What is Direct Foreign Investment?

Direct foreign investment refers to when a company or individual from one country invests in a business or project located in another country. This investment can take various forms, such as acquiring a controlling stake in a foreign company, establishing a new subsidiary or branch in a foreign market, or participating in a joint venture with a local partner.

Direct foreign investment is driven by the desire to expand operations into new markets, access resources or technology, gain a competitive advantage, or diversify business activities. It allows companies to establish a physical presence in a foreign country, which can provide them with better market insights, closer proximity to customers, and the ability to adapt to local market conditions.

Direct foreign investment plays a crucial role in promoting economic growth and development in both the investing and recipient countries. It creates job opportunities, fosters technology transfer, stimulates innovation, and contributes to the overall improvement of infrastructure and living standards.

However, direct foreign investment is not without risks. Political instability, regulatory changes, currency fluctuations, cultural differences, and economic uncertainties can pose challenges to foreign investors. Therefore, careful analysis and assessment of the investment climate, market potential, and legal framework of the host country are essential before making a direct foreign investment.

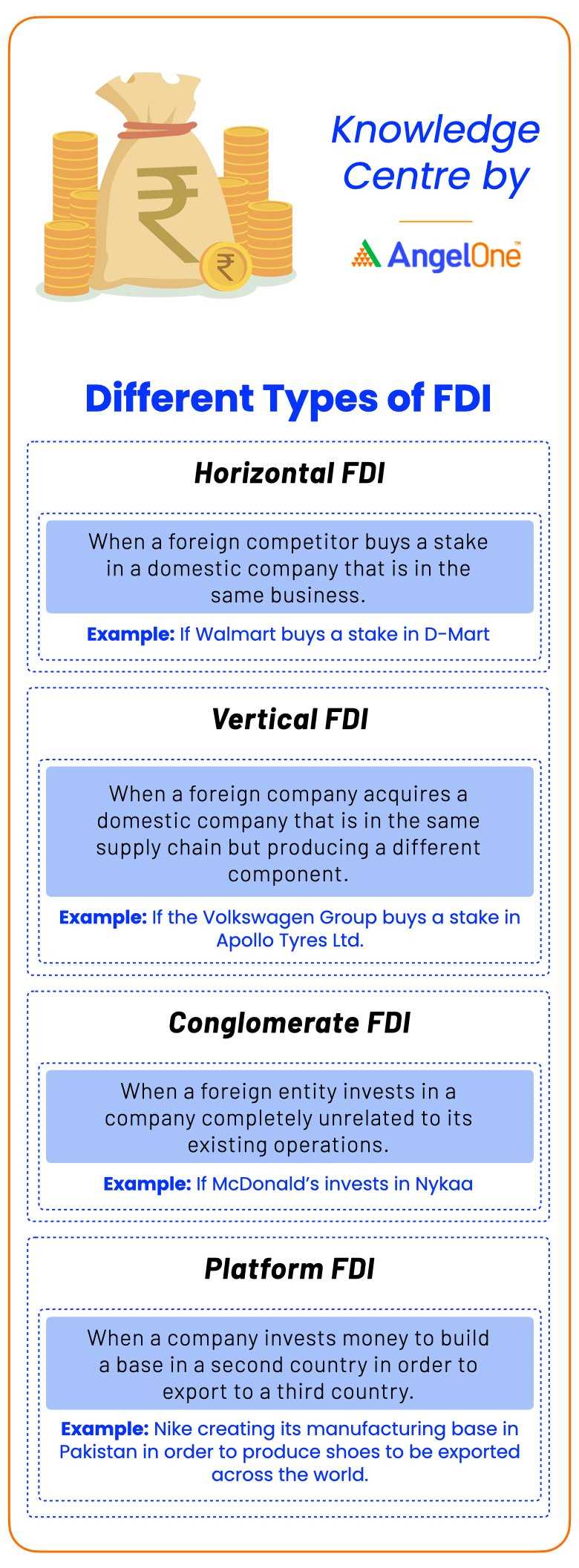

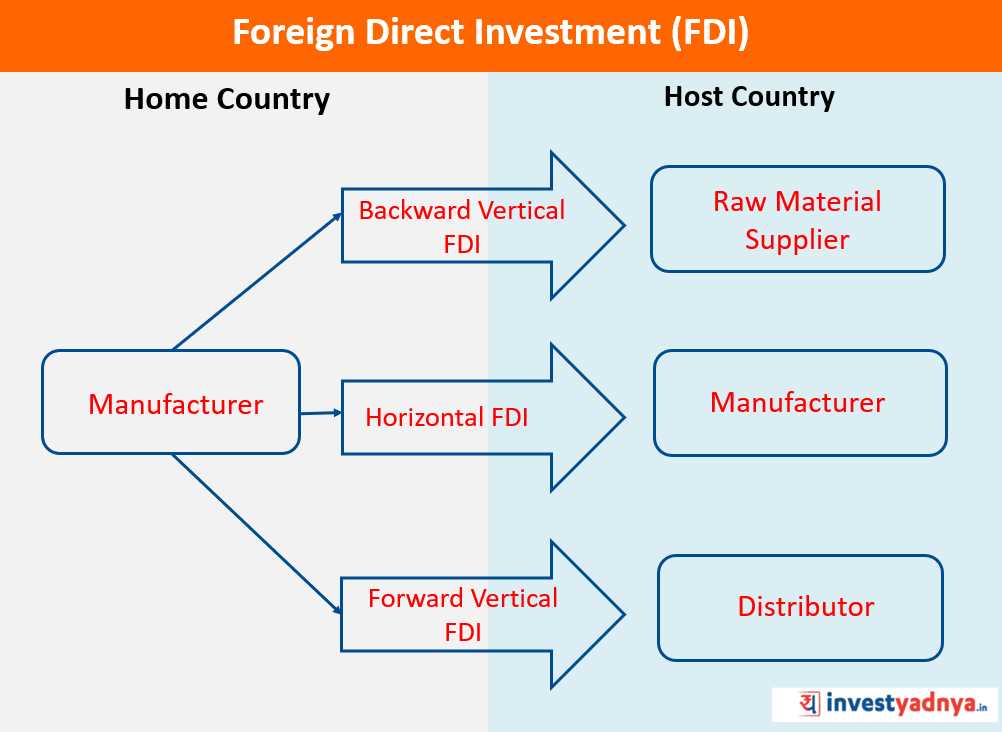

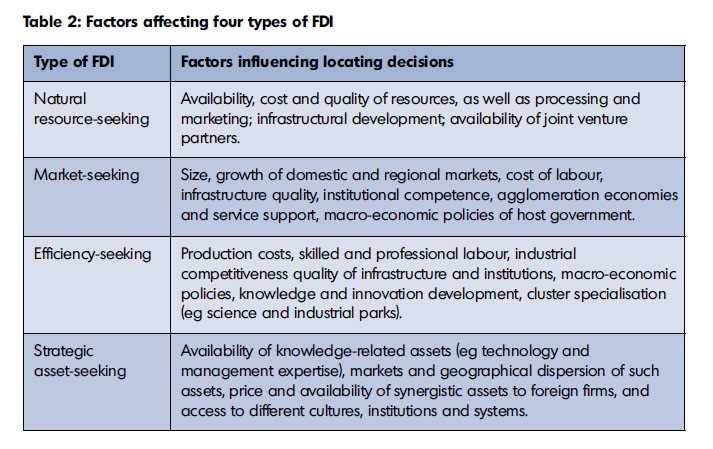

Types of Direct Foreign Investment

Direct foreign investment can take several different forms, each with its own characteristics and implications. Here are some of the most common types:

1. Greenfield Investment

Greenfield investment refers to the establishment of a new business or production facility in a foreign country. This type of investment involves building everything from scratch, including acquiring land, constructing buildings, and setting up operations. Greenfield investments are often seen as a long-term commitment to the foreign market and can provide significant economic benefits to the host country, such as job creation and technology transfer.

2. Merger and Acquisition

Merger and acquisition (M&A) involves the purchase or consolidation of an existing foreign company by a foreign investor. This type of investment allows companies to quickly enter a new market or expand their operations in a foreign country. M&A can provide access to established distribution networks, customer bases, and intellectual property rights. However, it also carries risks, such as cultural differences and integration challenges.

3. Joint Venture

A joint venture occurs when two or more companies from different countries come together to form a new entity in a foreign market. This type of investment allows companies to pool their resources, expertise, and market knowledge to pursue mutual business interests. Joint ventures can provide access to local market insights and distribution channels, as well as shared risks and costs. However, they also require careful negotiation and management of the partnership to ensure alignment of goals and objectives.

4. Strategic Alliance

A strategic alliance is a cooperative agreement between two or more companies to pursue a specific business opportunity in a foreign market. Unlike a joint venture, a strategic alliance does not involve the creation of a new entity. Instead, it focuses on collaboration and sharing of resources, such as technology, marketing expertise, or distribution networks. Strategic alliances can be flexible and allow companies to leverage each other’s strengths while maintaining their independence.

5. Franchising

Franchising involves granting the rights to operate a business under an established brand and business model to a foreign investor. This type of investment allows companies to expand their presence in foreign markets without bearing the full cost and risk of establishing and managing new locations. Franchising offers a win-win situation, as it provides local entrepreneurs with a proven business concept and support from the franchisor, while allowing the franchisor to expand its brand globally.

Examples of Direct Foreign Investment

Direct foreign investment refers to the investment made by a company or individual from one country into another country. This type of investment can take various forms and can be seen in many different industries. Here are some examples of direct foreign investment:

1. Manufacturing

One common example of direct foreign investment is when a company sets up a manufacturing plant in another country. This allows the company to take advantage of lower labor costs, access to new markets, or favorable government policies. For example, many automobile manufacturers have set up production facilities in countries like China and Mexico to take advantage of lower production costs.

2. Retail

Retail companies also often engage in direct foreign investment by opening stores or franchises in other countries. This allows them to expand their customer base and tap into new markets. For example, multinational retail giants like Walmart and Starbucks have opened stores in various countries around the world to reach a global audience.

3. Technology

Technology companies frequently engage in direct foreign investment to access new talent, research facilities, or to establish a presence in emerging markets. For example, many Silicon Valley companies have invested in research and development centers in countries like India and Israel to tap into their skilled workforce and innovative technology ecosystem.

4. Natural Resources

Direct foreign investment is also prevalent in the natural resources sector, particularly in industries like mining, oil, and gas. Companies invest in foreign countries to gain access to valuable resources or to secure long-term supply agreements. For instance, multinational oil companies invest in countries like Saudi Arabia and Nigeria to extract and export oil.

5. Infrastructure

Investment in infrastructure projects is another example of direct foreign investment. This can include building roads, bridges, airports, or power plants in another country. These projects often involve partnerships between foreign companies and the host country’s government. For example, Chinese companies have invested heavily in infrastructure projects in countries like Kenya and Pakistan as part of their Belt and Road Initiative.

These are just a few examples of how direct foreign investment can take shape in various industries. It is important to note that each investment is unique and comes with its own set of opportunities and challenges. However, direct foreign investment can be a strategic move for companies looking to expand their global presence and tap into new markets.

Benefits of Direct Foreign Investment

Direct foreign investment (DFI) offers numerous benefits for both the investing country and the recipient country. These benefits include:

1. Economic Growth: DFI can stimulate economic growth in the recipient country by attracting foreign capital, technology, and expertise. This can lead to increased production, job creation, and improved infrastructure.

2. Increased Employment: DFI often leads to the creation of new jobs in the recipient country. Foreign companies invest in local businesses, which can result in increased employment opportunities for the local population.

3. Technology Transfer: DFI brings advanced technology and know-how to the recipient country. This transfer of technology can help improve productivity, efficiency, and competitiveness in local industries.

4. Access to New Markets: DFI allows companies to enter new markets and expand their customer base. This can result in increased sales and profits for both the investing company and the recipient country.

5. Infrastructure Development: DFI often involves investments in infrastructure projects such as roads, ports, and power plants. These investments can improve the overall infrastructure of the recipient country, making it more attractive for further investments and economic development.

6. Knowledge and Skills Transfer: DFI brings not only technology but also knowledge and skills to the recipient country. Local employees can learn from foreign investors, gaining valuable expertise and improving their own capabilities.

7. Foreign Exchange Earnings: DFI can generate foreign exchange earnings for the recipient country. The profits made by foreign companies are often reinvested or repatriated, bringing in additional foreign currency.

8. Improved Balance of Payments: DFI can help improve the balance of payments of the recipient country. The inflow of foreign capital and the export of goods and services can help offset trade deficits and strengthen the country’s financial position.

Overall, direct foreign investment can have a transformative impact on the recipient country’s economy, promoting growth, development, and global integration. However, it is important for both the investing country and the recipient country to carefully consider the potential risks and challenges associated with DFI.

Risks and Challenges of Direct Foreign Investment

Direct foreign investment can bring numerous benefits to both the investing country and the host country. However, it also comes with its fair share of risks and challenges that need to be considered before making such a decision.

Political Risks: One of the major risks associated with direct foreign investment is political instability in the host country. Changes in government policies, regulations, or political unrest can significantly impact the investment and its returns. Investors need to carefully assess the political climate and stability of the host country before making any investment decisions.

Economic Risks: Economic risks such as currency fluctuations, inflation, and economic downturns can also pose challenges for direct foreign investment. These factors can affect the profitability and viability of the investment. Investors need to analyze the economic conditions of the host country and assess the potential risks before investing.

Legal and Regulatory Risks: Different countries have different legal and regulatory frameworks, which can create challenges for foreign investors. Complex and ambiguous laws, corruption, and lack of enforcement can hinder the smooth operation of the investment. Investors need to understand and comply with the legal and regulatory requirements of the host country to mitigate these risks.

Operational Risks: Direct foreign investment often involves setting up and managing operations in a foreign country, which can be challenging. Cultural differences, language barriers, and unfamiliar business practices can impact the efficiency and effectiveness of the investment. Investors need to adapt to the local business environment and develop strategies to overcome these operational challenges.

Reputation Risks: Direct foreign investment can also pose reputation risks for companies. Negative public perception, social unrest, or environmental concerns can damage the reputation of the investing company. Investors need to be mindful of their actions and ensure they operate in a socially and environmentally responsible manner to avoid reputational damage.

Exit Risks: Exiting from a direct foreign investment can be complex and challenging. Changes in market conditions, legal restrictions, or political instability can make it difficult to sell or divest the investment. Investors need to carefully plan and consider exit strategies to minimize potential losses.

Emily Bibb simplifies finance through bestselling books and articles, bridging complex concepts for everyday understanding. Engaging audiences via social media, she shares insights for financial success. Active in seminars and philanthropy, Bibb aims to create a more financially informed society, driven by her passion for empowering others.