Functional Obsolescence Definition

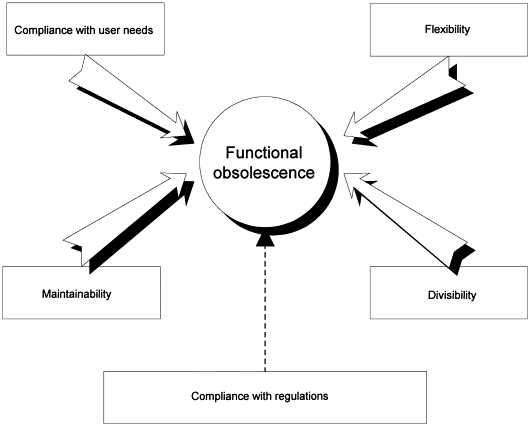

Functional obsolescence refers to a reduction in the desirability or usefulness of a property due to factors that are inherent to the property itself, rather than external factors such as market conditions or location. It occurs when a property’s design, layout, or features become outdated or no longer meet the needs and preferences of potential buyers or tenants.

Functional obsolescence can affect both residential and commercial properties. In residential properties, it can manifest as outdated floor plans, lack of modern amenities, or inadequate storage space. In commercial properties, it can be caused by inefficient layouts, outdated technology infrastructure, or a lack of accessibility.

Functional obsolescence can have a significant impact on the value and marketability of a property. Properties with functional obsolescence may take longer to sell or lease, and they may require renovations or updates to attract buyers or tenants. Additionally, properties with functional obsolescence may sell at a lower price compared to similar properties without these issues.

| Causes of Functional Obsolescence | Examples |

|---|---|

| Technological Advances | Outdated wiring or infrastructure, lack of high-speed internet access |

| Changing Demographics | Shifts in population preferences or needs, such as a decrease in demand for large suburban homes |

| Design and Layout | Awkward floor plans, lack of open-concept living spaces, insufficient storage |

Overall, functional obsolescence is an important concept for real estate investors to understand. By recognizing and addressing functional obsolescence, investors can make informed decisions and maximize the value of their properties.

What is Functional Obsolescence?

Functional obsolescence is a term used in real estate to describe a reduction in the desirability or usefulness of a property due to factors that make it less functional or outdated. It refers to the features or characteristics of a property that no longer meet the needs or preferences of potential buyers or tenants.

Functional obsolescence can occur for various reasons, including technological advances, changing demographics, and design and layout issues. It can affect both residential and commercial properties and can have a significant impact on their value and marketability.

Technological Advances

One common cause of functional obsolescence is technological advances. As technology evolves, certain features or amenities that were once considered desirable may become outdated or less useful. For example, a property with outdated wiring or insufficient electrical outlets may be less appealing to buyers who rely heavily on electronic devices.

Similarly, advancements in home automation and smart technology may make properties without these features less desirable. Buyers may be willing to pay a premium for properties that offer the latest technological conveniences, such as smart thermostats, security systems, or energy-efficient appliances.

Changing Demographics

Design and Layout

The design and layout of a property can also contribute to functional obsolescence. Poorly designed or inefficient layouts can make a property less functional and less appealing to potential buyers or tenants. For example, a property with a confusing or awkward floor plan may be less desirable than one with a more open and functional layout.

Similarly, properties with outdated or impractical features, such as small closets, insufficient storage space, or outdated kitchens and bathrooms, may be considered functionally obsolete. Buyers or tenants may be willing to pay more for properties that offer modern and functional features and amenities.

Examples of Functional Obsolescence

Functional obsolescence refers to a loss in the value or usefulness of a property due to factors that make it less desirable or efficient. Here are some examples of functional obsolescence in real estate:

1. Technological Advances

One common example of functional obsolescence is when a property becomes outdated due to technological advances. For instance, a commercial building may have been designed before the widespread use of computers and may lack the necessary infrastructure for modern technology. This can make the building less attractive to potential tenants or buyers who require advanced technology capabilities.

2. Changing Demographics

Another example of functional obsolescence is when a property no longer meets the needs of the surrounding community due to changing demographics. For example, a shopping mall that was once thriving may become functionally obsolete if the demographics of the area shift and the target market for the mall changes. This can result in decreased foot traffic and lower demand for retail space.

3. Design and Layout

The design and layout of a property can also contribute to functional obsolescence. For instance, a residential building with outdated floor plans or inefficient use of space may be less desirable to potential tenants or buyers. Similarly, a commercial building with an inefficient layout that does not meet the needs of modern businesses may struggle to attract tenants.

Functional obsolescence can have a significant impact on real estate investing. Properties with functional obsolescence may have lower rental rates, longer vacancy periods, and decreased overall value. Investors should carefully consider the potential for functional obsolescence when evaluating real estate opportunities and may need to invest in renovations or updates to mitigate its effects.

Technological Advances

Technological advances play a significant role in causing functional obsolescence in real estate. As technology continues to evolve at a rapid pace, buildings and properties that do not keep up with these advancements can quickly become functionally obsolete.

Impact on Real Estate Investing

On the other hand, investing in properties that embrace technological advancements can provide a competitive edge in the market. Properties with smart home features, renewable energy systems, and modern communication infrastructure may attract higher-quality tenants or buyers and command higher rental or sale prices.

Real estate investors should stay informed about emerging technologies and trends in the industry to make informed investment decisions. They should consider the potential for functional obsolescence when evaluating properties and prioritize those that align with the demands of the modern market.

| Advantages | Disadvantages |

|---|---|

| Higher demand and rental/sale prices | Decreased demand and lower rental/sale prices |

| Attract higher-quality tenants or buyers | Longer vacancy periods |

| Competitive edge in the market | Less desirable to potential buyers or tenants |

Changing Demographics

For example, a neighborhood that was once popular with young families may see a decline in demand if the population starts to age and younger families prefer to live in other areas. Similarly, changes in lifestyle trends, such as a shift towards urban living or a preference for eco-friendly homes, can also impact the desirability of certain properties.

Changing demographics can also affect commercial real estate. For instance, a shopping center that was once thriving may struggle to attract customers if the surrounding area experiences a decline in population or a shift in consumer preferences. This can lead to vacant storefronts and decreased rental income for property owners.

Adapting to Changing Demographics

In order to mitigate the impact of changing demographics on real estate investments, it is important for investors to stay informed about demographic trends and adapt their strategies accordingly. This may involve conducting market research to identify emerging markets or target demographics that are likely to drive demand in the future.

Investors can also consider making renovations or updates to properties in order to appeal to changing demographics. For example, if a neighborhood is becoming popular with young professionals, adding amenities such as co-working spaces or fitness centers can make a property more attractive to this target market.

Furthermore, investors can explore alternative uses for properties that may be experiencing functional obsolescence due to changing demographics. For instance, a vacant retail space in a declining neighborhood could be repurposed as office space or converted into residential units to meet the demand of a different demographic.

Design and Layout

Design and layout are important factors that can contribute to functional obsolescence in real estate. As trends and preferences change, buildings that were once considered well-designed and functional may become outdated and less desirable.

For example, a building with a closed floor plan and small, segmented rooms may no longer meet the needs of modern tenants who prefer open-concept spaces and flexible layouts. Similarly, buildings with outdated exterior designs or inefficient use of space may be less attractive to potential buyers or tenants.

Additionally, changes in technology and the way people use spaces can also impact the design and layout of buildings. For instance, the rise of remote work and the need for home offices may lead to a higher demand for buildings with dedicated workspaces or flexible areas that can be easily converted into office spaces.

When investing in real estate, it is important to consider the design and layout of a property to assess its potential for functional obsolescence. Buildings that have outdated or impractical designs may require costly renovations or may struggle to attract tenants or buyers in the future.

| Factors contributing to design and layout functional obsolescence: |

|---|

| Outdated floor plans |

| Segmented rooms |

| Inefficient use of space |

| Outdated exterior designs |

| Lack of flexible spaces |

Investors should carefully evaluate the design and layout of a property before making a purchase to ensure its long-term viability and potential for future demand.

How Functional Obsolescence Affects Real Estate Investing

Functional obsolescence is a term used in real estate investing to describe a reduction in the value or desirability of a property due to factors that make it less functional or outdated. This can have a significant impact on the profitability and success of real estate investments.

When a property suffers from functional obsolescence, it may be less attractive to potential tenants or buyers, resulting in longer vacancy periods and lower rental or sale prices. As an investor, it is important to understand how functional obsolescence can affect your investment strategy and make informed decisions to mitigate its impact.

One of the main causes of functional obsolescence is technological advances. As new technologies emerge, older properties may become outdated and less functional. For example, a commercial building without modern wiring or internet connectivity may be less appealing to businesses that rely heavily on technology. This can result in lower demand for the property and lower rental rates.

The design and layout of a property can also contribute to functional obsolescence. If a property has an inefficient or outdated layout, it may not meet the needs of modern tenants or buyers. For example, a retail space with limited parking or a residential property with small, cramped rooms may be less desirable and command lower rental or sale prices.

As a real estate investor, it is important to carefully assess the potential for functional obsolescence when evaluating investment opportunities. Consider the current and future demand for the property, as well as any factors that may contribute to its functional obsolescence. This can help you make informed decisions and mitigate the risks associated with functional obsolescence.

| Factors to Consider | Impact on Real Estate Investment |

|---|---|

| Technological Advances | Lower demand, lower rental/sale prices |

| Changing Demographics | Decreased demand, lower rental/sale prices |

| Design and Layout | Lower demand, lower rental/sale prices |

Emily Bibb simplifies finance through bestselling books and articles, bridging complex concepts for everyday understanding. Engaging audiences via social media, she shares insights for financial success. Active in seminars and philanthropy, Bibb aims to create a more financially informed society, driven by her passion for empowering others.