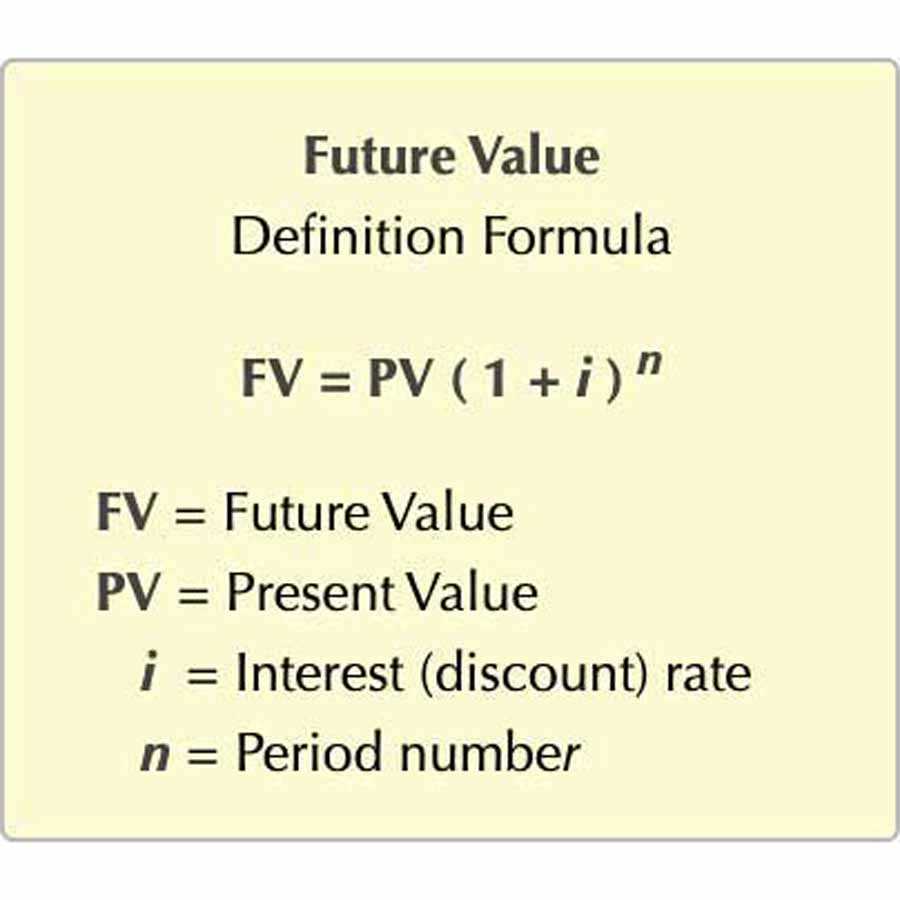

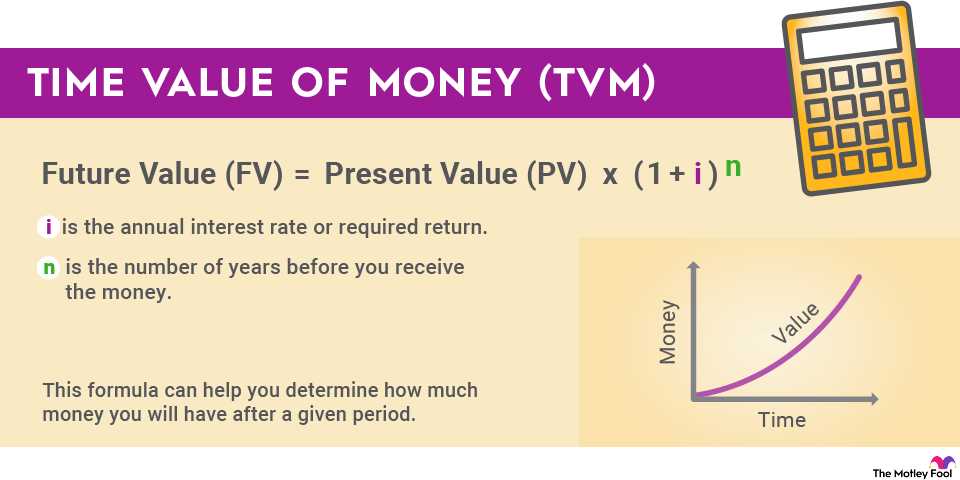

The formula to calculate the future value is:

Future Value = Present Value x (1 + Interest Rate)^Number of Periods

Where:

- Present Value is the initial investment or cash flow

- Interest Rate is the rate at which the investment or cash flow grows

- Number of Periods is the length of time the investment or cash flow will be held

Calculation

To calculate the future value, you need to know the present value, interest rate, and number of periods. Once you have these values, you can plug them into the formula mentioned above to find the future value.

For example, let’s say you have an initial investment of $10,000, an annual interest rate of 5%, and you plan to hold the investment for 5 years. Using the formula, the future value would be:

Future Value = $10,000 x (1 + 0.05)^5 = $12,762.82

Therefore, the future value of the investment after 5 years would be $12,762.82.

Applications

The concept of future value has various applications in finance and investment planning. Some common applications include:

- Retirement Planning: Future value calculations help individuals determine how much they need to save for retirement to achieve their desired financial goals.

- Investment Analysis: Future value calculations assist investors in evaluating the potential returns of different investment opportunities.

- Loan Repayment: Future value calculations can be used to determine the total amount to be repaid on a loan, including interest.

- Business Valuation: Future value calculations are used to estimate the worth of a business based on its projected future cash flows.

What is Future Value?

Future value is a financial concept that refers to the value of an investment or cash flow at a specific point in the future. It is a measure of the potential growth or increase in value of an investment over time. Future value is calculated based on the principle of compound interest, which takes into account the initial investment amount, the interest rate, and the time period.

Future value is an important concept in finance and is used in various financial calculations, such as retirement planning, investment analysis, and loan calculations. It helps investors and financial analysts to evaluate the potential returns and growth of an investment over time.

Formula for Future Value

The formula for calculating future value is:

Future Value = Present Value x (1 + Interest Rate)^Number of Periods

Where:

- Present Value is the initial investment or cash flow

- Interest Rate is the rate at which the investment grows

- Number of Periods is the length of time the investment is held

The formula takes into account the compounding effect of interest, which means that the interest earned in each period is added to the initial investment, resulting in exponential growth over time.

Example of Future Value Calculation

Let’s say you invest $10,000 in a savings account that offers an annual interest rate of 5%. You plan to keep the money in the account for 5 years. To calculate the future value of your investment, you can use the formula:

Future Value = $10,000 x (1 + 0.05)^5

Plugging in the values, the calculation would be:

Future Value = $10,000 x (1.05)^5 = $12,762.82

Therefore, the future value of your investment after 5 years would be approximately $12,762.82.

How to Calculate Future Value?

Calculating the future value of an investment is essential for financial planning and decision-making. By determining the future value, individuals and businesses can assess the potential growth and profitability of their investments over time. The future value calculation takes into account the initial investment, the interest rate, and the time period.

To calculate the future value, you can use the following formula:

Future Value = Present Value x (1 + Interest Rate)^Time

Where:

- Future Value is the value of the investment at a future date.

- Present Value is the initial investment or the current value of the investment.

- Interest Rate is the rate of return or interest earned on the investment.

- Time is the number of periods or years the investment will be held.

Let’s look at an example to better understand how to calculate the future value. Suppose you invest $10,000 in a savings account with an annual interest rate of 5% for a period of 5 years. Using the formula, the future value can be calculated as follows:

Future Value = $10,000 x (1 + 0.05)^5

Simplifying the equation:

Future Value = $10,000 x 1.27628

Future Value = $12,762.80

Therefore, the future value of your investment after 5 years would be $12,762.80.

Emily Bibb simplifies finance through bestselling books and articles, bridging complex concepts for everyday understanding. Engaging audiences via social media, she shares insights for financial success. Active in seminars and philanthropy, Bibb aims to create a more financially informed society, driven by her passion for empowering others.