What is XBRL?

XBRL, or eXtensible Business Reporting Language, is a standardized language for the electronic communication of business and financial data. It is designed to improve the accuracy, reliability, and usability of financial reporting.

XBRL allows companies to tag their financial data using a standardized set of tags, which makes it easier for investors, analysts, and regulators to analyze and compare financial information across different companies and industries. The tags provide a consistent way to identify and describe financial data, such as revenues, expenses, assets, and liabilities.

XBRL is based on XML, a widely used language for structuring and exchanging data on the internet. It is an open standard, which means that anyone can use it without having to pay royalties or license fees.

Key Features of XBRL

- Standardized Tags: XBRL uses a standardized set of tags to describe financial data, making it easier to compare and analyze information.

- Flexibility: XBRL allows companies to create their own custom tags to describe unique aspects of their financial data.

- Machine Readable: XBRL tags can be read and processed by computers, enabling automated analysis and reporting.

- Improved Accuracy: XBRL reduces the risk of errors and inconsistencies in financial reporting by providing a standardized format for data exchange.

- Efficiency: XBRL streamlines the financial reporting process, making it faster and more cost-effective.

Overall, XBRL is a powerful tool that enhances the transparency and efficiency of financial reporting, benefiting both companies and investors.

Benefits of XBRL for Investors

XBRL, or eXtensible Business Reporting Language, offers several benefits for investors. This standardized format for financial reporting allows investors to easily access and analyze financial information from various companies in a consistent and structured manner. Here are some of the key benefits of XBRL for investors:

| 1. Improved Efficiency | XBRL eliminates the need for manual data entry and analysis, saving investors time and effort. With XBRL, financial data can be automatically extracted and analyzed using software tools, allowing investors to quickly identify trends and make informed investment decisions. |

| 2. Enhanced Accuracy | XBRL reduces the risk of errors and inconsistencies in financial reporting. By using standardized tags and definitions, XBRL ensures that financial data is accurately represented and can be easily compared across different companies and periods. |

| 3. Increased Transparency | XBRL promotes transparency in financial reporting by providing investors with access to detailed and granular financial information. Investors can drill down into the data and analyze specific aspects of a company’s financial performance, such as revenue, expenses, and cash flows. |

| 4. Better Comparability | XBRL enables investors to compare financial data across different companies and industries. By using standardized tags, XBRL ensures that financial information is presented in a consistent format, making it easier for investors to identify similarities and differences between companies. |

| 5. Real-time Access | XBRL allows investors to access financial information in real-time. With XBRL, companies can publish their financial reports in a machine-readable format, which can be instantly accessed and analyzed by investors. This real-time access to financial data enables investors to make timely investment decisions. |

Overall, XBRL provides investors with a powerful tool for analyzing financial information in a standardized and efficient manner. By leveraging XBRL, investors can save time, improve accuracy, enhance transparency, facilitate comparability, and gain real-time access to financial data.

How XBRL Works

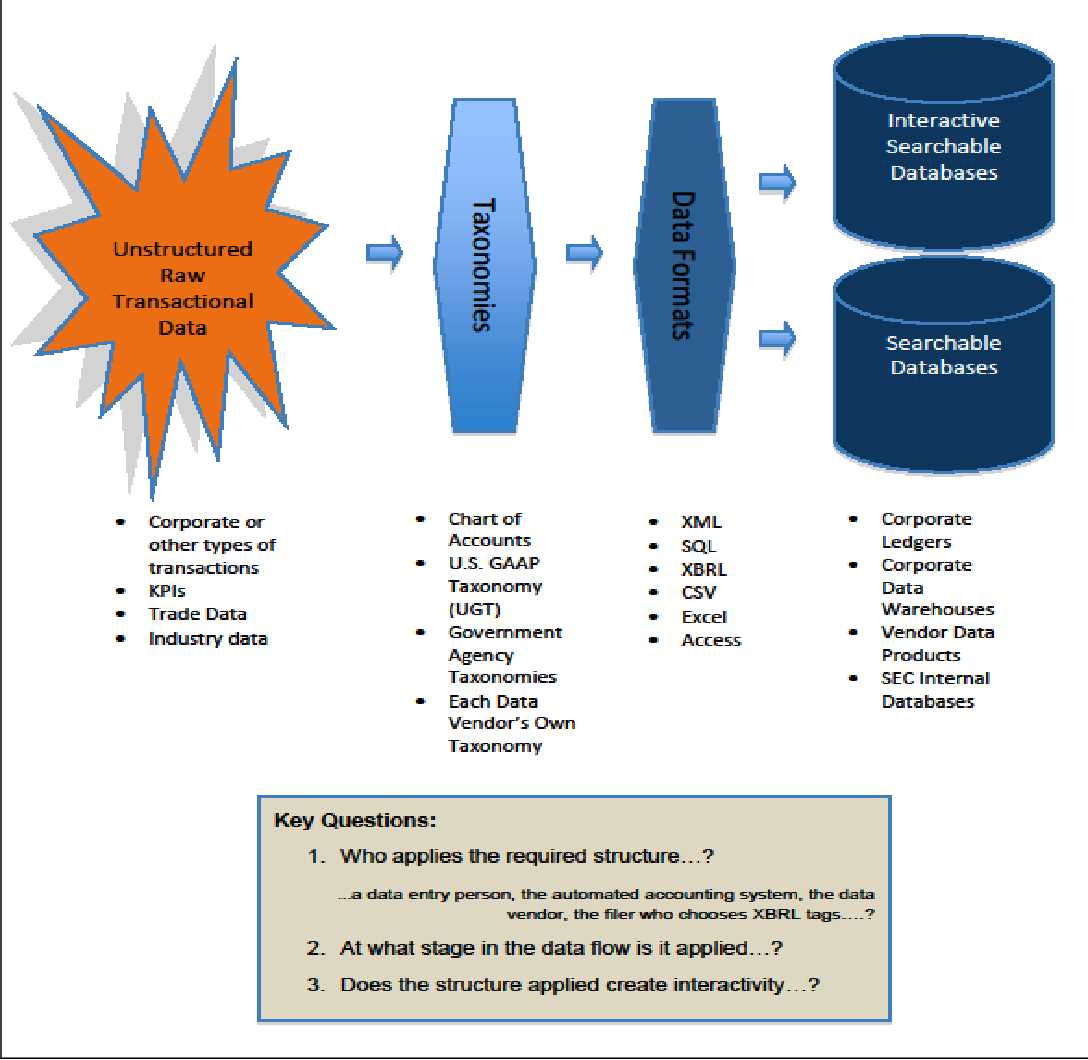

XBRL, or eXtensible Business Reporting Language, is a standardized language used for the electronic communication of business and financial data. It allows companies to easily exchange financial information with investors, regulators, and other stakeholders. XBRL works by tagging data in financial statements with specific codes that identify the information being reported.

When a company prepares its financial statements, it assigns XBRL tags to each individual piece of data, such as revenue, expenses, assets, and liabilities. These tags are based on a standardized taxonomy, which is a predefined set of codes that represent different financial concepts. The taxonomy ensures that the data is consistently labeled and can be easily understood by users.

One of the key benefits of XBRL is its ability to automate the process of data collection and analysis. With XBRL, companies no longer need to manually input data into spreadsheets or reformat financial statements for different purposes. Instead, they can simply tag the data once and it can be easily reused for various reporting requirements.

Furthermore, XBRL allows for greater transparency and accuracy in financial reporting. The standardized tags ensure that data is consistently labeled and can be easily understood by users. This reduces the risk of errors and inconsistencies in financial statements, improving the reliability of the information.

In addition, XBRL enables investors to quickly and efficiently analyze financial data. They can easily compare and benchmark companies based on specific financial metrics, such as revenue growth, profitability, and liquidity. This allows investors to make more informed decisions and identify potential investment opportunities.

Overall, XBRL revolutionizes the way financial information is reported and analyzed. It streamlines the reporting process, improves data accuracy, and enhances transparency for investors. By adopting XBRL, companies can save time and resources, while investors can access timely and reliable financial information for better decision-making.

XBRL Implementation in Financial Reporting

Implementing XBRL in financial reporting has numerous benefits for both companies and investors. By using XBRL, companies can streamline their financial reporting process and improve the accuracy and consistency of their financial data. This is achieved through the use of standardized tags that categorize and label financial information, making it easier to analyze and compare across different companies and industries.

One of the key advantages of XBRL is its ability to automate the extraction and analysis of financial data. Instead of manually inputting data into spreadsheets or databases, companies can use XBRL-enabled software to automatically extract financial information from their accounting systems and generate XBRL reports. This not only saves time and reduces the risk of errors, but also allows for real-time reporting and analysis.

Benefits for Investors

XBRL provides several benefits for investors. Firstly, it improves the transparency and comparability of financial information. With XBRL, investors can easily access and analyze financial reports from different companies in a standardized format, allowing for more accurate and efficient comparison of financial performance.

Secondly, XBRL enables investors to perform more detailed and granular analysis of financial data. By using the standardized tags provided by XBRL, investors can drill down into specific financial elements and compare them across different companies and periods. This level of detail and flexibility can help investors make more informed investment decisions.

Furthermore, XBRL facilitates the integration of financial data into investment analysis tools and platforms. Many financial analysis tools and platforms are now equipped with XBRL capabilities, allowing investors to easily import XBRL data and perform advanced analysis and modeling. This integration of XBRL data into investment tools enhances the efficiency and accuracy of investment analysis.

Resources for Learning More about XBRL

If you are interested in learning more about eXtensible Business Reporting Language (XBRL) and its applications in financial reporting, there are several resources available to help you expand your knowledge. Whether you are an investor, a financial professional, or simply curious about this technology, these resources can provide valuable insights and information.

1. XBRL International

XBRL International is a global consortium that promotes the adoption and use of XBRL. Their website offers a wealth of information, including educational materials, case studies, and technical documentation. They also organize conferences and events where you can learn from industry experts and network with other professionals.

2. Securities and Exchange Commission (SEC)

The SEC requires companies to submit financial statements in XBRL format. Their website provides access to XBRL filings, which can be a valuable resource for investors looking to analyze financial data. Additionally, the SEC offers guidance and resources on XBRL implementation and best practices.

3. Financial Accounting Standards Board (FASB)

The FASB is responsible for setting accounting standards in the United States. They have developed the US GAAP Financial Reporting Taxonomy, which is a standardized set of XBRL tags for financial statements. Their website provides resources and educational materials on XBRL implementation and usage.

4. XBRL US

XBRL US is a nonprofit organization that promotes the use of XBRL in the United States. They offer educational programs, webinars, and conferences to help individuals and organizations understand and implement XBRL. Their website also provides access to XBRL tools and resources.

5. Professional Associations and Industry Groups

Many professional associations and industry groups offer resources and educational materials on XBRL. For example, the CFA Institute, the Institute of Management Accountants (IMA), and the American Institute of Certified Public Accountants (AICPA) all provide guidance and training on XBRL for their members.

Emily Bibb simplifies finance through bestselling books and articles, bridging complex concepts for everyday understanding. Engaging audiences via social media, she shares insights for financial success. Active in seminars and philanthropy, Bibb aims to create a more financially informed society, driven by her passion for empowering others.