Formula and Calculations

EDITDAR = (Earnings Before Interest, Taxes, Depreciation, Amortization, and Rent) / Total Assets

This formula allows you to determine the efficiency of a company’s use of its assets to generate earnings. By dividing the earnings before certain expenses by the total assets, you can get a ratio that represents the company’s ability to generate profits from its assets.

Let’s break down the formula:

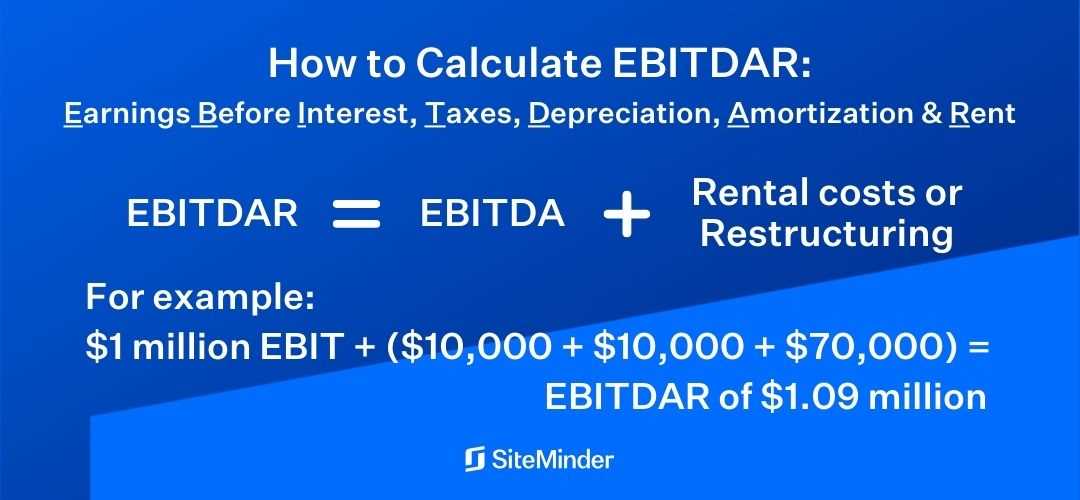

Earnings Before Interest, Taxes, Depreciation, Amortization, and Rent (EBITDAR)

EBITDAR is a measure of a company’s operating performance. It represents the earnings generated by the company before deducting interest, taxes, depreciation, amortization, and rent expenses. This metric is often used to analyze the profitability of a company’s core operations.

Total Assets

Total assets refer to all the resources owned by a company that have economic value. This includes tangible assets such as buildings, equipment, and inventory, as well as intangible assets such as patents, trademarks, and goodwill. Total assets provide a snapshot of a company’s financial health and its ability to generate future cash flows.

Once you have the values for EBITDAR and total assets, you can simply divide EBITDAR by total assets to calculate the EDITDAR ratio.

Meaning of EDITDAR

EDITDAR is a measure of a company’s operating performance, as it excludes non-operating expenses such as interest, taxes, and depreciation. By focusing on the core earnings generated by a company’s operations, EDITDAR provides a clearer picture of its profitability.

The formula for calculating EDITDAR is:

By subtracting operating expenses from revenue and adding back depreciation and amortization, EDITDAR represents the earnings generated solely from a company’s operations.

EDITDAR is commonly used in industries such as hospitality, transportation, and retail, where rent is a significant operating expense. Including rent in the calculation provides a more accurate representation of a company’s profitability.

Overall, EDITDAR is a useful metric for evaluating a company’s operating performance and profitability. It provides a clearer picture of the earnings generated solely from its operations, making it a valuable tool for investors, analysts, and stakeholders.

Formula and Calculations

The EDITDAR formula is a simple calculation that allows businesses to determine the efficiency and profitability of their operations. It is calculated by dividing the earnings before interest, depreciation, taxes, and amortization (EBITDA) by the average total assets.

The formula for EDITDAR is as follows:

EDITDAR = EBITDA / Average Total Assets

To calculate the EDITDAR, you need to have the EBITDA and the average total assets of the business. EBITDA is a measure of a company’s operating performance and is calculated by adding back interest, taxes, depreciation, and amortization to the net income. The average total assets can be calculated by adding the total assets at the beginning and end of a specific period and dividing it by two.

Once you have the EBITDA and average total assets, you can use the formula to calculate the EDITDAR. The result will be a ratio that indicates how efficiently a company is using its assets to generate earnings before interest, depreciation, taxes, and amortization.

Example:

Let’s say a company has an EBITDA of $500,000 and average total assets of $2,000,000. Using the EDITDAR formula, we can calculate the efficiency ratio as follows:

EDITDAR = $500,000 / $2,000,000 = 0.25 or 25%

This means that for every dollar of average total assets, the company generates 25 cents of earnings before interest, depreciation, taxes, and amortization. A higher EDITDAR ratio indicates better efficiency and profitability.

Example of EDITDAR

Let’s consider an example to understand how EDITDAR is calculated and how it can be used to evaluate a company’s financial performance.

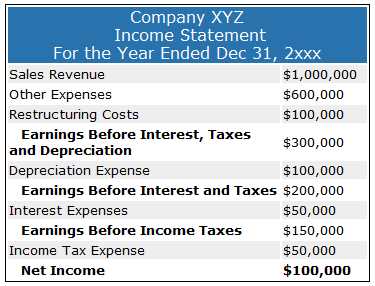

Company XYZ

Company XYZ is a manufacturing company that produces electronic devices. Let’s assume that the company’s net income for the last fiscal year was $1,000,000. The company’s total assets at the end of the year were $10,000,000, and the total liabilities were $5,000,000.

To calculate EDITDAR, we need to first determine the company’s interest expense. Let’s assume that the interest expense for the year was $500,000.

Using the formula for EDITDAR, we can calculate it as follows:

EDITDAR = $1,500,000 / $5,000,000

EDITDAR = 0.3

Therefore, the EDITDAR ratio for Company XYZ is 0.3. This means that for every dollar of the company’s total assets minus total liabilities, it generates 30 cents of earnings before interest, depreciation, taxes, amortization, and rent.

By comparing the EDITDAR ratio of Company XYZ with other companies in the same industry or with the company’s historical performance, investors and analysts can assess the company’s financial health and operational efficiency. A higher EDITDAR ratio indicates better profitability and financial performance.

Pros and Cons of Using EDITDAR

EDITDAR, or Economic Depreciation, Interest, Taxes, and Amortization of R&D, is a financial metric that provides insights into the profitability and financial health of a company. While it can be a useful tool for decision-making, it is important to consider the pros and cons before relying solely on this metric.

Pros:

1. Comprehensive Analysis: EDITDAR takes into account various financial factors, including depreciation, interest expenses, taxes, and amortization of research and development costs. This comprehensive analysis provides a holistic view of a company’s financial performance and helps in making informed decisions.

2. Comparability: EDITDAR allows for easy comparison between companies operating in the same industry. By normalizing the effects of different accounting practices, it provides a level playing field for evaluating financial performance.

3. Focus on Long-Term Value: By considering the amortization of research and development costs, EDITDAR focuses on the long-term value creation of a company. This is particularly important for technology-driven industries where R&D investments are critical for future growth.

Cons:

3. Limited Scope: EDITDAR focuses primarily on the financial aspects of a company and may not capture other important factors such as market dynamics, competitive landscape, and management quality. It should be used in conjunction with other metrics and qualitative analysis for a comprehensive evaluation.

4. Lack of Standardization: There is no standardized methodology for calculating EDITDAR, which can lead to inconsistencies in its interpretation and comparability across companies. It is important to understand the specific formula and assumptions used when comparing EDITDAR values.

Emily Bibb simplifies finance through bestselling books and articles, bridging complex concepts for everyday understanding. Engaging audiences via social media, she shares insights for financial success. Active in seminars and philanthropy, Bibb aims to create a more financially informed society, driven by her passion for empowering others.