What is Double Entry Accounting?

For example, when a company purchases inventory for cash, the inventory account is debited, representing an increase in assets, while the cash account is credited, representing a decrease in assets. This dual entry system provides a clear and accurate picture of the company’s financial position and helps in identifying any errors or discrepancies.

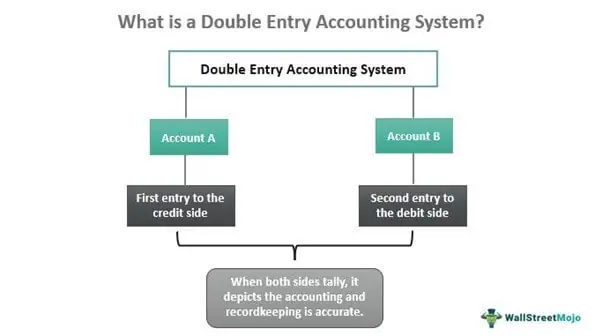

Double entry accounting is a fundamental concept in financial management that ensures accurate and reliable record-keeping. It is based on the principle that every financial transaction has two equal and opposite effects on the accounting equation, which consists of assets, liabilities, and equity.

At its core, double entry accounting follows the principle of duality, which means that for every debit entry, there must be a corresponding credit entry. This system allows for the tracking and balancing of all financial transactions, providing a clear and comprehensive picture of a company’s financial health.

The Accounting Equation

When a transaction occurs, it is recorded in the general ledger using debits and credits. Debits represent increases in assets or expenses and decreases in liabilities or equity, while credits represent decreases in assets or expenses and increases in liabilities or equity.

Recording Transactions

By following these principles, double entry accounting ensures that all financial transactions are accurately recorded and that the accounting equation remains in balance.

Conclusion

The Importance of Double Entry Accounting

Double entry accounting is a fundamental concept in financial management that plays a crucial role in ensuring accuracy and reliability of financial information. It is a system where every financial transaction is recorded in at least two accounts, with one account debited and another account credited.

The importance of double entry accounting cannot be overstated. It provides a systematic and organized approach to record and track financial transactions, which helps in preventing errors and fraud. By maintaining a balance between debits and credits, double entry accounting ensures that the books of accounts are always in equilibrium.

Double entry accounting also enables businesses to identify and rectify errors quickly. Since every transaction has an equal and opposite effect on the accounts, any discrepancy can be easily traced back to its source. This helps in maintaining the integrity of financial records and ensuring the reliability of financial information.

Furthermore, double entry accounting facilitates effective financial management by providing valuable insights into the financial performance and health of a business. It allows for the calculation of key financial ratios and metrics, which are essential for evaluating profitability, liquidity, and solvency. These insights enable management to make informed decisions and take appropriate actions to improve the financial well-being of the business.

Ensuring Accuracy and Reliability in Financial Management

Double entry accounting plays a crucial role in ensuring accuracy and reliability in financial management. By following the principles of double entry accounting, businesses can maintain a systematic and organized approach to recording their financial transactions.

One of the key advantages of double entry accounting is its ability to provide a checks and balances system. Every financial transaction is recorded in at least two accounts, with one account debited and the other credited. This ensures that the accounting equation, which states that assets must equal liabilities plus equity, is always balanced.

With this checks and balances system, any errors or discrepancies in the financial records can be easily identified and corrected. If the accounting equation does not balance, it indicates that there is an error in the recording of the transactions. This allows businesses to promptly identify and rectify any mistakes, ensuring the accuracy of their financial statements.

Moreover, double entry accounting provides a clear audit trail. Each transaction is recorded with a date, description, and the accounts affected. This level of detail allows for easy tracking and analysis of financial transactions, making it easier to identify any irregularities or fraudulent activities.

The Importance of Reliable Financial Information

Accurate and reliable financial information is crucial for making informed business decisions. It provides insights into the financial health of a business, helps in assessing profitability, and aids in planning for the future.

By implementing double entry accounting, businesses can ensure that their financial information is reliable and trustworthy. This is especially important for external stakeholders such as investors, lenders, and regulatory authorities who rely on accurate financial statements to make decisions.

Additionally, reliable financial information enables businesses to conduct thorough financial analysis. By comparing financial statements over different periods, businesses can identify trends, assess their financial performance, and make strategic decisions to improve profitability.

Conclusion

Double entry accounting is a fundamental concept in financial management that ensures accuracy and reliability in recording and reporting financial transactions. By implementing this system, businesses can maintain a checks and balances system, easily identify errors, and provide reliable financial information for decision making and analysis.

Overall, the benefits of double entry accounting are numerous, making it an essential tool for businesses of all sizes. By following the principles of double entry accounting, businesses can ensure the accuracy and reliability of their financial records, enabling them to make informed decisions and drive success.

Benefits of Double Entry Accounting

Double entry accounting is a fundamental concept in financial management that offers several benefits to businesses. By using this method, companies can ensure accuracy and reliability in their financial records, which is crucial for making informed decisions and conducting effective financial analysis.

Here are some key benefits of double entry accounting:

- Accuracy: Double entry accounting provides a systematic and precise way of recording financial transactions. Each transaction is recorded in at least two accounts, ensuring that debits and credits are always balanced. This accuracy helps in identifying errors and preventing fraud.

- Reliability: With double entry accounting, businesses can rely on their financial records to provide an accurate representation of their financial position. This is important for stakeholders such as investors, lenders, and regulators, who need reliable information to make decisions.

- Financial Analysis: Double entry accounting allows for more detailed financial analysis. By having a complete record of all transactions, businesses can generate various financial reports, such as balance sheets, income statements, and cash flow statements. These reports provide insights into the company’s performance and help in making strategic decisions.

- Decision Making: Double entry accounting enables better decision making by providing a clear picture of the financial health of the business. Managers can analyze financial data to assess profitability, liquidity, and solvency, and make informed decisions based on this information.

- Auditing and Compliance: Double entry accounting facilitates auditing and ensures compliance with financial regulations. The detailed records make it easier for auditors to verify the accuracy of financial statements and identify any discrepancies or irregularities.

- Business Growth: By maintaining accurate and reliable financial records, businesses can attract investors and secure financing for growth. Lenders and investors are more likely to trust companies that follow double entry accounting practices, as it demonstrates financial responsibility and transparency.

Improved Decision Making and Financial Analysis

Double entry accounting plays a crucial role in improving decision making and financial analysis for businesses. By maintaining accurate and reliable financial records, businesses can make informed decisions based on real-time data.

By having access to detailed financial information, businesses can analyze their revenue streams, identify areas of growth, and make strategic decisions to optimize their operations. They can also identify any financial risks or inefficiencies and take appropriate measures to mitigate them.

Furthermore, double entry accounting enables businesses to conduct financial analysis to evaluate their profitability, liquidity, and solvency. They can calculate important financial ratios such as gross profit margin, return on investment, and current ratio to assess their financial health.

Financial analysis helps businesses identify trends, patterns, and potential opportunities or challenges. It allows them to compare their performance with industry benchmarks and competitors, enabling them to make data-driven decisions.

Moreover, double entry accounting facilitates forecasting and budgeting processes. By analyzing historical financial data, businesses can project future revenues, expenses, and cash flows. This helps them create realistic budgets and set achievable financial goals.

Overall, improved decision making and financial analysis through double entry accounting can lead to better financial management and long-term success for businesses. It provides them with the necessary tools and insights to make informed decisions, allocate resources effectively, and drive growth.

Emily Bibb simplifies finance through bestselling books and articles, bridging complex concepts for everyday understanding. Engaging audiences via social media, she shares insights for financial success. Active in seminars and philanthropy, Bibb aims to create a more financially informed society, driven by her passion for empowering others.