What is Downside Risk?

Downside risk refers to the potential for an investment or portfolio to experience losses or negative returns. It is a measure of the uncertainty and potential downside that an investor faces when making investment decisions.

Investors are typically risk-averse and want to minimize the likelihood and magnitude of losses. Downside risk helps investors assess the potential downside of an investment and make informed decisions based on their risk tolerance and investment objectives.

Downside risk can be caused by various factors, including market volatility, economic downturns, company-specific risks, and unforeseen events. It is important for investors to understand and manage downside risk to protect their investments and achieve their financial goals.

Investors can use various risk management techniques to mitigate downside risk, such as diversification, hedging, and setting stop-loss orders. Diversification involves spreading investments across different asset classes, sectors, and geographic regions to reduce the impact of any single investment’s negative performance. Hedging involves using financial instruments, such as options or futures, to offset potential losses in an investment. Stop-loss orders are instructions to sell an investment if it reaches a certain price, limiting potential losses.

Definition of Downside Risk

Downside risk is a concept in risk management that refers to the potential loss or negative impact that an investment or portfolio may experience. It is the opposite of upside potential, which represents the potential for gains or positive outcomes.

Downside risk is an important consideration for investors and fund managers, as it helps them assess the potential downside of an investment and make informed decisions. It is particularly relevant for those who have a low tolerance for losses or are risk-averse.

Downside risk can be caused by various factors, including market volatility, economic downturns, company-specific issues, and unforeseen events. It is important to note that downside risk is not limited to financial investments but can also apply to other areas such as business ventures or personal decisions.

Measuring Downside Risk

There are several methods to measure downside risk, with some common approaches including:

- Standard Deviation: This statistical measure calculates the dispersion of returns around the mean. A higher standard deviation indicates higher downside risk.

- Value at Risk (VaR): VaR measures the maximum potential loss within a specified confidence level. It provides an estimate of the worst-case scenario for an investment.

By using these methods, investors and fund managers can assess the potential downside risk of an investment and take appropriate risk mitigation measures. This may include diversifying the portfolio, setting stop-loss orders, or implementing hedging strategies.

Example of Downside Risk

Scenario:

Suppose you have invested in a stock portfolio consisting of five different stocks. The value of each stock and its weightage in the portfolio are as follows:

Now, let’s assume that the overall market experiences a downturn, and the value of each stock in your portfolio decreases by a certain percentage. The downside risk is the potential loss you may incur due to this market downturn.

Calculation:

To calculate the downside risk, you need to consider the weightage of each stock in the portfolio and the percentage decrease in their values. Let’s assume that the market downturn causes the following percentage decrease in the value of each stock:

- Stock A: -5%

- Stock B: -8%

- Stock C: -10%

- Stock D: -6%

- Stock E: -12%

Now, let’s calculate the downside risk for each stock:

- Stock A: Downside Risk = Weightage (30%) * Percentage Decrease (-5%) = -1.5%

- Stock B: Downside Risk = Weightage (20%) * Percentage Decrease (-8%) = -1.6%

- Stock C: Downside Risk = Weightage (15%) * Percentage Decrease (-10%) = -1.5%

- Stock D: Downside Risk = Weightage (25%) * Percentage Decrease (-6%) = -1.5%

- Stock E: Downside Risk = Weightage (10%) * Percentage Decrease (-12%) = -1.2%

Finally, to calculate the overall downside risk of the portfolio, you need to sum up the downside risks of each stock:

Overall Downside Risk = -1.5% + -1.6% + -1.5% + -1.5% + -1.2% = -7.3%

How to Calculate Downside Risk

Calculating downside risk is an important step in risk management. It helps investors and analysts understand the potential losses associated with an investment or portfolio. Here are the steps to calculate downside risk:

Step 1: Gather Historical Data

The first step in calculating downside risk is to gather historical data on the investment or portfolio. This data should include the returns or prices for a specific time period, such as daily, monthly, or yearly.

Step 2: Calculate the Average Return

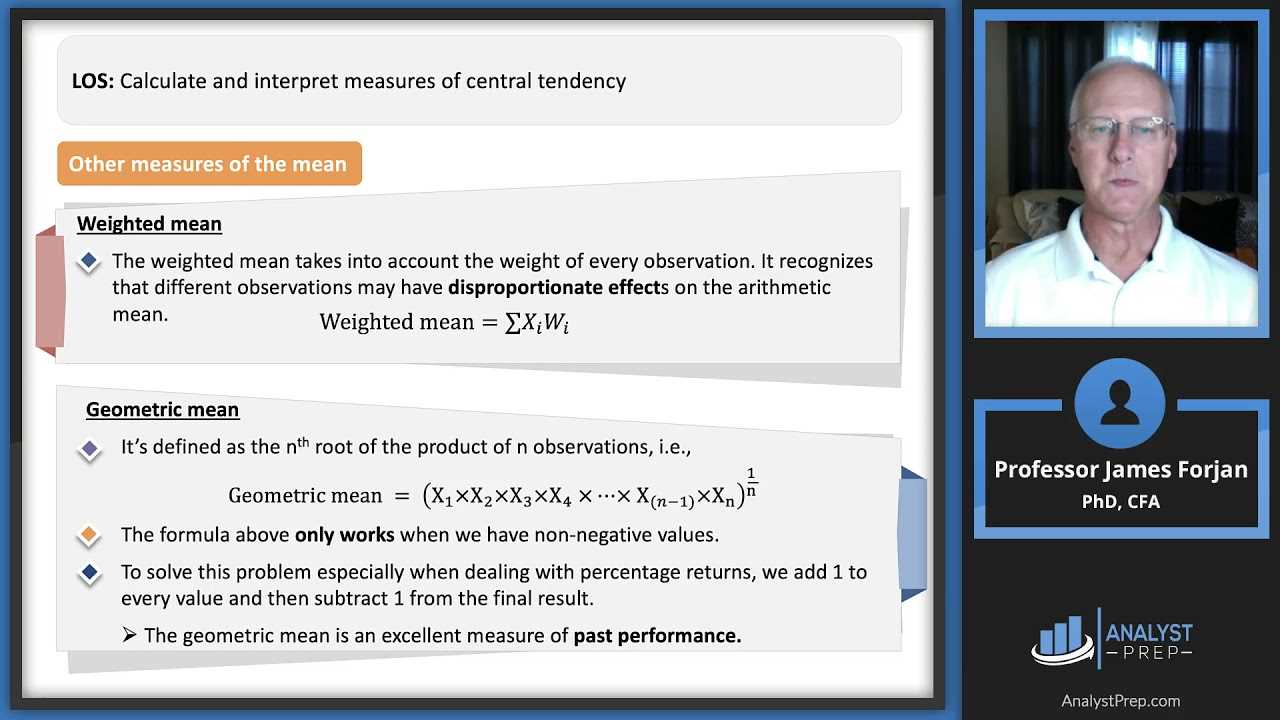

Next, calculate the average return for the investment or portfolio over the chosen time period. This can be done by summing up all the returns and dividing by the number of data points.

Step 3: Calculate the Deviation from the Average

For each data point, calculate the deviation from the average return. This can be done by subtracting the average return from each individual return.

Step 4: Square the Deviations

Square each deviation calculated in step 3. This step is important because it eliminates the negative signs and emphasizes the magnitude of the deviations.

Step 5: Calculate the Variance

Calculate the variance by summing up all the squared deviations and dividing by the number of data points. The variance represents the average squared deviation from the average return.

Step 6: Calculate the Downside Deviation

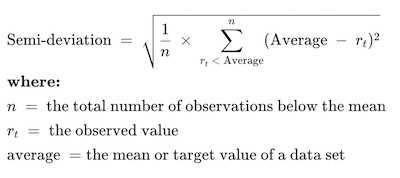

The downside deviation is a measure of the volatility of the negative returns. To calculate the downside deviation, first identify a threshold return below which returns are considered negative. Then, for each negative return, calculate the deviation from the threshold return and square it. Finally, calculate the average of the squared deviations.

Step 7: Calculate the Downside Risk

The downside risk is the square root of the downside deviation. It represents the standard deviation of the negative returns and provides an estimate of the potential losses associated with the investment or portfolio.

Emily Bibb simplifies finance through bestselling books and articles, bridging complex concepts for everyday understanding. Engaging audiences via social media, she shares insights for financial success. Active in seminars and philanthropy, Bibb aims to create a more financially informed society, driven by her passion for empowering others.